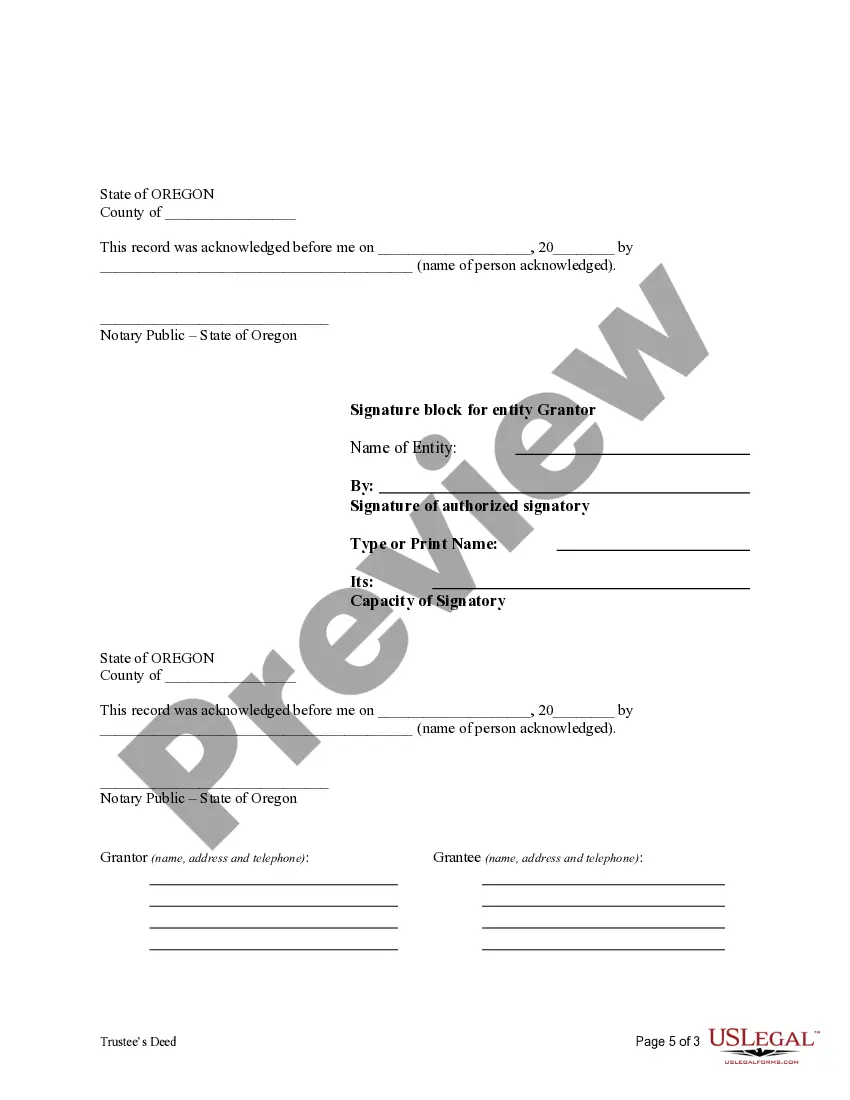

Oregon Fiduciary Deed for Trustee to Trustee

Description Oregon Trustee Complete

How to fill out Fiduciary Deed Printable?

Among countless paid and free templates that you can get on the internet, you can't be sure about their reliability. For example, who made them or if they’re skilled enough to take care of the thing you need those to. Always keep relaxed and use US Legal Forms! Discover Oregon Fiduciary Deed for Trustee to Trustee templates made by professional lawyers and avoid the costly and time-consuming process of looking for an lawyer or attorney and then paying them to draft a document for you that you can easily find on your own.

If you have a subscription, log in to your account and find the Download button near the file you are searching for. You'll also be able to access all of your previously acquired files in the My Forms menu.

If you’re making use of our service the first time, follow the instructions below to get your Oregon Fiduciary Deed for Trustee to Trustee quickly:

- Make certain that the document you see is valid in your state.

- Review the file by reading the information for using the Preview function.

- Click Buy Now to start the purchasing procedure or look for another example using the Search field found in the header.

- Select a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed file format.

Once you’ve signed up and paid for your subscription, you can utilize your Oregon Fiduciary Deed for Trustee to Trustee as many times as you need or for as long as it continues to be valid in your state. Edit it in your preferred offline or online editor, fill it out, sign it, and print it. Do far more for less with US Legal Forms!

Or Deed Trustee Form popularity

Oregon Deed Form Other Form Names

Oregon Deed Trustee FAQ

Quitclaim Deed. Deed of Trust. Warranty Deed. Grant Deed. Bargain and Sale Deed. Mortgage Deed.

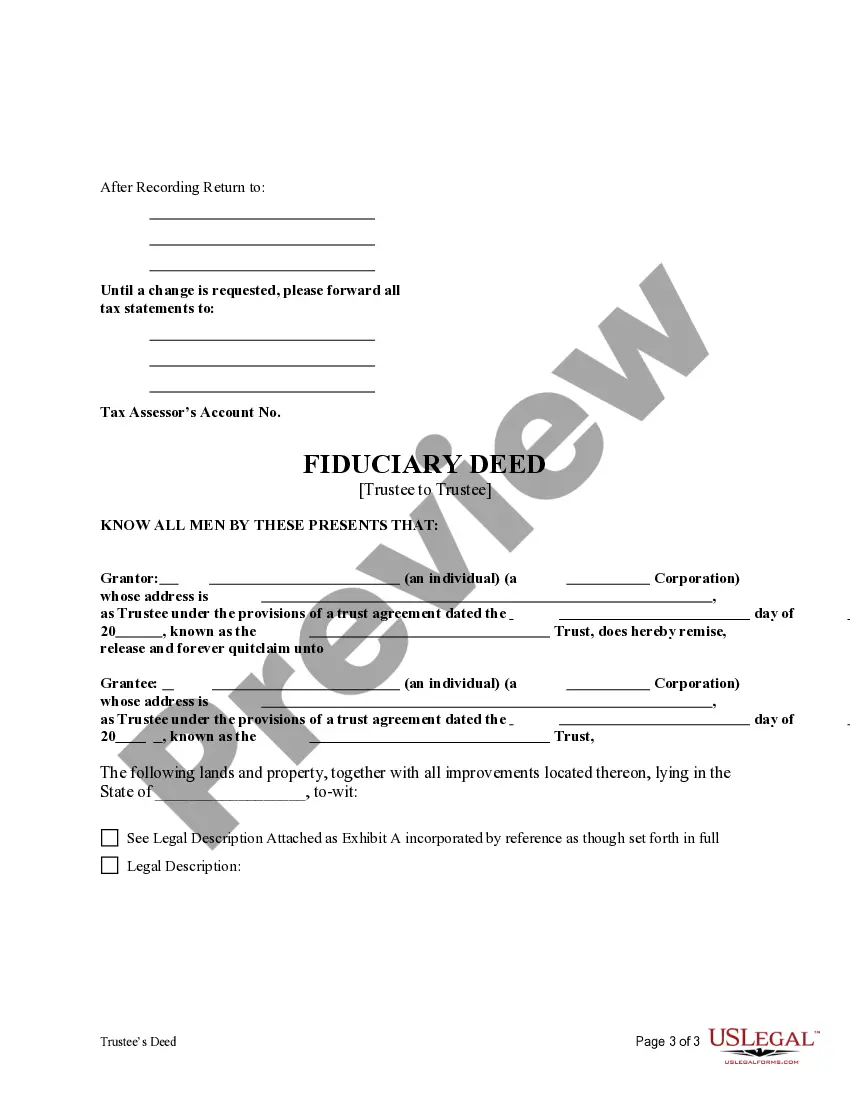

The trustee holds legal title to the property and the beneficiaries hold equitable title. Since the trustee holds legal title to the property, the property is always held in the trustee's name.Instead, it is simply a name denoting the legal relationship between a grantor and a trustee.

A trust is created by a settlor, who transfers title to some or all of his or her property to a trustee, who then holds title to that property in trust for the benefit of the beneficiaries.

(2) Beneficiary means a person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or the person's successor in interest, and who is not the trustee unless the beneficiary is qualified to be a trustee under ORS 86.713 (Qualifications of trustee) (1)(b)(D).

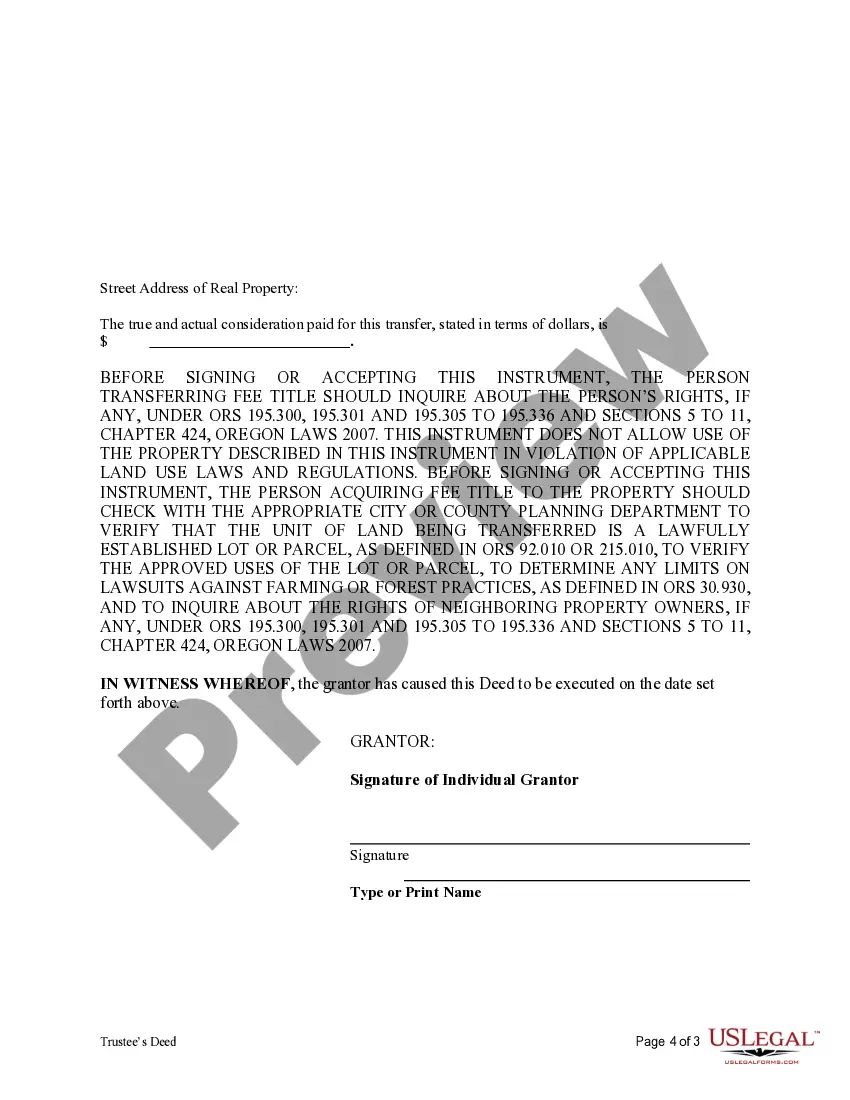

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

The different types of real estate title are joint tenancy, tenancy in common, tenants by entirety, sole ownership, and community property. Other, less common types of property ownership are corporate ownership, partnership ownership, and trust ownership.

A trustee deedsometimes called a deed of trust or a trust deedis a legal document created when someone purchases real estate in a trust deed state, such as California (check your local laws to see what is required in your state). A trust deed is used in place of a mortgage.

The trustee holds legal title to the property and the beneficiaries hold equitable title. Because the trustee holds legal title to the property, that property must be held in the trustee's name.

A warranty deed protects property owners from future claims that someone else actually owns a portion (or all) of their property, while trustee deeds protect lenders when borrowers default on their mortgage loans.