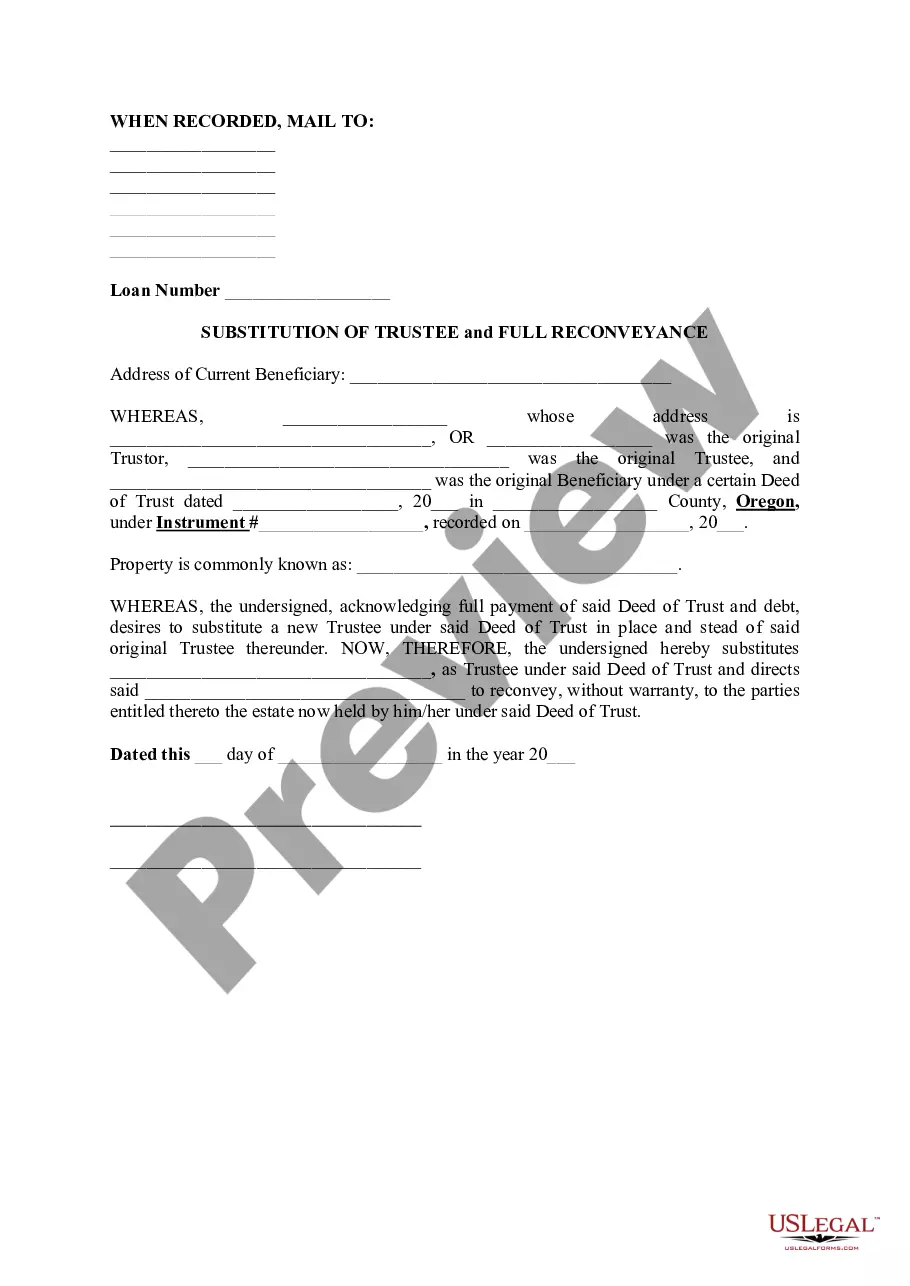

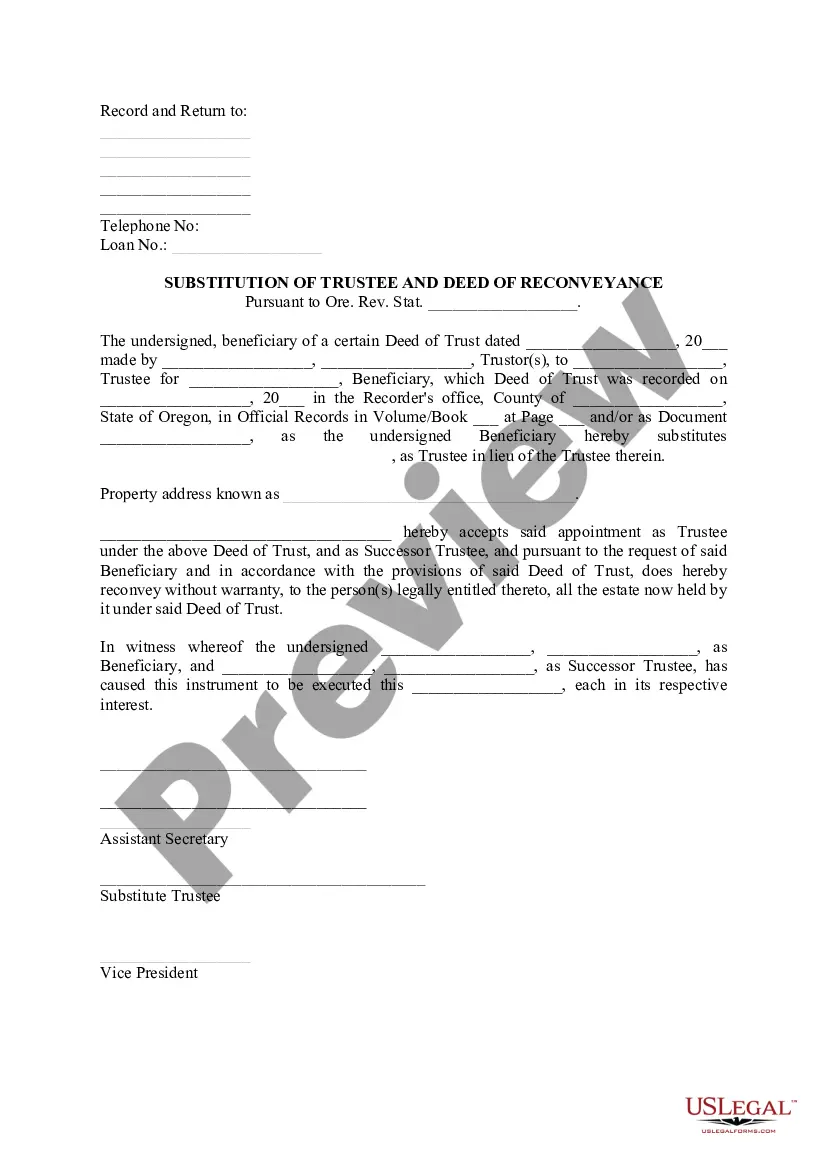

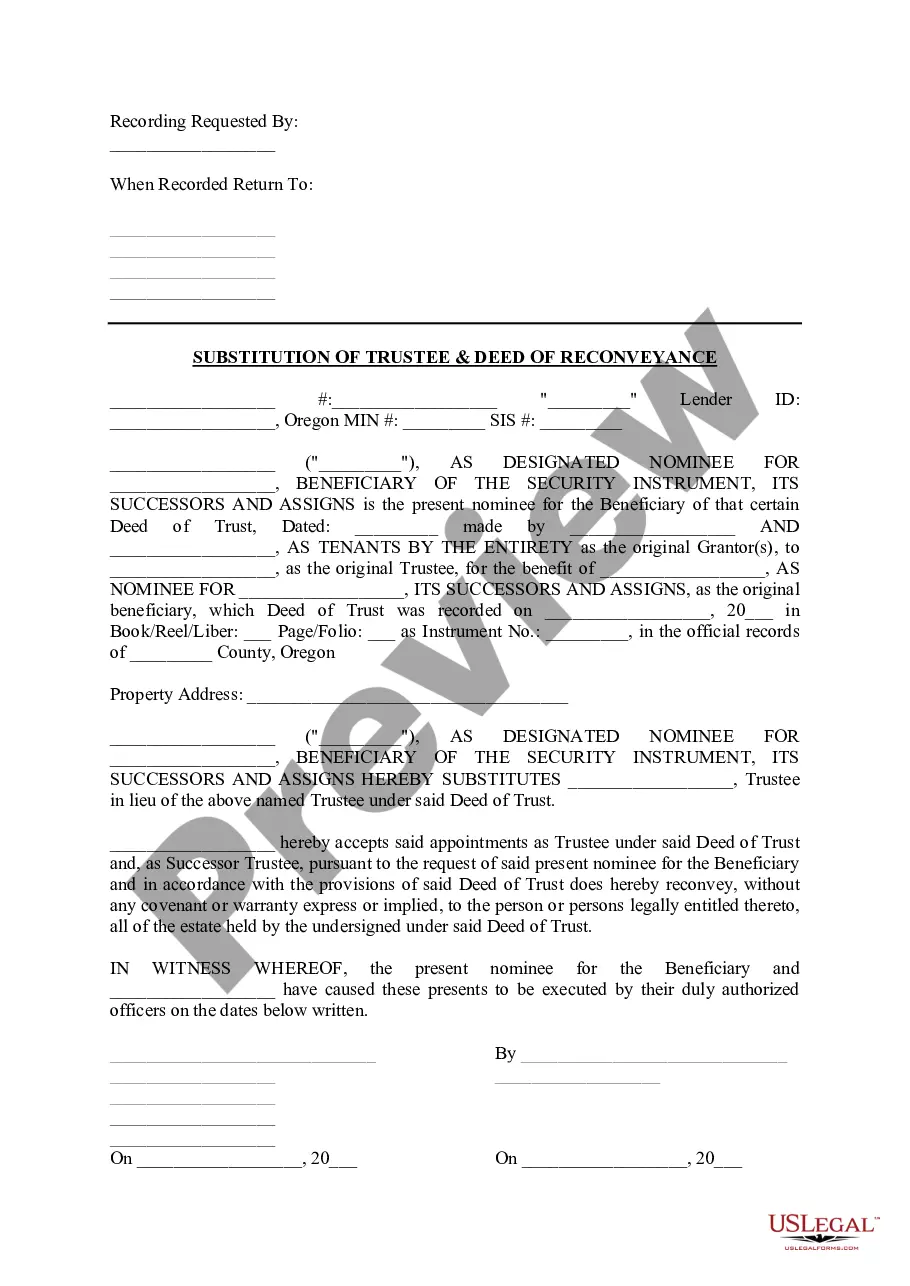

Oregon Substitution of Trustee and Full Reconveyance

Description

How to fill out Oregon Substitution Of Trustee And Full Reconveyance?

The work with papers isn't the most uncomplicated job, especially for people who rarely deal with legal papers. That's why we advise making use of correct Oregon Substitution of Trustee and Full Reconveyance templates created by skilled lawyers. It allows you to avoid difficulties when in court or working with formal organizations. Find the files you want on our website for top-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, simply log in your account. When you are in, the Download button will automatically appear on the template web page. After downloading the sample, it’ll be stored in the My Forms menu.

Users without an active subscription can quickly create an account. Look at this simple step-by-step guide to get the Oregon Substitution of Trustee and Full Reconveyance:

- Ensure that the form you found is eligible for use in the state it’s necessary in.

- Verify the document. Make use of the Preview option or read its description (if offered).

- Click Buy Now if this form is the thing you need or go back to the Search field to get another one.

- Select a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a required format.

Right after completing these simple steps, it is possible to fill out the form in a preferred editor. Check the filled in information and consider requesting a lawyer to review your Oregon Substitution of Trustee and Full Reconveyance for correctness. With US Legal Forms, everything becomes easier. Give it a try now!

Form popularity

FAQ

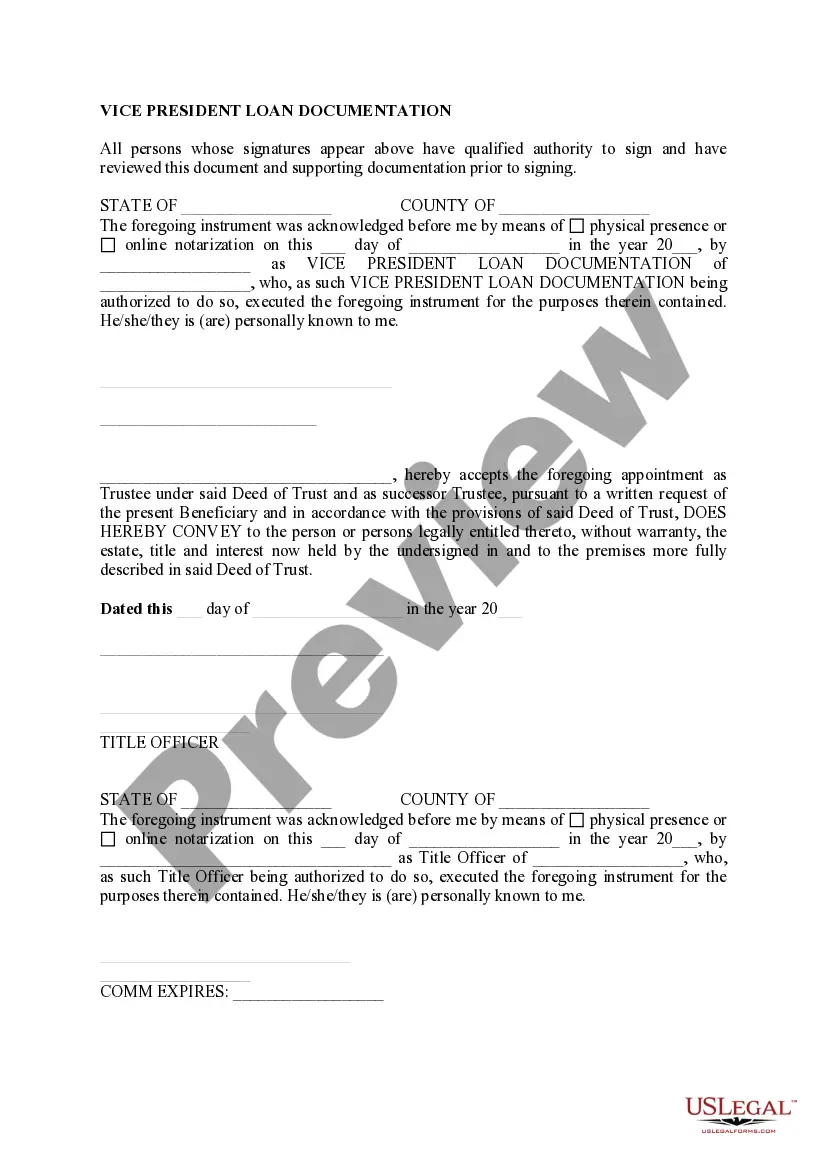

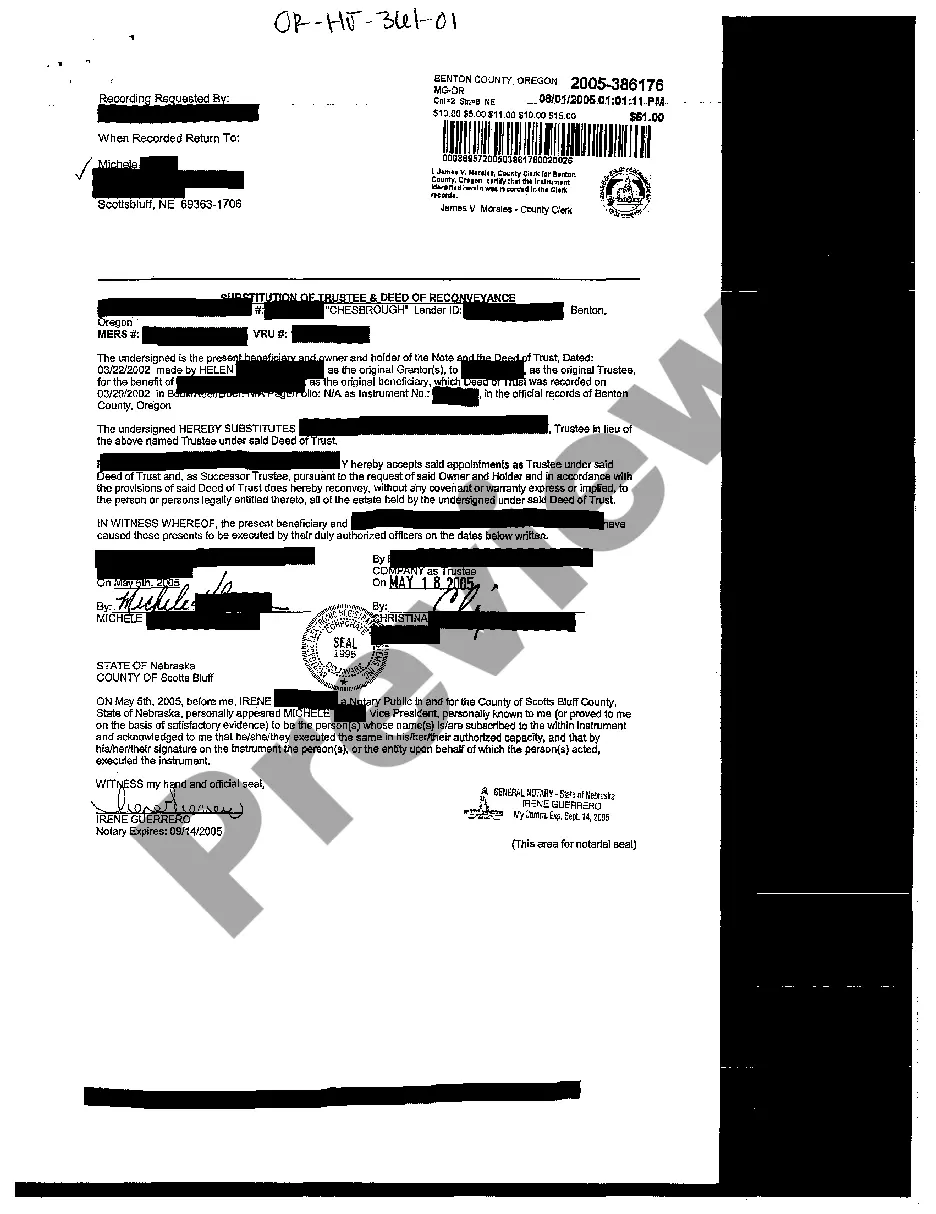

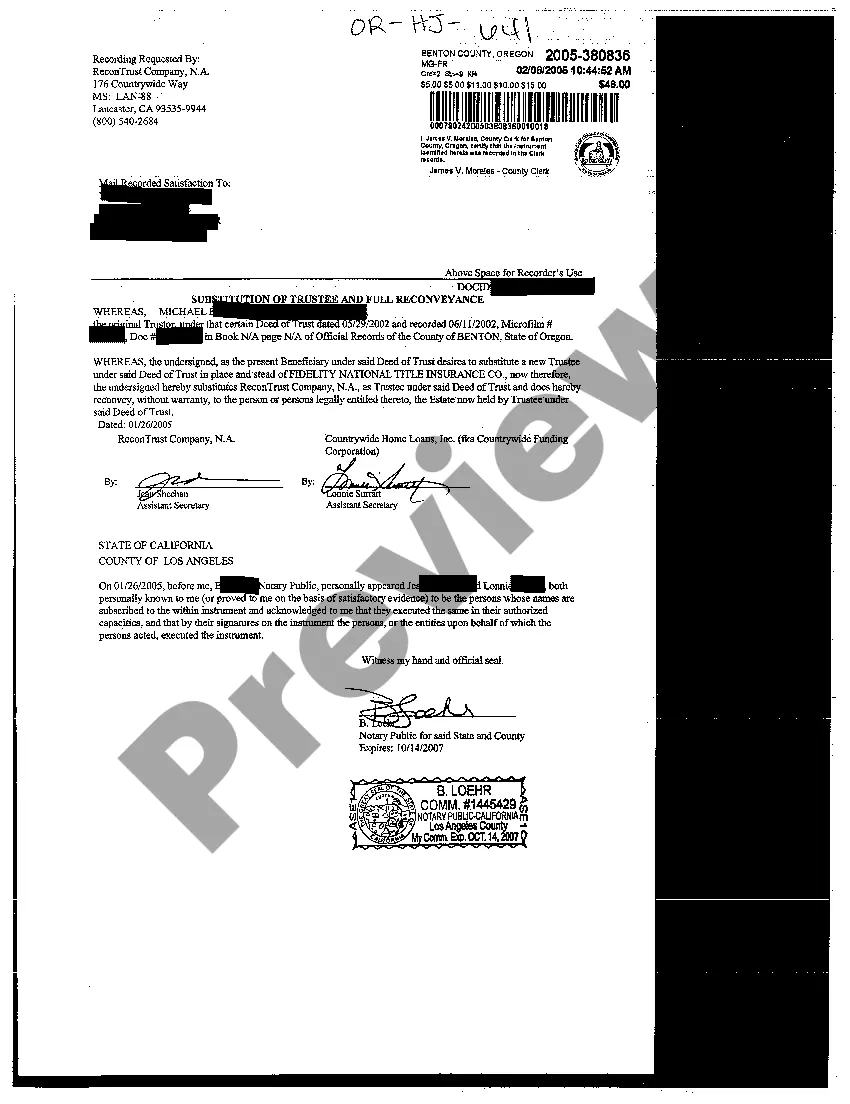

A document known as a substitution of trustee and full reconveyance identifies the person who has the authority to reconvey the property and remove the lien.Once the document is registered, it establishes the borrower as the sole owner of the property, which is now free and clear of the previous mortgage.

The deed must be signed by the party or parties making the conveyance or grant; and 7.

A reconveyance is the official transfer of the property title after the mortgage has been paid in full. The processing time can vary based on the county in which the property is located and can take up to three months. You will need to contact your county for questions on their specific processing time.

Only until the debt is paid off by the borrower can a deed of reconveyance then be used to clear the deed of trust from the title to the property. The document is signed by the trustee, whose signature must be notarized.

A deed of trust is a method of securing a real estate transaction that includes three parties: a lender, borrower and a third-party trustee.

Some use deeds of trust instead, which are similar documents, but they have some fundamental differences.With a deed of trust, however, the lender must act through a go-between called the trustee. The beneficiary and the trustee can't be the same person or entity.

A mortgage holder issues a deed of reconveyance to indicate that the borrower has been released from the mortgage debt. The deed transfers the property title from the lender, also called the beneficiary, to the borrower. This document is most commonly used when a mortgage has been paid in full.

The act or process of reconveying property. A discharge acts as a reconveyance of the legal title from the mortgagee to the holder of the equity. 2. rare, archaic. the act or process of conveying something or someone back to their original location.

In order to clear the Deed of Trust from the title to the property, a Deed of Reconveyance must be recorded with the Country Recorder or Recorder of Deeds. If the Trustee/Beneficiary fails to record a satisfaction within the set time limits, the Trustee/Beneficiary may be responsible for damages as set out by statute.