Oregon Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out Oregon Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

Creating documents isn't the most straightforward task, especially for people who almost never work with legal paperwork. That's why we recommend utilizing accurate Oregon Installments Fixed Rate Promissory Note Secured by Residential Real Estate samples made by skilled attorneys. It gives you the ability to eliminate troubles when in court or handling official organizations. Find the documents you require on our site for high-quality forms and correct descriptions.

If you’re a user with a US Legal Forms subscription, simply log in your account. When you’re in, the Download button will immediately appear on the file webpage. After downloading the sample, it will be stored in the My Forms menu.

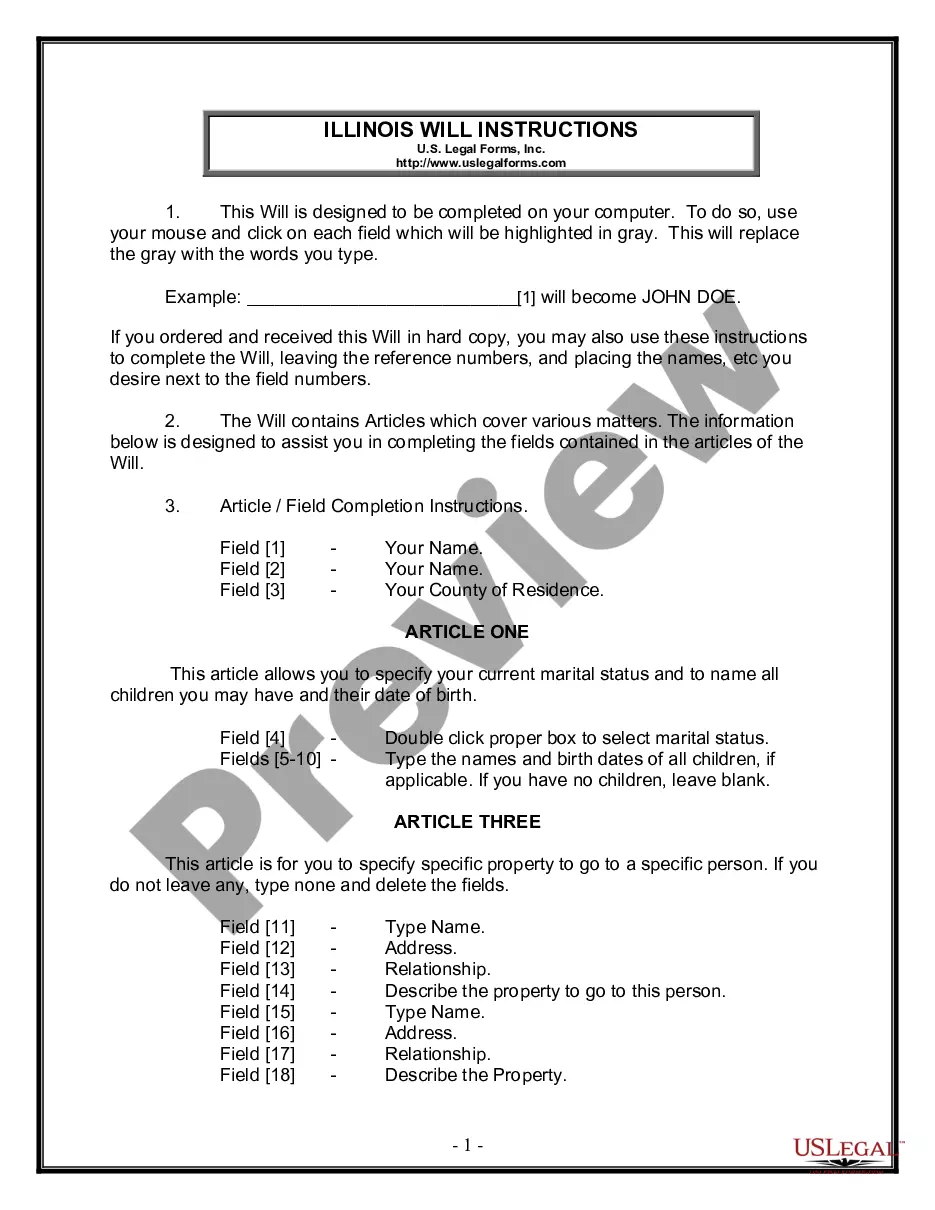

Users without an active subscription can quickly get an account. Utilize this simple step-by-step help guide to get your Oregon Installments Fixed Rate Promissory Note Secured by Residential Real Estate:

- Ensure that the sample you found is eligible for use in the state it’s needed in.

- Verify the file. Utilize the Preview option or read its description (if offered).

- Click Buy Now if this form is the thing you need or return to the Search field to find another one.

- Select a convenient subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

Right after doing these simple actions, you can fill out the sample in a preferred editor. Check the completed data and consider asking a legal professional to examine your Oregon Installments Fixed Rate Promissory Note Secured by Residential Real Estate for correctness. With US Legal Forms, everything gets much simpler. Try it now!

Form popularity

FAQ

An unsecured note is not backed by any collateral and thus presents more risk to lenders.In contrast, a secured note is a loan backed by the borrower's assets, such as a mortgage or auto loan. If the borrower defaults, these assets will go towards the repayment of the note.

A Promissory Note with Installment Payments specifies and documents the terms of a loan that will be paid back with consistent, equal, payments.You're a borrower and are agreeing to a loan with installments. You're in the business of loans or manage a loan company.

These include checking accounts, savings accounts, mortgages, debit cards, credit cards, and personal loans., he may use his car or the title of a piece of property as collateral. If he fails to repay the loan, the collateral may be seized by the bank, based on the two parties' agreement.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

Purchasing a Home without a MortgagePromissory notes are ideal for individuals who do not qualify for traditional mortgages because they allow them to purchase a home by using the seller as the source of the loan and the purchased home as the source of the collateral.

A secured note is a type of loan or corporate bond that is backed by the borrower's assets as a form of collateral. If a borrower defaults on a secured note, the assets pledged as collateral can be sold to repay the note.

Collateral notes are simply promissory notes that commit specific resources to the repayment of an outstanding loan amount. During the period of time in which the note is in force, the recipient of the loan may not sell or otherwise make use of the assets without the express permission of the lender.

A promissory note includes a specific promise to pay, and the steps required to do so (like the repayment schedule), while an IOU merely acknowledges that a debt exists, and the amount one party owes another.

Collateral Payments means Eligible Funds paid by the Lender and/or the Bridge Lender for the benefit of the Borrower in respect to the repayment of the Loan, to the Trustee for deposit into the Collateral Fund pursuant to the Loan Agreement and the Indenture as a prerequisite to the disbursement of money held in the