Oregon Instructions for filing an appeal depend on the type of appeal being filed. 1. Appealing an Oregon Tax Court Decision: To appeal a decision from the Oregon Tax Court, you must file a Notice of Appeal with the Oregon Supreme Court, along with a copy of the Tax Court's decision and the required filing fee, within 35 days of the Tax Court's decision. The Notice of Appeal must include details of the parties involved, a description of the relief sought, and a statement that the appeal is being taken from a Tax Court decision. 2. Appealing an Oregon Court of Appeals Decision: To appeal a decision from the Oregon Court of Appeals, you must file a Notice of Appeal with the Oregon Supreme Court, along with a copy of the Court of Appeals’ decision and the required filing fee, within 40 days of the Court of Appeals’ decision. The Notice of Appeal must include details of the parties involved, a description of the relief sought, and a statement that the appeal is being taken from a Court of Appeals decision. 3. Appealing an Oregon Circuit Court Decision: To appeal a decision from the Oregon Circuit Court, you must file a Notice of Appeal with the Oregon Court of Appeals, along with a copy of the Circuit Court's decision and the required filing fee, within 30 days of the Circuit Court's decision. The Notice of Appeal must include details of the parties involved, a description of the relief sought, and a statement that the appeal is being taken from a Circuit Court decision. 4. Appealing an Oregon Land Use Board of Appeals Decision: To appeal a decision from the Oregon Land Use Board of Appeals, you must file a Notice of Appeal with the Oregon Court of Appeals, along with a copy of the Board’s decision and the required filing fee, within 45 days of the Board’s decision. The Notice of Appeal must include details of the parties involved, a description of the relief sought, and a statement that the appeal is being taken from a Land Use Board of Appeals decision. No matter which type of appeal you are filing, you must also submit a copy of the record on appeal and the required filing fee to the appropriate court. Additionally, you must serve a copy of the Notice of Appeal on all parties to the action and the court from which you are appealing. The court may dismiss your appeal if you fail to meet these requirements.

Oregon Instructions for filing an appeal

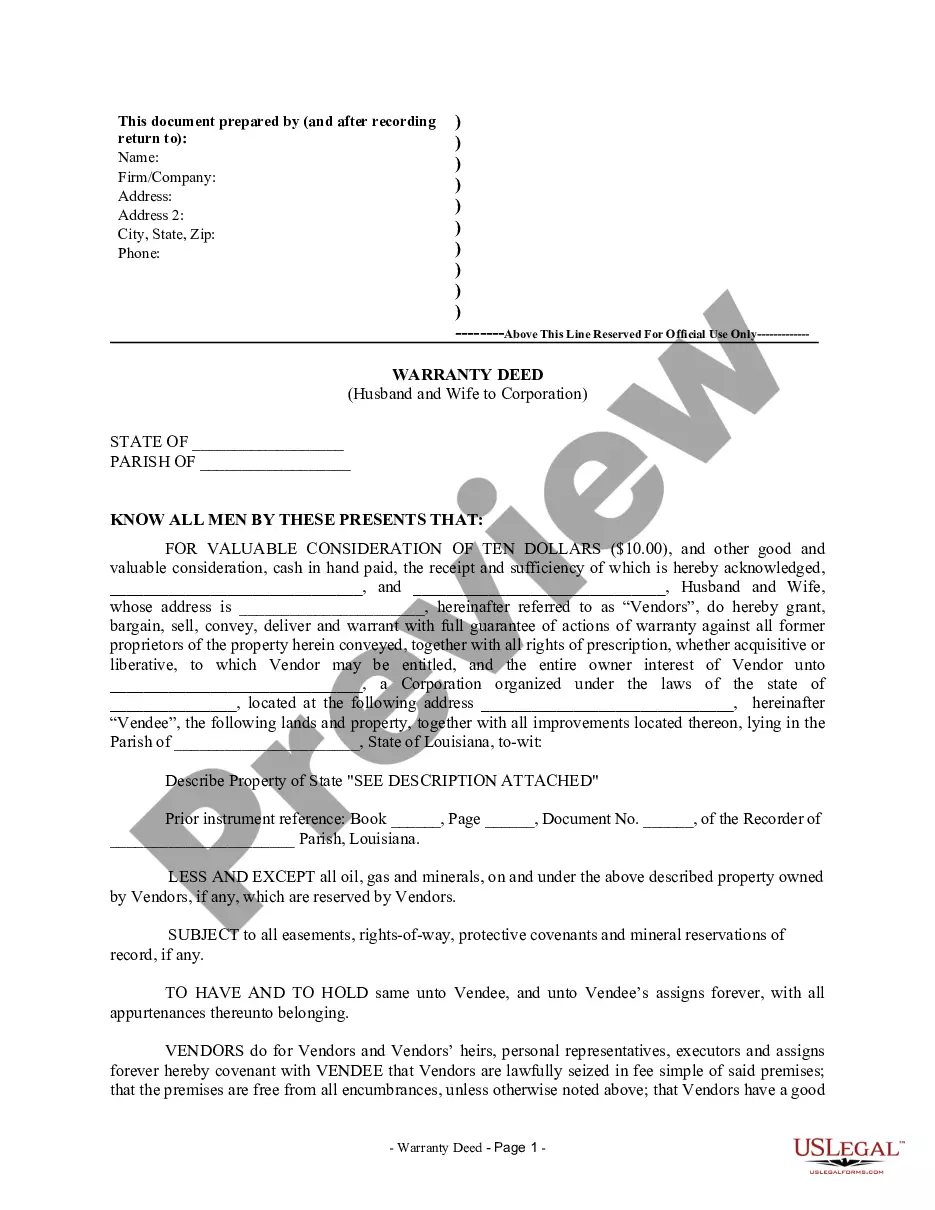

Description

How to fill out Oregon Instructions For Filing An Appeal?

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them correspond with federal and state laws and are verified by our specialists. So if you need to complete Oregon Instructions for filing an appeal, our service is the best place to download it.

Getting your Oregon Instructions for filing an appeal from our service is as easy as ABC. Previously authorized users with a valid subscription need only log in and click the Download button once they locate the proper template. Later, if they need to, users can use the same blank from the My Forms tab of their profile. However, even if you are new to our service, registering with a valid subscription will take only a few minutes. Here’s a quick guideline for you:

- Document compliance verification. You should carefully examine the content of the form you want and make sure whether it suits your needs and meets your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library through the Search tab on the top of the page until you find a suitable template, and click Buy Now once you see the one you need.

- Account registration and form purchase. Register for an account with US Legal Forms. After account verification, log in and choose your most suitable subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Select the file format for your Oregon Instructions for filing an appeal and click Download to save it on your device. Print it to complete your papers manually, or use a multi-featured online editor to prepare an electronic version faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service today to get any formal document quickly and easily any time you need to, and keep your paperwork in order!