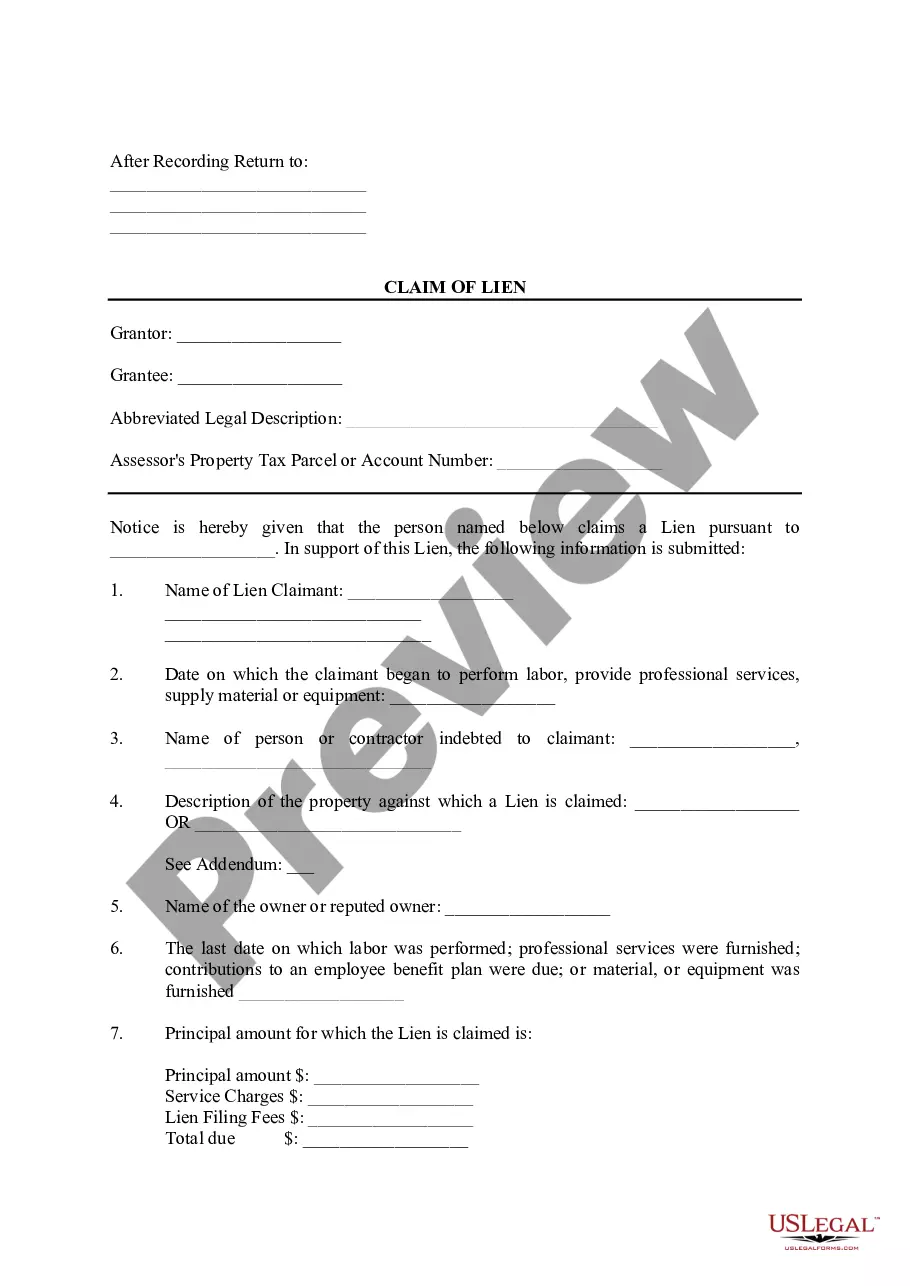

Oregon Claim of Lien Claim of Lien

Description

employee, laborer, worker, or supplier wishing to file and

record a Lien Claim.

How to fill out Oregon Claim Of Lien Claim Of Lien?

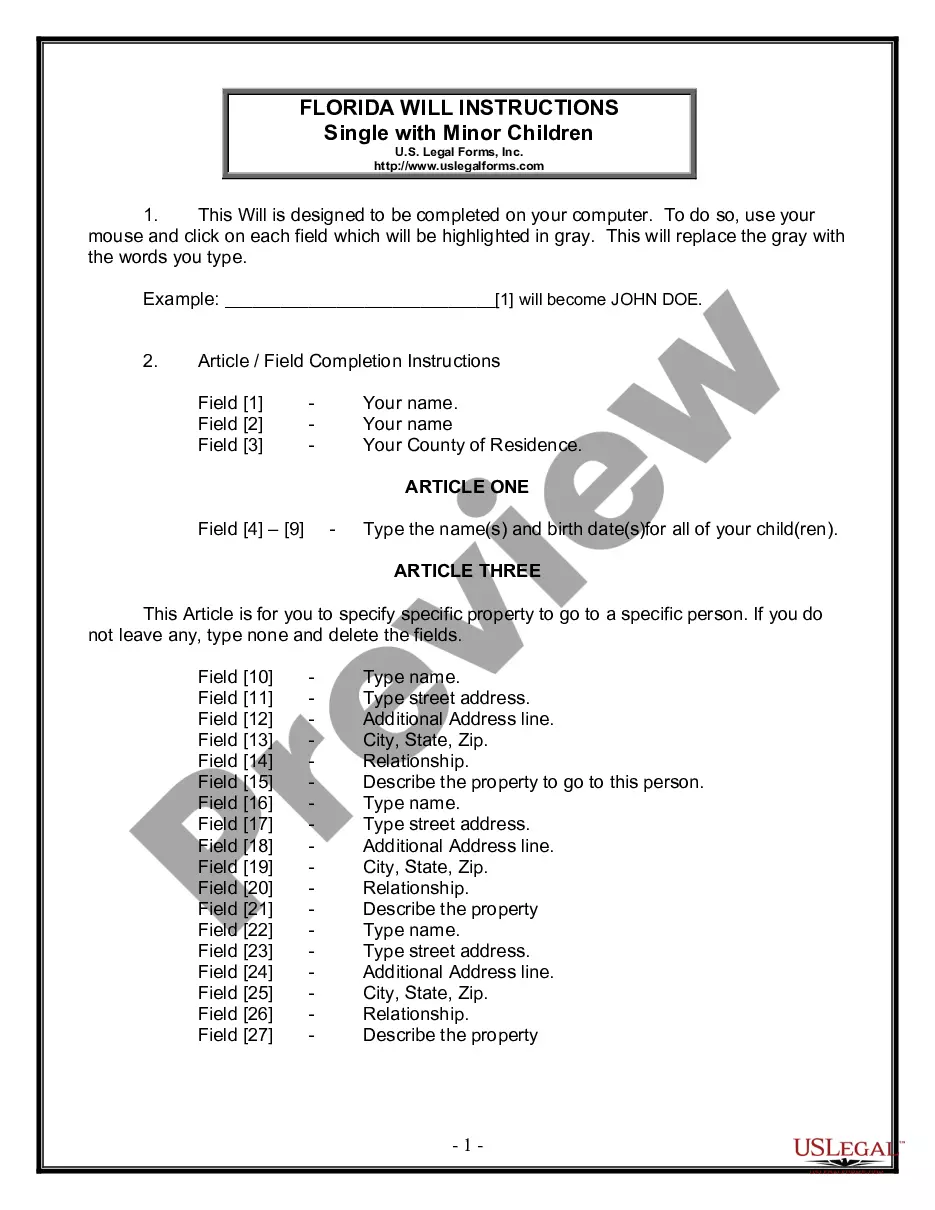

The work with papers isn't the most straightforward task, especially for people who almost never work with legal paperwork. That's why we advise utilizing accurate Oregon Claim of Lien samples made by professional attorneys. It allows you to prevent difficulties when in court or dealing with formal organizations. Find the templates you need on our site for top-quality forms and correct descriptions.

If you’re a user having a US Legal Forms subscription, just log in your account. As soon as you’re in, the Download button will immediately appear on the file page. Soon after accessing the sample, it will be stored in the My Forms menu.

Customers with no an active subscription can easily create an account. Utilize this brief step-by-step help guide to get the Oregon Claim of Lien:

- Ensure that the form you found is eligible for use in the state it’s needed in.

- Confirm the file. Utilize the Preview option or read its description (if available).

- Click Buy Now if this template is the thing you need or use the Search field to find another one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

After doing these straightforward actions, you are able to complete the form in a preferred editor. Recheck completed information and consider requesting a lawyer to review your Oregon Claim of Lien for correctness. With US Legal Forms, everything becomes easier. Try it out now!

Form popularity

FAQ

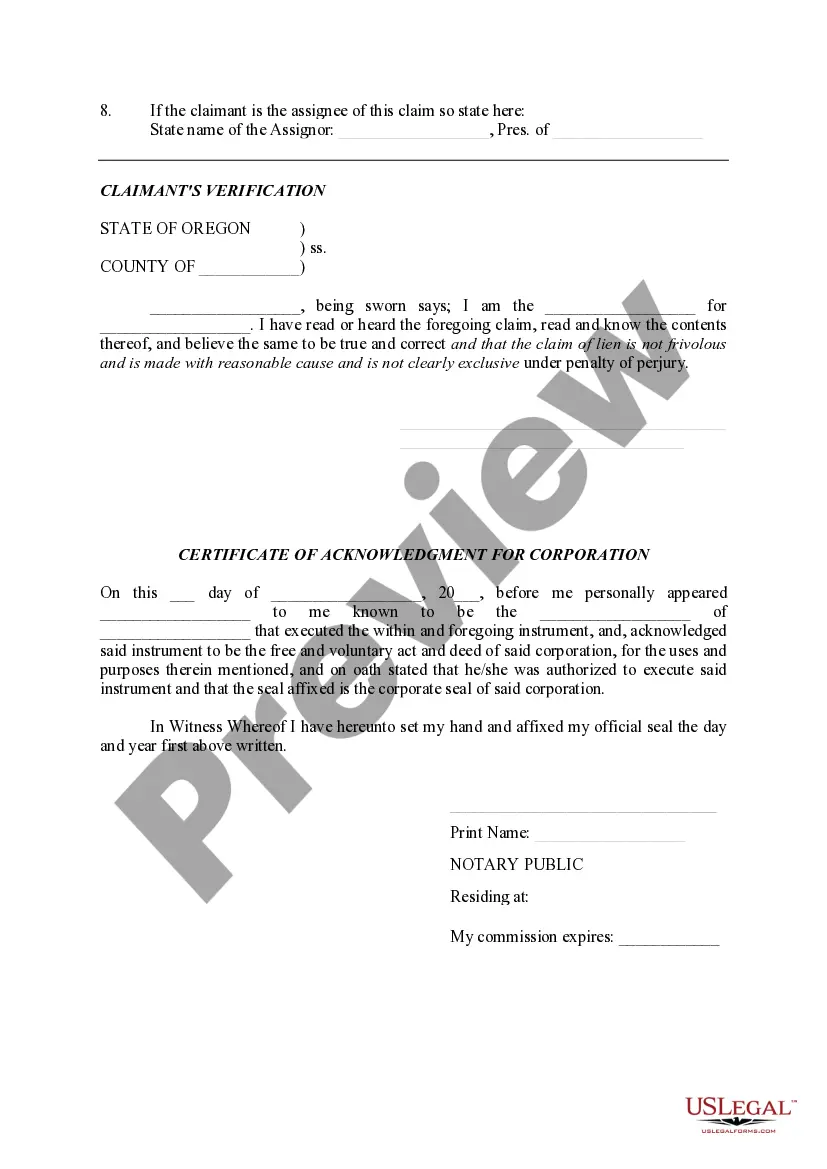

Step 1: Determine if you have the right to file a lien. Step 2: Send notice of right to lien. Step 3: Prepare the lien document. Step 4: File the lien. Step 5: Send notice of lien. Step 6: Secure payment. Step 7: Release the lien.

Step 1: Determine if you have the right to file a lien. Step 2: Send notice of right to lien. Step 3: Prepare the lien document. Step 4: File the lien. Step 5: Send notice of lien. Step 6: Secure payment. Step 7: Release the lien.

Negotiate with the contractor who placed the lien (the "lienor" to remove it. Obtain a lien bond to discharge the lien, or. File a lawsuit to vacate the lien.

In the state of Oregon, a lien must be filed within 75 days after the last day of performing labor or providing materials or within 75 days after the completion of construction.

The short answer to that question is usually no. If somebody owes you money you could sue them, you could obtain a judgment, you can obtain what's called a "judgment lien" and once you get the judgment lien, you can have the court record that against their property including the real estate.

To place a lien, you must first demonstrate that you have a valid debt that has not been paid by the property holder for example if you performed construction work as a contractor or subcontractor at company headquarters and the business did not pay your bill.

Therefore, liens are not officially recorded, and personal property could be sold off to a third party who is unaware of the lien's existence. In most states, judgment liens must be filed by the creditor through the county or state.

Be sure to include the following pieces of information in your lien: The name, company name and address (including county) of the property owner against whom your lien is filed; the same information about the delinquent client, if different; the beginning and ending dates of the unpaid service; the due date for payment