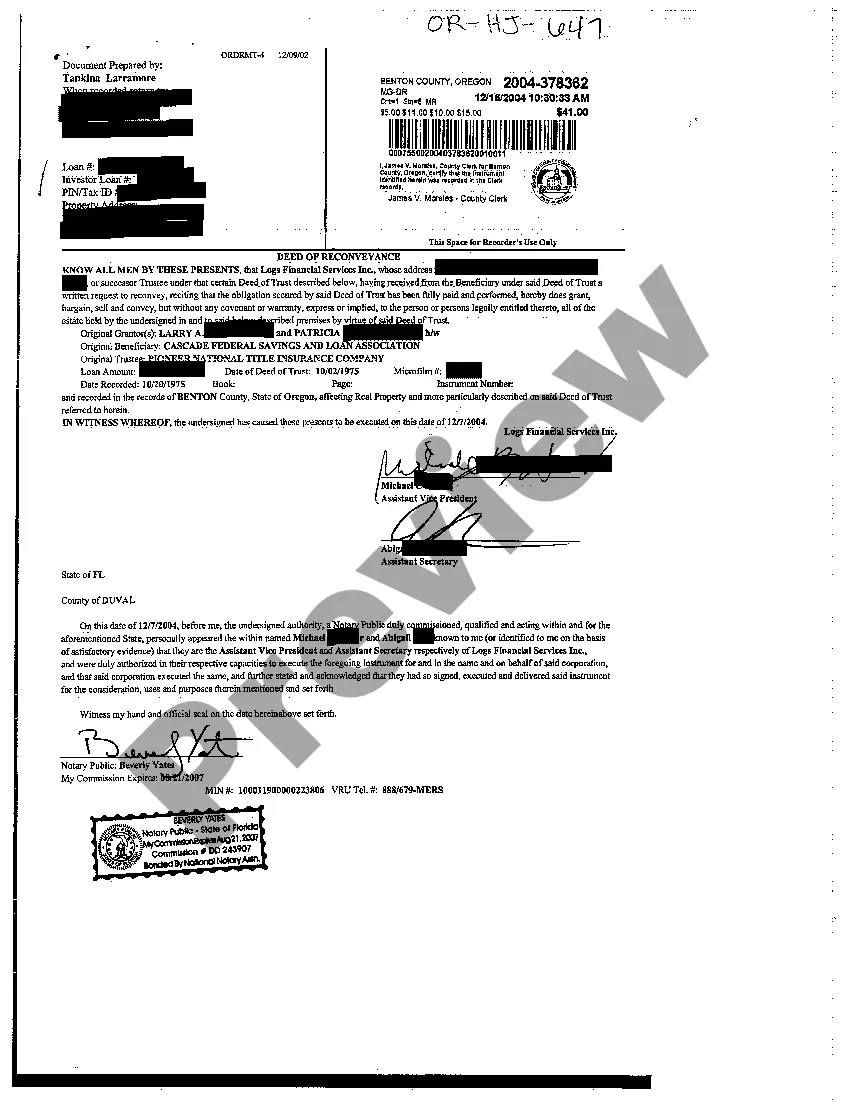

Oregon Deed of Reconveyance

Description

How to fill out Oregon Deed Of Reconveyance?

Creating documents isn't the most straightforward task, especially for people who rarely work with legal papers. That's why we advise utilizing correct Oregon Deed of Reconveyance samples created by skilled attorneys. It gives you the ability to prevent problems when in court or dealing with official organizations. Find the documents you need on our website for top-quality forms and correct information.

If you’re a user having a US Legal Forms subscription, just log in your account. Once you are in, the Download button will immediately appear on the file page. Right after downloading the sample, it’ll be stored in the My Forms menu.

Users without an active subscription can quickly create an account. Utilize this brief step-by-step help guide to get your Oregon Deed of Reconveyance:

- Make sure that the sample you found is eligible for use in the state it’s required in.

- Confirm the document. Make use of the Preview option or read its description (if offered).

- Click Buy Now if this file is what you need or return to the Search field to get a different one.

- Select a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

After finishing these straightforward steps, it is possible to complete the form in a preferred editor. Recheck completed info and consider asking a legal professional to review your Oregon Deed of Reconveyance for correctness. With US Legal Forms, everything becomes much simpler. Try it now!

Form popularity

FAQ

Is completed and signed by the trustee, whose signature must be notarized. Full Reconveyance form can be purchased at most office supply or stationery stores. Usually the trustee named on your Deed of Trust will also have forms available and will issue the Full Reconveyance.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

How do you file a Deed of Reconveyance? A Deed of Reconveyance should be filed with your local county recorder or recorder of deeds once it has been signed by a notary public (such as an attorney). Once the document has been filed, the debt that was registered to the property will be considered paid off.

A deed of trust is a method of securing a real estate transaction that includes three parties: a lender, borrower and a third-party trustee.

The deed must be signed by the party or parties making the conveyance or grant; and 7.

In order to clear the Deed of Trust from the title to the property, a Deed of Reconveyance must be recorded with the Country Recorder or Recorder of Deeds. If the Trustee/Beneficiary fails to record a satisfaction within the set time limits, the Trustee/Beneficiary may be responsible for damages as set out by statute.

Complete the top area of the reconveyance deed. Enter the name of and address of the person who executed the deed of trust, the borrower or debtor. Refer to the original deed of trust for the name spelling. Complete the middle section, the trustee's name and address.

A reconveyance is the official transfer of the property title after the mortgage has been paid in full. The processing time can vary based on the county in which the property is located and can take up to three months. You will need to contact your county for questions on their specific processing time.

Generally, the lender sends the documents to be recorded after the closing. The recording fees are included in your closing costs. Typically, the lender will provide you with a copy of the deed of trust after the closing. The original warranty deeds are often mailed to the grantee after they are recorded.