The Oregon Missing Stamp-Certificate or Journal is a form issued by the Oregon Department of Revenue to document the amount of taxes that a business has paid. It is used to track the amount of taxes paid to the state of Oregon and can be used to claim a refund if the amount of taxes paid is greater than the amount due. The Oregon Missing Stamp-Certificate or Journal is divided into two parts: the certificate and the journal. The certificate portion of the document contains all the information related to the tax payments made by the business. This includes the date of payment, the type of tax paid, the amount paid, and any other relevant information related to the payment. The certificate also contains a stamp or seal from the Oregon Department of Revenue verifying that the tax payment was made. The journal portion of the document is used to keep track of the tax payments made over a period of time. This includes the date of payment, the type of tax paid, and the amount paid. The journal portion also includes a summary of the tax payments made and any adjustments made to the total amount due. The Oregon Missing Stamp-Certificate or Journal is an important document for businesses to keep track of their tax payments to the state of Oregon. It can also be used to claim a refund if the amount of taxes paid is greater than the amount due.

Oregon Missing Stamp-Certificate Or Journal

Description

How to fill out Oregon Missing Stamp-Certificate Or Journal?

If you’re looking for a way to properly prepare the Oregon Missing Stamp-Certificate Or Journal without hiring a legal professional, then you’re just in the right spot. US Legal Forms has proven itself as the most extensive and reputable library of official templates for every individual and business scenario. Every piece of paperwork you find on our web service is drafted in accordance with federal and state regulations, so you can be certain that your documents are in order.

Adhere to these straightforward instructions on how to obtain the ready-to-use Oregon Missing Stamp-Certificate Or Journal:

- Ensure the document you see on the page meets your legal situation and state regulations by checking its text description or looking through the Preview mode.

- Type in the form title in the Search tab on the top of the page and select your state from the dropdown to locate another template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Create an account with the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The blank will be available to download right after.

- Choose in what format you want to save your Oregon Missing Stamp-Certificate Or Journal and download it by clicking the appropriate button.

- Import your template to an online editor to complete and sign it rapidly or print it out to prepare your hard copy manually.

Another great thing about US Legal Forms is that you never lose the paperwork you acquired - you can pick any of your downloaded blanks in the My Forms tab of your profile any time you need it.

Form popularity

FAQ

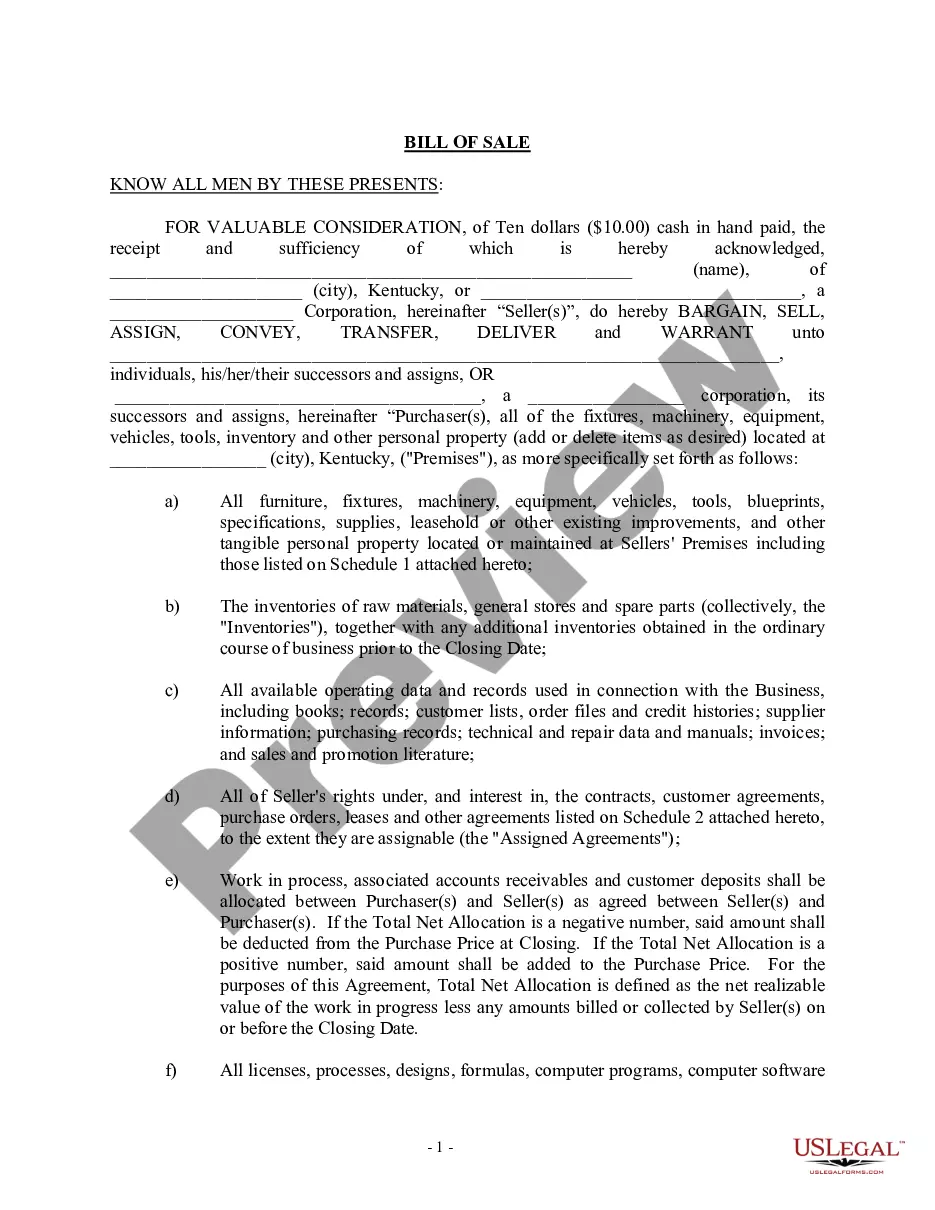

If the notary journal is in the possession of the Secretary of State's office, or if the notary public is a public official or public employee, then the notarial journal falls under the public record disclosure laws.

During a notarial commission term, a notary public may change employers several times, and the notarial commission, stamping device, and notarial journal move with the notary public.

??An electronic journal is required for remote notarizations. The electronic journal will include the signature of the individual. You may also keep a paper journal.

If the notary journal is in the possession of the Secretary of State's office, or if the notary public is a public official or public employee, then the notarial journal falls under the public record disclosure laws.

You must store your notarial journal for ten years after the last act noted in the journal. If you have a letter of retention agreement with your employer, the employer must store your journal for ten years after the date of your last notarization.

ASN recommends that ALL notaries use a recordbook of notarial acts.

(1) A notary public may use an embosser in the performance of a notarial act but only in addition to the notary public's official stamp. (2) A notary public shall not place the embossment over any signature in a record to be notarized, or in a notarial certificate or over any writing in a notarial certificate.

The date of the notarization. The name and mailing address of the signer. The method used to identify the signer and if a credible witness identified the signer, the credible witness' name and address. A description of the document.