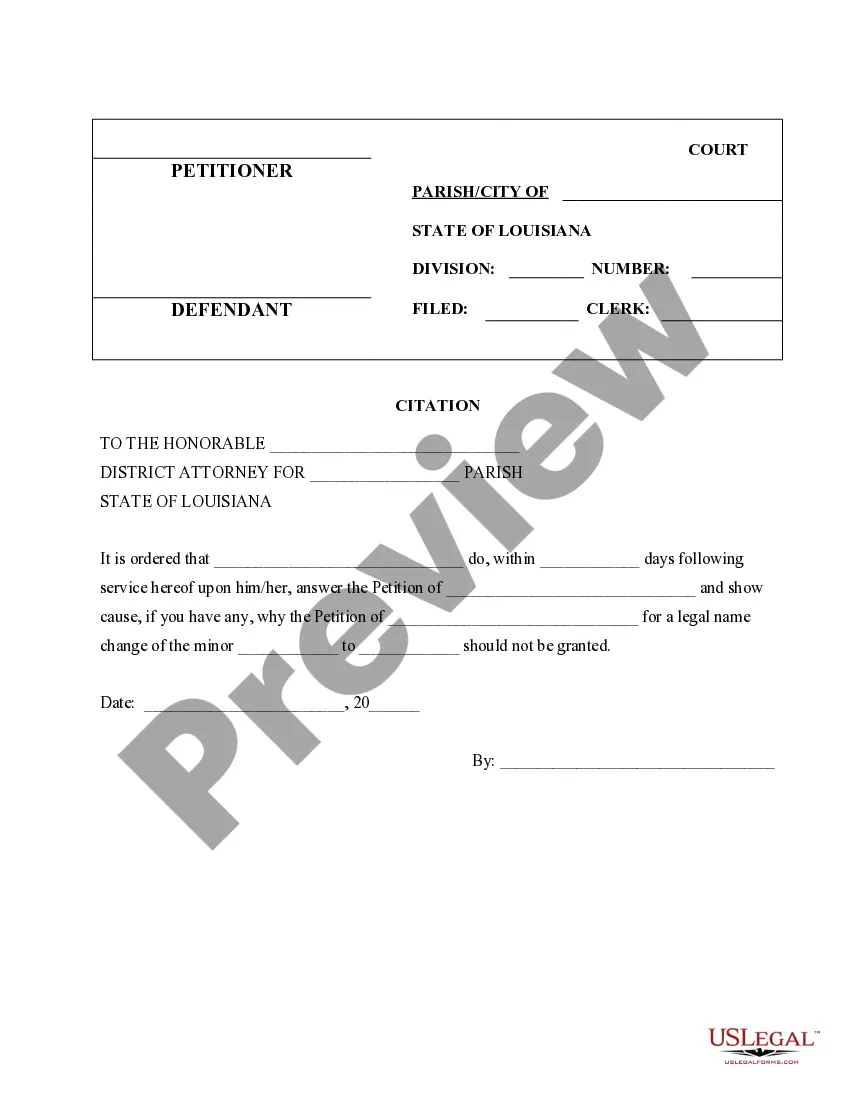

Oregon VITO EN LA SALE DEL SUEZ MAGISTRATE DEL TRIBUNAL TRIBUTARIES DE OREGON Impasto sober Los ingress (Income Tax Complaint) BS RNA Queen legal presented PO Run contribute en contra Del Department de Impuestos de Oregon. ESTA Queen SE relations con reclamations o violations all Impasto sober Los Ingress de Oregon. Existed dos tips principals de Queens presented ant eel Tribunal Tributaries de Oregon: Queens de Revisión de ImpuestosQueenss de Impuestossobere la Rent. La Queen de Revisión de ImpuestosSEereleasee a unaQueenapresenteda PO Run contribute argumentation Que la candida DE impetus Que SE LE require pagan BS incorrect. POR Otto Lady, RNA Queen de Impuestos sober la Rent SE release an RNA Queen presented PO Run contribute argumentation Que la candida DE impetus Que LE due required de Pago BS excessive. Las queen SER presented en El Tribunal Tributaries de Oregon para oftener RNA revision final RNA decisióofficialal.

Oregon VISTO EN LA SALA DEL JUEZ MAGISTRADO DEL TRIBUNAL TRIBUTARIO DE OREGON Impuesto sobre los ingresos(Income Tax Complaint)

Description

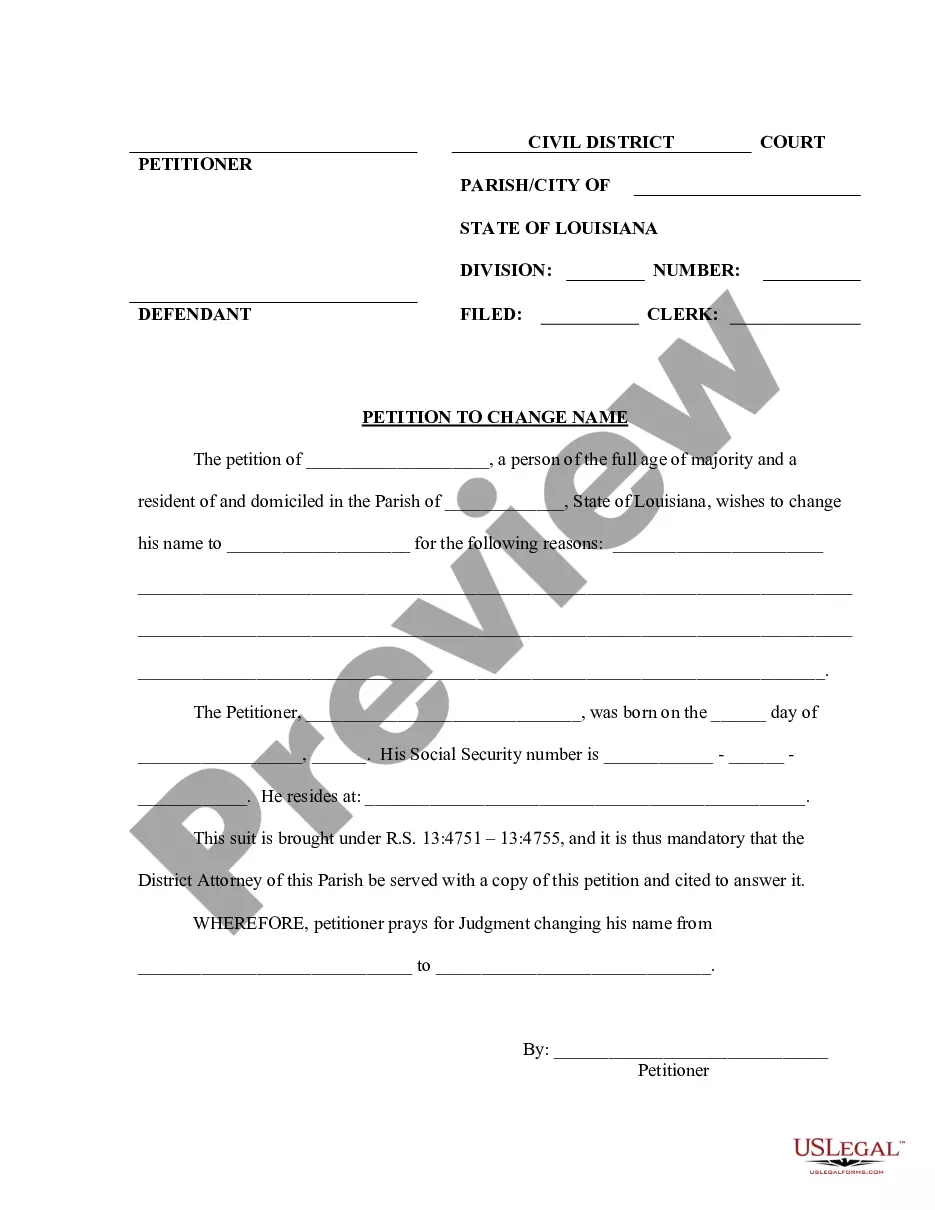

How to fill out Oregon VISTO EN LA SALA DEL JUEZ MAGISTRADO DEL TRIBUNAL TRIBUTARIO DE OREGON Impuesto Sobre Los Ingresos(Income Tax Complaint)?

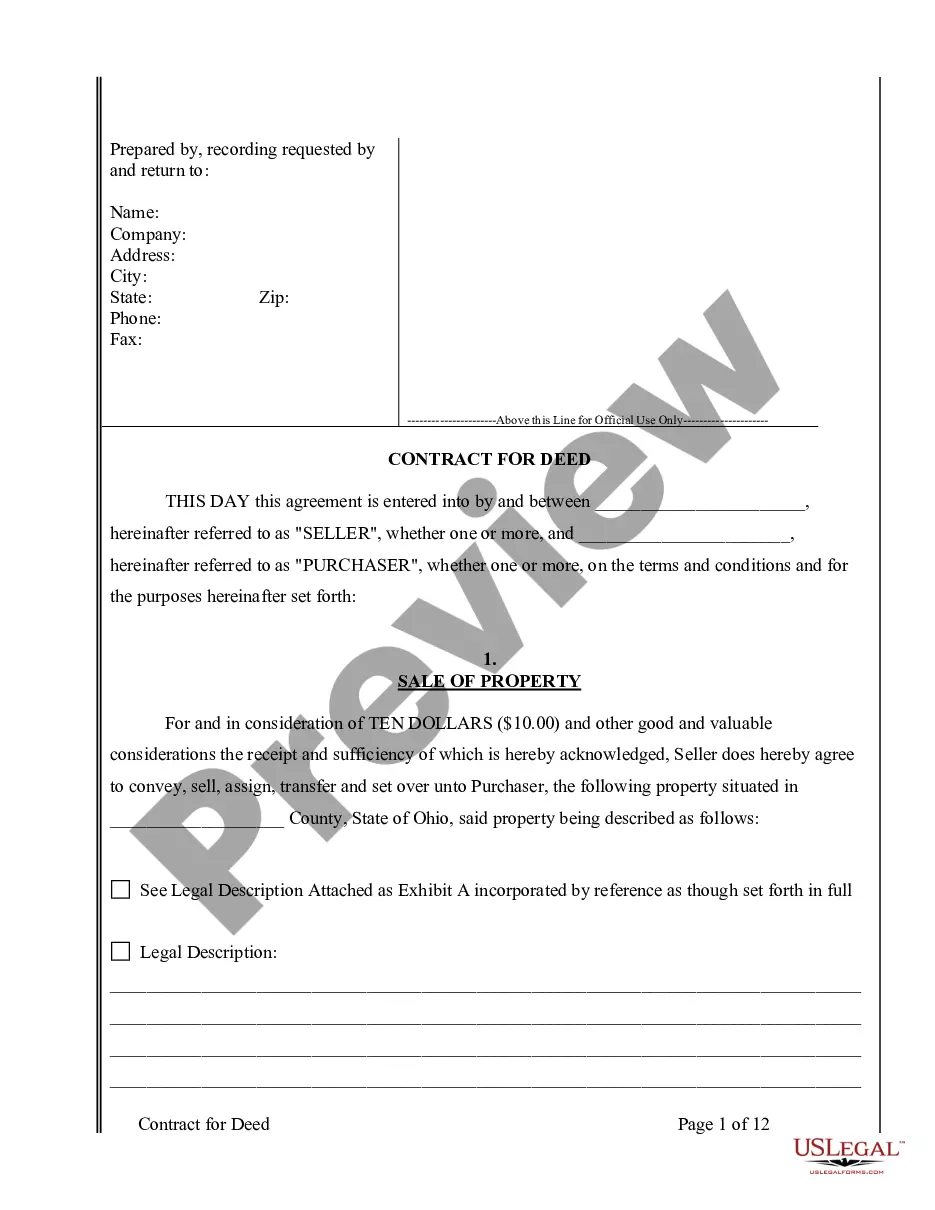

Dealing with official documentation requires attention, accuracy, and using well-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Oregon VISTO EN LA SALA DEL JUEZ MAGISTRADO DEL TRIBUNAL TRIBUTARIO DE OREGON Impuesto sobre los ingresos(Income Tax Complaint) template from our service, you can be certain it meets federal and state laws.

Working with our service is straightforward and quick. To get the required document, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to find your Oregon VISTO EN LA SALA DEL JUEZ MAGISTRADO DEL TRIBUNAL TRIBUTARIO DE OREGON Impuesto sobre los ingresos(Income Tax Complaint) within minutes:

- Make sure to carefully examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for an alternative formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the Oregon VISTO EN LA SALA DEL JUEZ MAGISTRADO DEL TRIBUNAL TRIBUTARIO DE OREGON Impuesto sobre los ingresos(Income Tax Complaint) in the format you need. If it’s your first experience with our service, click Buy now to proceed.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to prepare it paper-free.

All documents are drafted for multi-usage, like the Oregon VISTO EN LA SALA DEL JUEZ MAGISTRADO DEL TRIBUNAL TRIBUTARIO DE OREGON Impuesto sobre los ingresos(Income Tax Complaint) you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

State Income Tax Program (SIT) State tax-collecting departments (often called the Department of Revenue) send information about delinquent state income tax debt to TOP. By law, TOP may offset a federal tax refund to collect that money owed to the states.

Once TOP receives certification from the state of the past-due tax debt, the federal income tax refund may be taken to pay down the state debt. This process is referred to as offset.

In addition to federal taxes, Oregon taxpayers have to pay state taxes. Oregon has some of the highest tax burdens in the U.S. The state uses a four-bracket progressive state income tax, which means that higher income levels correspond to higher state income tax rates.

?Yes. Federal and Oregon returns are separate, even though they are sent in the same transmission.

What You Need To Know About Oregon State Taxes. The state of Oregon requires you to pay taxes if you're a resident or nonresident that receives income from an Oregon source. Oregon assesses income taxes up to 9.9%, and doesn't have a general sales tax rate.

Your Oregon income tax is based on your taxable income. Oregon taxable income is your federal taxable income with the additions, subtractions, and modifications described in Oregon's tax laws.

Explanation:Generally, an IRS or federal tax refund from last year is not taxable on the subsequent tax year federal or state income tax return.

For 2022, the maximum credit is $219 for each qualifying personal exemption. You can claim a credit for yourself, your spouse, and your qualifying child or qualifying relative. An additional exemption credit is available if you or your spouse have a severe disability or if you have a child with a qualifying disability.