Oregon Report of Administrative Expenses

Description

How to fill out Oregon Report Of Administrative Expenses?

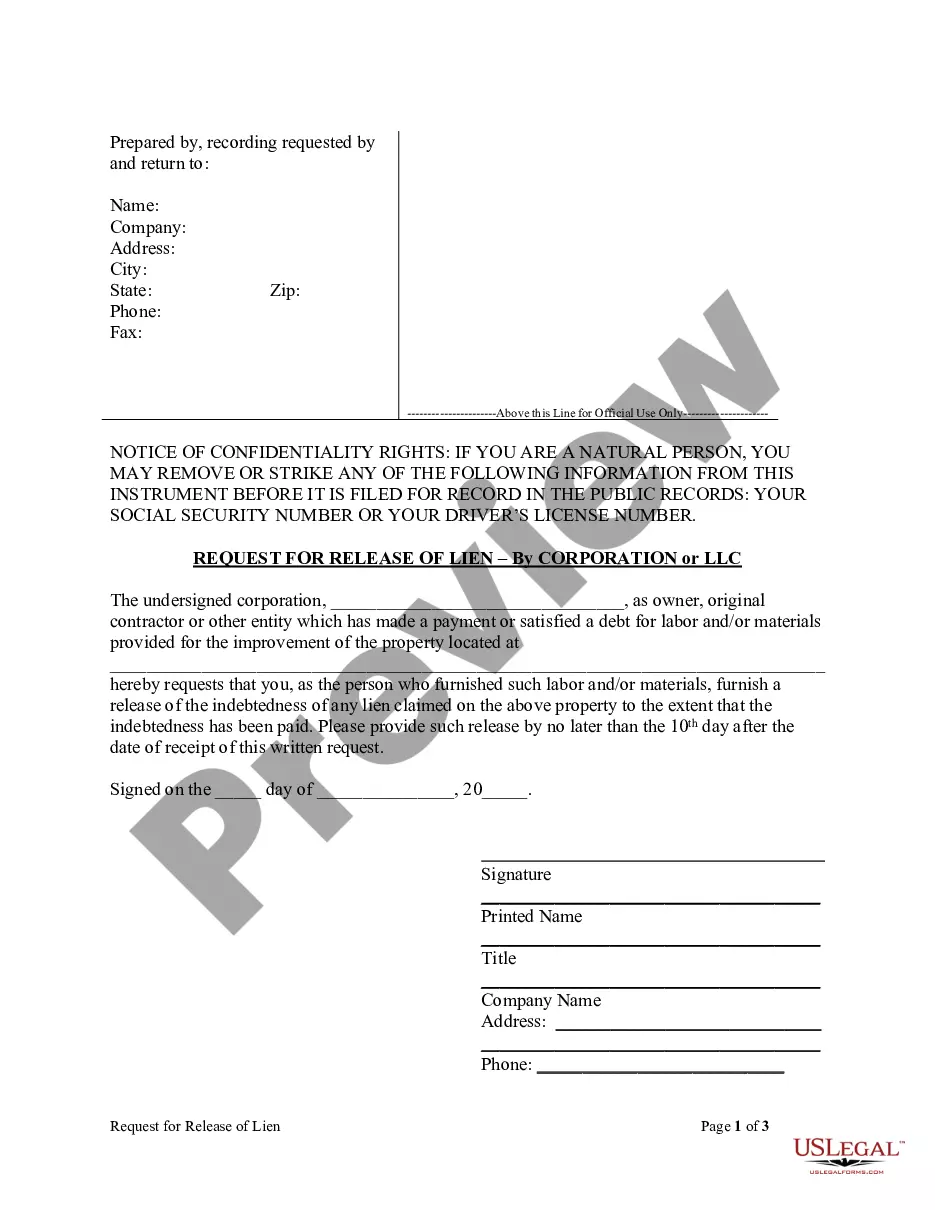

Preparing legal paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them comply with federal and state regulations and are examined by our experts. So if you need to fill out Oregon Report of Administrative Expenses, our service is the perfect place to download it.

Getting your Oregon Report of Administrative Expenses from our library is as easy as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button once they find the proper template. Later, if they need to, users can take the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few minutes. Here’s a brief instruction for you:

- Document compliance verification. You should attentively review the content of the form you want and check whether it suits your needs and meets your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab above until you find an appropriate blank, and click Buy Now when you see the one you want.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Oregon Report of Administrative Expenses and click Download to save it on your device. Print it to complete your paperwork manually, or use a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service now to obtain any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

Vendor Collected Administrative Fee (VCAF)

Wages are taxable by the federal government and the state of California. However, per diems are generally not considered wages. Therefore, when handled correctly, per diems are not considered taxable wages. There are exceptions that employers should understand, including a recent court case involving per diems.

1. Annual high-low rates. For purposes of the high-low substantiation method, the per diem rates in lieu of the rates described in Notice 2021-52 (the per diem substantiation method) are $297 for travel to any high-cost locality and $204 for travel to any other locality within CONUS.

These are written letters asking you to confirm items on a return. The letter explains what items we're reviewing and what we need from you to verify them.

Taxability of Meal Per Diem. Meal allowances that do not involve an overnight stay are taxable income to the traveler.

Per diem employees get W-2 and have taxes automatically withheld from their pay. Freelancers receive a 1099-NEC and have no taxes withheld. This is a key distinction, because if you're hired as a per diem employee, and your employer hands you a 1099, then no taxes were taken out of your pay all year.

GSA Per Diem Primary DestinationCountyOct 2022Standard Rate(For all locations without specified rates)$98BeavertonWashington$136BendDeschutes$120ClackamasClackamas$1158 more rows