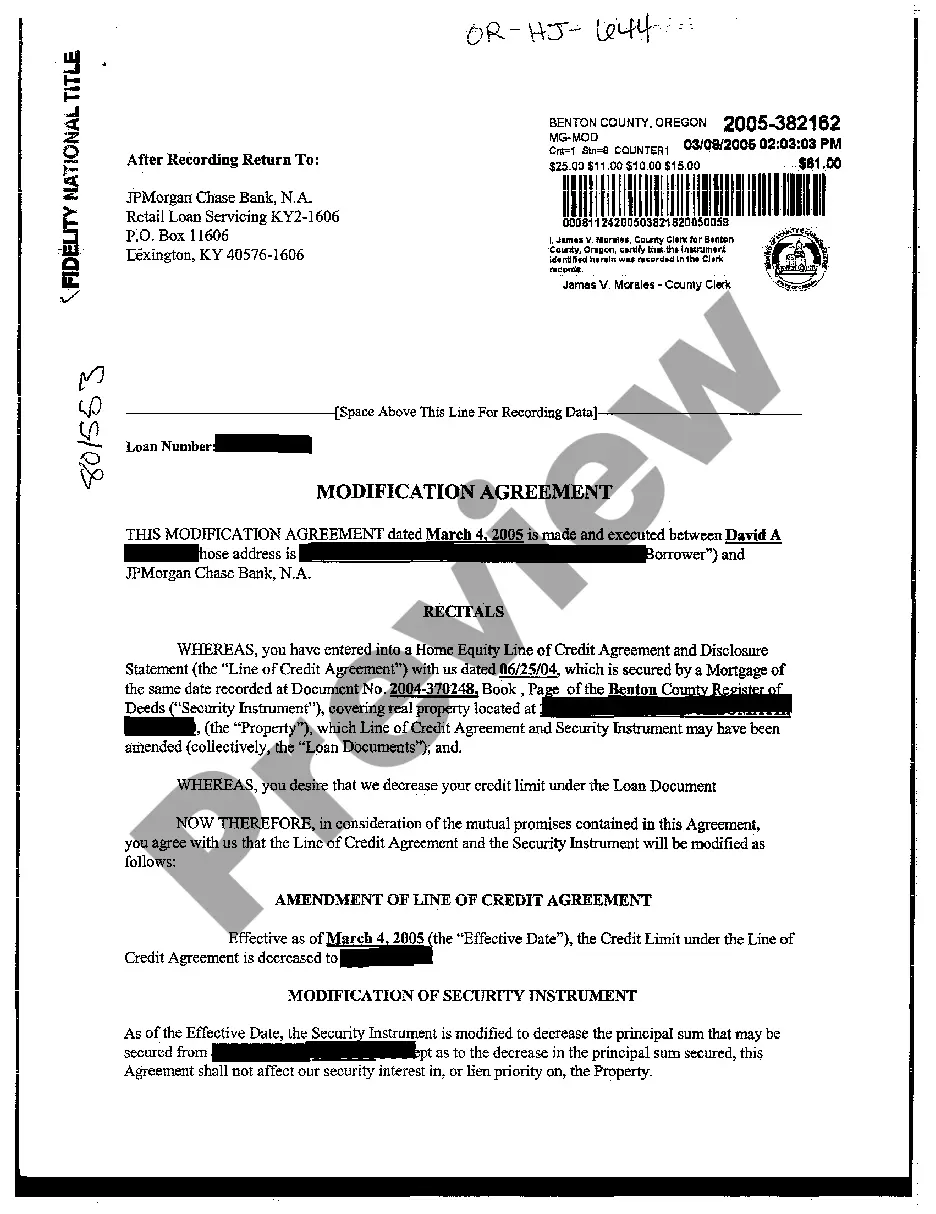

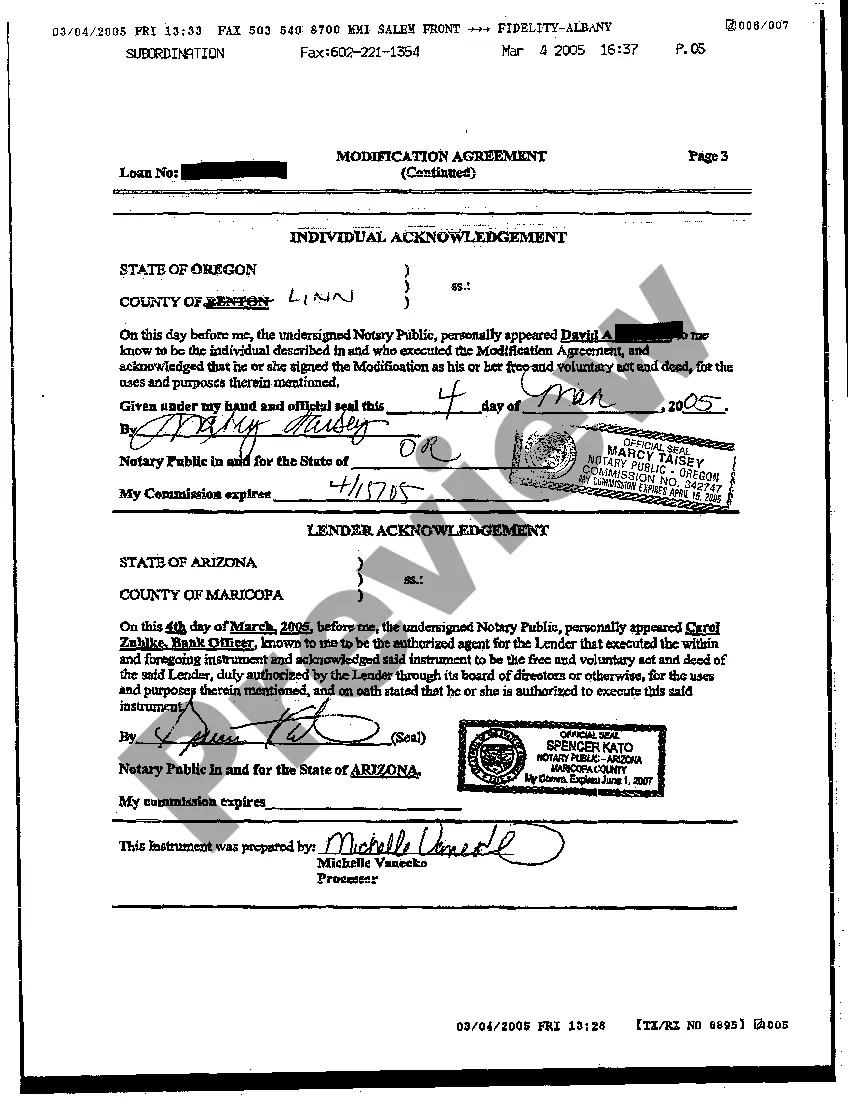

Oregon Modification Agreement decreasing Line of Credit

Description

How to fill out Oregon Modification Agreement Decreasing Line Of Credit?

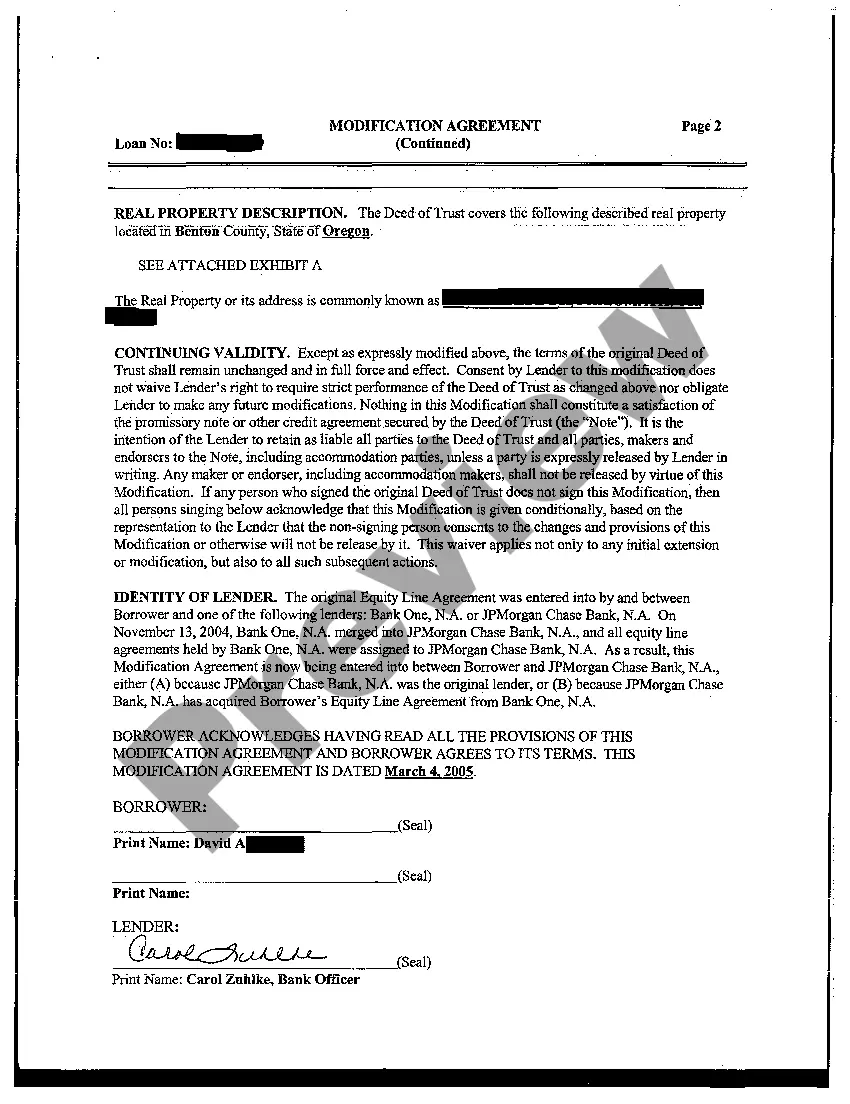

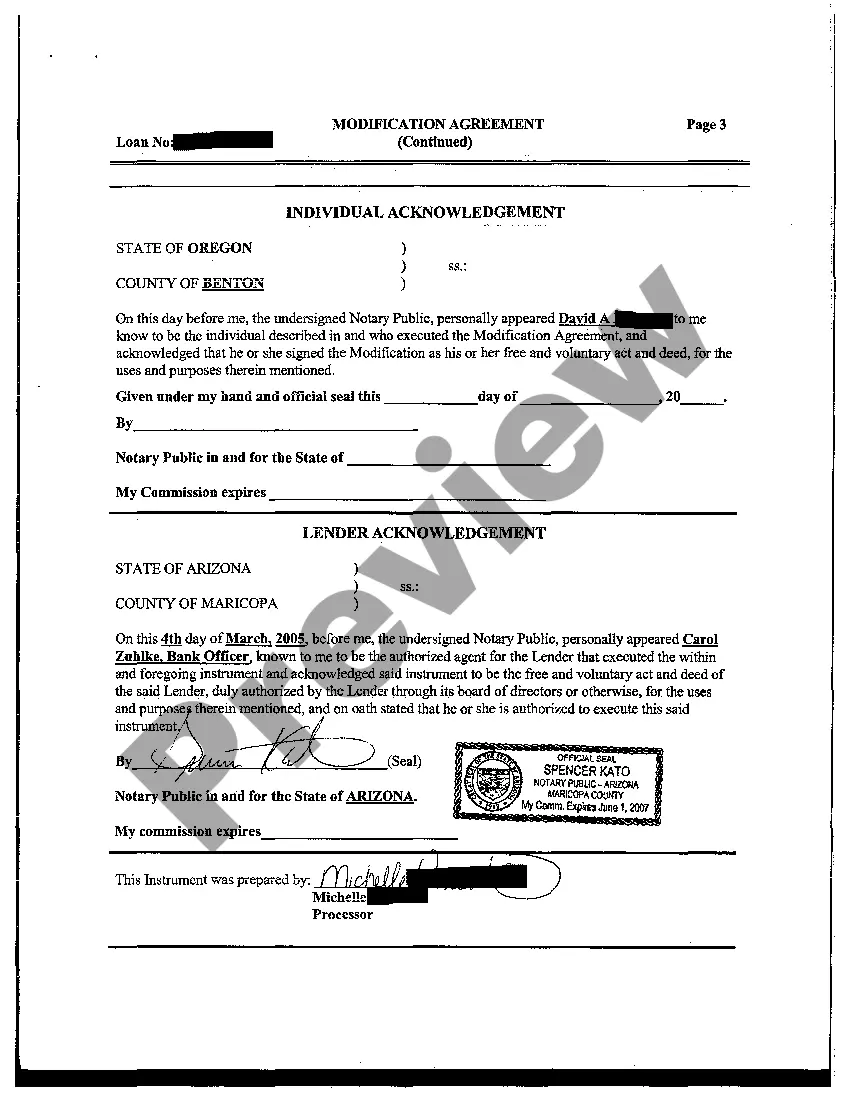

The work with documents isn't the most easy task, especially for those who almost never work with legal paperwork. That's why we recommend making use of accurate Oregon Modification Agreement decreasing Line of Credit templates made by professional attorneys. It allows you to stay away from problems when in court or dealing with official organizations. Find the templates you want on our website for top-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you’re in, the Download button will automatically appear on the file web page. After downloading the sample, it’ll be stored in the My Forms menu.

Customers with no an active subscription can easily create an account. Look at this brief step-by-step help guide to get the Oregon Modification Agreement decreasing Line of Credit:

- Make sure that file you found is eligible for use in the state it is necessary in.

- Confirm the document. Utilize the Preview option or read its description (if available).

- Click Buy Now if this template is what you need or utilize the Search field to find a different one.

- Choose a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a required format.

After finishing these easy steps, you can fill out the form in your favorite editor. Check the completed data and consider requesting a legal professional to examine your Oregon Modification Agreement decreasing Line of Credit for correctness. With US Legal Forms, everything gets much easier. Try it out now!

Form popularity

FAQ

You can refinance a modified home loan depending on your current financial conditions, the terms of the modification and how much time passed since completing the modification. Typically, lenders don't approve modifications unless you stand a better chance of repaying the debt under new modified terms.

Technically, a loan modification should not have any negative impact on your credit score. That's because you and the lender have agreed to new terms for paying off your loan, so if you continue to meet those terms, there shouldn't be anything negative to report.

Some of the most common types of hardship are: job loss, pay reduction, underemployment, declining business revenue, death of a coborrower, illness, injury, and divorce.

Depending on how your lender reports it to the credit bureaus, a loan modification can result in a drop in your credit rating. But at the same time, it's going to have far less negative impact than a foreclosure or string of late payments, so in that case, it can actually help your rating in the long run.

A loan modification can relieve some of the financial pressure you feel by lowering your monthly payments and stopping collection activity. But loan modifications are not foolproof. They could increase the cost of your loan and add derogatory remarks to your credit report.

A loan modification can change the principal of the loan, the interest rate, and other terms to make the loan more affordable.However, a lender must agree to the loan modification, which means borrowers must negotiate with them.

Either way, it stays on your report for seven years.

Conventional loan modification In particular, Freddie Mac and Fannie Mae offer Flex Modification programs designed to decrease a qualified borrower's mortgage payment by about 20%.

Lenders will often report a loan modification to credit bureaus as a type of settlement or adjustment to the terms of the loan. If it shows up as not fulfilling the original terms of your loan, that can have a negative effect on your credit.