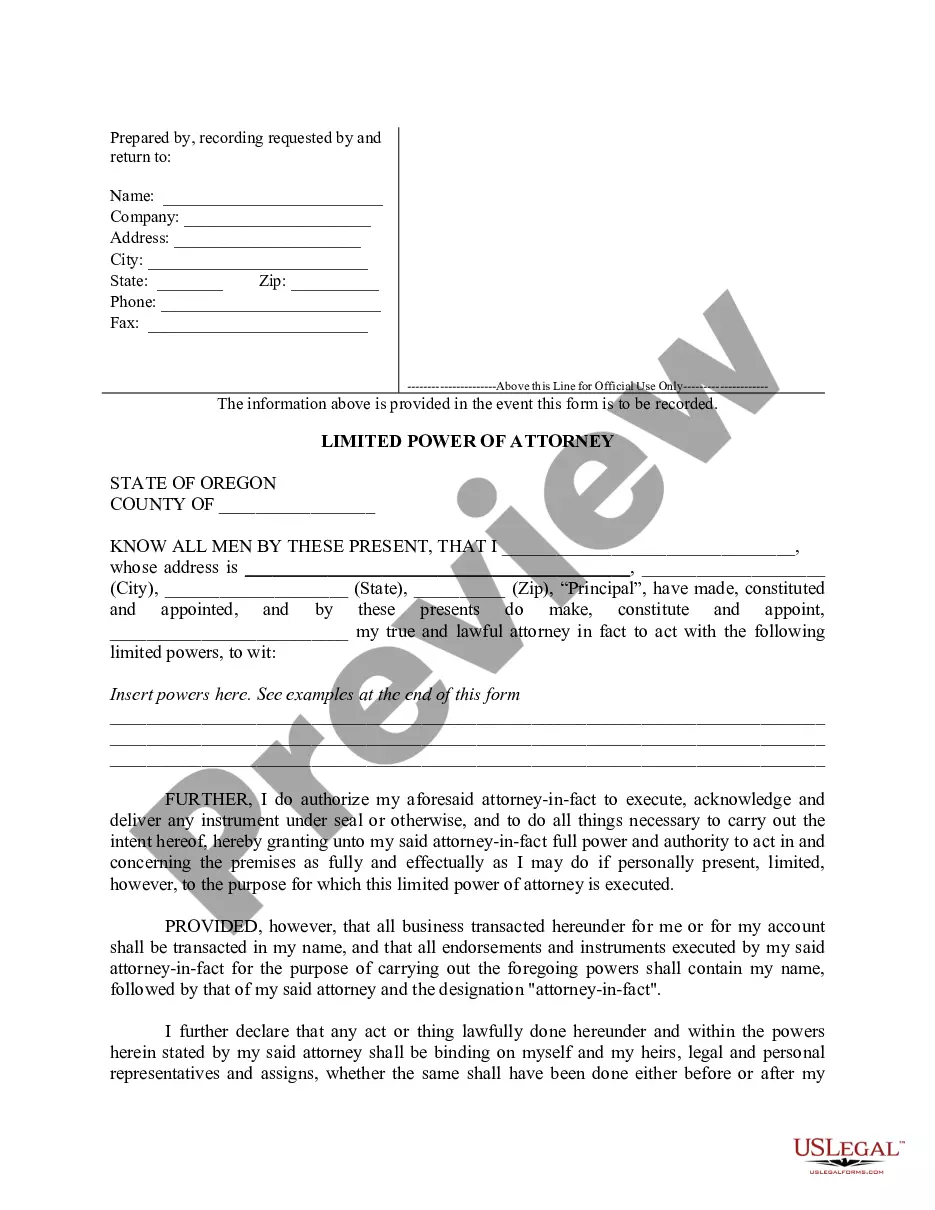

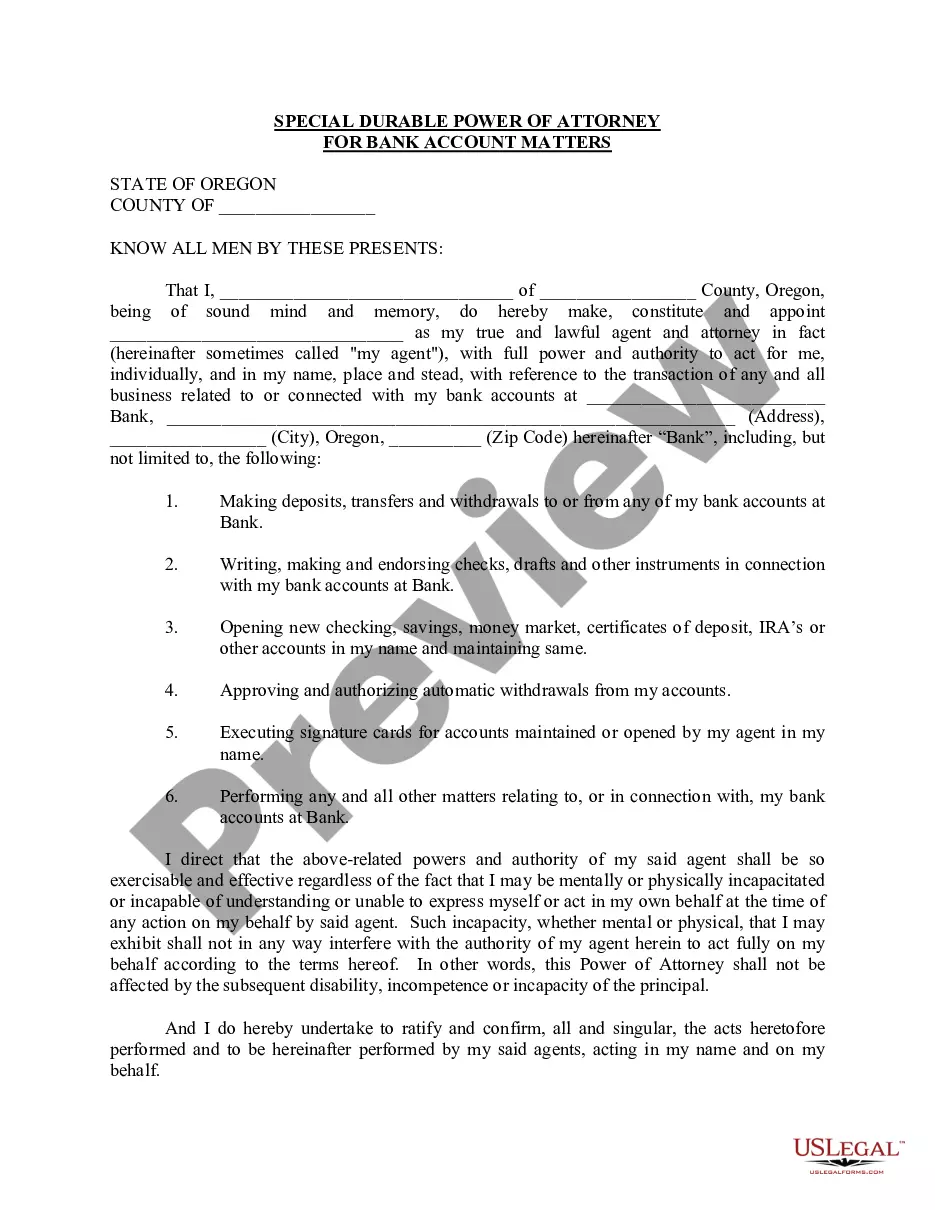

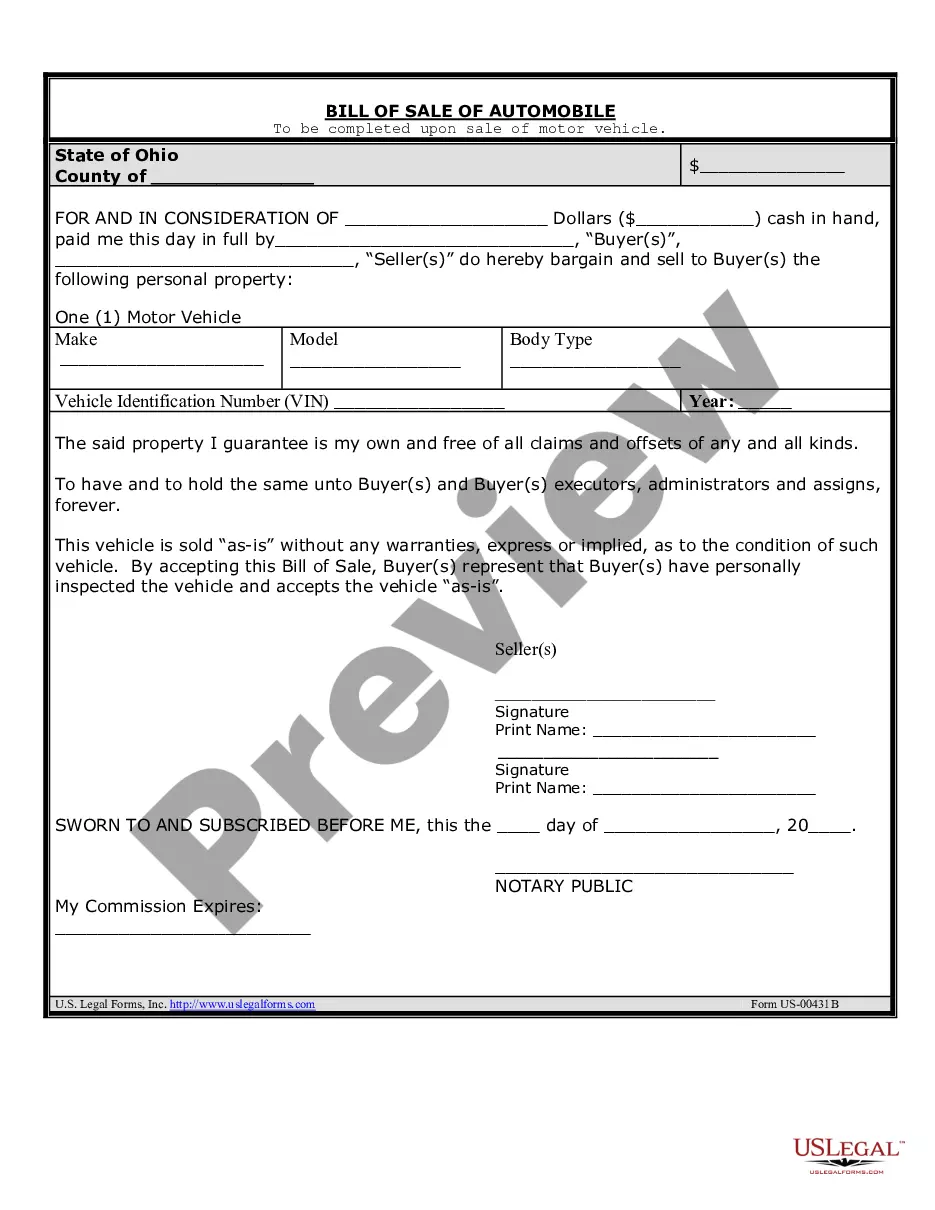

Oregon Limited Power of Attorney where you Specify Powers with Sample Powers Included

Description Power Attorney Sample

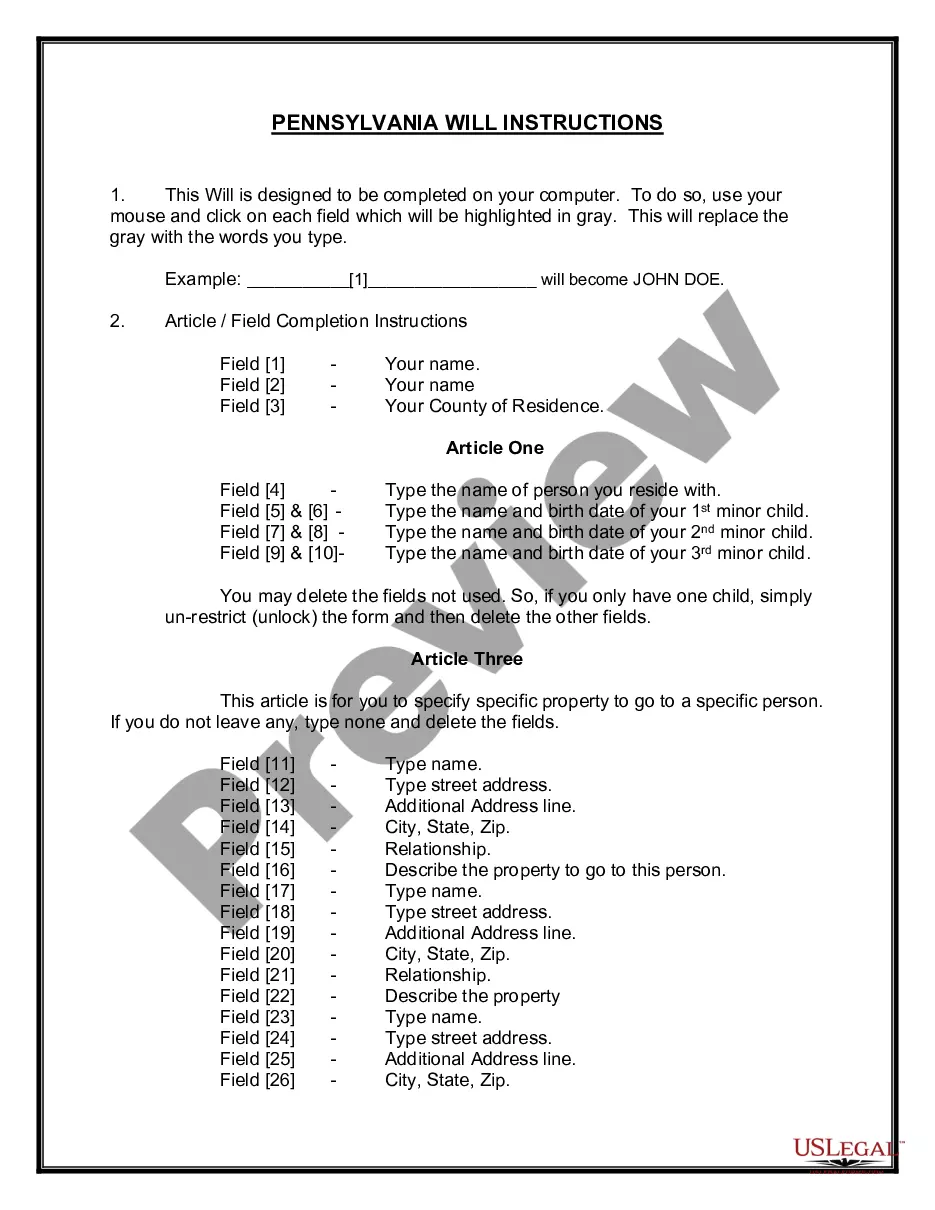

How to fill out Examples Of Limited Power Of Attorney?

The work with papers isn't the most uncomplicated task, especially for those who almost never work with legal papers. That's why we recommend utilizing accurate Oregon Limited Power of Attorney where you Specify Powers with Sample Powers Included templates made by professional attorneys. It gives you the ability to stay away from troubles when in court or handling formal organizations. Find the documents you require on our site for high-quality forms and exact information.

If you’re a user having a US Legal Forms subscription, just log in your account. When you are in, the Download button will immediately appear on the template page. Right after getting the sample, it’ll be saved in the My Forms menu.

Users with no a subscription can quickly get an account. Utilize this brief step-by-step help guide to get the Oregon Limited Power of Attorney where you Specify Powers with Sample Powers Included:

- Ensure that the document you found is eligible for use in the state it’s required in.

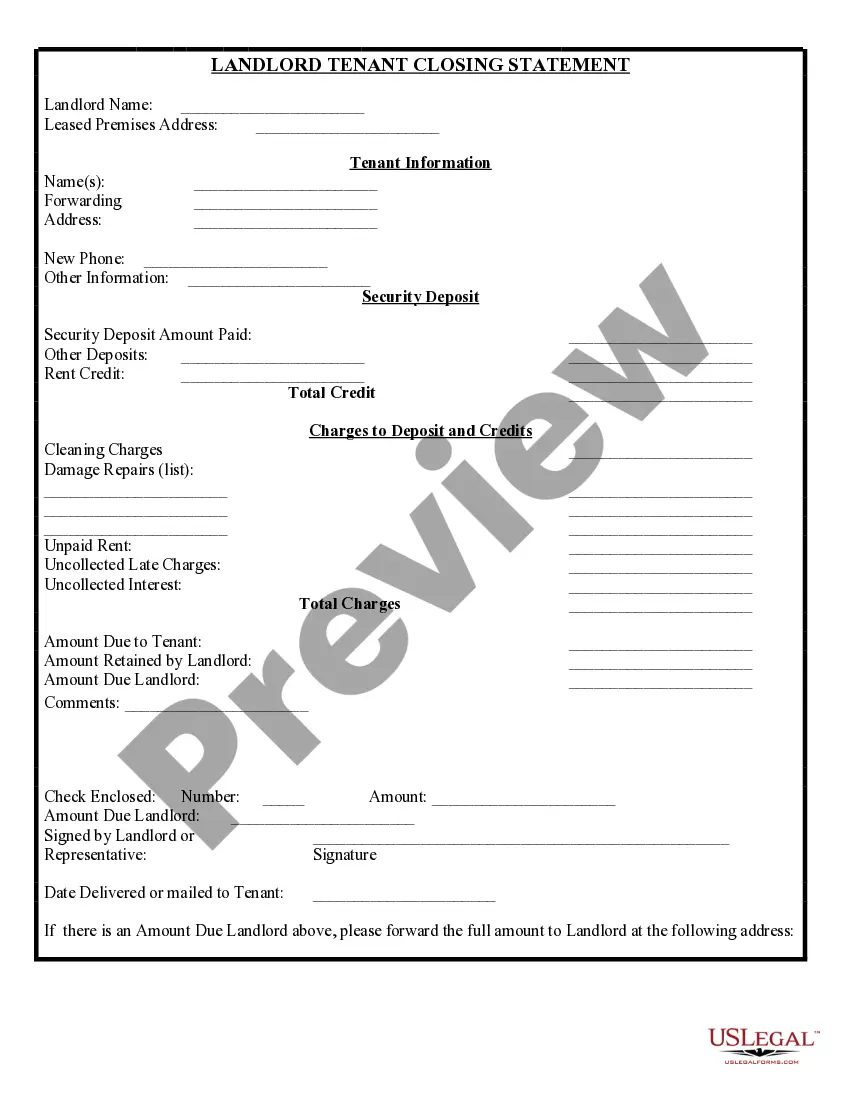

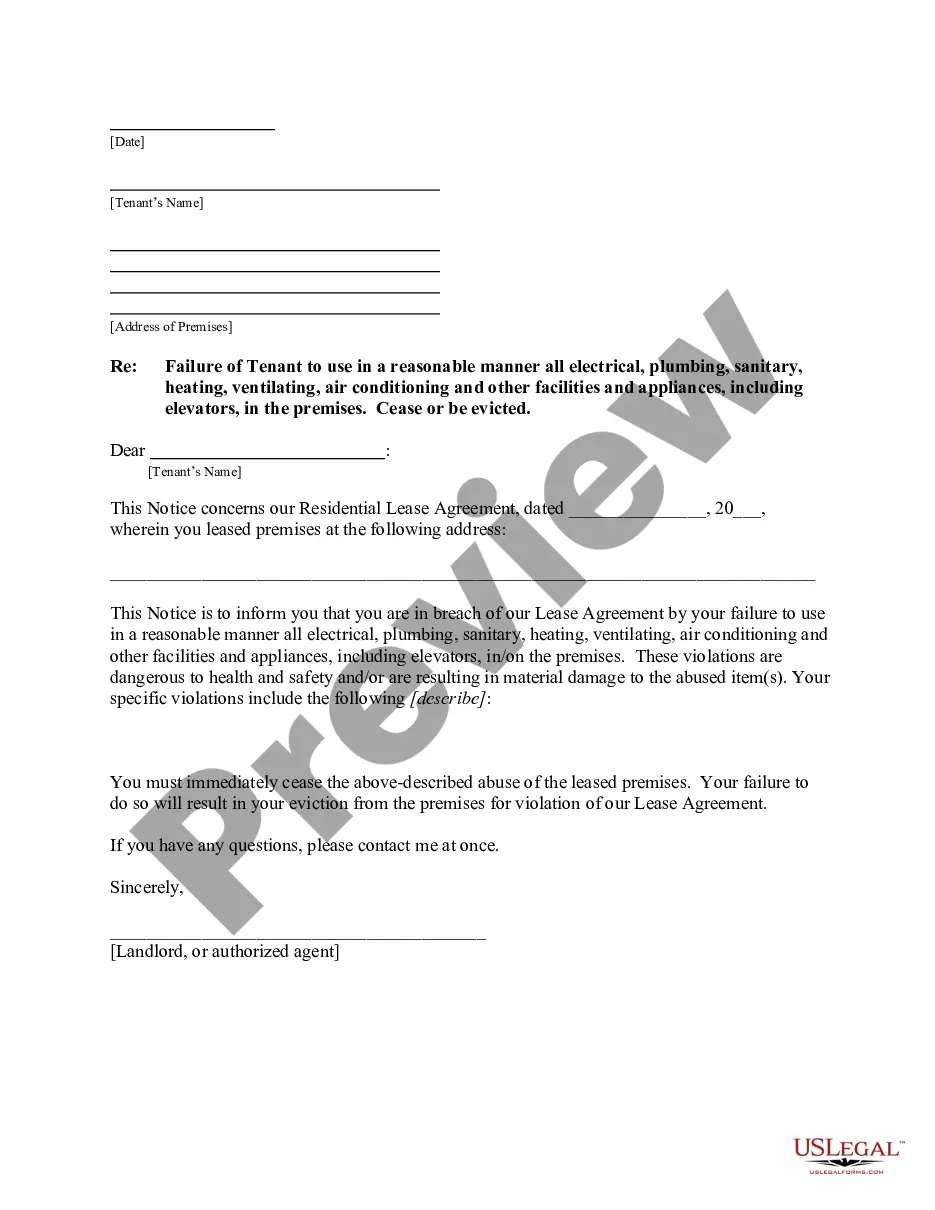

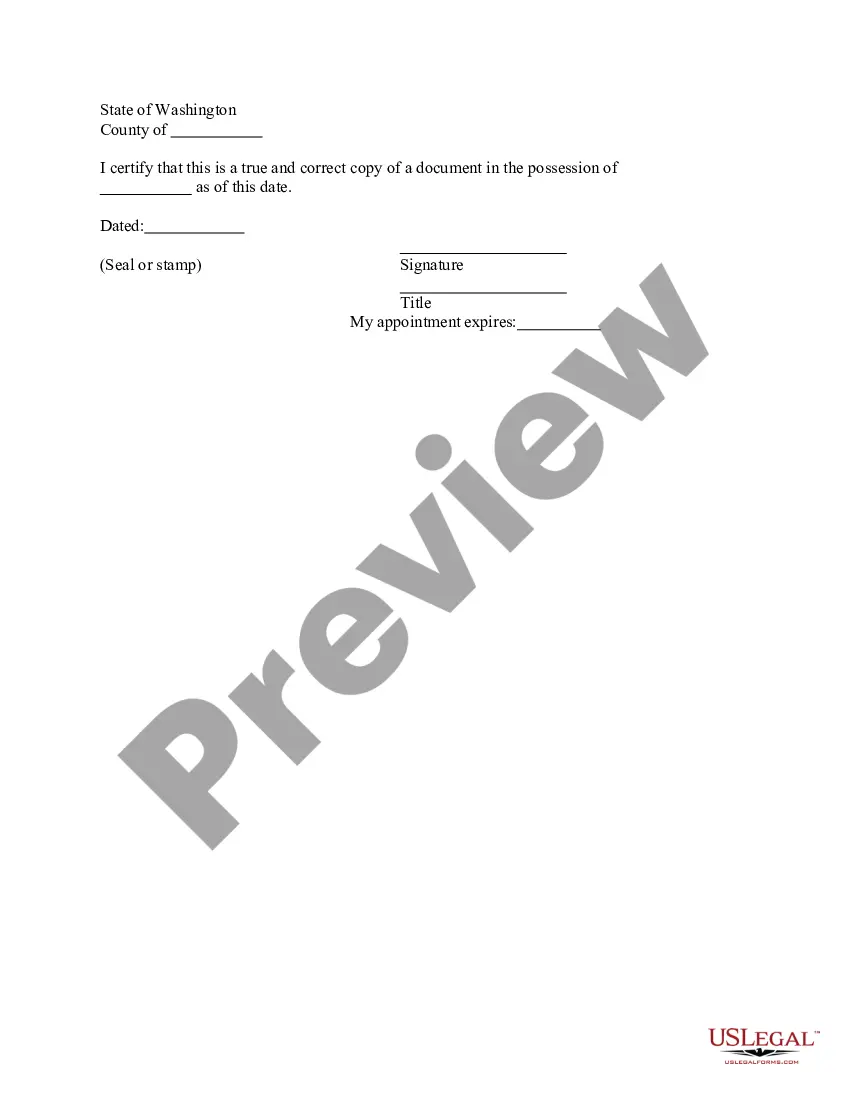

- Confirm the document. Use the Preview option or read its description (if available).

- Buy Now if this template is what you need or go back to the Search field to find another one.

- Choose a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your document in a wanted format.

After doing these straightforward steps, you are able to complete the form in your favorite editor. Double-check filled in details and consider asking an attorney to examine your Oregon Limited Power of Attorney where you Specify Powers with Sample Powers Included for correctness. With US Legal Forms, everything becomes much easier. Try it out now!

Oregon Powers Form popularity

Limited Power Attorney Other Form Names

Limited Power Of Attorney FAQ

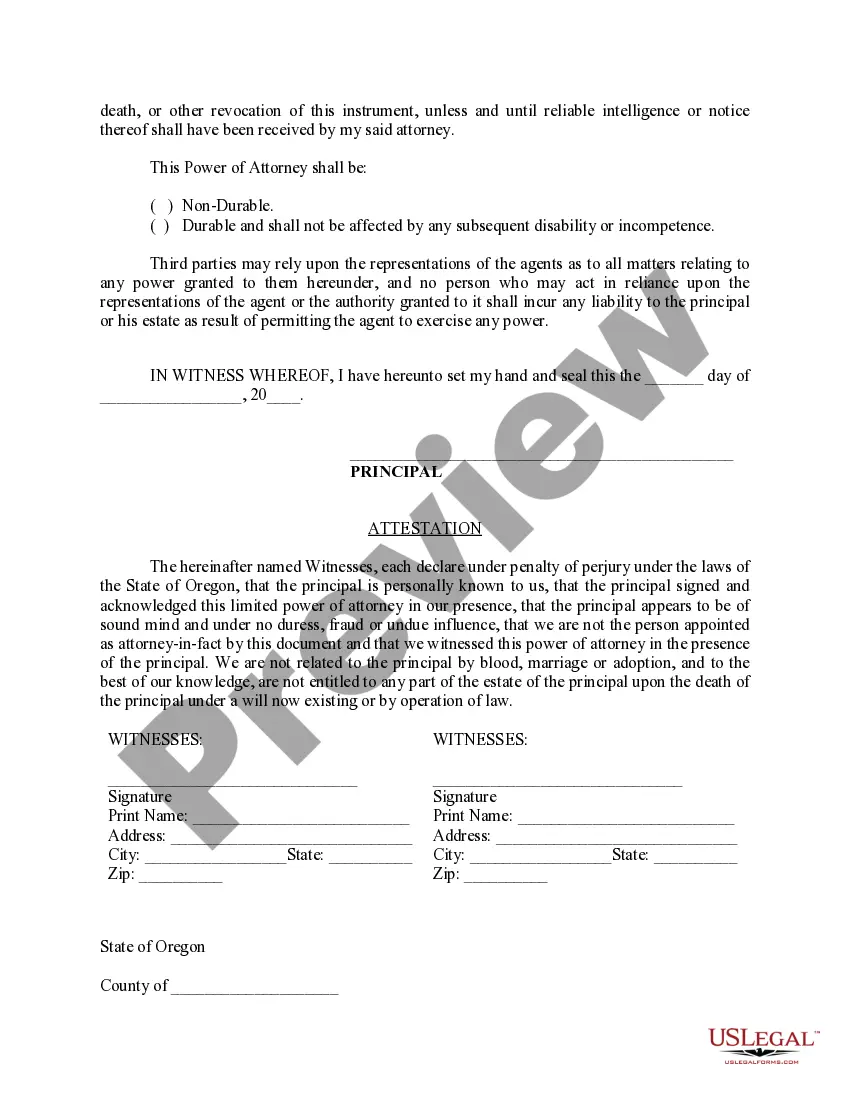

General Power of Attorney. Durable Power of Attorney. Special or Limited Power of Attorney. Springing Durable Power of Attorney.

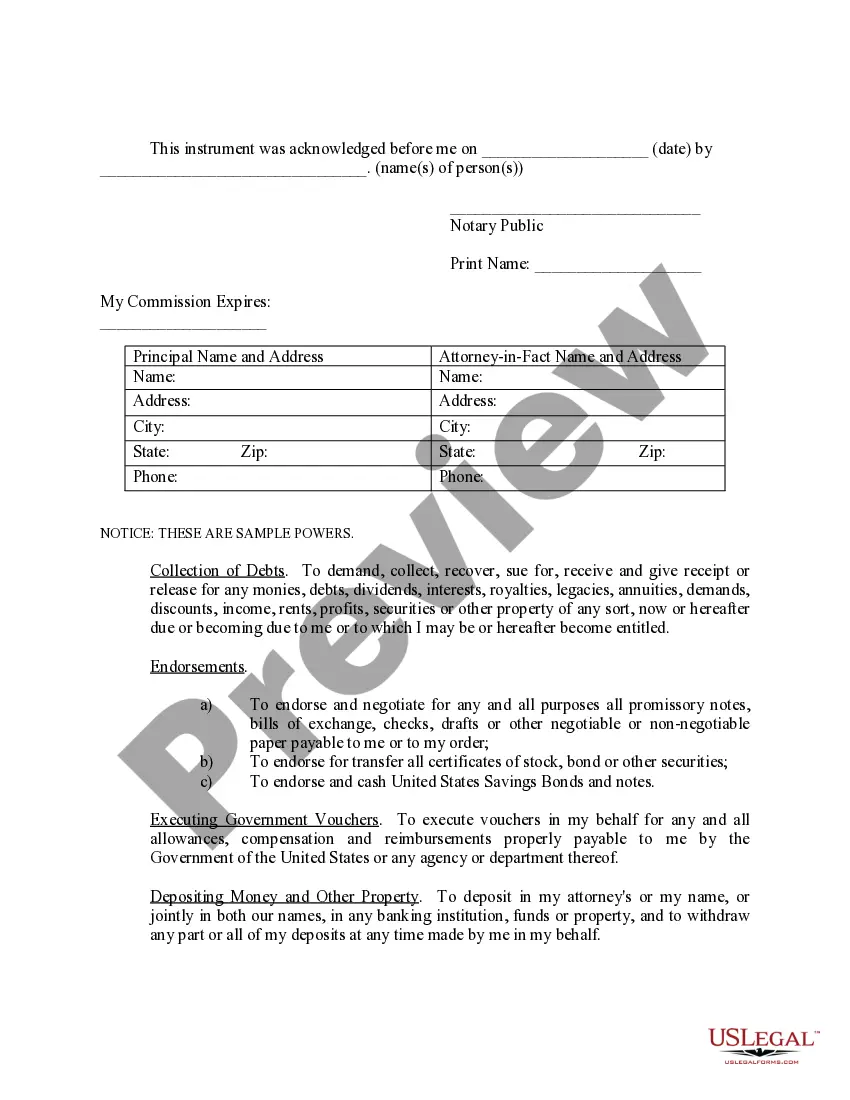

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.

1. Durable Power of Attorney. A durable power of attorney, or DPOA, is effective immediately after you sign it (unless stated otherwise), and allows your agent to continue acting on your behalf if you become incapacitated.

Power of Attorney broadly refers to one's authority to act and make decisions on behalf of another person in all or specified financial or legal matters.Durable POA is a specific kind of power of attorney that remains in effect even after the represented party becomes mentally incapacitated.

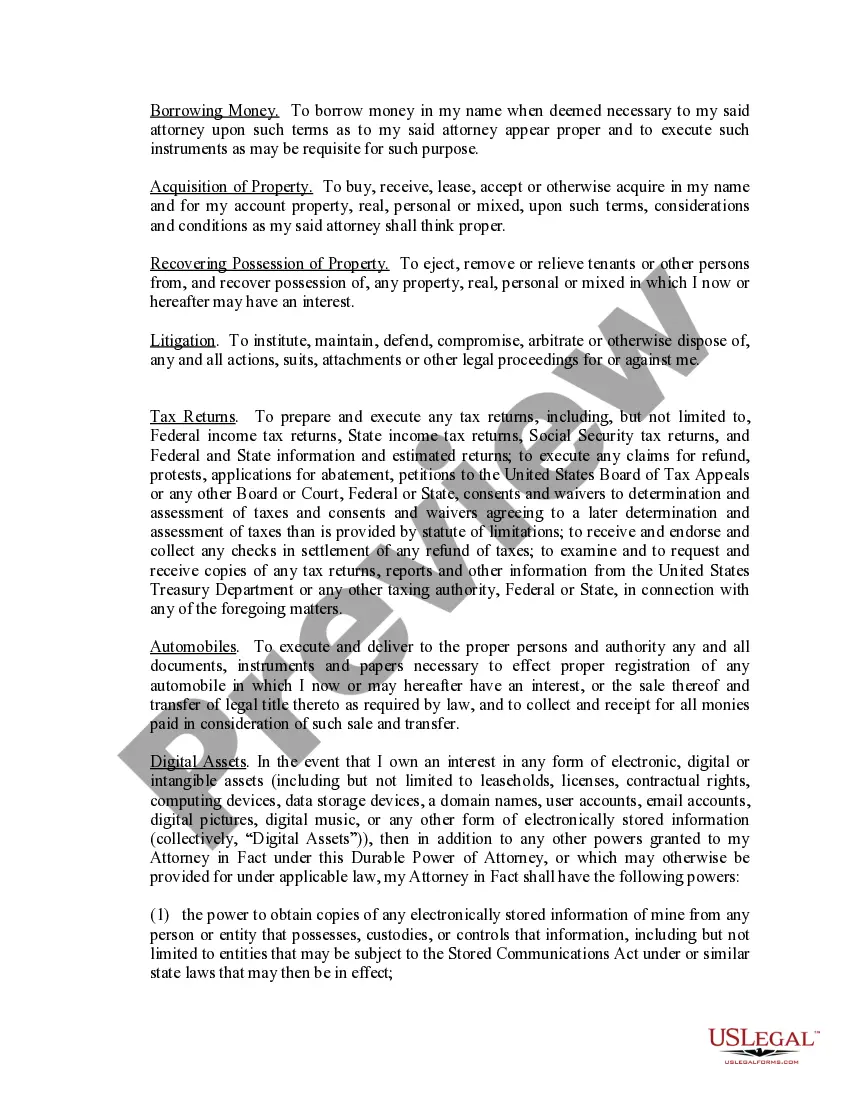

A Power of Attorney might be used to allow another person to sign a contract for the Principal. It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.

A general power of attorney is comprehensive and gives your attorney-in-fact all the powers and rights that you have yourself. For example, a general power of attorney may give your attorney-in-fact the right to sign documents for you, pay your bills, and conduct financial transactions on your behalf.

A limited power of attorney grants the representative that you choose (the agent or attorney-in-fact) the power to act on your behalf under limited circumstances.Under a general power of attorney, the agent or attorney-in-fact can do anything that you can do.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.

The non-durable power of attorney is used only for a set period of time and usually for a particular transaction in which you grant your agent authority to act on your behalf. Once the transaction is completed, or should the principal become incapacitated during this time, the non-durable power of attorney ceases.