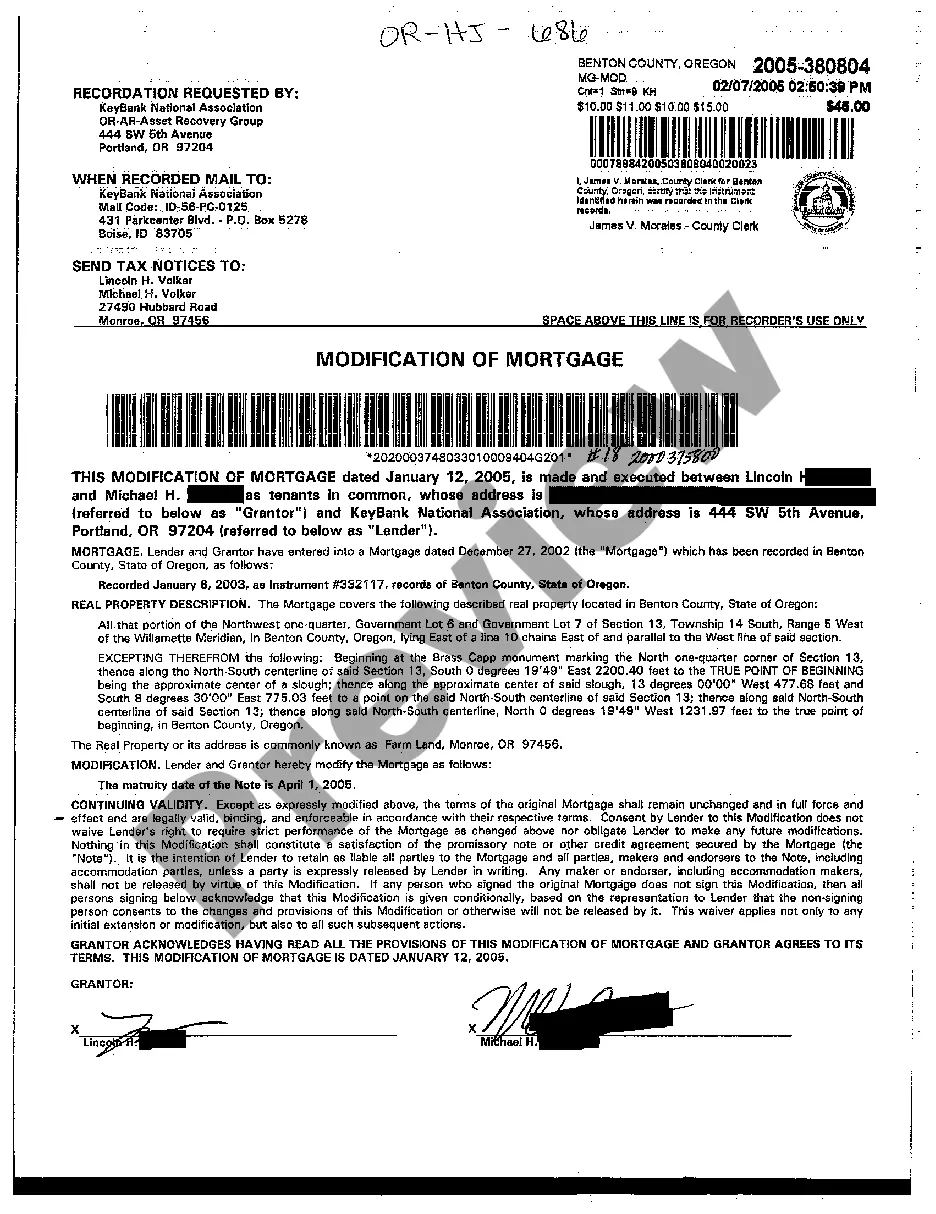

Oregon Modification of Mortgage

Description

How to fill out Oregon Modification Of Mortgage?

The work with papers isn't the most simple process, especially for those who almost never deal with legal papers. That's why we advise utilizing correct Oregon Modification of Mortgage templates made by skilled lawyers. It allows you to stay away from problems when in court or dealing with official organizations. Find the samples you need on our website for high-quality forms and exact explanations.

If you’re a user having a US Legal Forms subscription, simply log in your account. Once you are in, the Download button will immediately appear on the template web page. Soon after accessing the sample, it will be saved in the My Forms menu.

Users with no a subscription can quickly create an account. Look at this brief step-by-step guide to get the Oregon Modification of Mortgage:

- Make certain that the document you found is eligible for use in the state it’s necessary in.

- Confirm the document. Utilize the Preview feature or read its description (if offered).

- Click Buy Now if this template is what you need or return to the Search field to get another one.

- Select a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a preferred format.

Right after completing these easy actions, you can complete the form in your favorite editor. Check the filled in details and consider asking an attorney to review your Oregon Modification of Mortgage for correctness. With US Legal Forms, everything becomes much easier. Try it now!

Form popularity

FAQ

In order to properly and efficiently document loan modifications for real estate loans, it is essential that: All modifications be in writing. All parties involved sign the modification. In appropriate cases, the modification should be recorded.

Suspend past due amounts. Bring your account current. Adjust your interest rate. Lower your minimum payments. Modify your loan. Agree to a short sale of a home. Consider a settlement option.

Some of the most common types of hardship are: job loss, pay reduction, underemployment, declining business revenue, death of a coborrower, illness, injury, and divorce.

The loan modification underwriter will analyze and review the particular circumstances which justify a loan modification. The underwriter will evaluate and assess the borrower's financial status, current income and asset situation and ability to pay.

Under this option, you reach an agreement between you and your mortgage company to change the original terms of your mortgagesuch as payment amount, length of loan, interest rate, etc. In most cases, when your mortgage is modified, you can reduce your monthly payment to a more affordable amount.

Under this option, you reach an agreement between you and your mortgage company to change the original terms of your mortgagesuch as payment amount, length of loan, interest rate, etc. In most cases, when your mortgage is modified, you can reduce your monthly payment to a more affordable amount.

Be at least one regular mortgage payment behind or show that missing a payment is imminent. Provide evidence of significant financial hardship, for reasons such as:

You have to be suffering a financial hardship. You have to show you cannot afford your current mortgage payments. You have to be able to show that you can stay current on a modified payment schedule.

Yes, probably. In California, a law called the Homeowner Bill of Rights (HBOR) generally gives borrowers the right to appeal a modification denial. Under HBOR, in most cases, if the servicer denies a borrower's application to modify a first lien loan, the borrower can appeal.