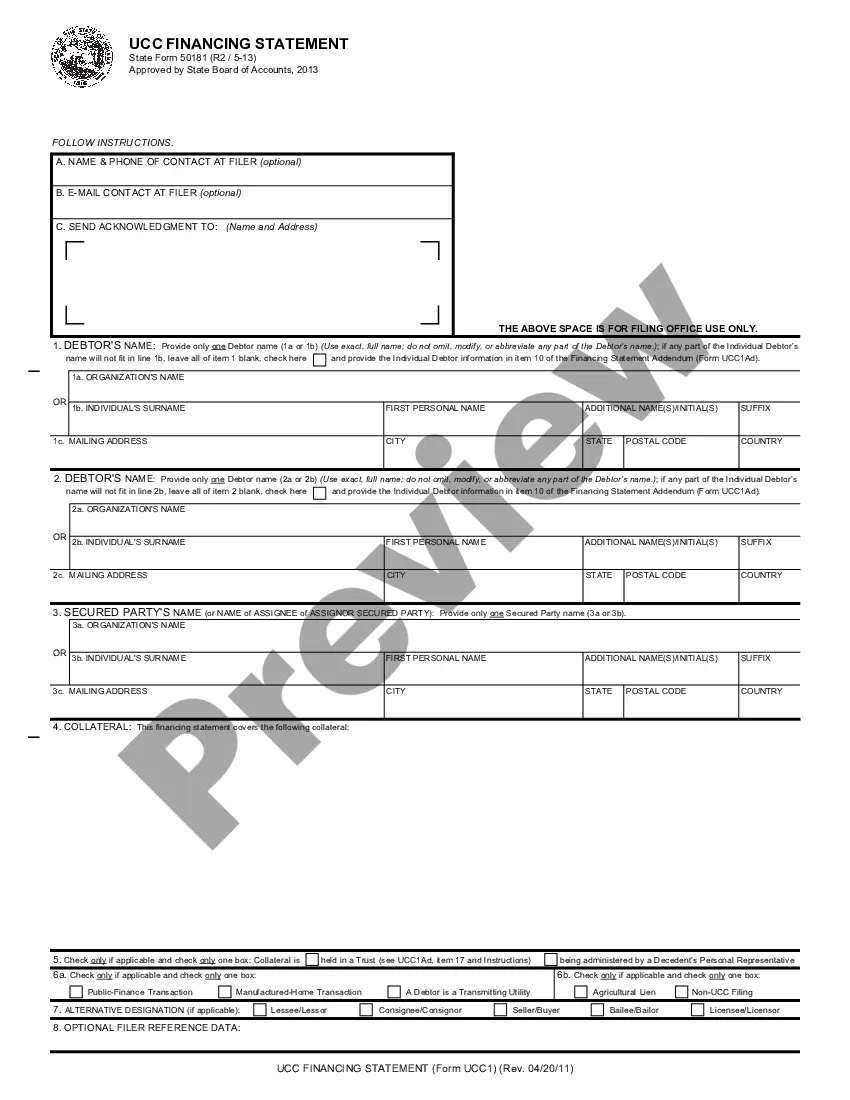

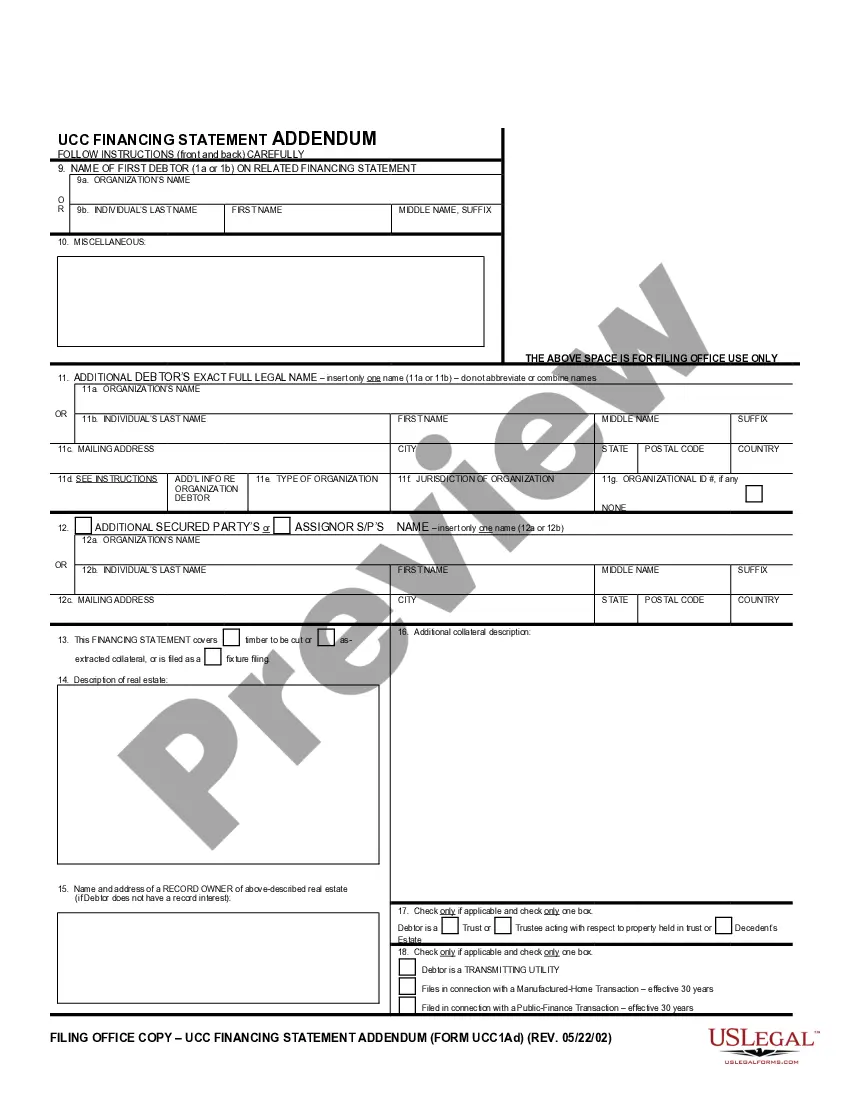

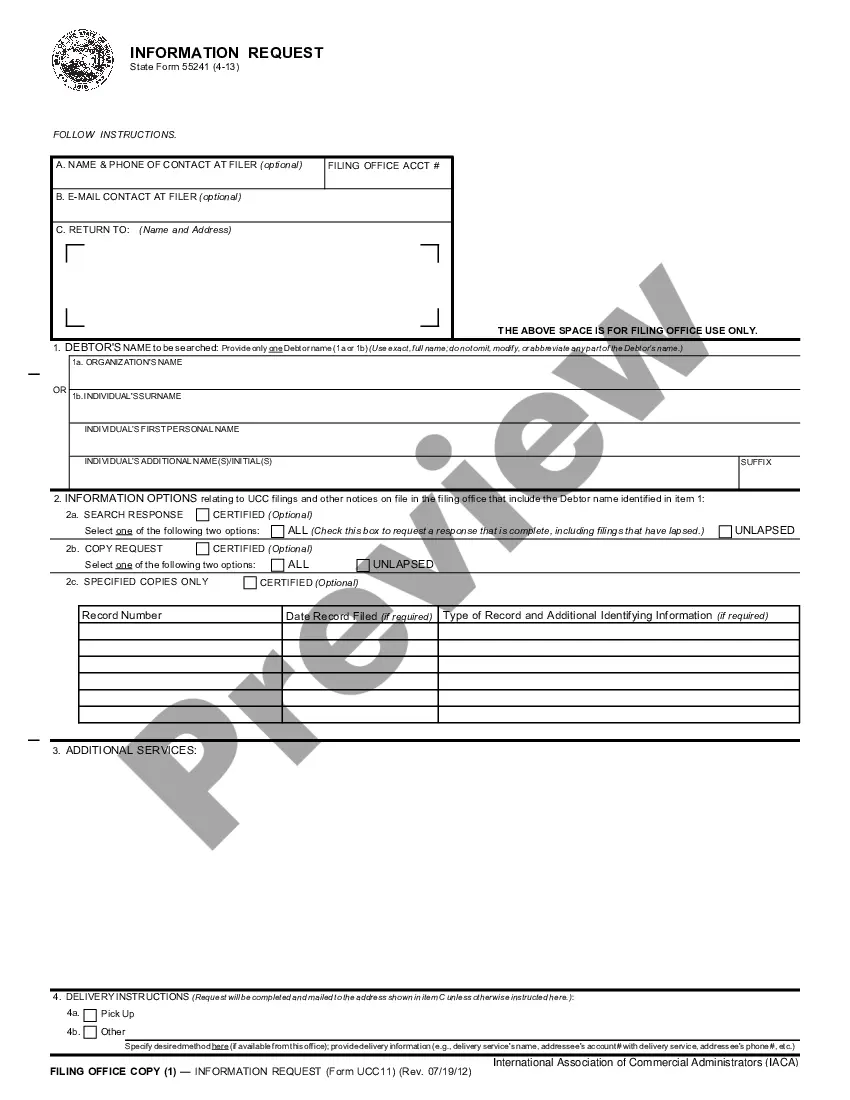

Oregon Instructions and Challenge to Garnishment is a legal form used in the state of Oregon, which gives a creditor the right to take money from a debtor's bank account or wages. It is important to note that the Instructions and Challenge to Garnishment must be filed in the county where the debtor resides. Oregon Instructions and Challenge to Garnishment is used by creditors to collect on a money judgment obtained in court. The form outlines the debtor's name, address, and Social Security number. It also includes the creditor's name, the court in which the judgment was obtained, the amount of the judgment, the name of the garnishee (the party who holds the money or property of the debtor), and the amount to be garnished from the garnishee. The Instructions and Challenge to Garnishment form must be completed and signed by the creditor and filed with the court. Once filed, the garnishee must answer the Challenge to Garnishment. If the garnishee fails to answer the Challenge to Garnishment, the creditor can obtain a wage garnishment order from the court. Types of Oregon Instructions and Challenge to Garnishment include: wage garnishment, bank account garnishment, and property garnishment.

Oregon Instructions and Challenge to Garnishment

Description

How to fill out Oregon Instructions And Challenge To Garnishment?

US Legal Forms is the most straightforward and affordable way to locate suitable legal templates. It’s the most extensive web-based library of business and individual legal paperwork drafted and verified by attorneys. Here, you can find printable and fillable templates that comply with national and local regulations - just like your Oregon Instructions and Challenge to Garnishment.

Getting your template requires just a few simple steps. Users that already have an account with a valid subscription only need to log in to the web service and download the document on their device. Later, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted Oregon Instructions and Challenge to Garnishment if you are using US Legal Forms for the first time:

- Look at the form description or preview the document to make certain you’ve found the one meeting your needs, or find another one utilizing the search tab above.

- Click Buy now when you’re certain about its compatibility with all the requirements, and judge the subscription plan you like most.

- Create an account with our service, log in, and pay for your subscription using PayPal or you credit card.

- Choose the preferred file format for your Oregon Instructions and Challenge to Garnishment and download it on your device with the appropriate button.

Once you save a template, you can reaccess it at any time - just find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more effectively.

Take advantage of US Legal Forms, your trustworthy assistant in obtaining the required official paperwork. Give it a try!

Form popularity

FAQ

Questions & Answers Fill out the Challenge to Garnishment form.Make a copy of the completed form for you to keep.Ask the court clerk when your court hearing will be held. Get ready for the hearing by making sure you can give evidence about the value of the things you are claiming and which exemptions they fall under.

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less. (15 U.S.C. § 1673).

If wage garnishment means that you can't pay for your family's basic needs, you can ask the court to order the debt collector to stop garnishing your wages or reduce the amount. This is called a Claim of Exemption.

Some of the property that you may be able to get back is listed below. (1) Wages or a salary as described in ORS 18.375 (Definitions) and 18.385 (Wage exemption).(2) Social Security benefits. (3) Supplemental Security Income (SSI). (4) Public assistance (welfare). (5) Unemployment benefits. (6)(7)(8)

If one of the garnishments is from a state or federal taxing agency, or a Court order, then you may be subject to more than one garnishment. However, generally only one Oregon Wage Garnishment from a non-governnmental creditor can be active at the same time.

Under Oregon law, a Wage Garnishment can last up to a maximum of 90 days from when it is delivered. It will stop earlier than that if the debt is paid in full. Unfortunately, there is no restriction under Oregon law to stop a creditor from issuing a new Wage Garnishment once the first garnishment expires.

The written objection should include: the case number (a unique set of numbers or letters specific to your case) your name, address, and phone number. a detailed explanation of your reasons for challenging the garnishment. a request for a hearing if the court has not already set a hearing date.

Here's some very helpful tips on how to put a stop to wage garnishment in Oregon. File a claim in your county courthouse. A SUMMONS is delivered to you. Default judgment is awarded if no settlement can be reached. Apply for a Writ of Garnishment.