The Oregon Application For Business Trust (Domestic) is a form used to register a business trust in the state of Oregon. The form is used to provide information about the trust, such as the name of the trust and its purpose, the trustees and their roles, the beneficiaries and their roles, and the trust's governing law. The form must also be accompanied by a filing fee. There are three types of Oregon Application For Business Trust (Domestic): Single Member Trust, Multi-member Trust, and Charitable Trust.

Oregon Application For Business Trust (Domestic)

Description

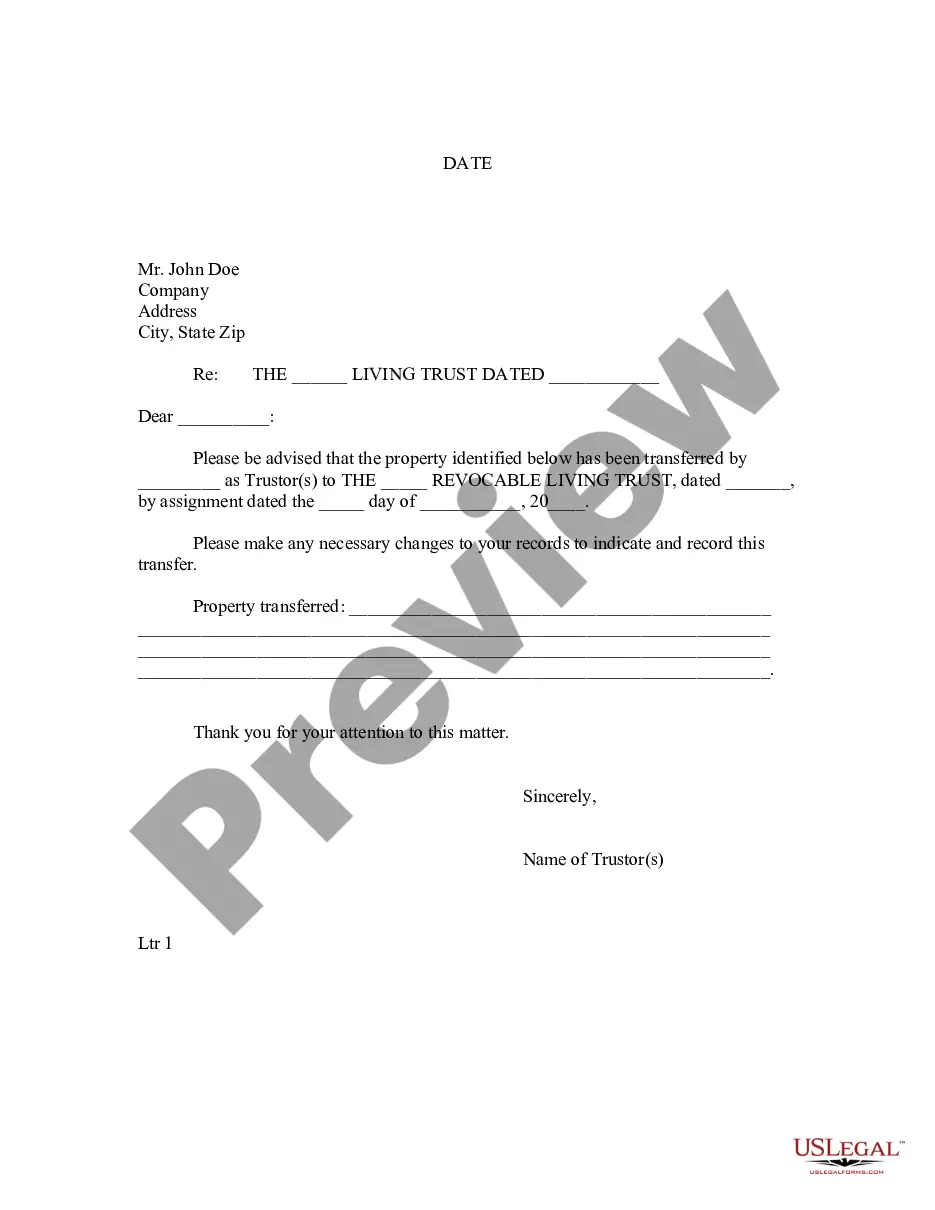

How to fill out Oregon Application For Business Trust (Domestic)?

Coping with legal paperwork requires attention, accuracy, and using well-drafted templates. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Oregon Application For Business Trust (Domestic) template from our library, you can be sure it complies with federal and state regulations.

Dealing with our service is straightforward and quick. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to get your Oregon Application For Business Trust (Domestic) within minutes:

- Remember to attentively look through the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for an alternative official template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Oregon Application For Business Trust (Domestic) in the format you prefer. If it’s your first time with our service, click Buy now to proceed.

- Create an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to submit it paper-free.

All documents are created for multi-usage, like the Oregon Application For Business Trust (Domestic) you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

A registered agent can be an individual or a legal entity. Limited liability companies organized under Oregon statute are "domestic" limited liability companies. Those formed under the laws of other states, but transacting business in Oregon, are "foreign" limited liability companies.

Registering a foreign LLC in Oregon involves submitting an Application for Authority to Transact Business to Oregon's Secretary of State and paying a $275 state filing fee.

How Do I Make a Living Trust in Oregon? Choose the type of trust you want to set up.Decide what items to leave in the trust.Choose a trustee.Decide who will be the beneficiary of the trust asset.Create the trust agreement document.Sign the document.Fund the trust by transferring your property into it.

For a Corporation: You'll need to file Articles of Incorporation with the Oregon Secretary of State. You also need to appoint a registered agent in Oregon, and you should prepare bylaws to establish operating rules, though this is not a legal requirement and does not need to be filed.

To register your business in Oregon, you must file an Application for Authority to Transact Business ? Foreign Limited Liability Company with the Oregon Secretary of State (SOS). You can download a copy of the application form from the SOS website.

The state of Oregon doesn't have a general business license. However, many occupations and business activities require special licenses, permits or certifications from state agencies or boards.

Starting a business in Oregon FAQ Corporations must file Articles of Incorporation. Both filings cost $100. You also pay $100 to register your business entity name with the Oregon Business Registry and an additional $50 if you want to register a DBA (called an assumed business name in Oregon).

Yes, a trust can own an LLC. A trust can own almost any asset, including membership interests, in an LLC the grantor owns.