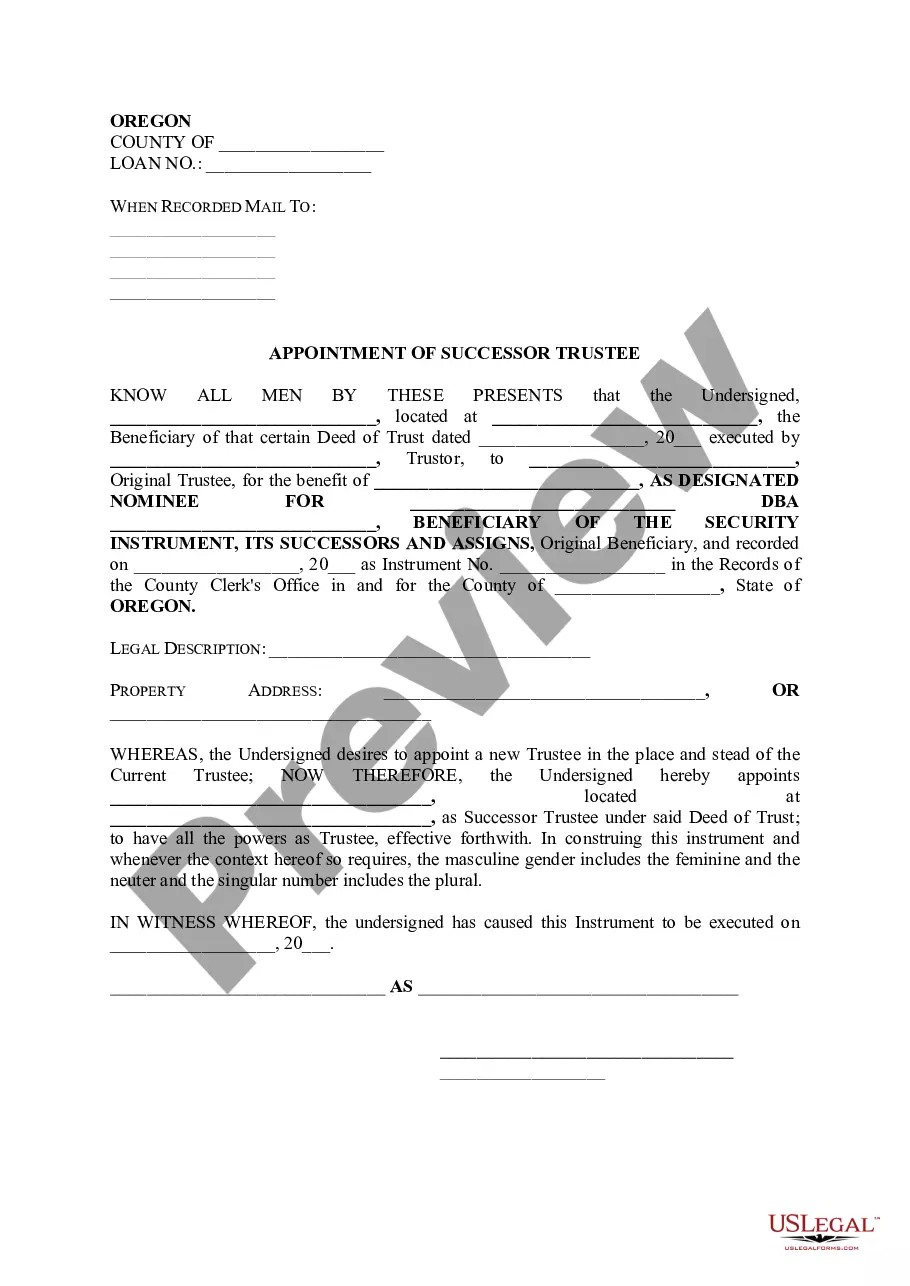

Oregon Appointment of Successor Trustee

Description Successor Trustee Document

How to fill out Oregon Appointment Of Successor Trustee?

Creating papers isn't the most uncomplicated task, especially for people who almost never deal with legal paperwork. That's why we recommend using correct Oregon Appointment of Successor Trustee templates created by professional attorneys. It allows you to stay away from troubles when in court or working with official organizations. Find the files you require on our website for top-quality forms and exact descriptions.

If you’re a user with a US Legal Forms subscription, just log in your account. As soon as you are in, the Download button will automatically appear on the template page. After downloading the sample, it will be stored in the My Forms menu.

Customers without an activated subscription can quickly create an account. Utilize this brief step-by-step guide to get the Oregon Appointment of Successor Trustee:

- Be sure that file you found is eligible for use in the state it is needed in.

- Verify the file. Utilize the Preview feature or read its description (if readily available).

- Buy Now if this sample is what you need or utilize the Search field to find a different one.

- Select a convenient subscription and create your account.

- Make use of your PayPal or credit card to pay for the service.

- Download your document in a required format.

After finishing these simple actions, you can complete the form in a preferred editor. Check the completed info and consider asking an attorney to examine your Oregon Appointment of Successor Trustee for correctness. With US Legal Forms, everything becomes easier. Give it a try now!

Who Is The Trustee Form popularity

Appointment Of Successor Trustee Document Other Form Names

FAQ

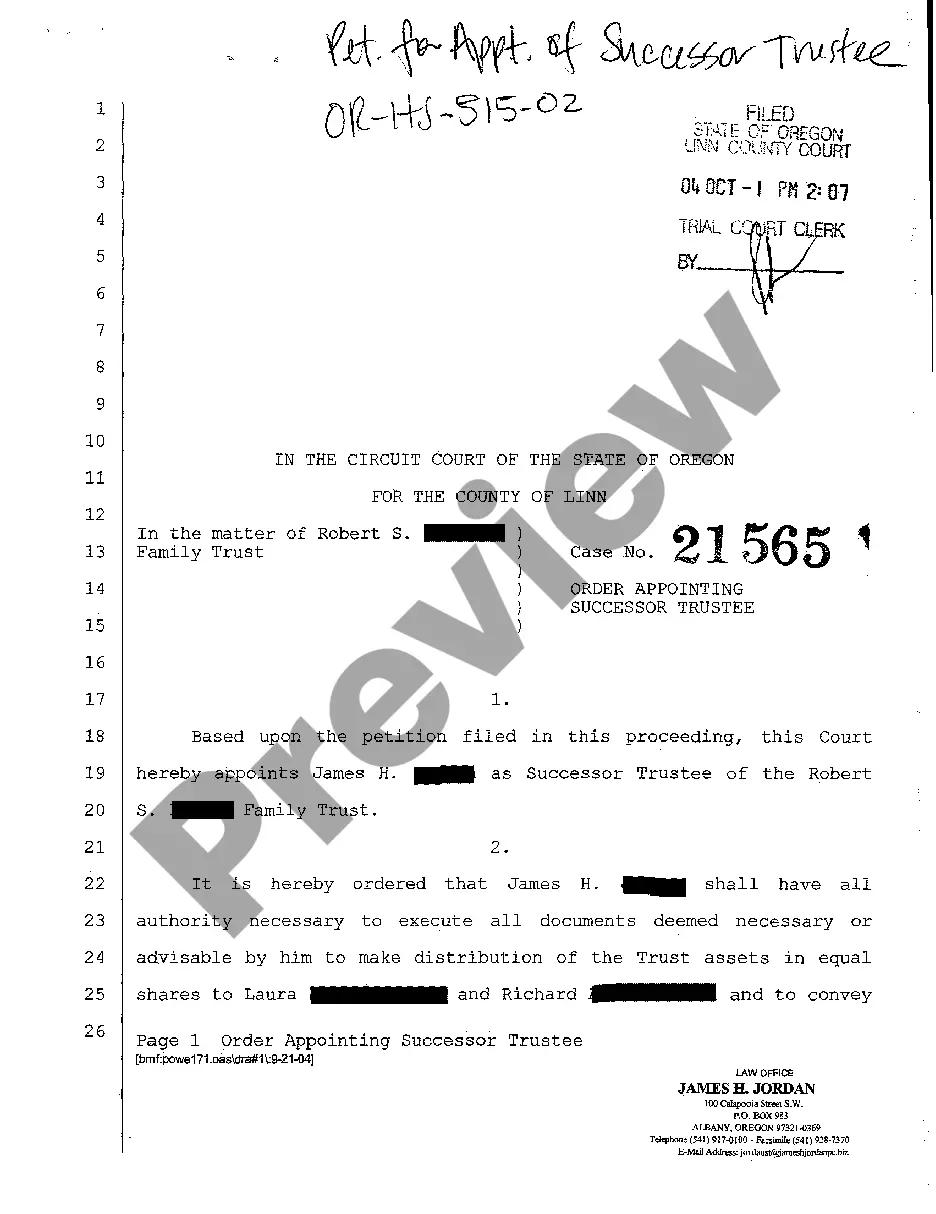

When the grantor dies, the trust becomes irrevocable and management or distribution of the assets passes to a successor trustee. Most trusts name the successor trustee when the trust is established; however, if you need to change or add a successor trustee, you can do so by amending the document.

For a revocable living trust, that Trustee is usually the person that created the trust.The successor trustee usually takes power when the person that created the trust either becomes incapacitated or has died. The Trustee only manages the assets that are owned by the trust, not assets outside the trust.

Removing a successor trustee is possible, and generally requires filing a petition for removal, while working with a trust litigation attorney.

Successor trustees have to willingly accept their role usually by signing a consent to serve or affidavit of appointment. If an existing trustee wishes to change their successor trustee, they must make an actual amendment to the trust. Most courts won't accept informal, self-made changes.

Nolo's Living Trust does not currently allow you to name an institution as successor trustee. If you want to do so, you will need help from an attorney. Normally, your first choice as successor trustee should be a flesh-and-blood person, not the trust department of a bank or other institution.

Successor trustees are appointed in the trust document itself. The trustor will specify who they want to take over management of the trust if and when they can't do it themselves.

Generally speaking, a living trust's grantor (the person who created the revocable living document) may appoint or remove trustees during their lifetime without hiring an attorney. The grantor can accomplish this by either creating an amendment to it or by revoking the original document and creating a new trust.

Once you follow that directive, the Trustee must step down and a successor Trustee can be appointed.Once a Trustee resigns, then either the next person named would act, or maybe you can appoint someone new if the Trust terms allow you to do that. Either way, a new Trustee will be in office when a Trustee resigns.

Can the Successor Trustee Be a Beneficiary of the Trust? It's perfectly legal to name a beneficiary of the trust (someone who will receive trust property after your death) as successor trustee. In fact, it's common.