Oregon Procedures Re: Redemption of Personal Property are a set of rules that guide the process of an individual reclaiming property that has been repossessed by a creditor. This procedure applies to any debtors or creditors involved in a repossession of personal property within the state of Oregon. The two types of Oregon Procedures Re: Redemption of Personal Property are Self-Help Repossession and Voluntary Surrender. In Self-Help Repossession, the creditor can take possession of the collateral without first obtaining a court order. In Voluntary Surrender, the debtor agrees to the repossession of the property and voluntarily gives up possession of the property to the creditor. Once the repossession has occurred, the debtor can redeem the property by making the full payment of the debt owed to the creditor. The debtor must also pay any fees associated with the repossession, such as storage and transportation costs. If the debtor fails to redeem the property within 30 days, the creditor may proceed to sell or otherwise dispose of the property. The Oregon Procedures Re: Redemption of Personal Property also outlines the procedures for the creditor if they choose to pursue a lawsuit against the debtor. The creditor must serve the debtor with a summons and complaint, and the debtor must then file an answer to the complaint with the court. The court will then decide whether the creditor is entitled to a judgment against the debtor for the amount of the debt. If the creditor is awarded a judgment, they may then proceed to enforce the judgment by garnishing wages or seizing the debtor’s assets.

Oregon Procedures Re: Redemption of Personal Property

Description

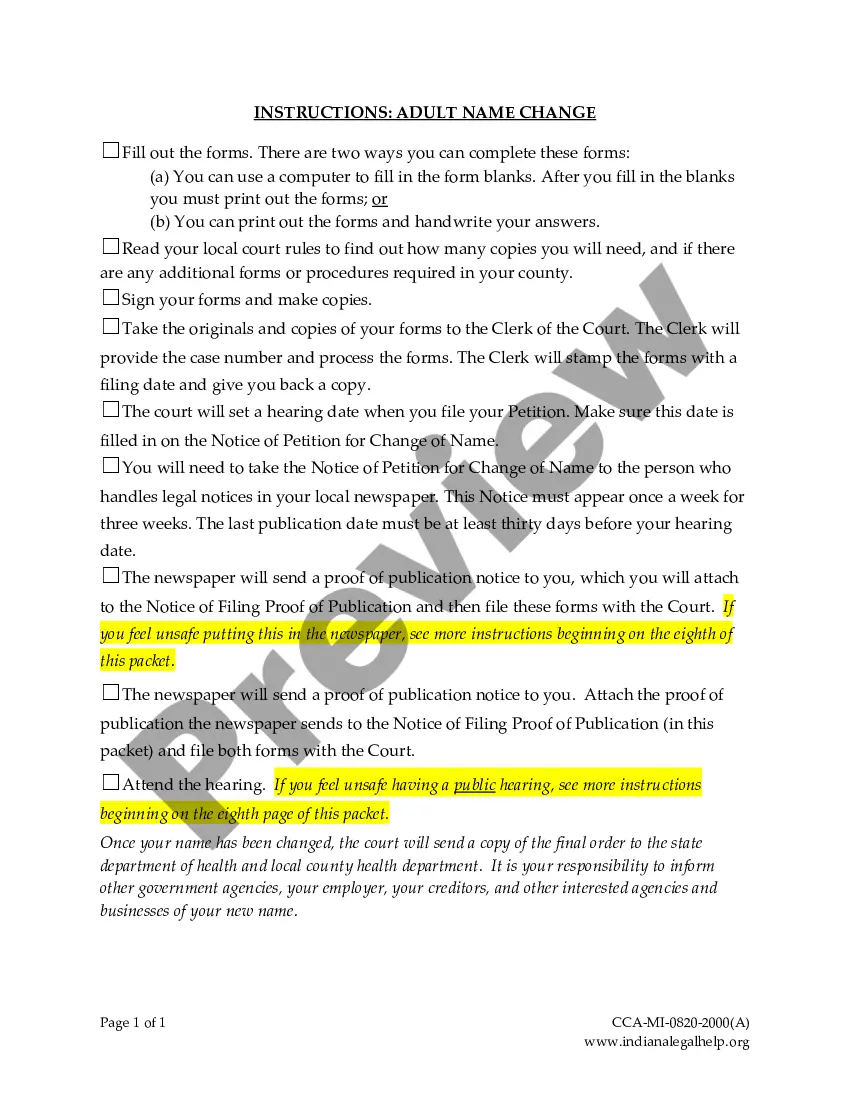

How to fill out Oregon Procedures Re: Redemption Of Personal Property?

If you’re looking for a way to properly complete the Oregon Procedures Re: Redemption of Personal Property without hiring a legal representative, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every private and business scenario. Every piece of documentation you find on our online service is created in accordance with nationwide and state regulations, so you can be certain that your documents are in order.

Follow these simple guidelines on how to obtain the ready-to-use Oregon Procedures Re: Redemption of Personal Property:

- Make sure the document you see on the page corresponds with your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Enter the document title in the Search tab on the top of the page and choose your state from the dropdown to find an alternative template if there are any inconsistencies.

- Repeat with the content verification and click Buy now when you are confident with the paperwork compliance with all the requirements.

- Log in to your account and click Download. Sign up for the service and select the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Choose in what format you want to save your Oregon Procedures Re: Redemption of Personal Property and download it by clicking the appropriate button.

- Upload your template to an online editor to complete and sign it quickly or print it out to prepare your hard copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you acquired - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

In Oregon, property taxes that aren't paid on or before May 15 of the tax year in which they're billed are delinquent. The property is subject to a tax foreclosure three years after the first date of delinquency.

About tax deferral State residents who are disabled or senior homeowners may qualify for Oregon's tax deferral program if eligible and borrow from the State of Oregon to pay their county property taxes. Qualified homeowners repay the loan amounts with 6% interest.

A lien secures the state's interest in your property when you don't pay your tax debt. A garnishment takes property or assets to pay the tax debt. If you don't pay in full or set up a payment plan, we can garnish, seize, and/or sell the real or personal property that you own or have an interest in.

Right of redemption is a legal process that allows a delinquent mortgage borrower to reclaim their home or other property subject to foreclosure if they are able to repay their obligations in time.

Redemption is a period after your home has already been sold at a foreclosure sale when you can still reclaim your home. You will need to pay the outstanding mortgage balance and all costs incurred during the foreclosure process. Many states have some type of redemption period.

? A TAX DEED STATE. Now to answer your question, ?Is Oregon a tax lien state?? The answer is, ?No.?

After the sale, the owner has 180 days to buy the property back from the purchaser for an amount equal to the auction price paid, plus interest and anything the purchaser had to pay for such items as taxes and maintenance. This is known as a right of redemption.

Use multcoproptax.com to look up your property tax bill/statement.