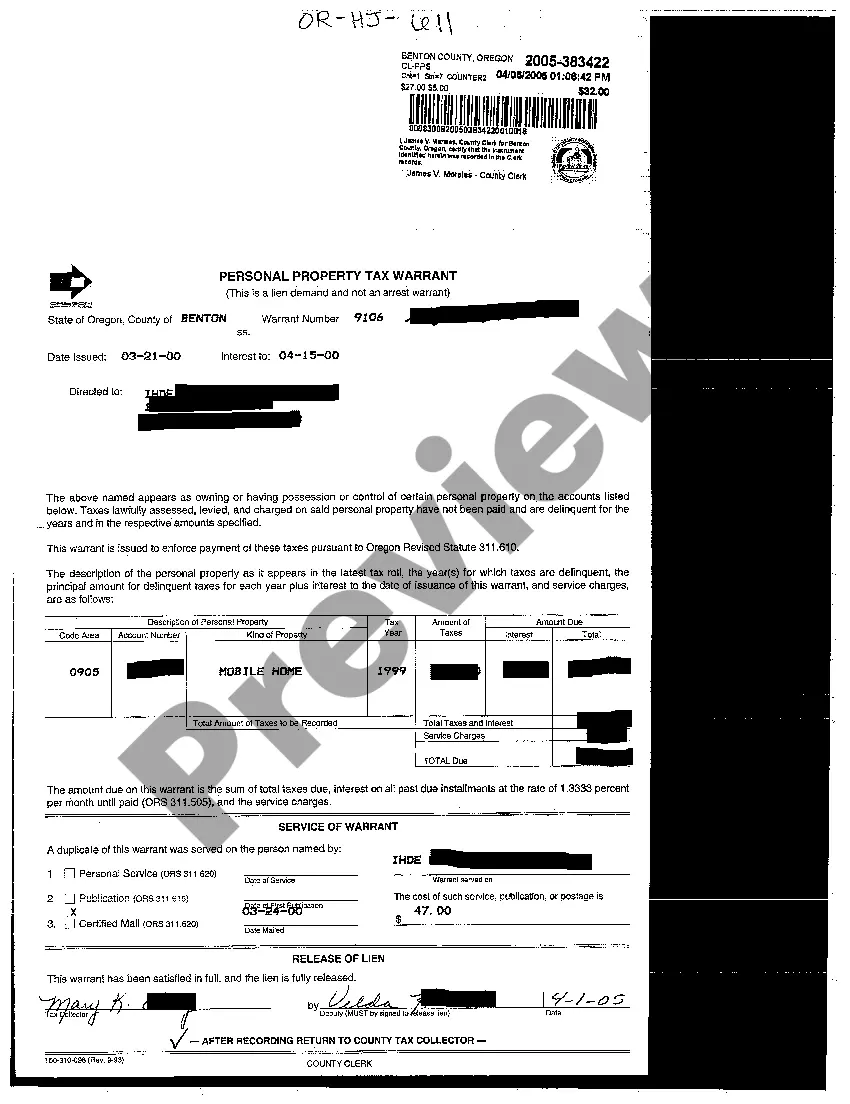

Oregon Personal Property Tax Warrant

Description

How to fill out Oregon Personal Property Tax Warrant?

The work with papers isn't the most uncomplicated task, especially for those who rarely work with legal paperwork. That's why we recommend utilizing accurate Oregon Personal Property Tax Warrant templates made by professional attorneys. It allows you to avoid troubles when in court or handling official institutions. Find the documents you require on our website for high-quality forms and accurate explanations.

If you’re a user with a US Legal Forms subscription, just log in your account. When you are in, the Download button will immediately appear on the template web page. Soon after accessing the sample, it’ll be stored in the My Forms menu.

Customers with no an active subscription can easily get an account. Use this simple step-by-step help guide to get the Oregon Personal Property Tax Warrant:

- Ensure that the document you found is eligible for use in the state it’s required in.

- Confirm the document. Use the Preview option or read its description (if available).

- Click Buy Now if this template is the thing you need or go back to the Search field to find a different one.

- Select a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

After finishing these easy actions, you are able to fill out the sample in an appropriate editor. Check the completed details and consider requesting an attorney to examine your Oregon Personal Property Tax Warrant for correctness. With US Legal Forms, everything becomes easier. Give it a try now!

Form popularity

FAQ

Oregon is basically not a tax lien state. What happens is the county will eventually foreclose and then auction off the property. Oregon counties do not sell tax liens or certificates.

Alabama. Arizona. Colorado. Florida. Illinois. Indiana. Iowa. Kentucky.

Distraint warrant: This is not a warrant for your arrest. Rather, it's a legal document that establishes our right to collect the tax debt from you. Federal offset letter: If you have tax debt, your federal tax refund or certain federal payments may be sent to us to apply to your debt.

Distraint or distress is "the seizure of someone's property in order to obtain payment of rent or other money owed", especially in common law countries.

(1) The Department of Revenue is authorized to continuously garnish up to 25 percent of an employee's disposable earnings to recover delinquent state tax debt.

Federal law allows only state and federal government agencies (not individual or private creditors) to take your refund as payment toward a debt.

Oregon. Oregon's statute is three years after the return is filed, regardless of whether it's filed on or after the due date. 6feff So if the return is filed earlier than April 15, the limitations period will end earlier, as well.

Liens generally follow the first in time, first in right rule, which says that whichever lien is recorded first in the land records has higher priority than later recorded liens. For example, a mortgage has priority over a judgment lien if the lender records it before the judgment creditor records its lien.

In Oregon, real proper- ty is subject to foreclosure three years after the taxes become delinquent. When are taxes delinquent? Property taxes can be paid in full by November 15 or in three installments: November 15, February 15, and May 15. If the taxes aren't paid in full by May 16 they are delinquent.