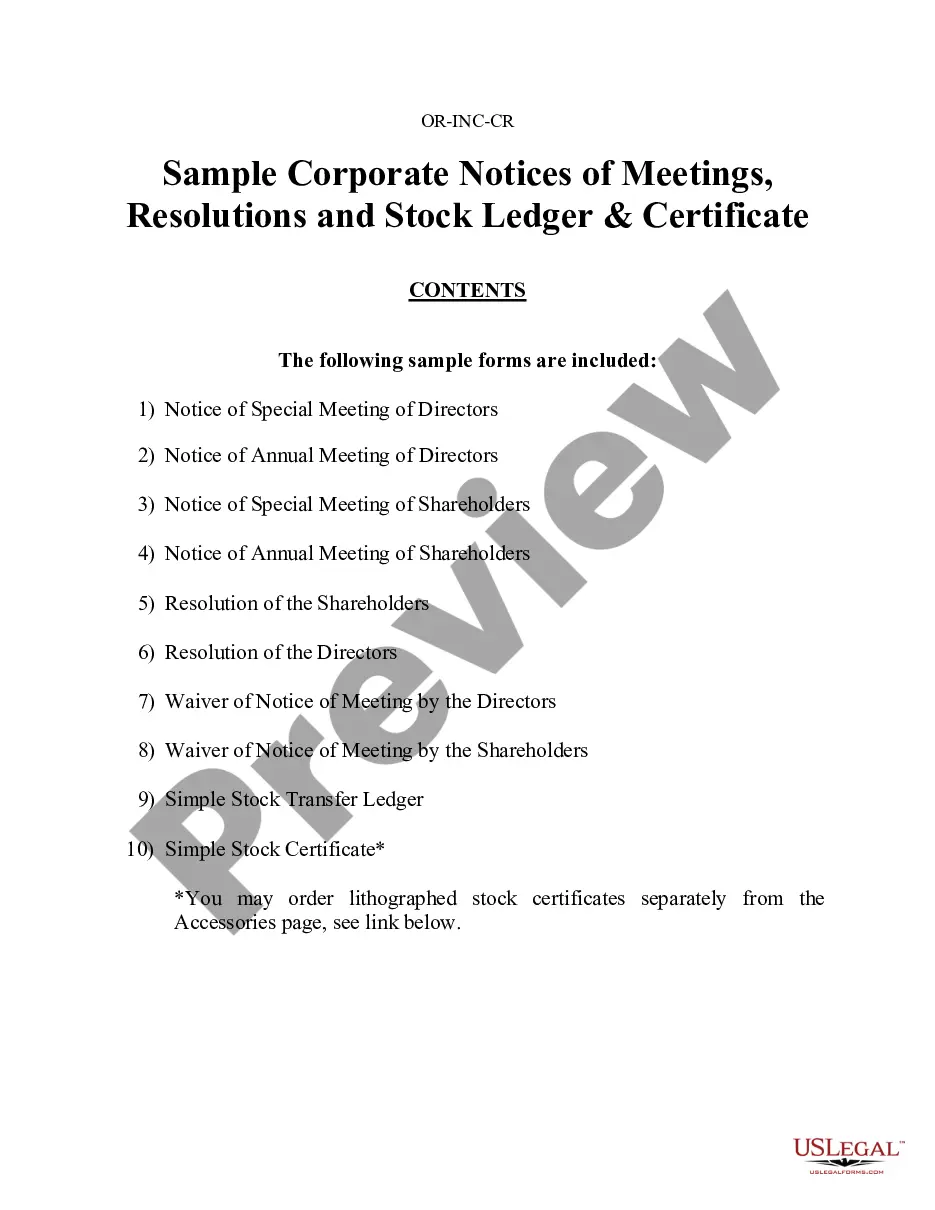

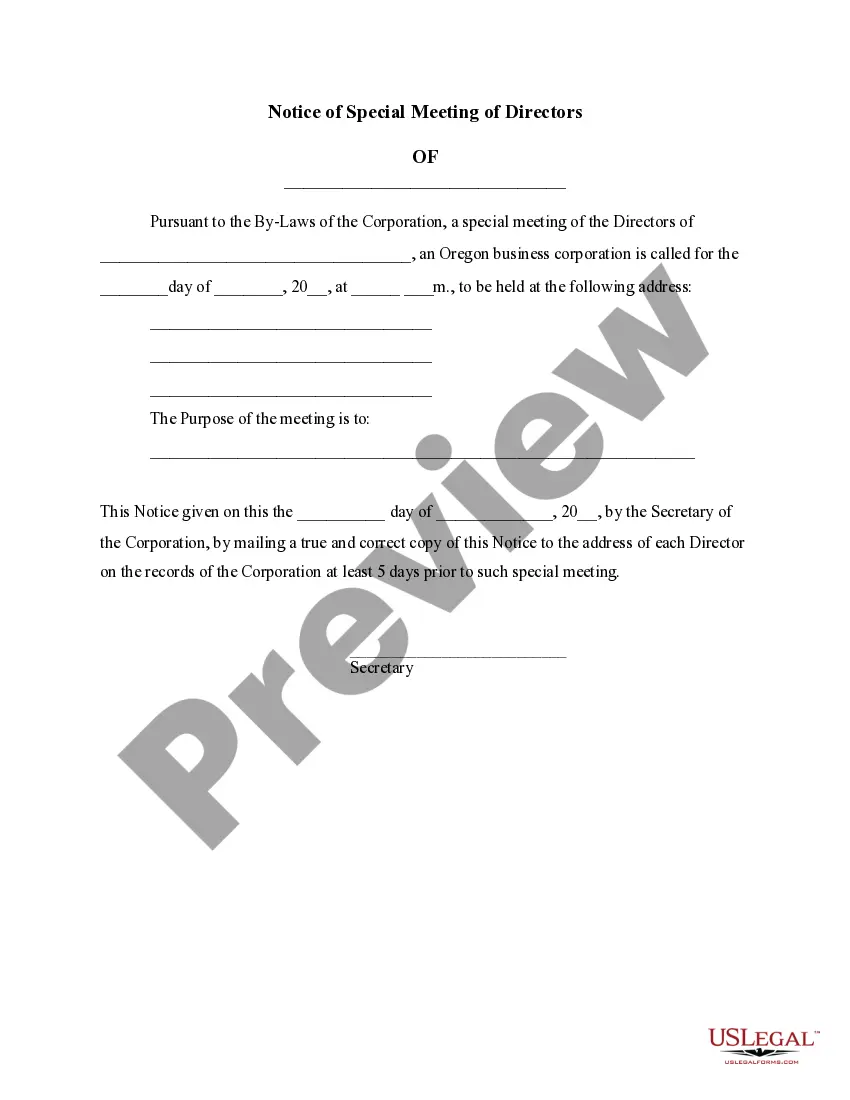

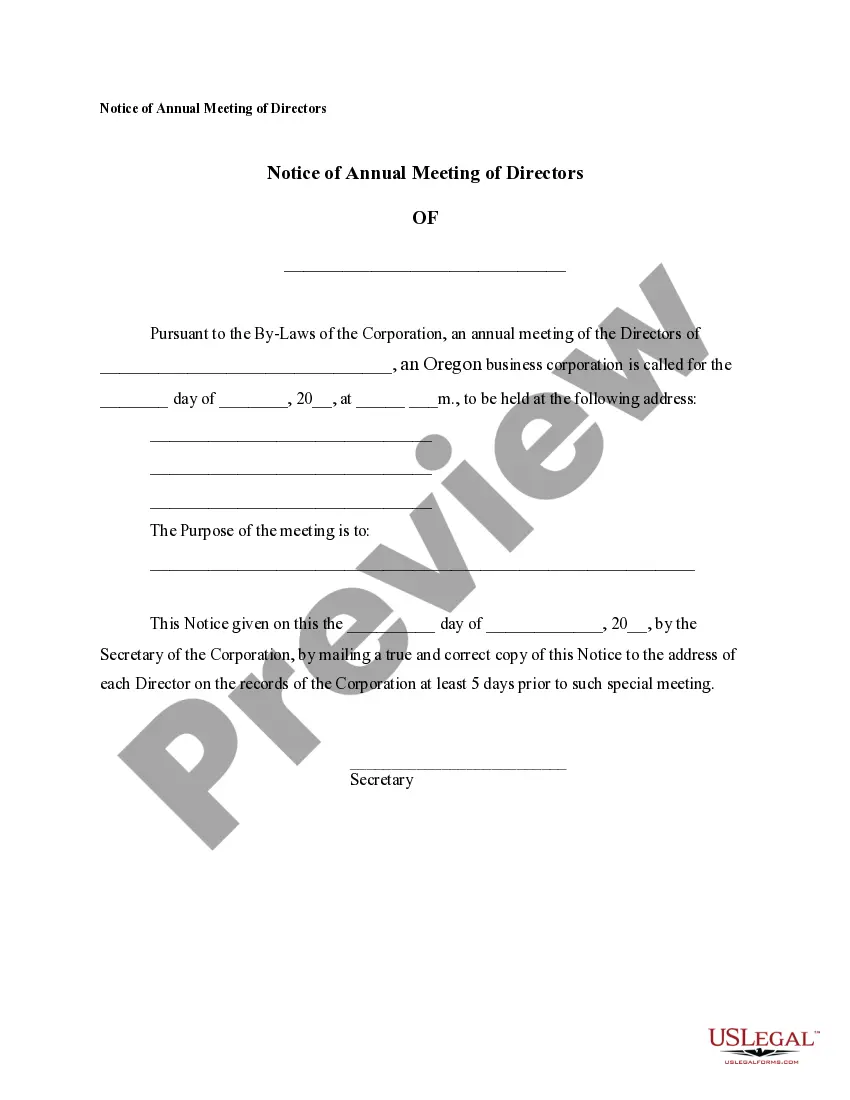

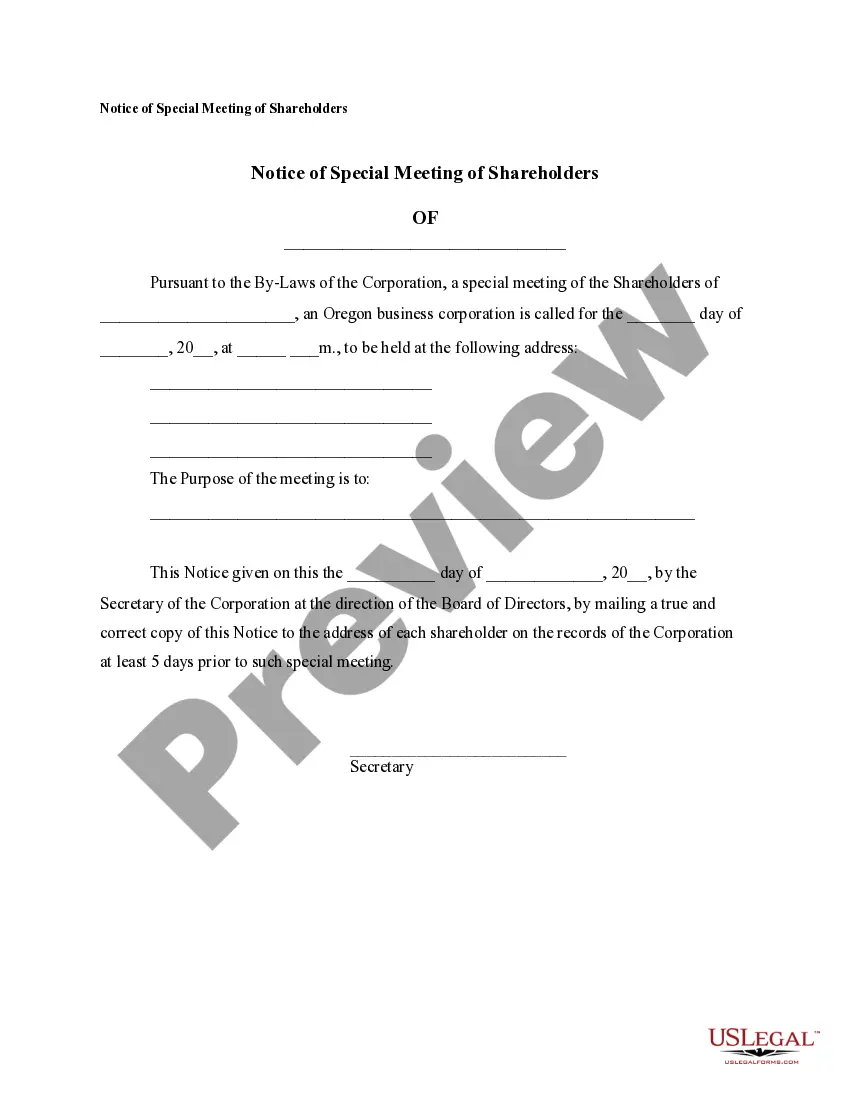

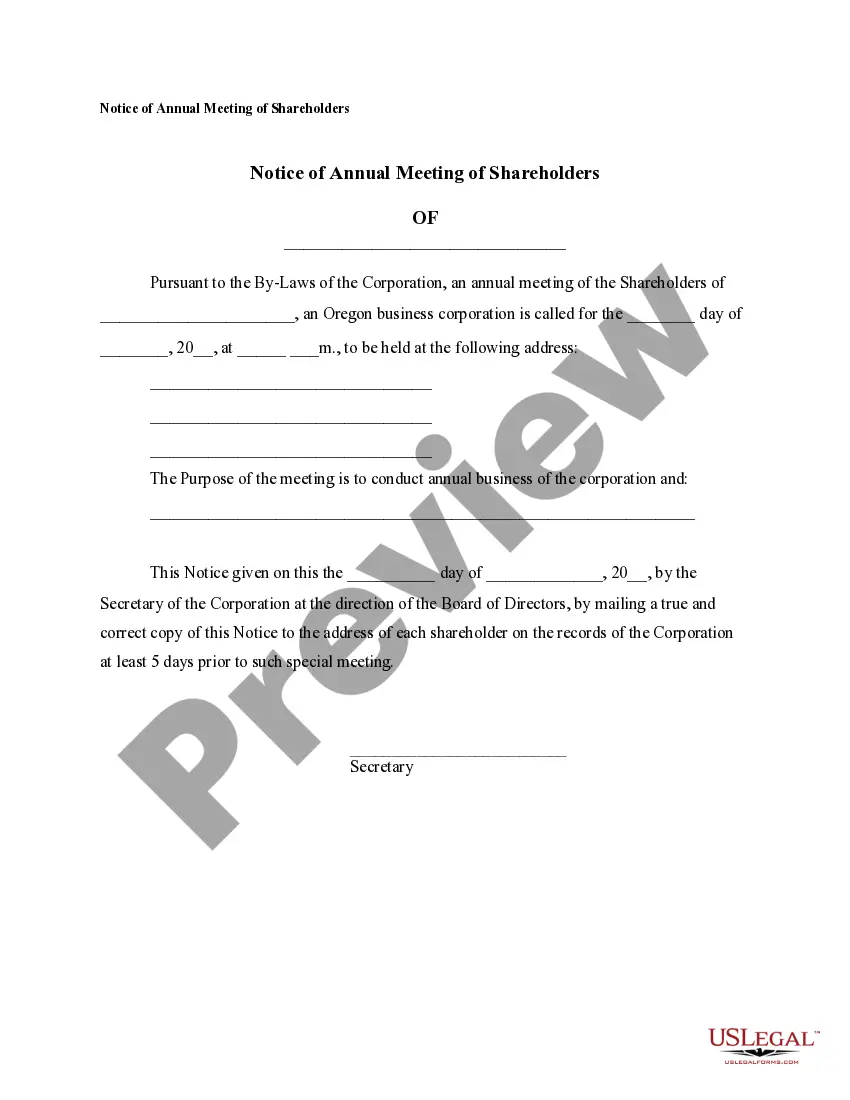

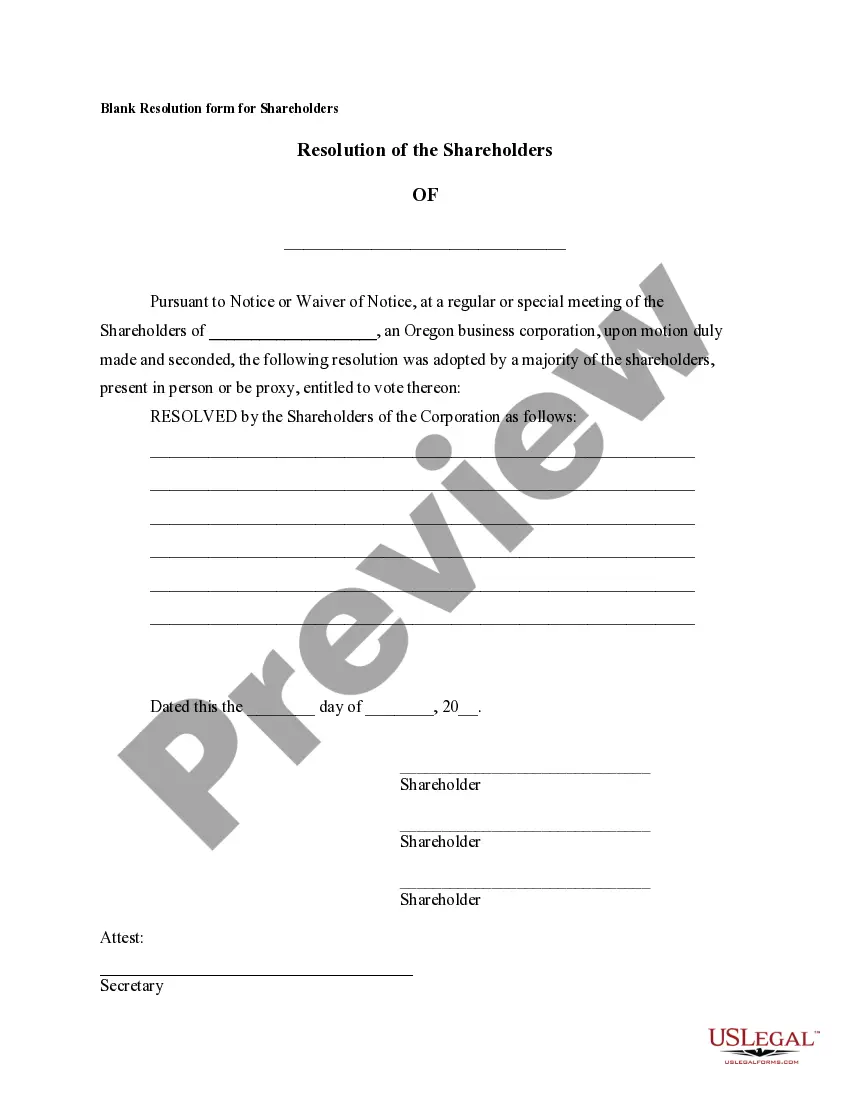

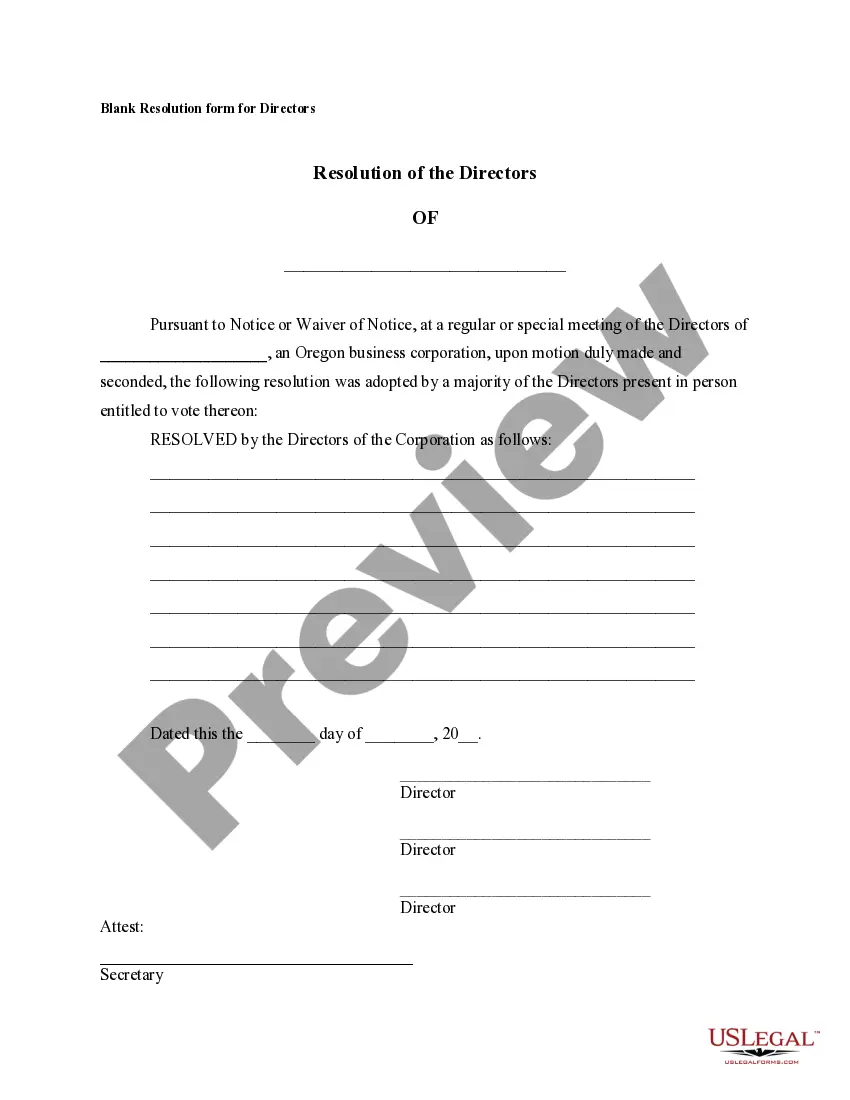

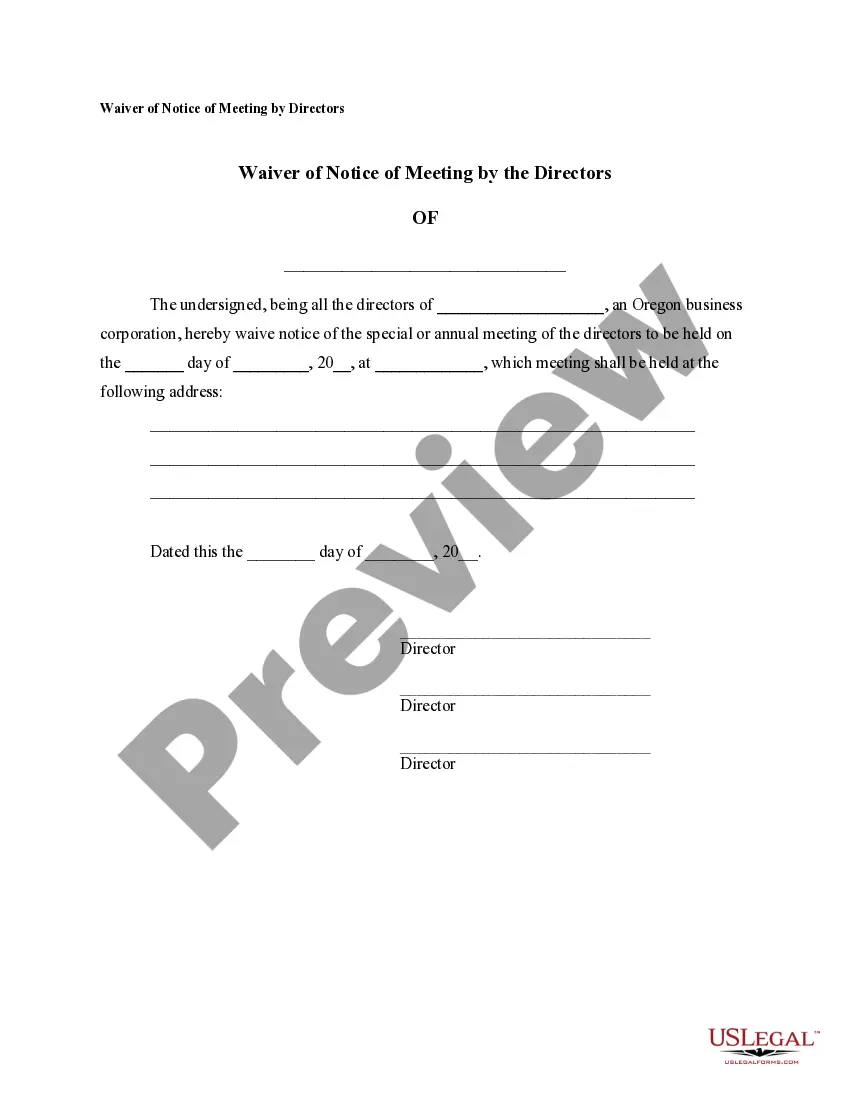

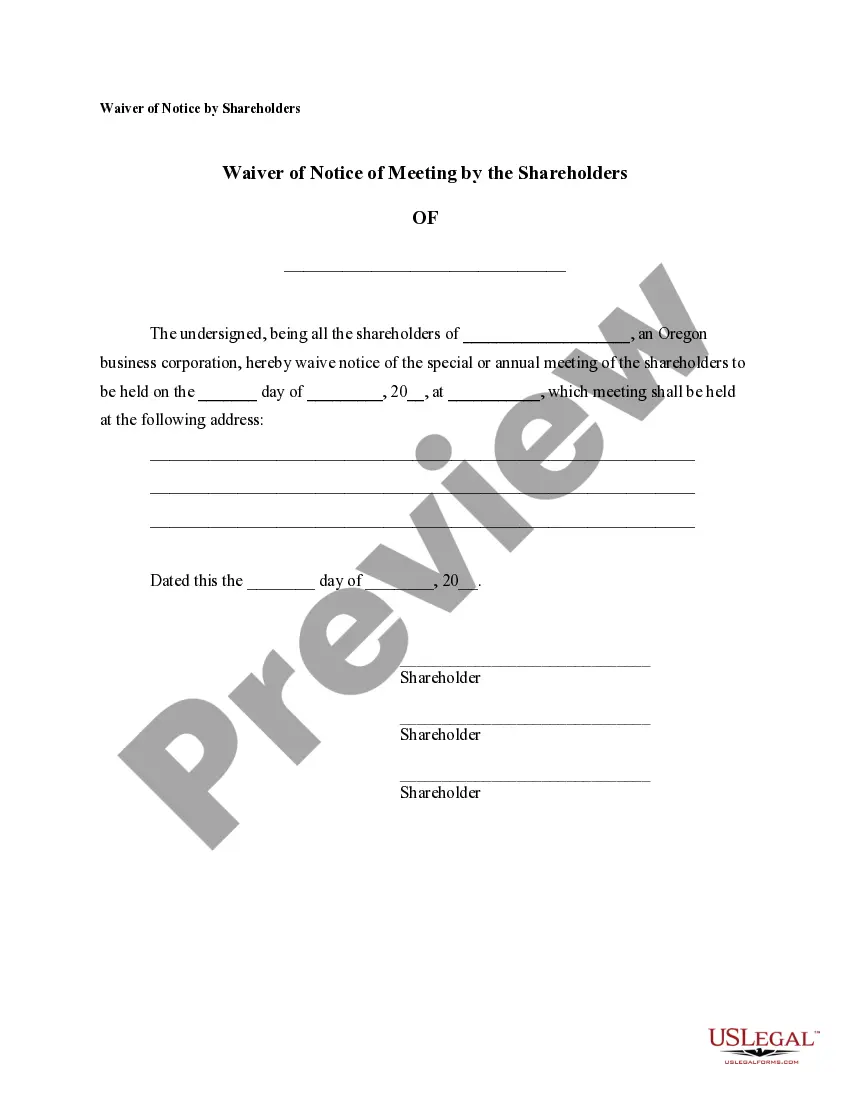

This is a group of forms that includes Notices of Meetings, Corporate Resolutions, a Stock Ledger, and a sample Stock Certificate.

Oregon Notices, Resolutions, Simple Stock Ledger and Certificate

Description

How to fill out Oregon Notices, Resolutions, Simple Stock Ledger And Certificate?

Creating documents isn't the most simple job, especially for people who almost never work with legal paperwork. That's why we advise using correct Oregon Notices, Resolutions, Simple Stock Ledger and Certificate samples made by professional lawyers. It allows you to stay away from problems when in court or handling formal organizations. Find the samples you need on our website for high-quality forms and exact descriptions.

If you’re a user with a US Legal Forms subscription, just log in your account. As soon as you are in, the Download button will immediately appear on the file web page. Soon after downloading the sample, it’ll be saved in the My Forms menu.

Users with no an activated subscription can quickly get an account. Look at this simple step-by-step help guide to get your Oregon Notices, Resolutions, Simple Stock Ledger and Certificate:

- Ensure that the form you found is eligible for use in the state it’s required in.

- Confirm the document. Utilize the Preview feature or read its description (if offered).

- Click Buy Now if this form is the thing you need or use the Search field to get a different one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

Right after doing these simple steps, you are able to fill out the sample in a preferred editor. Recheck filled in data and consider asking an attorney to examine your Oregon Notices, Resolutions, Simple Stock Ledger and Certificate for correctness. With US Legal Forms, everything becomes much simpler. Try it out now!

Form popularity

FAQ

Help Guide. A stock transfer ledger is a document in a corporation's record books that is used to keep an accurate record of all of the corporation's stock transactions. It includes the relevant details anytime corporate shares are issued, sold, or otherwise transferred.

Choose a Corporate Name. File Articles of Incorporation. Appoint a Registered Agent. Prepare Corporate Bylaws. Appoint Initial Directors and Hold First Board Meeting. File an Annual Report. Obtain an EIN.

Print the "Stock Transfer Form," fill it out in its entirety, and endorse the stock certificates. You'll also have to obtain a medallion guarantee from an approved financial institution. Once you're satisfied that you filled everything out correctly, mail the stock transfer form and the stock certificates to the agent.

Requesting a Certificate Complete a certificate request form (PDF) to ord200ber the document. Ordering a certificate is easy. Fees for certificates are $10 each. Requests for certificates are processed in the order they are received and within 3 business days.

Name of the shareholder; Complete mailing address of the stock shareholder including contact number; Stock certificate number; The total number of shares outstanding; The date the shares were purchased;

The stock ledger holds financial data that allows you to monitor your company's performance. It incorporates financial transactions related to merchandising activities, including sales, purchases, transfers, and markdowns; and is calculated weekly or monthly.

Stock Ledgers If stockholders prefer to hold original of stock certificates, copies of each certificate should be kept in the stock record book together with a receipt evidencing that the stockholder receipt. All stock certificates or copies are kept sequentially in the stock records of the company.

Look this up online or on any correspondence received from the OR Department of Revenue. If you have a Business Identification Number that is 8 digits long, please add a 0 to the beginning. If you're unsure, contact the agency at 503-945-8091 or 800-356-4222.

Name of the shareholder; Complete mailing address of the stock shareholder including contact number; Stock certificate number; The total number of shares outstanding; The date the shares were purchased;