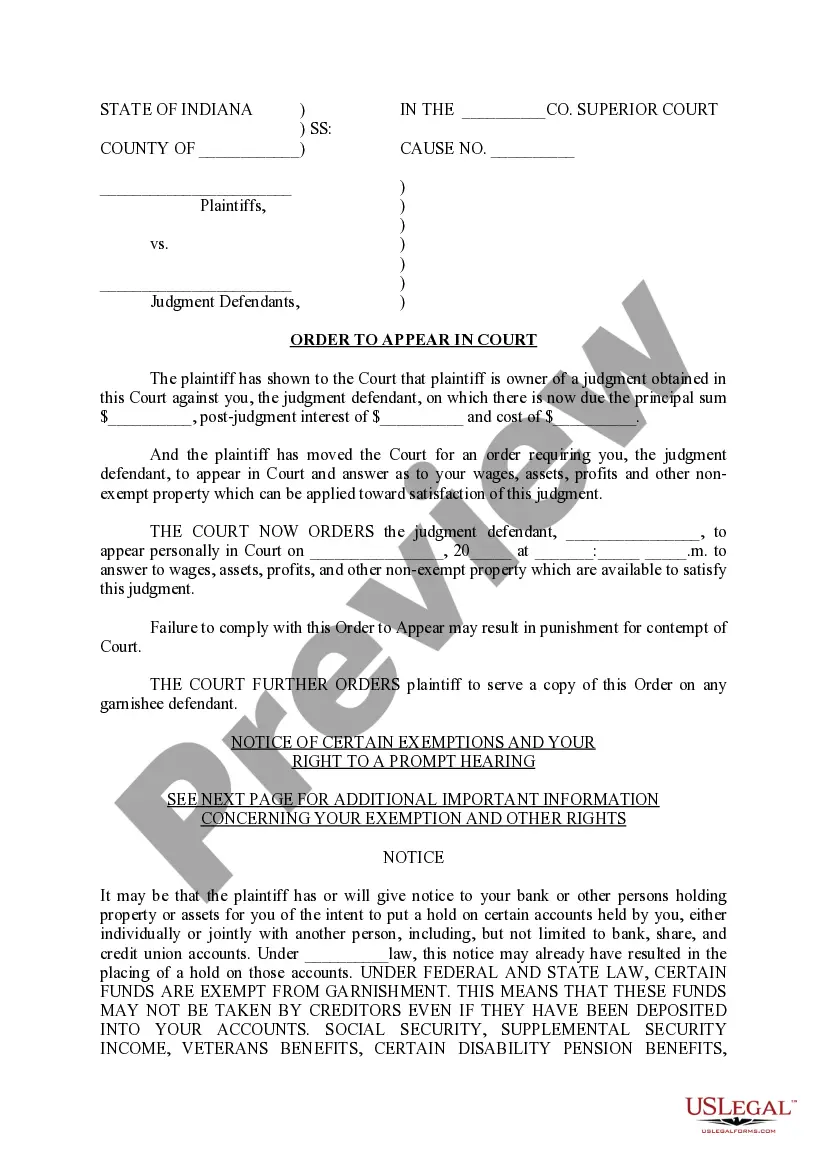

Oregon Garnishment Information includes any court-ordered seizure of wages or other assets from an individual's pay, bank account, or other property to satisfy a debt. Types of Oregon garnishment information include wage garnishment, bank levy, and other forms of asset seizure. Wage garnishment is the most common form of garnishment in Oregon, and it requires an employer to withhold a portion of an employee's wages each pay period until the debt is paid. Bank levies, also known as bank attachments, are used to seize funds from an individual's bank account to pay off a debt. Other forms of asset seizure in Oregon can include the garnishment of Social Security benefits, unemployment benefits, or other types of income for debt repayment.

Oregon Garnishment Information includes any court-ordered seizure of wages or other assets from an individual's pay, bank account, or other property to satisfy a debt. Types of Oregon garnishment information include wage garnishment, bank levy, and other forms of asset seizure. Wage garnishment is the most common form of garnishment in Oregon, and it requires an employer to withhold a portion of an employee's wages each pay period until the debt is paid. Bank levies, also known as bank attachments, are used to seize funds from an individual's bank account to pay off a debt. Other forms of asset seizure in Oregon can include the garnishment of Social Security benefits, unemployment benefits, or other types of income for debt repayment.