Oregon Non-Judicial Relief From Automatic Stay is a process that provides relief from the automatic stay created by a bankruptcy filing. The automatic stay is a court order that prohibits creditors from taking any action against a debtor without court permission. The relief from the automatic stay allows certain creditors to pursue their legal rights against the debtor outside the bankruptcy court. There are two types of Oregon Non-Judicial Relief From Automatic Stay: 1) Limited Relief, which allows a creditor to pursue remedies that are necessary to protect their rights, such as filing a lien or initiating a foreclosure; and 2) Complete Relief, which allows a creditor to pursue all of its remedies against the debtor, including filing a lawsuit and collection activities. Both types of relief require the creditor to file a Motion for Relief from Stay with the bankruptcy court.

Oregon Non Judicial Relief From Automatic Stay

Description

How to fill out Oregon Non Judicial Relief From Automatic Stay?

Handling official documentation requires attention, accuracy, and using well-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Oregon Non Judicial Relief From Automatic Stay template from our library, you can be certain it meets federal and state laws.

Dealing with our service is easy and fast. To get the required document, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to find your Oregon Non Judicial Relief From Automatic Stay within minutes:

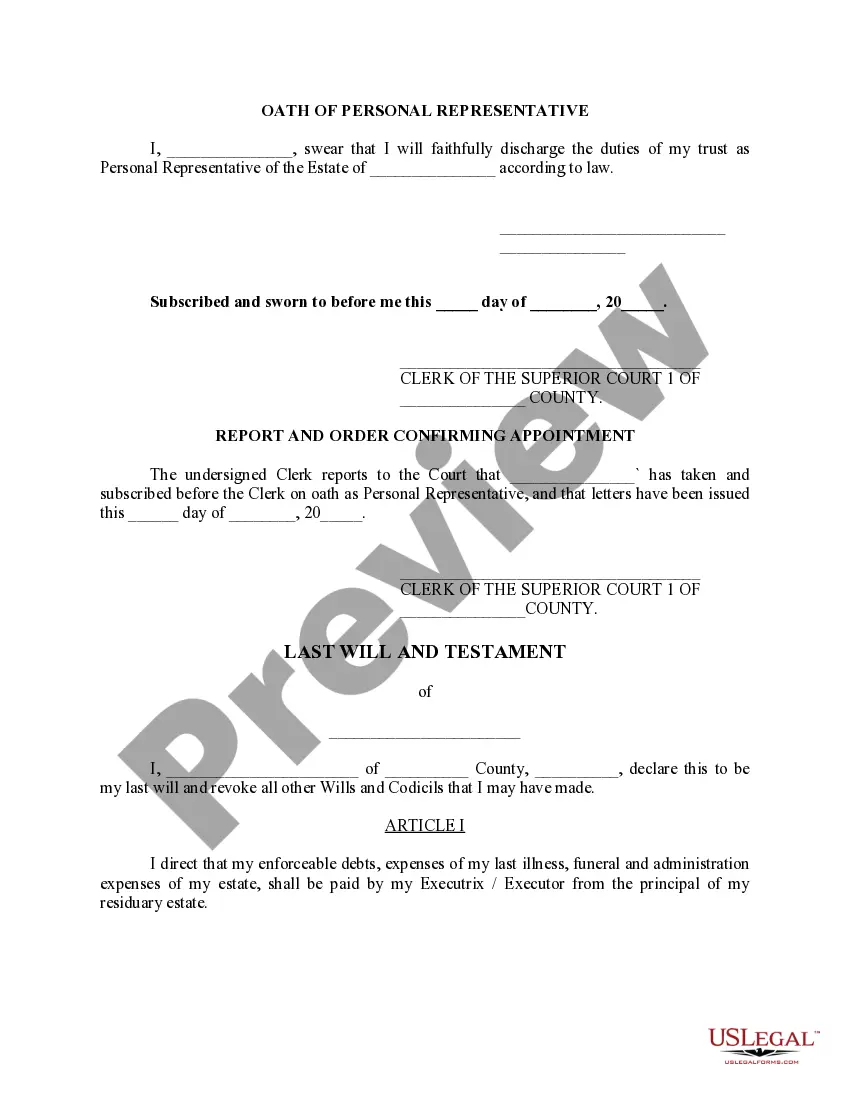

- Make sure to carefully look through the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for another formal blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Oregon Non Judicial Relief From Automatic Stay in the format you prefer. If it’s your first time with our website, click Buy now to continue.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to submit it electronically.

All documents are drafted for multi-usage, like the Oregon Non Judicial Relief From Automatic Stay you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

The most common reason for a creditor to make a motion for relief from the automatic stay is that the debtor has filed Chapter 7 Bankruptcy or Chapter 13 Bankruptcy and does not want to use the bankruptcy to keep their house or car.

An ?automatic stay? protects a bankruptcy debtor from creditors' collection activities and halts all judicial and administrative collection proceedings (including proceedings pending before the U.S. Tax Court). The stay is effective immediately after the bankruptcy petition is filed.

Creditors Obtaining Relief From the Automatic Stay -- If a creditor properly files and serves a Motion for Relief from the Automatic Stay, and a bankruptcy judge grants the Motion, the Automatic Stay will either be removed or modified so that the creditor can resume collection efforts against the debtor.

An order for relief invokes the automatic stay and brings down an iron curtain, separating the pre-bankruptcy from the post-bankruptcy debtor, creating a bankruptcy estate and prohibiting unauthorized transfers of the debtor's property.

Motion for Relief from the Automatic Stay is a request by a creditor to allow the creditor to take action against the debtor or the debtor's property that would otherwise be prohibited by the automatic stay.

The Stay Has Been Lifted ? Now What? Once a creditor gets a court order lifting the automatic stay, they are allowed to move forward with foreclosure or repossession of the property that secures the debt. That said, the creditor still needs to follow state law for their collection or eviction proceedings.

Automatic Stay -- Immediately after a bankruptcy case is filed, an injunction (called the "Automatic Stay") is generally imposed against certain creditors who want to start or continue taking action against a debtor or the debtor's property.