Oregon Accounting is the practice of recording, analyzing, and interpreting financial information for businesses and individuals in the state of Oregon. It covers the preparation of financial statements, accounts receivable and accounts payable, budgeting, taxation, and auditing. It also includes bookkeeping, payroll accounting, and financial reporting. There are two main types of Oregon Accounting- public accounting and private accounting. Public accounting includes services such as tax preparation, auditing, and consulting. Private accounting includes services such as accounting information systems, financial forecasting, and cost analysis.

Oregon Accounting

Description

How to fill out Oregon Accounting?

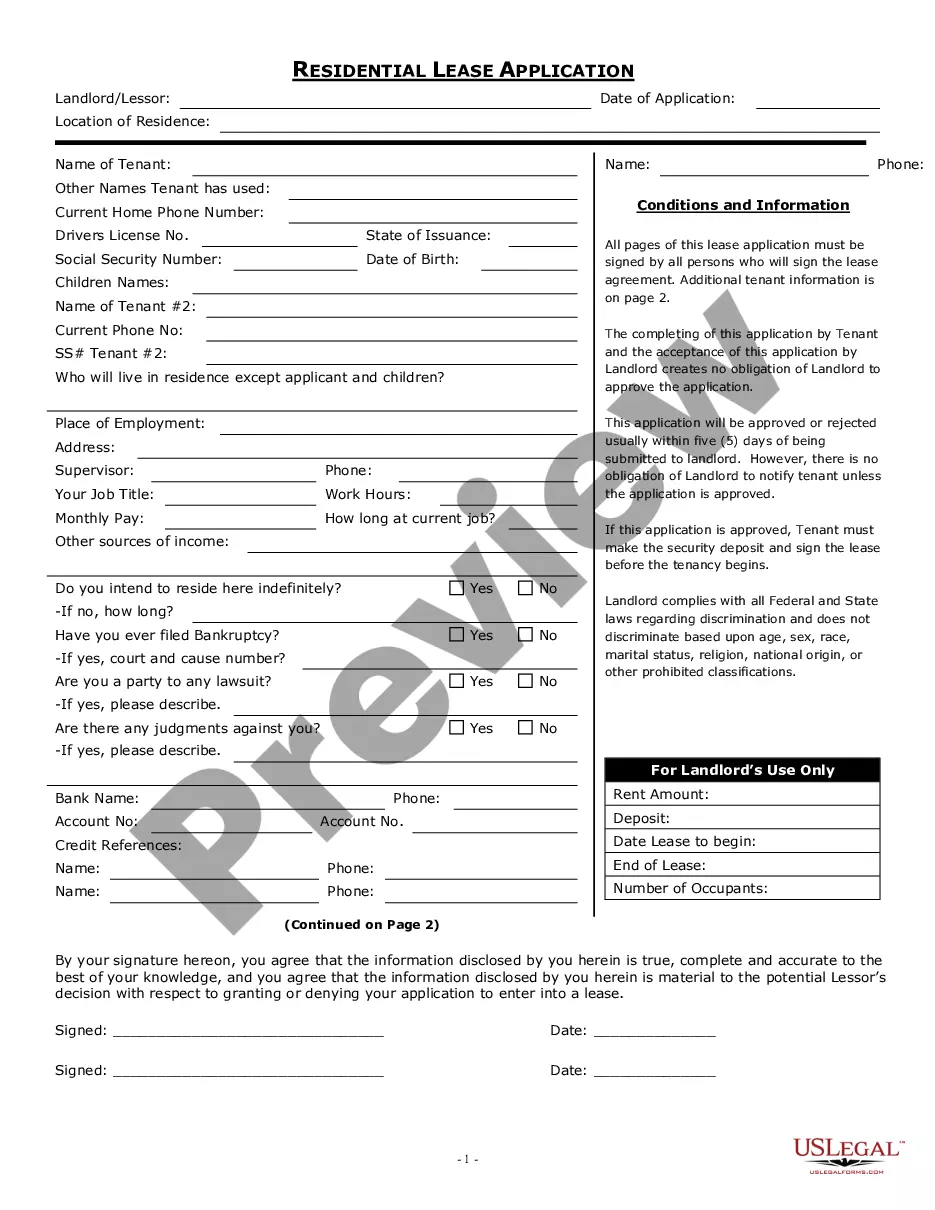

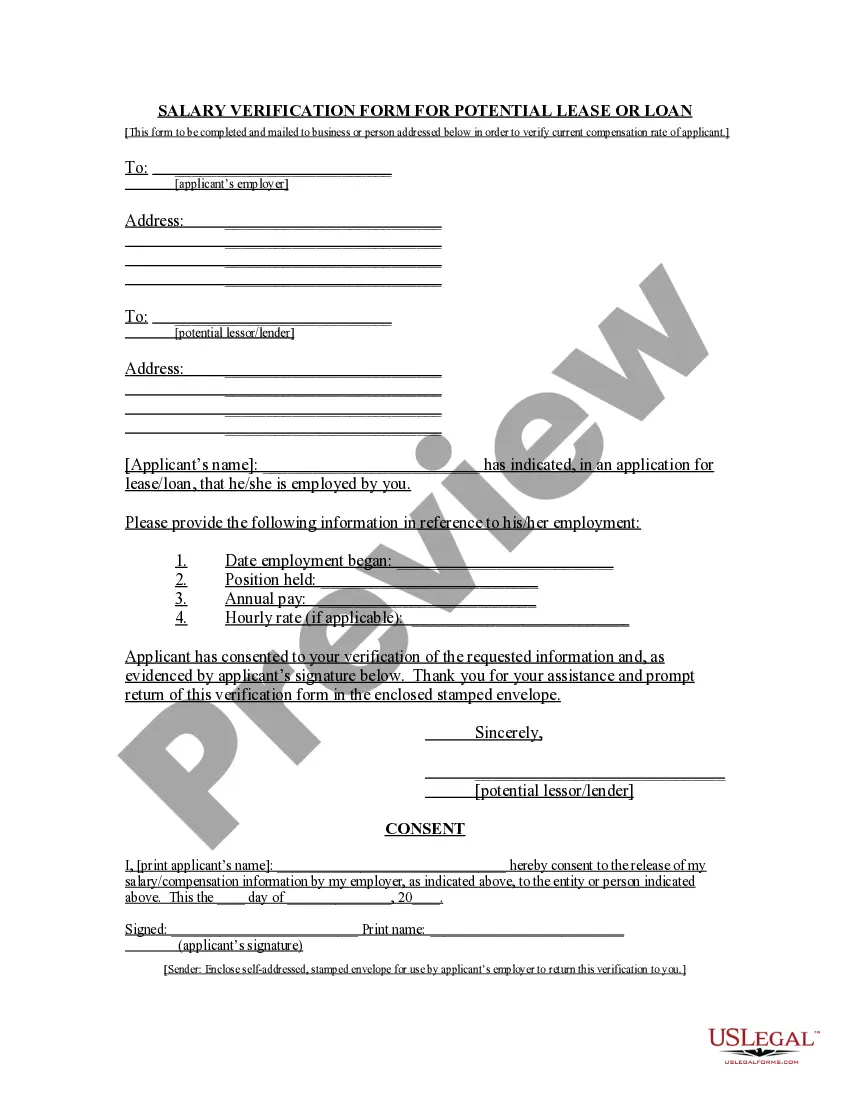

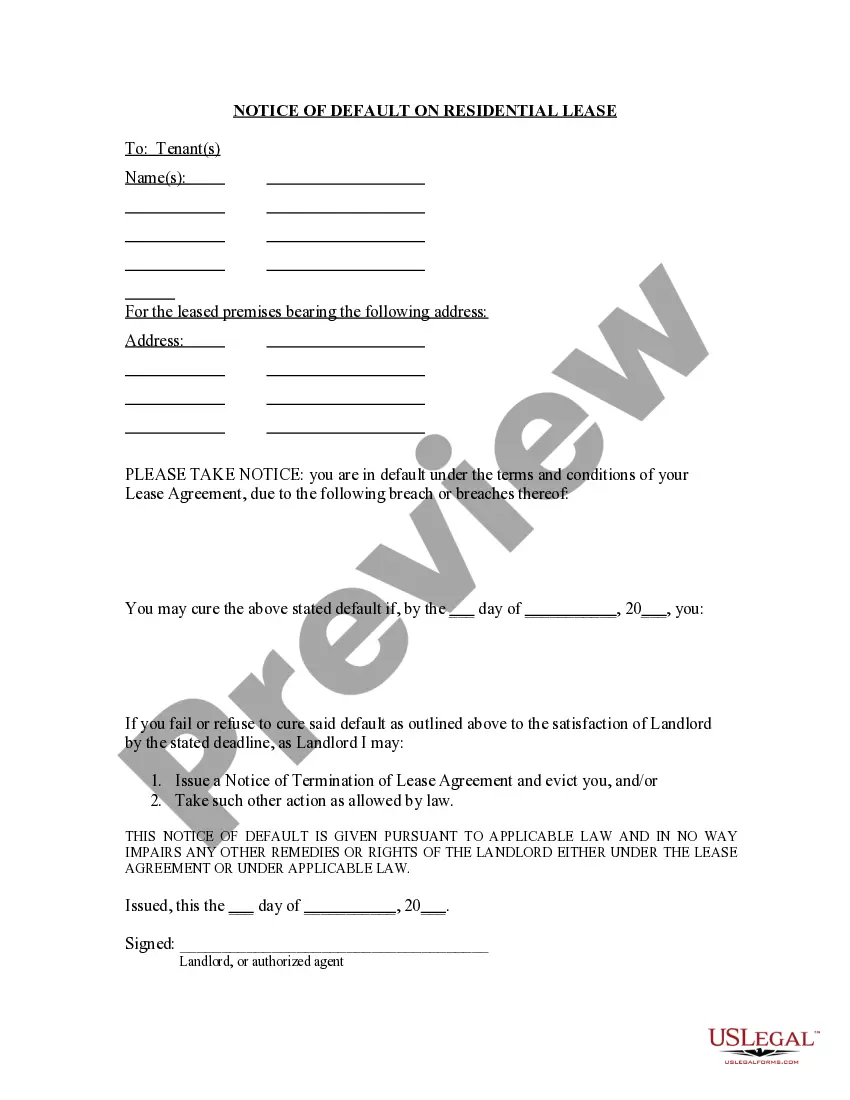

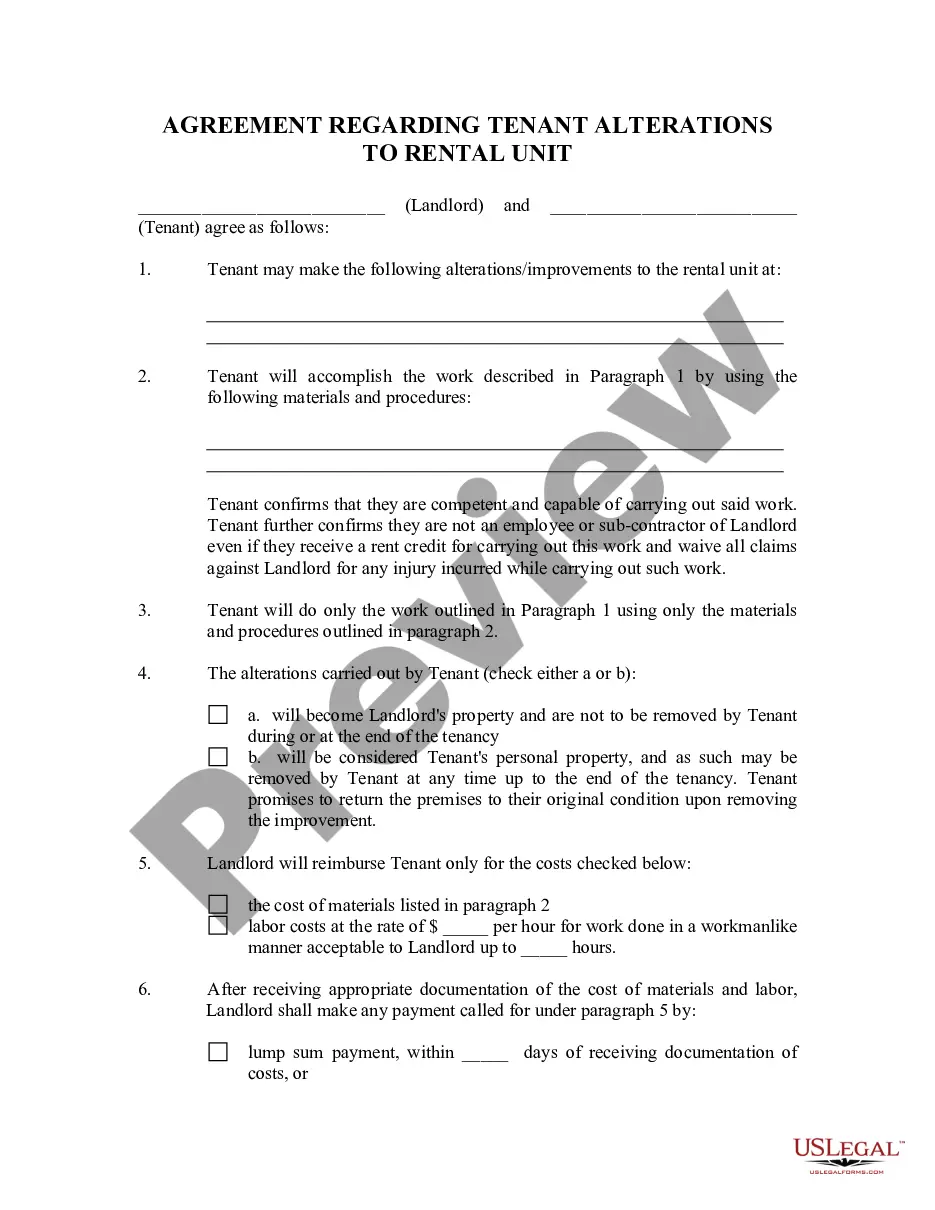

Preparing official paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them comply with federal and state laws and are checked by our experts. So if you need to complete Oregon Accounting, our service is the perfect place to download it.

Getting your Oregon Accounting from our service is as simple as ABC. Previously registered users with a valid subscription need only sign in and click the Download button once they find the correct template. Later, if they need to, users can pick the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few minutes. Here’s a quick guide for you:

- Document compliance check. You should attentively review the content of the form you want and make sure whether it satisfies your needs and fulfills your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library through the Search tab above until you find a suitable blank, and click Buy Now once you see the one you need.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Oregon Accounting and click Download to save it on your device. Print it to fill out your papers manually, or take advantage of a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to obtain any official document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

This accounting program is offered by Oregon State's AACSB-accredited College of Business and it is delivered by OSU Ecampus, a national leader in online education.

Best of the best The School of Accounting is honored to be an accredited school through the Association to Advance Collegiate Schools of Business International (AACSB) and the Federation of Schools of Accountancy (FSA).

With the accounting major, you have the opportunity to finish your undergraduate degree in three years and complete your master's degree in one.

Average GPA: 3.59 (Most schools use a weighted GPA out of 4.0, though some report an unweighted GPA. With a GPA of 3.59, Oregon State University requires you to be around average in your high school class. You'll need a mix of A's and B's, and very few C's.

How to become a CPA in Oregon Meet the education requirements described in OAR 801-010-0050, which includes 150 semester hours or 225 quarter hours and a bachelor's degree from an accredited college. Complete one year of experience in accounting. Pass the Uniform CPA Examination. Pass the Ethics Examination.

To provide CPA services to consumers in Oregon, a practitioner should be licensed as a Certified Public Accountant or Public Accountant by the Oregon Board of Accountancy, (or may be practicing in Oregon under provisions of mobility OAR 801-010-0080).

The most popular majors at Oregon State University include: Computer Science; Business Administration and Management, General; Mechanical Engineering; Psychology, General; Human Development and Family Studies, General; Exercise Science and Kinesiology; Biology/Biological Sciences, General; Finance, General; and Health/

With the accounting major, you have the opportunity to finish your undergraduate degree in three years and complete your master's degree in one.