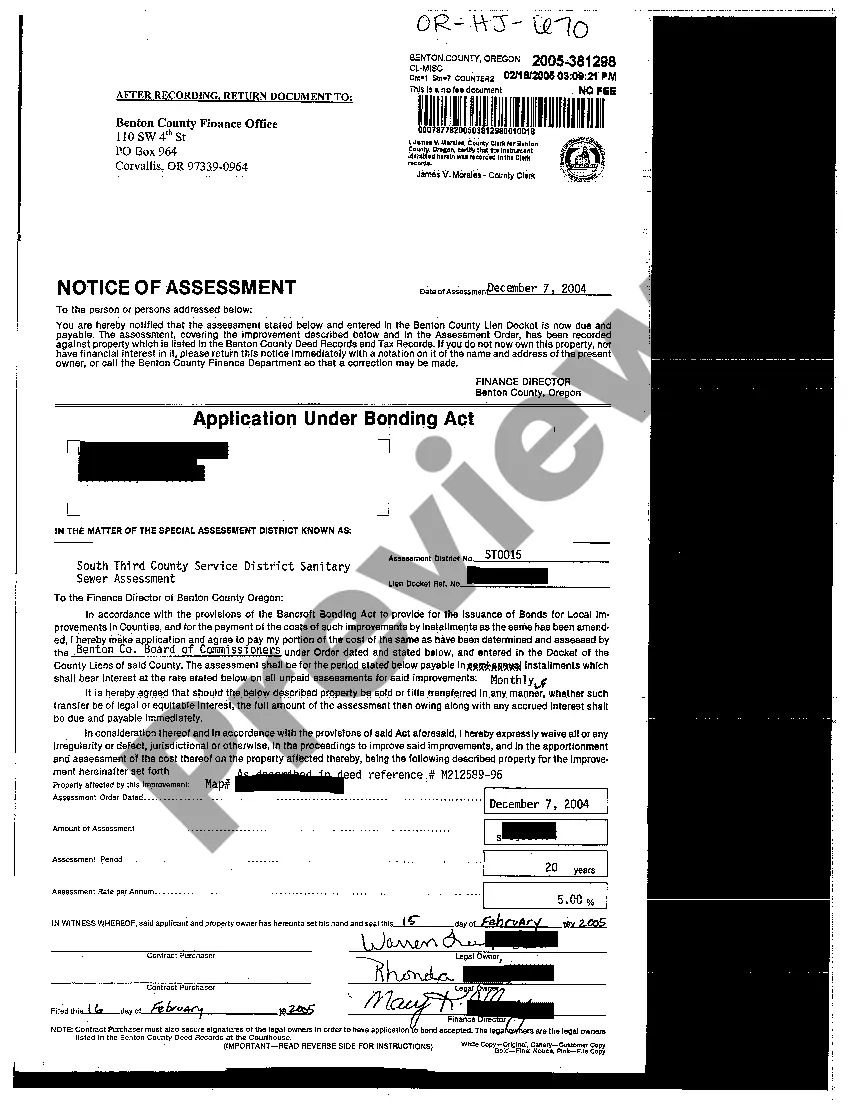

Oregon Notice of Assessment for County Improvements

Description

How to fill out Oregon Notice Of Assessment For County Improvements?

Creating papers isn't the most simple task, especially for people who rarely deal with legal papers. That's why we advise utilizing accurate Oregon Notice of Assessment for County Improvements samples created by professional attorneys. It allows you to avoid problems when in court or handling formal organizations. Find the documents you need on our site for high-quality forms and exact descriptions.

If you’re a user having a US Legal Forms subscription, just log in your account. As soon as you are in, the Download button will immediately appear on the file web page. Soon after accessing the sample, it will be stored in the My Forms menu.

Customers with no an active subscription can quickly create an account. Use this short step-by-step guide to get the Oregon Notice of Assessment for County Improvements:

- Be sure that file you found is eligible for use in the state it’s necessary in.

- Verify the document. Use the Preview feature or read its description (if offered).

- Click Buy Now if this file is the thing you need or return to the Search field to get a different one.

- Select a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a wanted format.

After doing these straightforward actions, you can fill out the sample in a preferred editor. Double-check completed information and consider requesting an attorney to review your Oregon Notice of Assessment for County Improvements for correctness. With US Legal Forms, everything becomes much simpler. Test it now!

Form popularity

FAQ

Function of Appraisals vs. The tax assessed value is only used to determine property taxes. Your mortgage company may use the assessment data in order to estimate your escrow.Appraisals are used to determine the fair market value -- what someone would actually pay for the house if listed on the market.

Clackamas County collects the highest property tax in Oregon, levying an average of $2,814.00 (0.85% of median home value) yearly in property taxes, while Gilliam County has the lowest property tax in the state, collecting an average tax of $956.00 (0.96% of median home value) per year.

Overview of Oregon Taxes The effective property tax rate in Oregon is 0.90%, while the U.S. average currently stands at 1.07%.

House assessments and appraisals are not the same species. Your county's tax assessor sets a value on your house as a step in setting your property taxes. The appraisal tells buyers how big a mortgage your house is worth. The tax assessor's judgment doesn't affect your home price or your appraiser's evaluation.

Property taxes are placed on the tax roll in the form of a rate per $1,000 of assessed value.To compute a tax rate, the tax levy amount is divided by the taxable assessed value of the property in the district. This tax rate is placed on the individual property tax accounts in the district.

California is 19.3% more expensive than Oregon.The average CA residents earns more money, but it is still very difficult to save because of the high cost of living in the state. No sales tax. Next to income taxes that vary between 5 and 9.9% and 1% of property tax, there is no sales tax unlike California.

Property Improvements Are Assessed Separately When property owners improve or remodel their property, the additions or upgrades are valued at market value in that year. Only the value of the new addition or upgrade will be added to your existing assessed value.

Oregon's property tax rates are higher than a number of other States. The main reason is that we do not have a sales tax (on anything). Just think, you can buy a new car and only pay an additional $50 for a two-year auto registration.

Most people figure that Portlanders pay some of the highest property taxes in the state, and that's true. The state's Measure 50 pegged tax bills to 1995 property values, plus 3 percent a year thereafter.In many areas, real home values have risen much faster.