An Oregon Corporate Resolution for LLC is a legally-binding document that outlines the decisions made by a limited liability company (LLC) in the state of Oregon. This resolution is typically adopted by the LLC's members or managers to establish the actions, policies, or agreements of the company. The resolution serves as a formal record of important business decisions made within the LLC, and it is often required to be kept on file and presented when necessary. This document helps to ensure corporate transparency and accountability by providing a written record of decisions, which can be referred to in the future. There are several types of Oregon Corporate Resolutions for LLC, depending on the specific issue or decision being addressed. Some common types include: 1. Decision-Making Resolutions: These resolutions pertain to general matters that require a corporate decision. This can include decisions related to business operations, such as the appointment of officers or managers, establishing banking relationships, opening new bank accounts, or hiring key personnel. 2. Bylaws Adoption or Amendment Resolutions: These resolutions outline the company's internal rules and regulations (bylaws) that govern its operations. They may address issues such as voting rights, membership obligations, or procedures for conducting meetings. 3. Membership Resolutions: These resolutions involve decisions made by the LLC's members, such as admitting or removing members, transferring membership interests, or approval of agreements or contracts. 4. Financial Resolutions: These resolutions deal with financial matters, such as authorization to borrow money, enter into loan agreements, or sell or purchase assets. Additionally, they may address the distribution of profits or the declaration of dividends. 5. Dissolution or Liquidation Resolutions: These resolutions outline the steps to be taken if the LLC decides to dissolve or wind up its operations. This can include assigning responsibilities, paying off debts, liquidating assets, and distributing remaining proceeds among members. Each of these resolutions is tailored to specific situations and needs, and they require proper documentation and filing to ensure legal compliance. It is recommended to consult with legal professionals or hire experienced business lawyers to draft and review Oregon Corporate Resolutions for LLC, ensuring accuracy and adherence to state laws and regulations.

Oregon Corporate Resolution for LLC

Description

How to fill out Oregon Corporate Resolution For LLC?

Are you presently in a situation where you require documentation for both commercial and personal purposes almost every time.

There are numerous legal document templates available online, but locating trustworthy ones is not easy.

US Legal Forms provides a vast array of document templates, like the Oregon Corporate Resolution for LLC, which are designed to meet state and federal standards.

Once you find the right form, click on Purchase now.

Choose the pricing plan you want, fill in the required information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Oregon Corporate Resolution for LLC template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and confirm it is for the correct area/state.

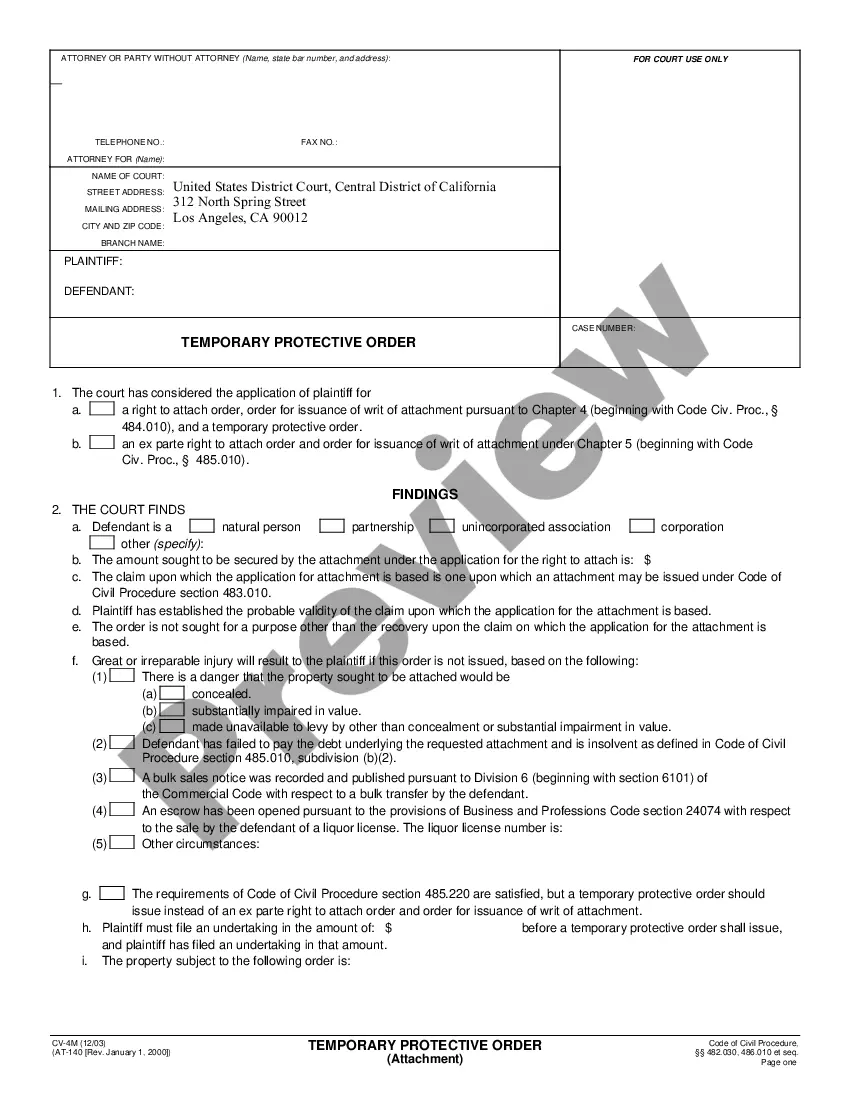

- Use the Preview button to review the form.

- Check the description to ensure you have selected the correct form.

- If the form isn’t what you’re looking for, utilize the Search section to find the form that suits your needs.

Form popularity

FAQ

A board resolution template is a manner of documenting decisions made by the company's Shareholders or Board of Directors. The decision can cover anything relevant to the affairs of the organization like a decision extending loans to other companies or when voting for a new member to join the board.

A corporate resolution is a document that formally records the important binding decisions into which a company enters. These decisions are made by such stakeholders as the corporation's managers, directors, officers or owners.

A corporate resolution is typically found in the board meeting minutes, although its form and structure can vary.

By way of example, corporate resolutions are typically required in order for a company to open bank accounts, execute contracts, lease equipment or facilities, and many more situations where the corporation's ownership or directors must be in agreement in order to transact business.

A corporate resolution is a document that formally records the important binding decisions into which a company enters. These decisions are made by such stakeholders as the corporation's managers, directors, officers or owners.

Issuing corporate resolutions is one way for corporations to demonstrate independence and avoid piercing the veil. In fact, all states require C-corporations and S-corporations to issue corporate resolutions to document important board of director decisions.

The Oregon Business Corporation Act includes laws and regulations for corporations doing business in the state of Oregon. By forming a corporation, the owner's personal assets aren't at risk for legal or financial issues relating to the business.

Bylaws are the rules and guidelines for a corporation, and resolutions are supplemental documents to the bylaws.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.