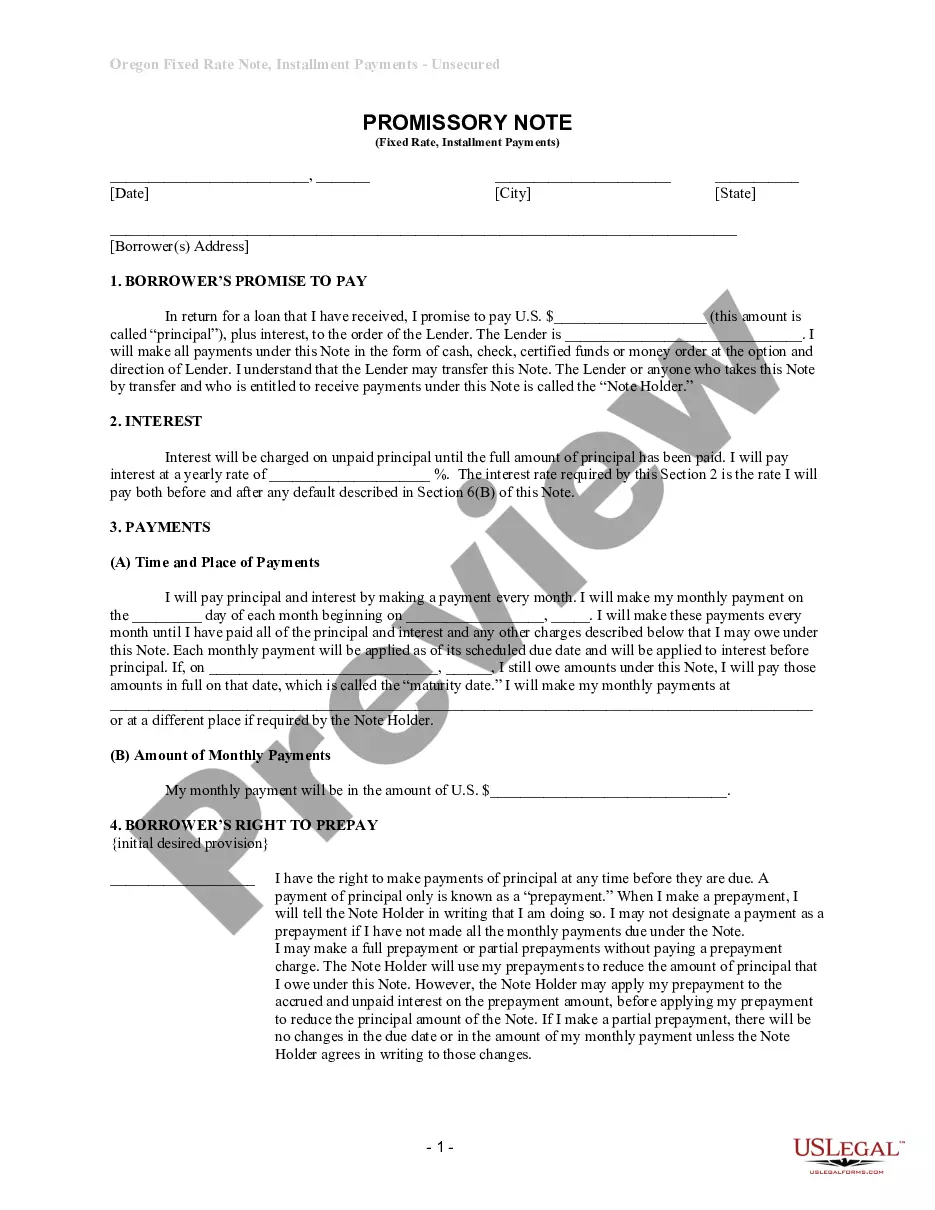

Oregon Unsecured Installment Payment Promissory Note for Fixed Rate

Description

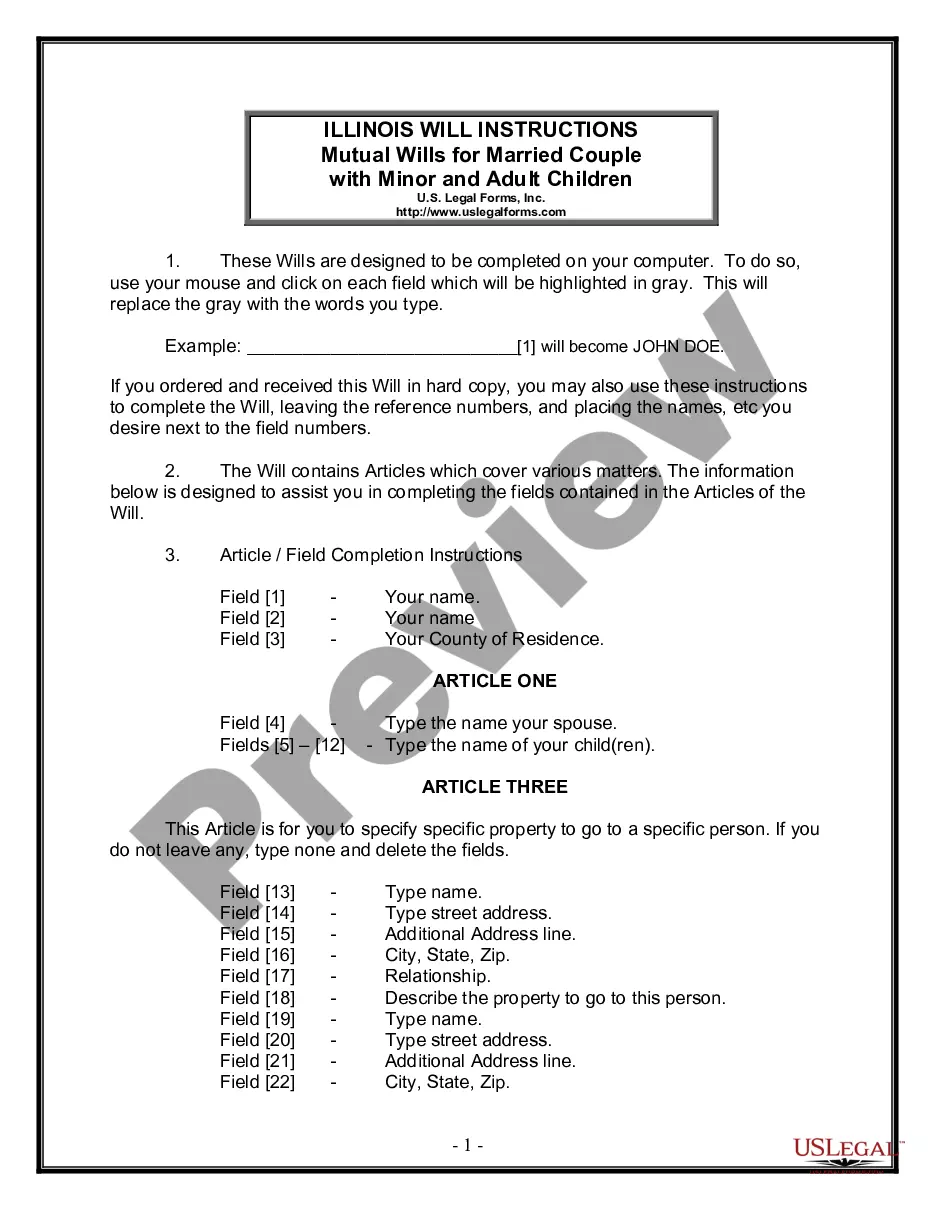

How to fill out Oregon Unsecured Installment Payment Promissory Note For Fixed Rate?

Creating documents isn't the most simple process, especially for those who rarely work with legal paperwork. That's why we advise utilizing accurate Oregon Unsecured Installment Payment Promissory Note for Fixed Rate templates created by professional lawyers. It allows you to stay away from troubles when in court or working with official institutions. Find the templates you want on our website for high-quality forms and exact descriptions.

If you’re a user having a US Legal Forms subscription, simply log in your account. When you are in, the Download button will automatically appear on the template page. Soon after accessing the sample, it’ll be saved in the My Forms menu.

Users with no an activated subscription can quickly get an account. Utilize this simple step-by-step help guide to get the Oregon Unsecured Installment Payment Promissory Note for Fixed Rate:

- Be sure that the document you found is eligible for use in the state it is needed in.

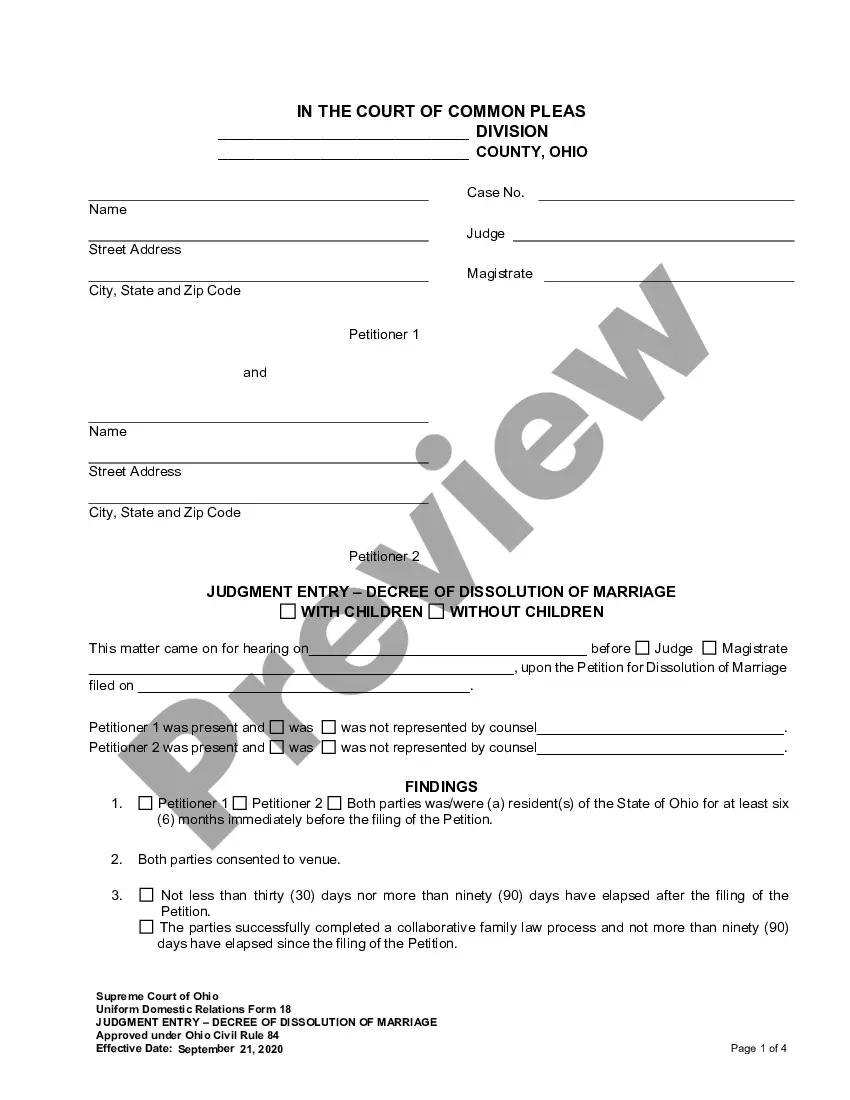

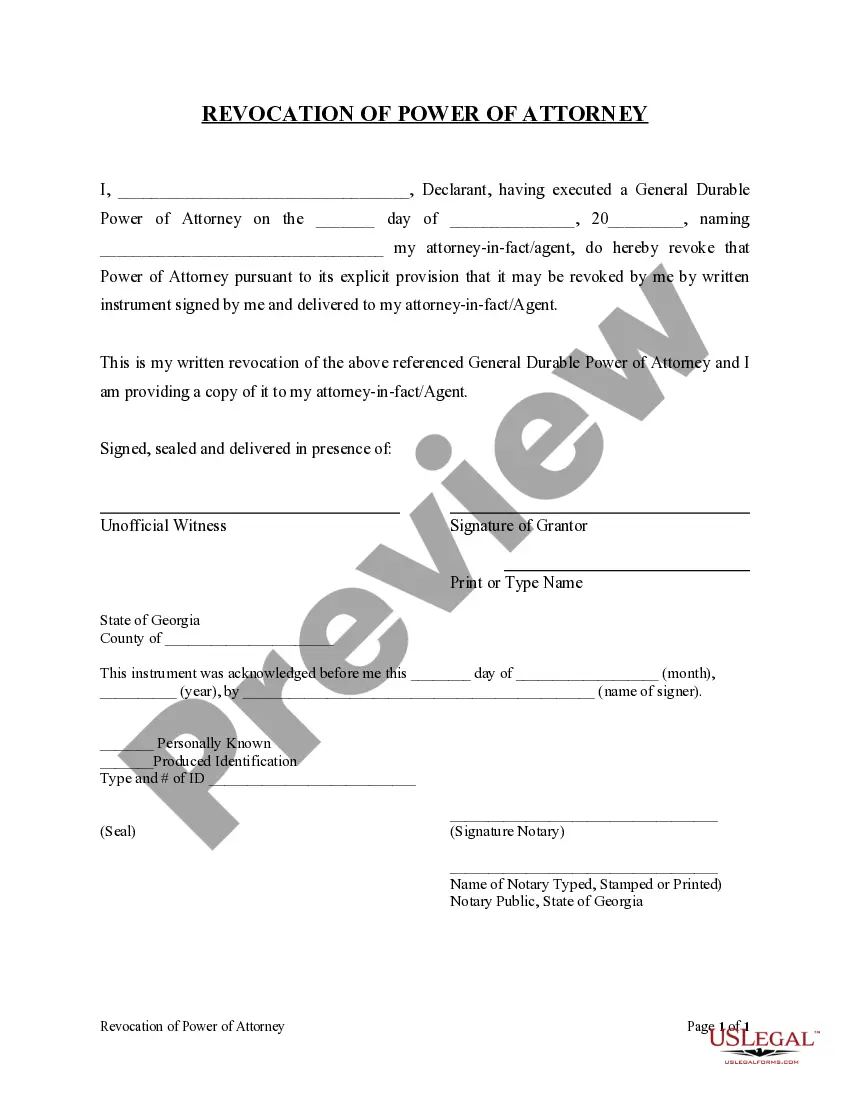

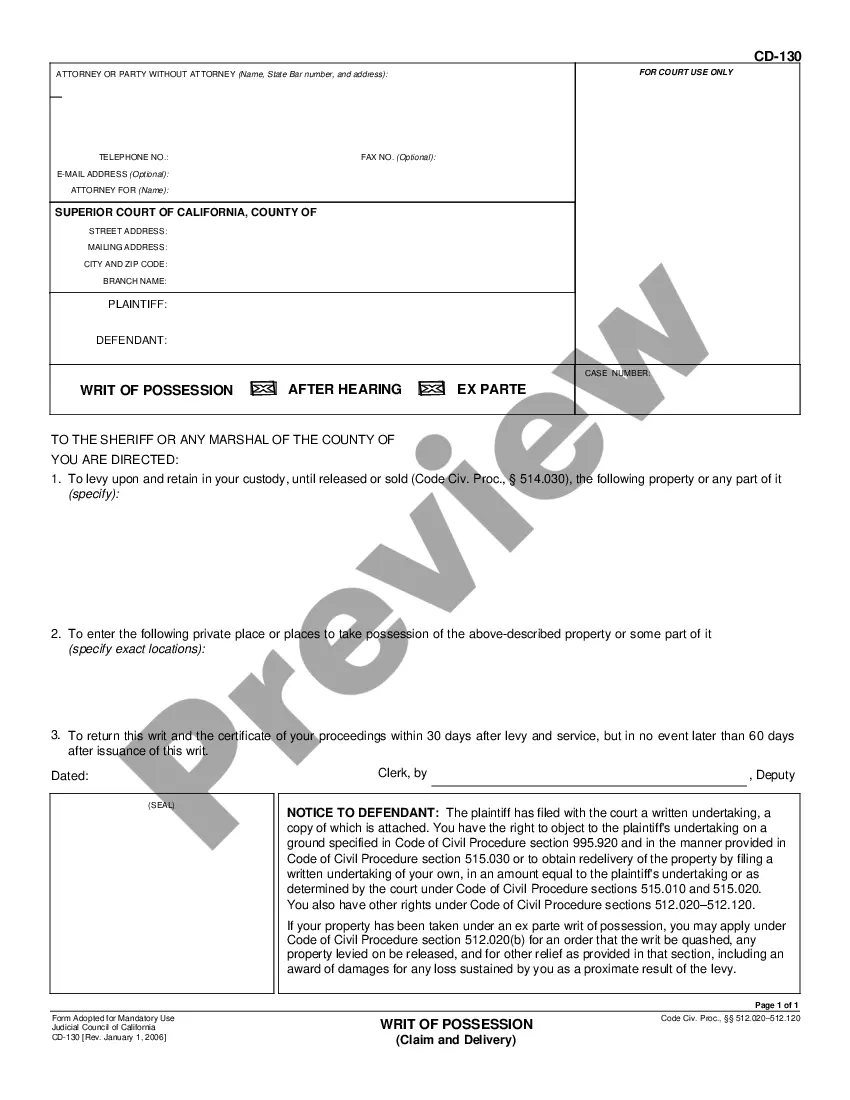

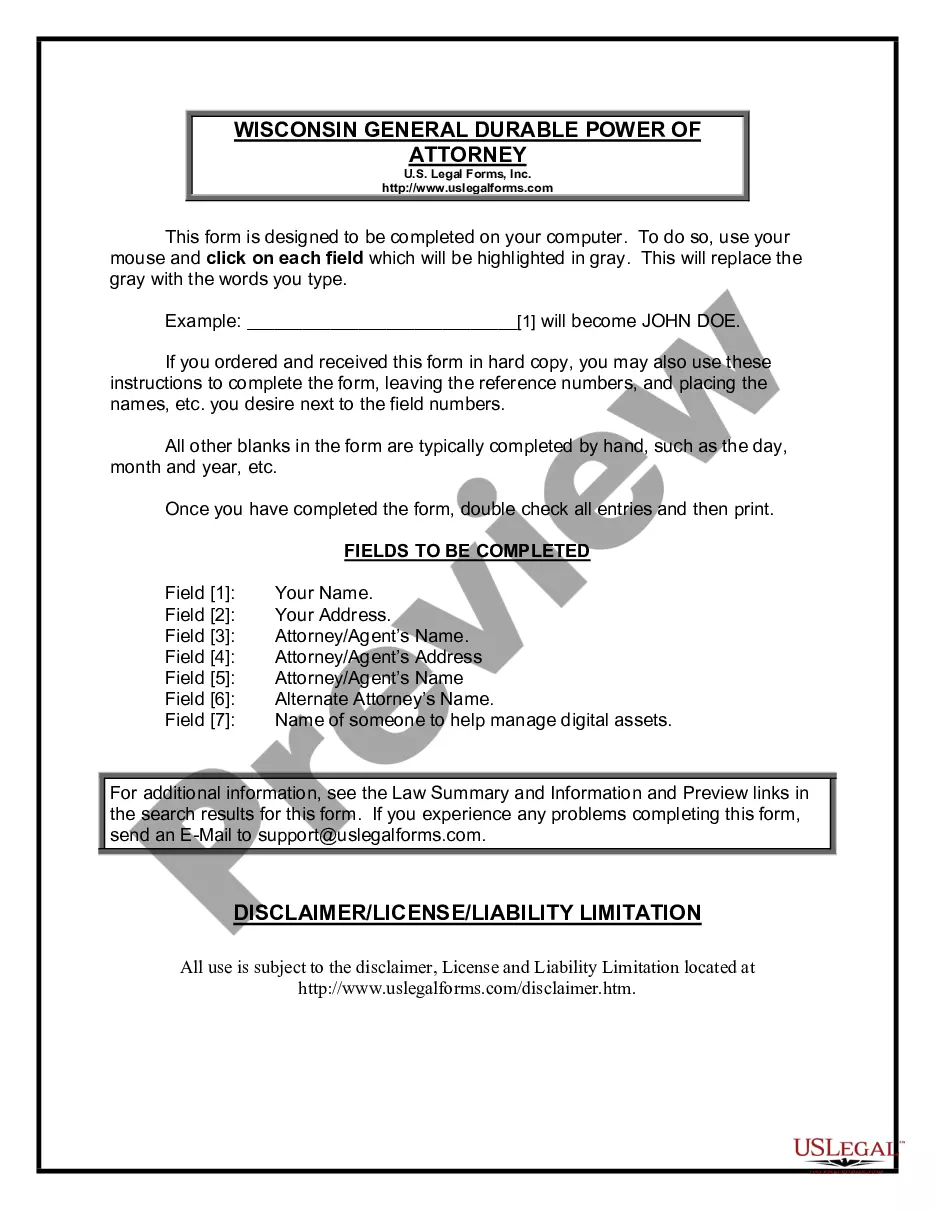

- Verify the document. Use the Preview feature or read its description (if readily available).

- Buy Now if this form is what you need or return to the Search field to find a different one.

- Select a convenient subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

After doing these simple steps, it is possible to complete the sample in an appropriate editor. Check the filled in info and consider asking an attorney to review your Oregon Unsecured Installment Payment Promissory Note for Fixed Rate for correctness. With US Legal Forms, everything becomes easier. Give it a try now!

Form popularity

FAQ

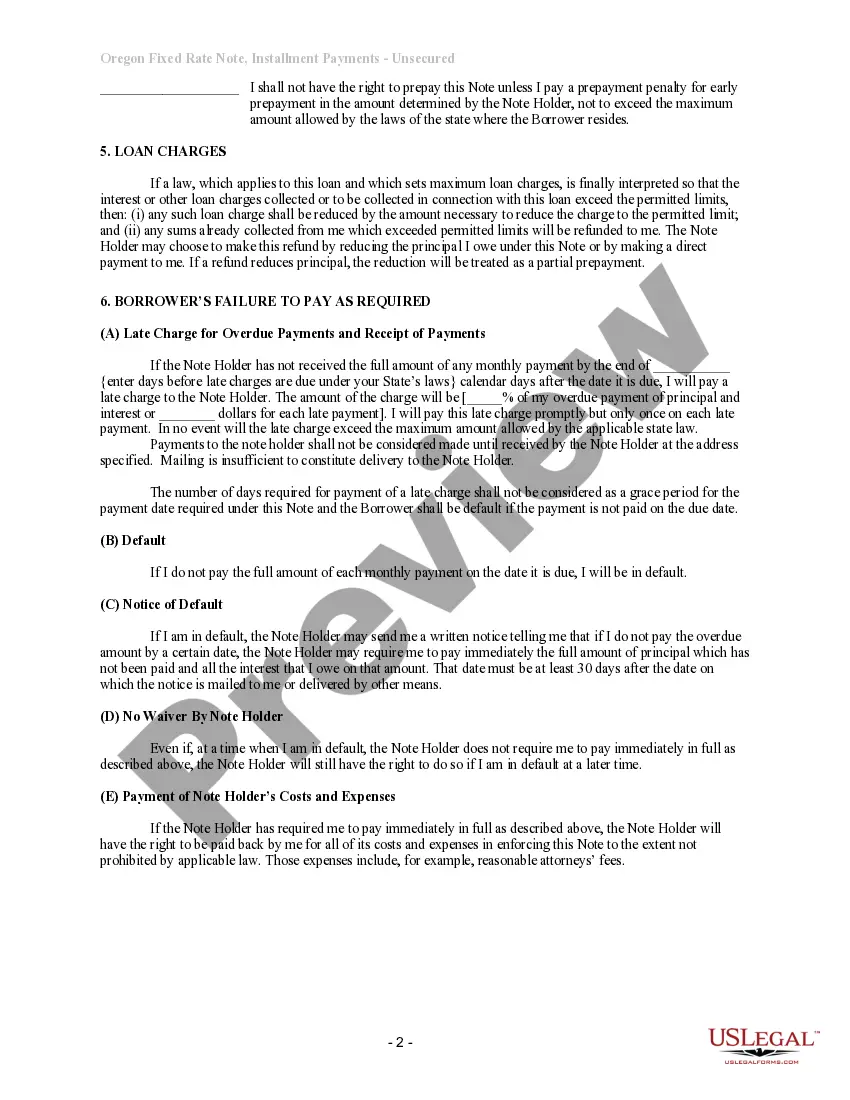

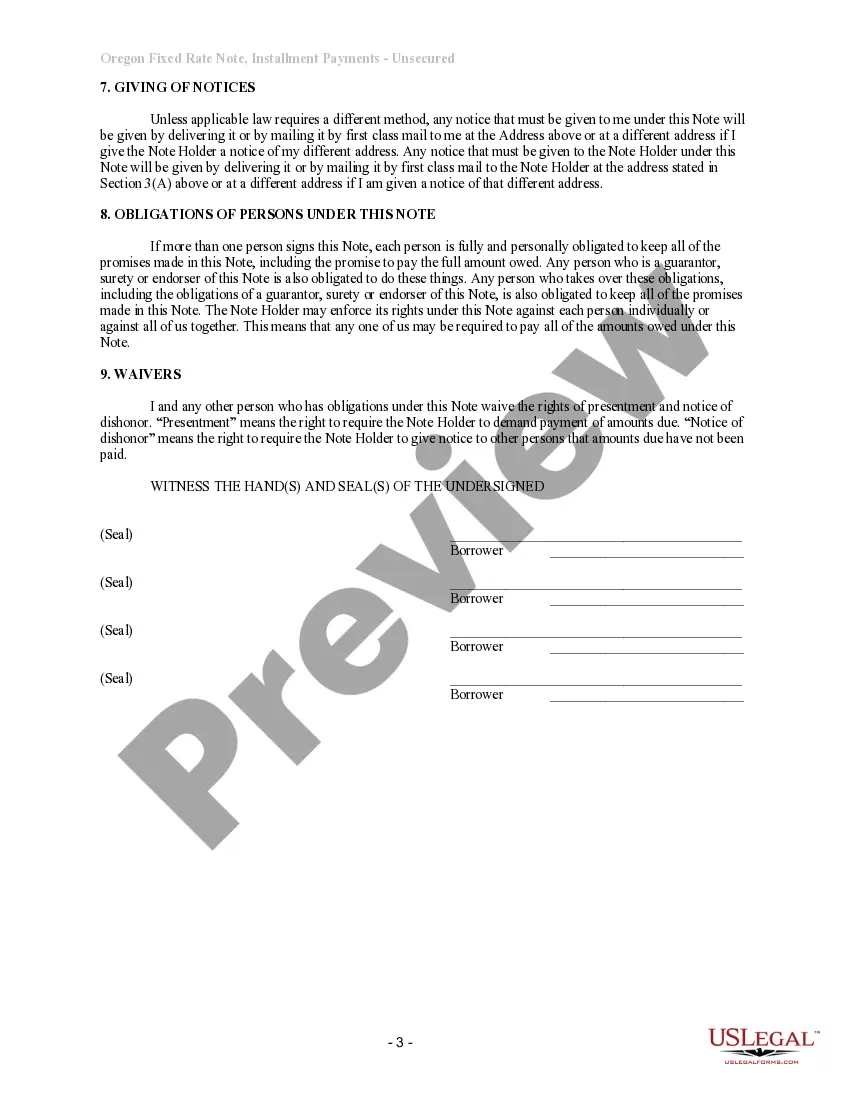

Borrower and Lender Details. A promissory note outlines information about both parties including the names, streets addresses, city, state and zip code of each party. Loan Information. Legal Language. Signatures. Warnings.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Writing the Promissory Note Terms You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

However, it is still smart to contact a lawyer to help you prepare a personal promissory note, even if you already used an online template. A lawyer can prepare and/or review the note to ensure that all state law requirements are included. This will help with enforceability if there are any issues down the road.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

Amount of repayment. Repayment terms. Interest rate. Default penalties.

No. California promissory notes do not need to be notarized or witnessed for validity.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.