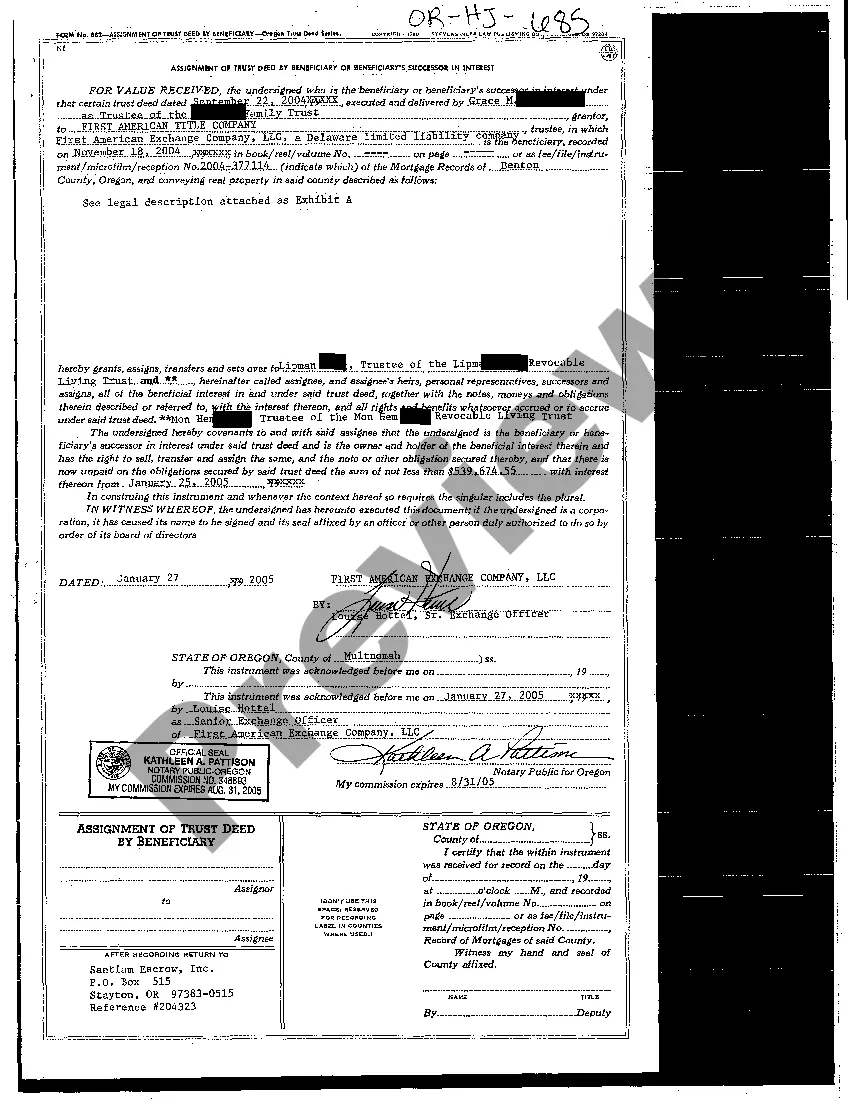

Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest

Description Successor In Interest Letter Template

How to fill out Oregon Assignment Of Trust Deed By Beneficiary Or Beneficiary's Successor In Interest?

The work with documents isn't the most easy process, especially for those who almost never work with legal paperwork. That's why we advise making use of correct Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest samples made by professional lawyers. It gives you the ability to avoid difficulties when in court or dealing with formal organizations. Find the documents you want on our website for high-quality forms and exact descriptions.

If you’re a user with a US Legal Forms subscription, just log in your account. As soon as you are in, the Download button will automatically appear on the file web page. Soon after accessing the sample, it will be stored in the My Forms menu.

Customers without a subscription can quickly create an account. Make use of this short step-by-step help guide to get your Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest:

- Make certain that the sample you found is eligible for use in the state it is necessary in.

- Verify the file. Make use of the Preview feature or read its description (if available).

- Buy Now if this template is the thing you need or return to the Search field to get another one.

- Choose a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your file in a required format.

Right after doing these easy actions, it is possible to complete the sample in an appropriate editor. Check the completed data and consider requesting a legal representative to examine your Oregon Assignment of Trust Deed by Beneficiary or Beneficiary's Successor in Interest for correctness. With US Legal Forms, everything gets much simpler. Try it now!

Form popularity

FAQ

The person who owns the property usually signs a promissory note and a deed of trust. The deed of trust does not have to be recorded to be valid.

(2) Beneficiary means a person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or the person's successor in interest, and who is not the trustee unless the beneficiary is qualified to be a trustee under ORS 86.713 (Qualifications of trustee) (1)(b)(D).

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

Some use deeds of trust instead, which are similar documents, but they have some fundamental differences.With a deed of trust, however, the lender must act through a go-between called the trustee. The beneficiary and the trustee can't be the same person or entity.

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

An absolute assignment is typically intended to transfer all your interests, rights and ownership in the policy to an assignee.A collateral assignment is a more limited type of transfer.