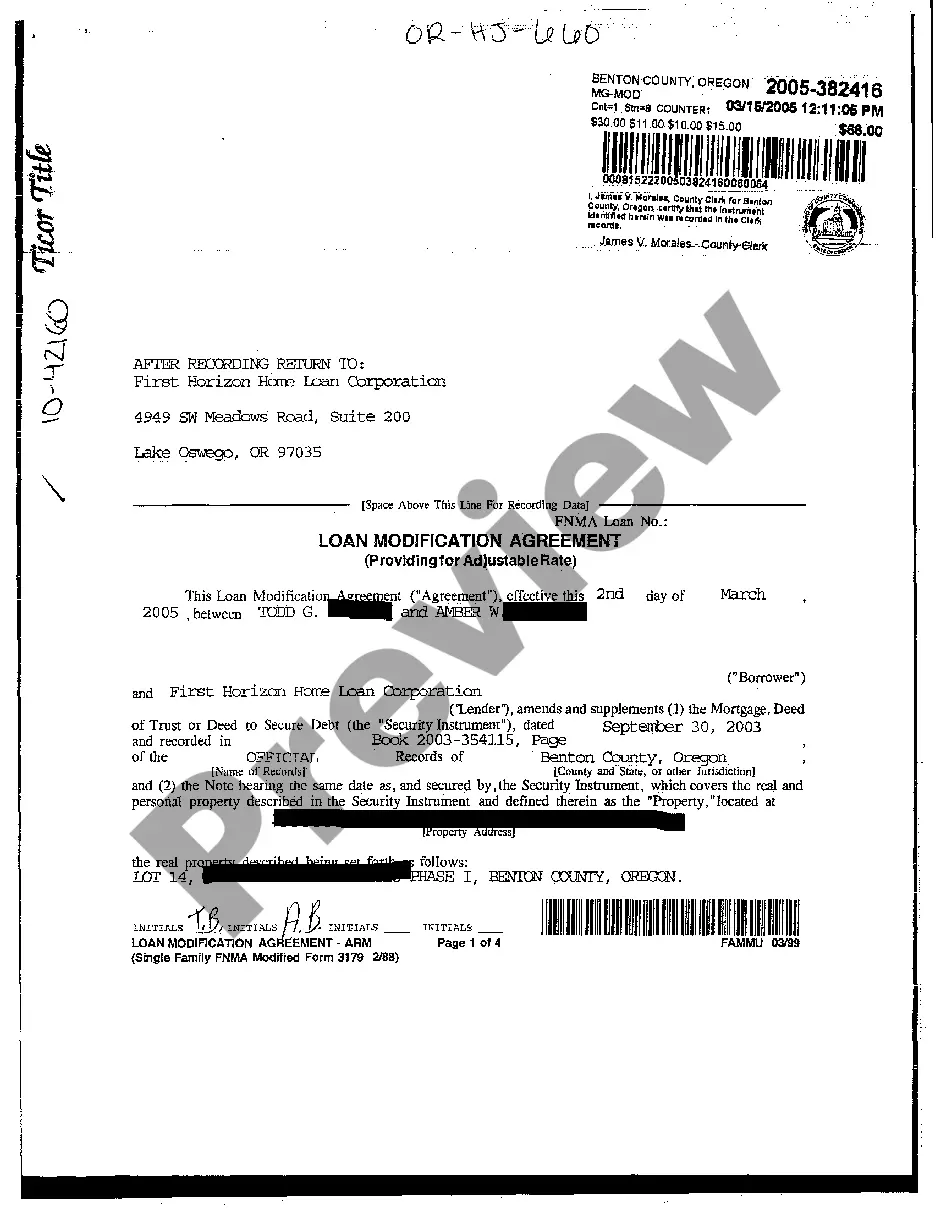

Oregon Loan Modification Agreement providing for Adjustable Rate

Description

How to fill out Oregon Loan Modification Agreement Providing For Adjustable Rate?

Creating papers isn't the most uncomplicated task, especially for those who almost never work with legal papers. That's why we recommend using accurate Oregon Loan Modification Agreement providing for Adjustable Rate templates created by skilled attorneys. It allows you to eliminate troubles when in court or working with formal organizations. Find the files you require on our website for high-quality forms and accurate information.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you are in, the Download button will immediately appear on the template webpage. Soon after downloading the sample, it will be stored in the My Forms menu.

Customers without an activated subscription can quickly create an account. Make use of this brief step-by-step guide to get the Oregon Loan Modification Agreement providing for Adjustable Rate:

- Make sure that the form you found is eligible for use in the state it’s required in.

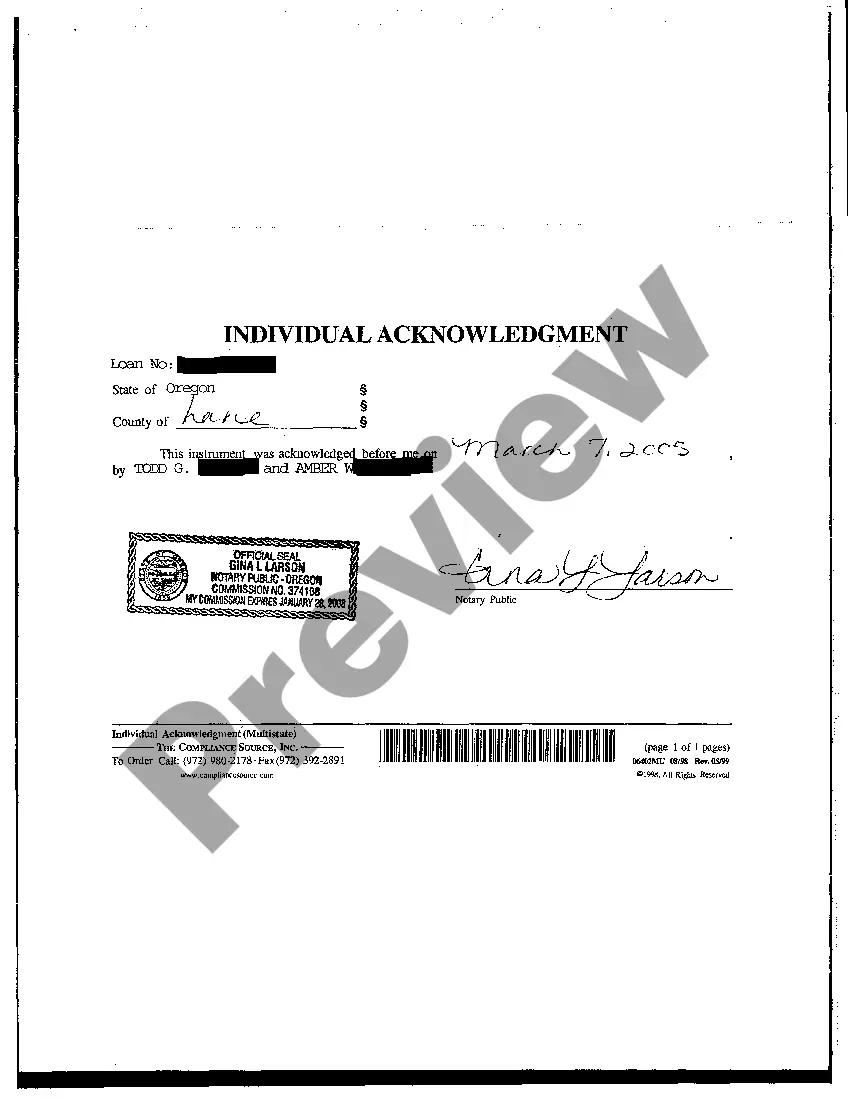

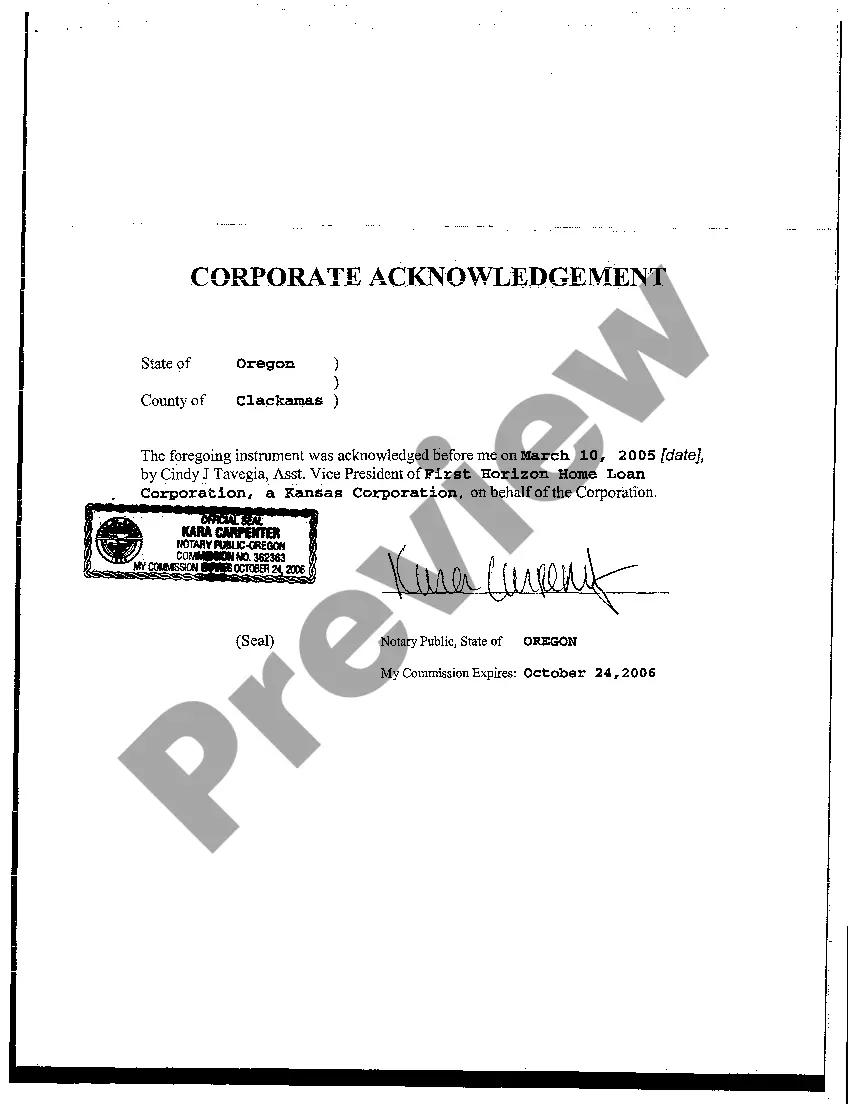

- Verify the document. Use the Preview feature or read its description (if available).

- Click Buy Now if this form is the thing you need or use the Search field to get a different one.

- Choose a suitable subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after completing these easy actions, it is possible to complete the sample in your favorite editor. Recheck completed information and consider requesting an attorney to examine your Oregon Loan Modification Agreement providing for Adjustable Rate for correctness. With US Legal Forms, everything gets much easier. Try it out now!

Form popularity

FAQ

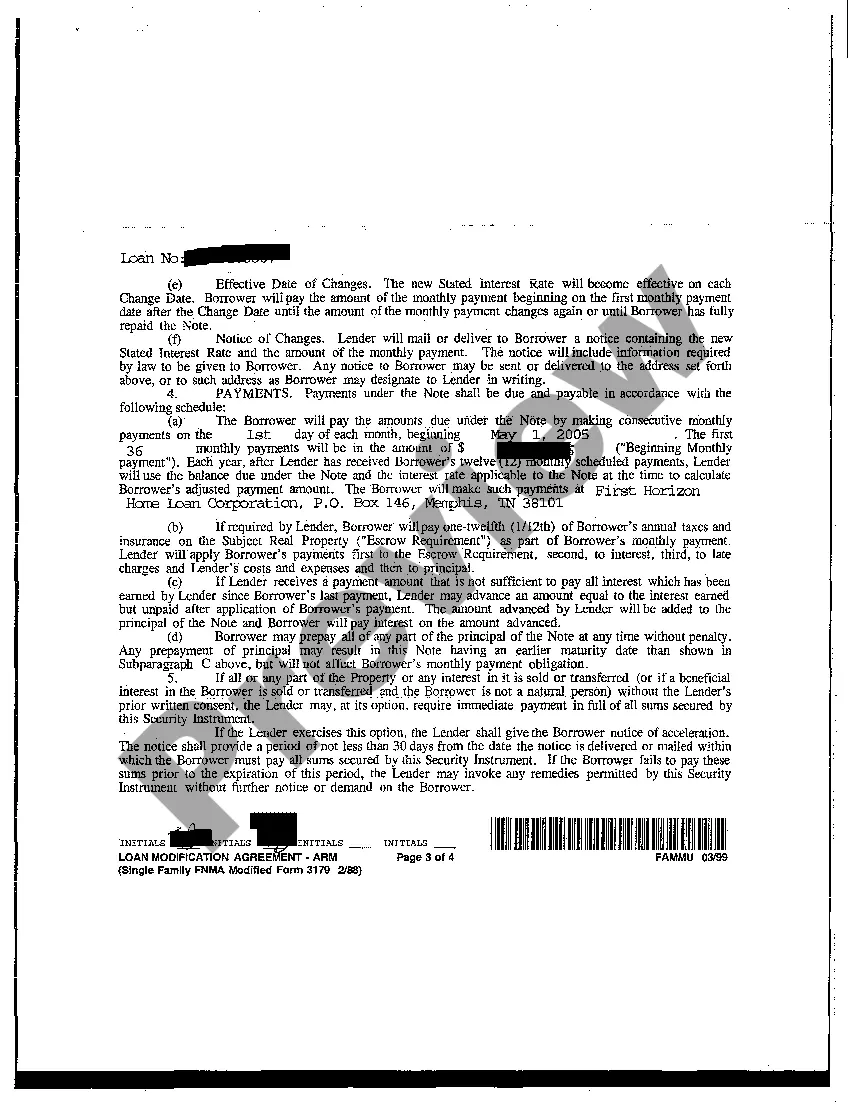

Suspend past due amounts. Bring your account current. Adjust your interest rate. Lower your minimum payments. Modify your loan. Agree to a short sale of a home. Consider a settlement option.

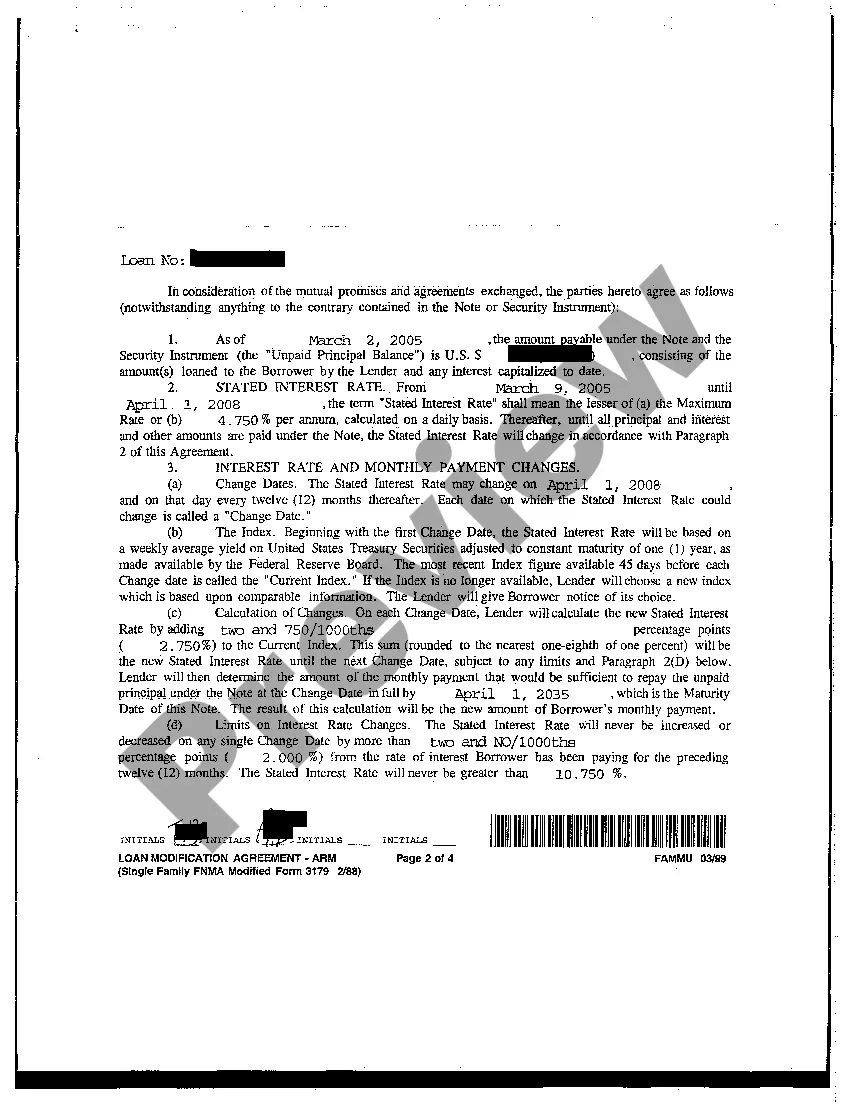

A loan modification is different from a refinance. When you take a loan modification, you change the terms of your loan directly through your lender.When you refinance, you can change your loan's term, your interest rate and even your loan type. You can also take cash out of your equity with a cash-out refinance.

You would avoid foreclosure and remain in your home. If you are behind on payments, you would resolve your delinquency status. You may be able to reduce your monthly payments so they are more affordable. You would suffer less damage to your credit than if the bank foreclosed on your house.

Some of the most common types of hardship are: job loss, pay reduction, underemployment, declining business revenue, death of a coborrower, illness, injury, and divorce.

Successful modifications rewarded. Currently, many lenders are extending temporary loan modification terms to borrowers. Lenders can recoup cash from underwater homes. Incentives to act early and save borrowers.

You should contact the lender's loss and mitigation department to discuss the reason of you loan modification rejection. Possible reasons for a modification rejection include insufficient income, high debt-to-income ratio, missing documents, or delinquent credit history.

A loan modification can relieve some of the financial pressure you feel by lowering your monthly payments and stopping collection activity. But loan modifications are not foolproof. They could increase the cost of your loan and add derogatory remarks to your credit report.

If your servicer or lender agrees to a mortgage loan modification, it may result in lowering your monthly payment, extending or shortening your loan's term, or decreasing the interest rate you pay.

Conventional loan modification In particular, Freddie Mac and Fannie Mae offer Flex Modification programs designed to decrease a qualified borrower's mortgage payment by about 20%.