Oregon Stipulated Agreement (Property Tax) is an agreement that allows taxpayers and the Department of Revenue to settle a disputed property tax bill. This agreement is used when taxpayers disagree with the Department’s assessment of their property taxes and are unable to resolve the dispute through regular channels. The Stipulated Agreement outlines the terms of the settlement, including the amount of taxes due and when the taxpayer will pay them. It is legally binding and enforceable in court. There are two types of Oregon Stipulated Agreement (Property Tax): one-time stipulated agreements and installment stipulated agreements. A one-time stipulated agreement is for a single tax year, while an installment stipulated agreement covers multiple tax years. In both cases, the taxpayer agrees to pay the amount of taxes due in full, as outlined in the agreement. The Department of Revenue agrees not to pursue further collection action if the taxpayer meets the terms of the agreement.

Oregon Stipulated Agreement (Property Tax)

Description

How to fill out Oregon Stipulated Agreement (Property Tax)?

How much time and resources do you often spend on composing formal paperwork? There’s a better option to get such forms than hiring legal specialists or wasting hours browsing the web for a proper blank. US Legal Forms is the top online library that provides professionally designed and verified state-specific legal documents for any purpose, like the Oregon Stipulated Agreement (Property Tax).

To get and complete a suitable Oregon Stipulated Agreement (Property Tax) blank, adhere to these simple instructions:

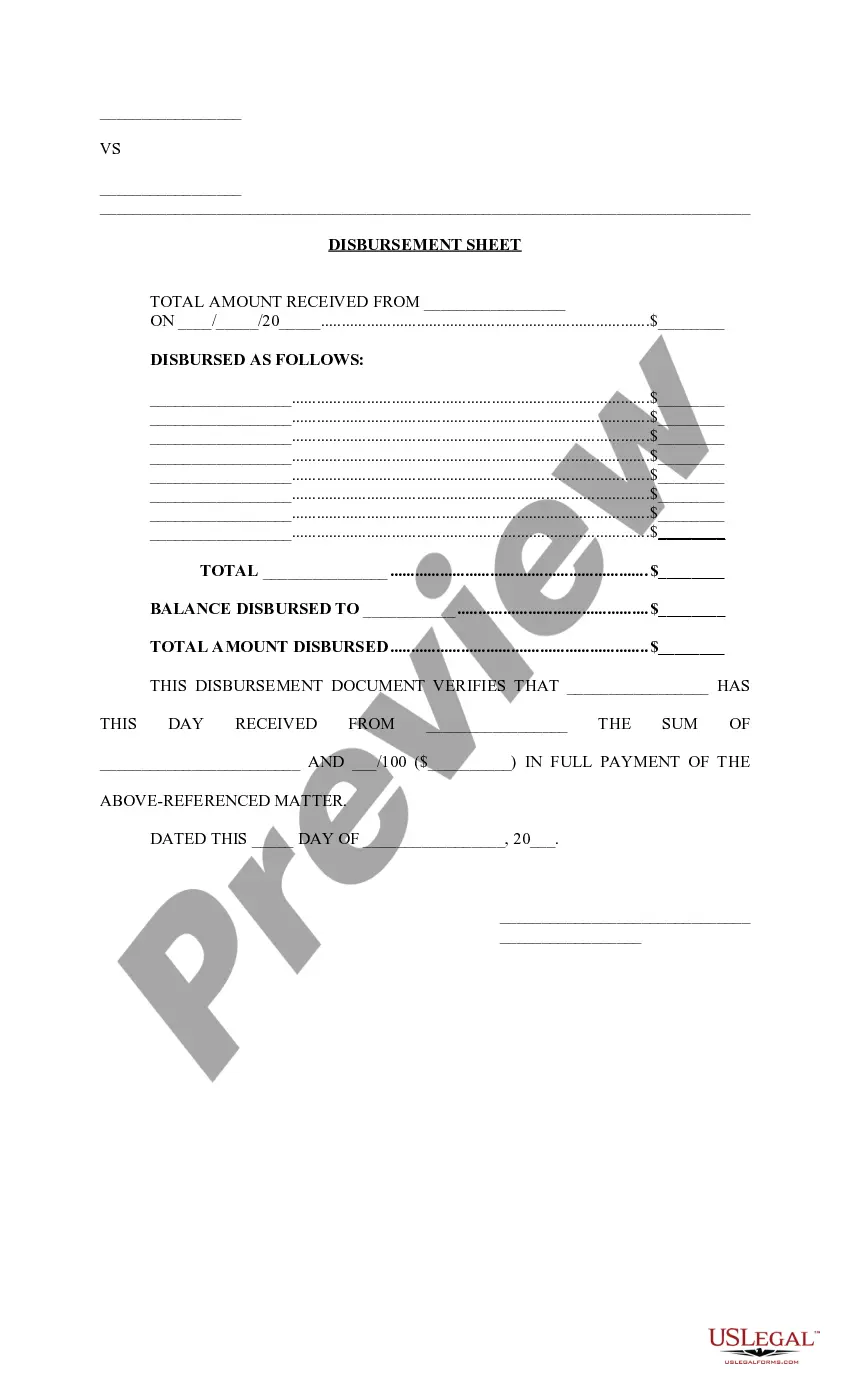

- Examine the form content to make sure it complies with your state requirements. To do so, read the form description or use the Preview option.

- If your legal template doesn’t meet your needs, find a different one using the search bar at the top of the page.

- If you already have an account with us, log in and download the Oregon Stipulated Agreement (Property Tax). Otherwise, proceed to the next steps.

- Click Buy now once you find the correct document. Choose the subscription plan that suits you best to access our library’s full service.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or via PayPal - our service is totally secure for that.

- Download your Oregon Stipulated Agreement (Property Tax) on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously downloaded documents that you safely keep in your profile in the My Forms tab. Obtain them anytime and re-complete your paperwork as often as you need.

Save time and effort preparing official paperwork with US Legal Forms, one of the most reliable web services. Sign up for us now!