Oregon Notice of Appeal (Criminal)

Description

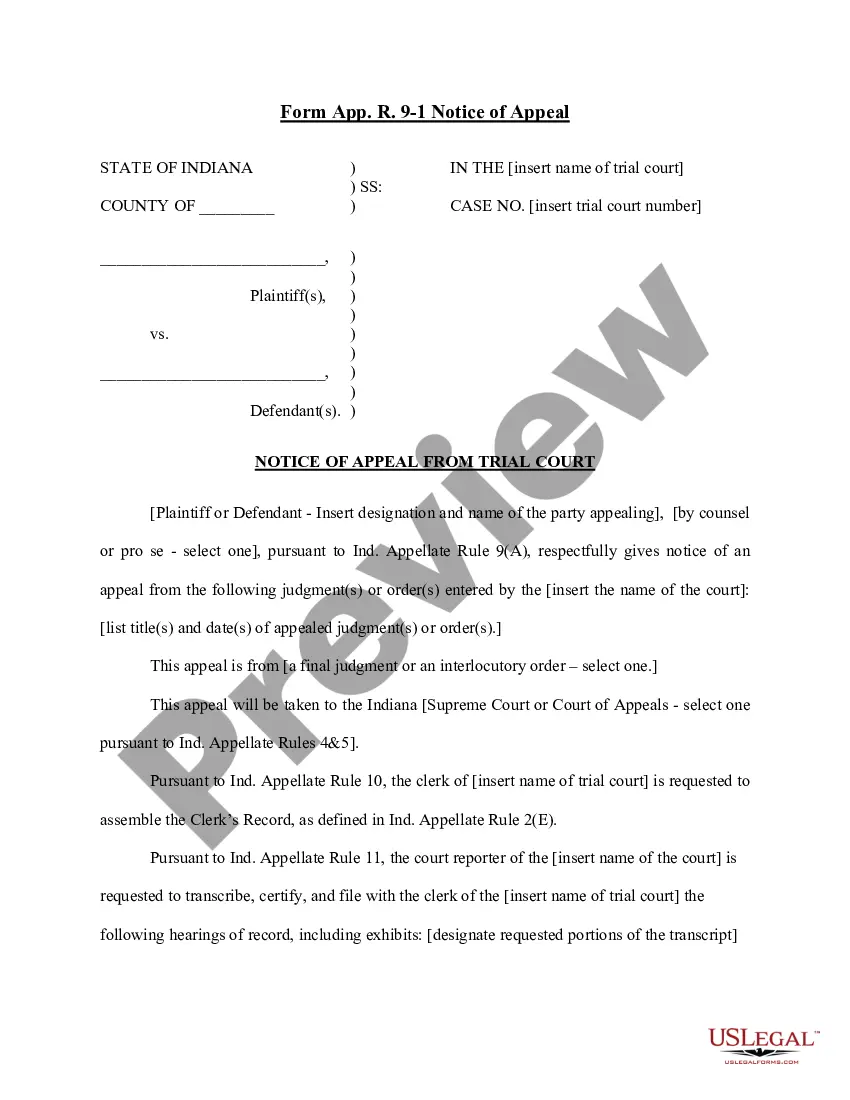

How to fill out Oregon Notice Of Appeal (Criminal)?

How much time and resources do you often spend on composing official paperwork? There’s a greater option to get such forms than hiring legal experts or spending hours browsing the web for an appropriate blank. US Legal Forms is the top online library that provides professionally designed and verified state-specific legal documents for any purpose, such as the Oregon Notice of Appeal (Criminal).

To acquire and complete an appropriate Oregon Notice of Appeal (Criminal) blank, adhere to these simple instructions:

- Examine the form content to make sure it meets your state regulations. To do so, read the form description or utilize the Preview option.

- If your legal template doesn’t meet your requirements, locate another one using the search tab at the top of the page.

- If you are already registered with our service, log in and download the Oregon Notice of Appeal (Criminal). If not, proceed to the next steps.

- Click Buy now once you find the right document. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a payment with your credit card or through PayPal - our service is totally secure for that.

- Download your Oregon Notice of Appeal (Criminal) on your device and complete it on a printed-out hard copy or electronically.

Another advantage of our library is that you can access previously acquired documents that you safely keep in your profile in the My Forms tab. Get them at any moment and re-complete your paperwork as often as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most trustworthy web solutions. Sign up for us today!

Form popularity

FAQ

The traditional way to appeal a criminal conviction is to file an appeals request with the appropriate court. In some instances, you must file with the municipal court, but in the majority of cases, you need to file with the Oregon Court of Appeals.

After completing the Notice of Appeal form, a copy must be served by mail or in person to City Prosecutor's Office at 99 West 10th Avenue, Suite 310, Eugene Oregon 97401.

The court has jurisdiction to hear all civil and criminal appeals from circuit courts, except death penalty cases, and to review most state administrative agency actions. The Chief Justice of the Supreme Court appoints the Chief Judge from among the thirteen judges on the Court of Appeals.

What Is Post-Conviction Relief? In a post-conviction relief (PCR) proceeding, the person who was convicted following a trial or by pleading guilty, known as the petitioner, raises new claims that their trial or plea was unfair.

When can an appeal be filed? In general, an appeal must be filed within 30 days after the judgment is entered into a record-keeping system called the trial court register.

When the Court of Appeals issues a judgment in an appeal that decision is communicated to the trial court pursuant to ORAP 14.05 and the trial court then regains jurisdiction over the case (ORS 19.270 and ORS 138.227).

?Within 90 days of the date on the Notice of Assessment, or two years from the date tax is paid in full. Many issues can be solved without appealing to the tax court. Within 30 days of the date on the notice. ?Within 30 days of the date on the notice.