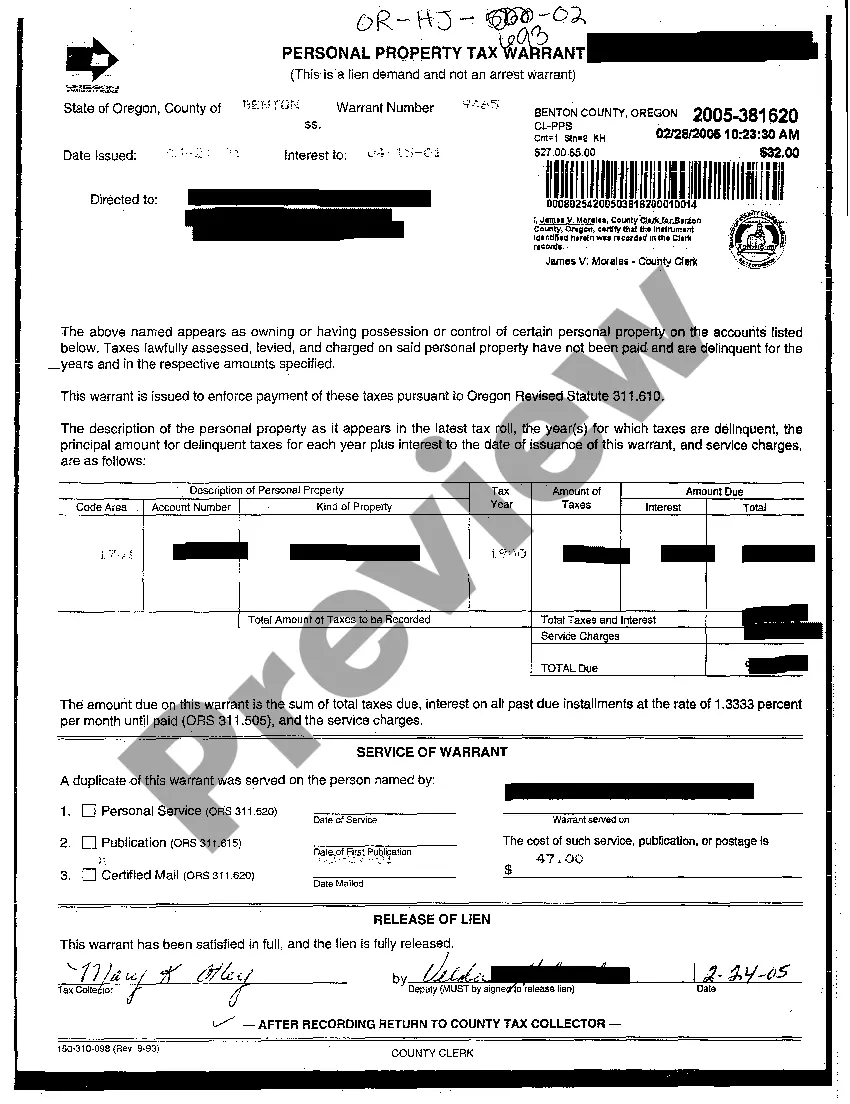

Oregon Personal Property Tax Warrant

Description

How to fill out Oregon Personal Property Tax Warrant?

Creating papers isn't the most easy task, especially for people who almost never work with legal paperwork. That's why we recommend using accurate Oregon Personal Property Tax Warrant samples created by skilled attorneys. It allows you to stay away from difficulties when in court or working with official institutions. Find the documents you need on our website for high-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, just log in your account. Once you’re in, the Download button will immediately appear on the file web page. Soon after accessing the sample, it’ll be stored in the My Forms menu.

Users with no an activated subscription can easily get an account. Make use of this short step-by-step help guide to get your Oregon Personal Property Tax Warrant:

- Be sure that the document you found is eligible for use in the state it’s required in.

- Confirm the file. Utilize the Preview option or read its description (if readily available).

- Buy Now if this file is what you need or use the Search field to find a different one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

Right after completing these straightforward steps, it is possible to fill out the form in a preferred editor. Double-check filled in info and consider asking a legal representative to review your Oregon Personal Property Tax Warrant for correctness. With US Legal Forms, everything becomes much easier. Try it out now!

Form popularity

FAQ

In Oregon, real proper- ty is subject to foreclosure three years after the taxes become delinquent. When are taxes delinquent? Property taxes can be paid in full by November 15 or in three installments: November 15, February 15, and May 15. If the taxes aren't paid in full by May 16 they are delinquent.

Distraint warrant: This is not a warrant for your arrest. Rather, it's a legal document that establishes our right to collect the tax debt from you. Federal offset letter: If you have tax debt, your federal tax refund or certain federal payments may be sent to us to apply to your debt.

In Oregon, property taxes that aren't paid on or before May 15 of the tax year in which they're billed are delinquent. The property is subject to a tax foreclosure three years after the first date of delinquency.It then applies for a judgment with the court and publishes the foreclosure list in a newspaper.

Oregon is basically not a tax lien state. What happens is the county will eventually foreclose and then auction off the property. Oregon counties do not sell tax liens or certificates.