This form is a sample letter in Word format covering the subject matter of the title of the form.

Oregon Sample Letter for Acknowledgment of Receipt of Gift or Donation - Neutral

Description

How to fill out Sample Letter For Acknowledgment Of Receipt Of Gift Or Donation - Neutral?

Selecting the most appropriate authentic document format can pose challenges.

Of course, there are numerous templates accessible online, but how can you find the genuine type you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Oregon Sample Letter for Acknowledgment of Receipt of Gift or Donation - Neutral, which can be utilized for business and personal purposes.

First, confirm that you have selected the correct form for your area or county. You can review the form using the Review button and examine the form overview to ensure it is the right one for you.

- All of the forms are verified by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to receive the Oregon Sample Letter for Acknowledgment of Receipt of Gift or Donation - Neutral.

- Use your account to search through the legal forms you have previously purchased.

- Navigate to the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, below are straightforward instructions that you can follow.

Form popularity

FAQ

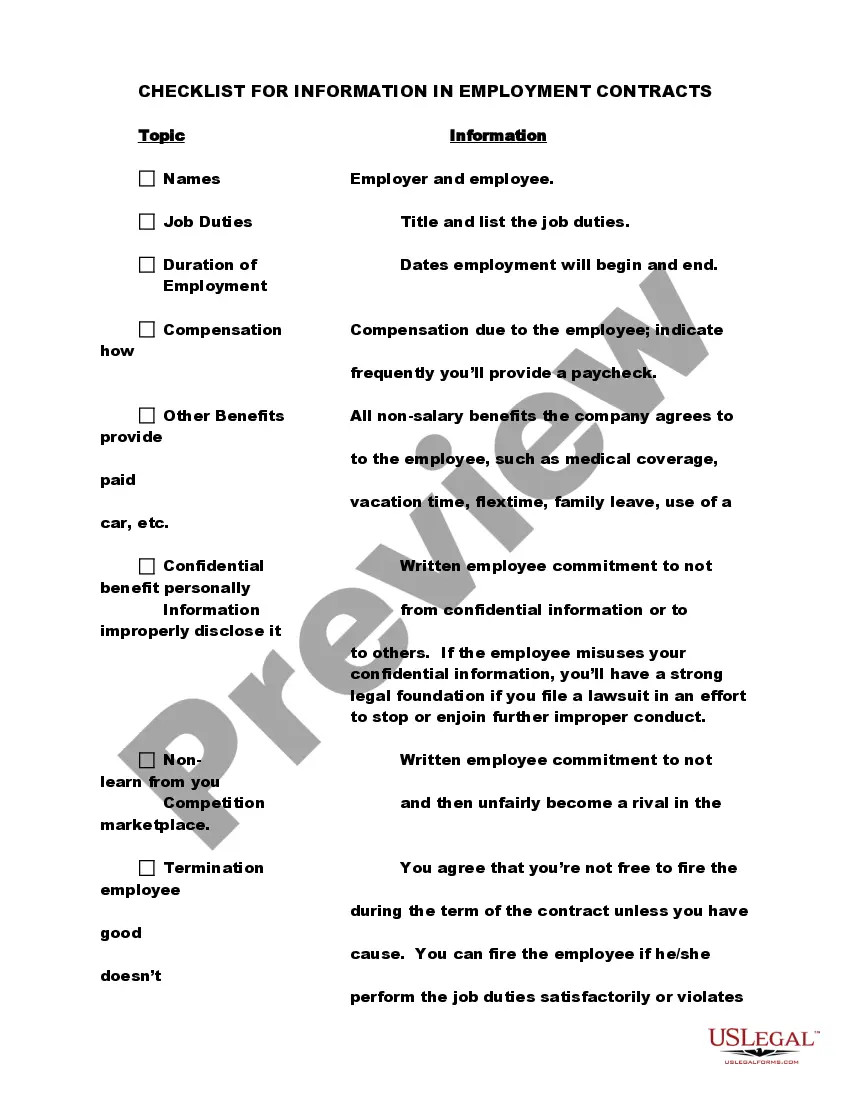

A formal donor acknowledgment letter should include the following information:A statement declaring the nonprofit's tax-exempt status as a 501c3.The name of the donor that they used to make their gift.The date the gift was received by your nonprofit.A description of the donation.

1. How to write an Acknowledgment Letter?Name and details of the person who is sending the letter.Name and details of the recipient to whom the letter is been sent.Date of sending the acknowledgment letter.Subject stating the reason for writing it.Statement of confirmation of receipt of the item.More items...?

Put your personal spin on any of these ideas to show donors that you care!Letter or Email Acknowledgement. Direct mail and email are the most common ways to thank your donors because you can send multiple letters at once.Public Thank You.Social Media Shout Out.Donor Gift.Website Appreciation Page.

The acknowledgement should include the date of the gift, the name of the IRA custodian, the amount of the gift, that the gift is a qualified charitable distribution under Sec. 408(d)(8)(A), and state that no goods or services were provided in exchange for the gift.

A donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. Sometimes your donation receipt functions as a donor acknowledgement. However, that's not always the case. All donors deserve to be thanked, no matter the size of their gift.

Dear (Sir/Name/Uncle), We, at the (Foundation name), would like to express our gratitude for your generous gift of (Product/Item type and name) with (Support item type/money) and other accessories from (Institute/Supplier name) Association towards the noble cause of our organization.

What do you need to include in your donation acknowledgment letter?The name of your donor.The full legal name of your organization.A declaration of your organization's tax-exempt status.Your organization's employer identification number.The date the gift was received.A description of the gift and the amount received.More items...?

In the first paragraph, immediately thank donors for their gift. Clearly state your official name and make your tax-exempt statement. In the second paragraph, include the details of their gift including its cash value, a description of the contribution, and the date it was made.

Acknowledge a gift directly by saying thank you so much for the . It is good to state early on what you are thanking someone for that way you connect the gift with the giver. If you were given money, do not list the exact amount instead write thank for the check. "Thank you so much for the new red sweater."

Here are some suggestions for acknowledging memorial gifts:Communicate with the family or donor.Acknowledge that the gift is a memorial donation.Create a notification letter template to notify a family member of donations made in their loved one's memory.Build relationships.More items...?