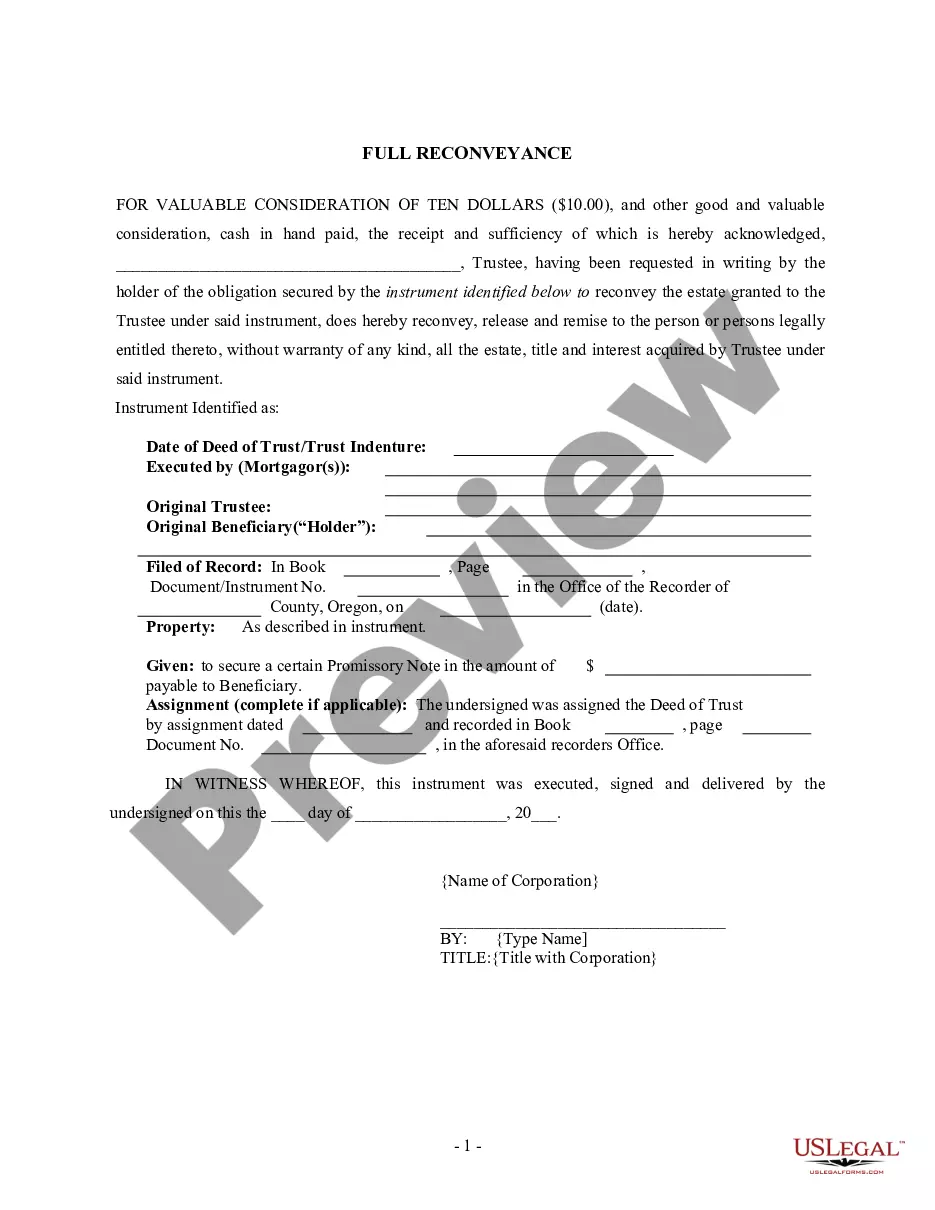

Oregon Full Reconveyance of Deed of Trust - by Corporate Trustee

Description

How to fill out Oregon Full Reconveyance Of Deed Of Trust - By Corporate Trustee?

The work with documents isn't the most uncomplicated job, especially for people who rarely deal with legal papers. That's why we advise utilizing accurate Oregon Full Reconveyance of Deed of Trust - by Corporate Trustee samples made by professional lawyers. It allows you to eliminate problems when in court or working with formal organizations. Find the documents you require on our site for high-quality forms and exact explanations.

If you’re a user with a US Legal Forms subscription, just log in your account. When you are in, the Download button will automatically appear on the template page. Soon after downloading the sample, it’ll be saved in the My Forms menu.

Users without an activated subscription can quickly get an account. Make use of this short step-by-step guide to get your Oregon Full Reconveyance of Deed of Trust - by Corporate Trustee:

- Make certain that the form you found is eligible for use in the state it is necessary in.

- Verify the file. Utilize the Preview option or read its description (if available).

- Click Buy Now if this sample is what you need or return to the Search field to get another one.

- Choose a suitable subscription and create your account.

- Use your PayPal or credit card to pay for the service.

- Download your document in a preferred format.

After finishing these easy actions, it is possible to fill out the sample in an appropriate editor. Recheck completed data and consider requesting a legal representative to examine your Oregon Full Reconveyance of Deed of Trust - by Corporate Trustee for correctness. With US Legal Forms, everything becomes easier. Try it out now!

Form popularity

FAQ

When your mortgage lender decides he wants to sell your mortgage loan to another lender, your mortgage lender will sign an assignment of deed of trust in favor of the new lender. This assignment gives the new lender the same lien on your property that your original lender had under the mortgage loan.

If there's a deed of trust on a property, the lender can sell the property and pay off the loan. Whether your loan falls under the mortgage or deed of trust definition, you'll need to get approval from the lender before you sell your home for less than you owe.

Essentially, the Deed of Assignment (DOA) is a legal document that transfers the ownership of a property from one party to another.

Only until the debt is paid off by the borrower can a deed of reconveyance then be used to clear the deed of trust from the title to the property. The document is signed by the trustee, whose signature must be notarized.

Corporate mortgage assignment defined. An assignment of a mortgage occurs when a loan for a piece of property (home or otherwise) is assigned to another party.A corporate assignment of a mortgage occurs when the third party that assumes the obligation for the loan is a corporation.

An assignment of a deed of trust is simply the movement of the deed of trust from one party to another, a party that was not originally involved in the deed creation when the property was bought. A corporate assignment is simply an assignment of the deed of trust between different businesses.

Some use deeds of trust instead, which are similar documents, but they have some fundamental differences.With a deed of trust, however, the lender must act through a go-between called the trustee. The beneficiary and the trustee can't be the same person or entity.

Property cannot be conveyed to a grantee who does not exist. Thus, a deed to a grantee who is dead at the time of delivery is void. For example, a deed recorded by the grantor is presumed to have been delivered.For example, a deed is voidable if it was obtained by fraud in the inducement.

Giving the wrong legal address for the property or the wrong amount of the debt can render the deed unenforceable. In some cases, the error is easy to fix, and the court will rule the deed is enforceable.