Oregon Accounts Receivable Monthly Customer Statement is a financial document that provides a detailed summary of all outstanding invoices and payments for a specific period of time in Oregon. This statement is sent by a business to its customers who have credit accounts with them. The primary purpose of an Oregon Accounts Receivable Monthly Customer Statement is to keep customers informed about their outstanding balances, recent transactions, and any additional charges or credits. It serves as a convenient tool for customers to reconcile their records with the business and ensure accuracy in their financial dealings. Keywords: Oregon, Accounts Receivable, Monthly Customer Statement, invoices, payments, credit accounts, outstanding balances, recent transactions, additional charges, credits, reconciliation, accuracy, financial dealings. Different types of Oregon Accounts Receivable Monthly Customer Statements may include: 1. Standard Monthly Statement: This type of statement typically includes details of all outstanding invoices, invoice numbers, invoice dates, respective amounts, and the total outstanding balance. It may also provide a summary of payments made during the month, any adjustments, credits, and current due dates for each invoice. 2. Past Due Statement: A Past Due Statement is generated when customers have overdue balances. It serves as a reminder to customers about their unpaid invoices and urges them to make prompt payment to avoid any potential penalties or credit issues. It includes specific information about overdue invoices, interest charges, and any late payment penalties that may apply. 3. Statement with Itemized Transactions: Some Oregon businesses provide a detailed itemized transaction statement to their customers. This type of statement lists each transaction separately, including the date, description, quantity, unit price, and total amount. It allows customers to review their purchases and payments in detail, making it easier for them to track and reconcile their accounts. 4. Summary Statement: A summary statement provides a high-level overview of the customer's account, including the total outstanding balance, recent payments, and any outstanding credits. This statement is concise and is often used when customers have a smaller number of transactions or if a detailed itemization is not necessary. Overall, an Oregon Accounts Receivable Monthly Customer Statement is an essential financial document that facilitates transparency and communication between businesses and their customers. It ensures accurate record-keeping and helps maintain a healthy financial relationship by promoting prompt payments and resolving any discrepancies in a timely manner.

Oregon Accounts Receivable Monthly Customer Statement

Description

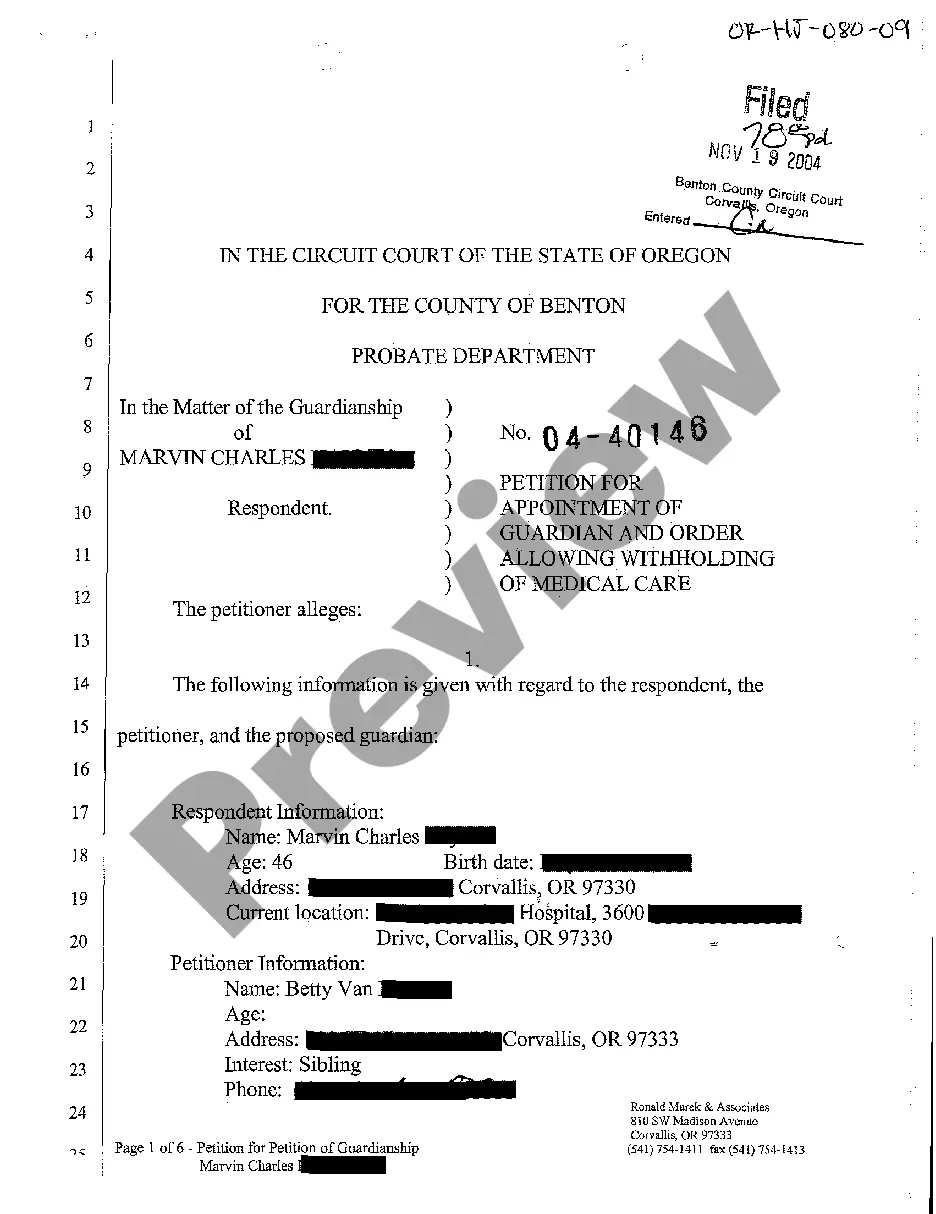

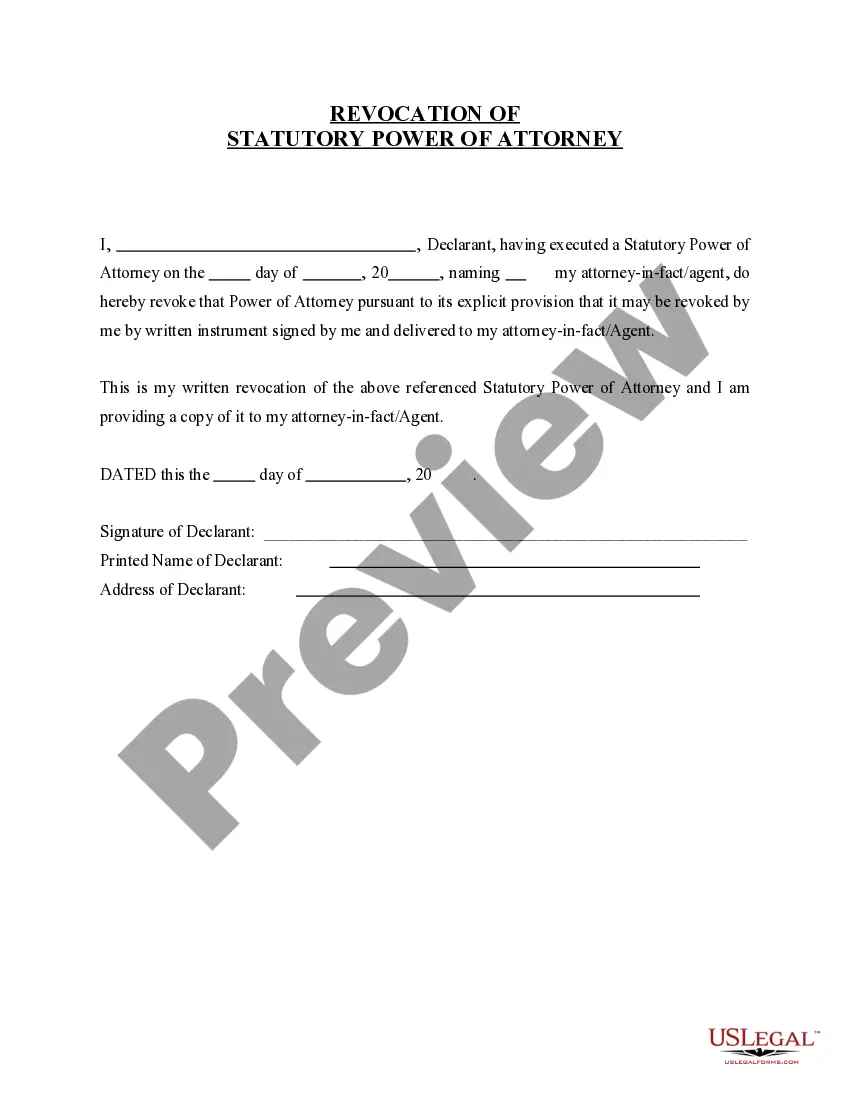

How to fill out Oregon Accounts Receivable Monthly Customer Statement?

It is possible to commit hrs on the Internet searching for the authorized papers design which fits the state and federal requirements you want. US Legal Forms provides 1000s of authorized kinds which are analyzed by pros. It is simple to down load or print the Oregon Accounts Receivable Monthly Customer Statement from my support.

If you currently have a US Legal Forms accounts, it is possible to log in and then click the Acquire option. After that, it is possible to complete, revise, print, or indicator the Oregon Accounts Receivable Monthly Customer Statement. Each authorized papers design you purchase is the one you have eternally. To have one more backup of any purchased kind, visit the My Forms tab and then click the related option.

If you work with the US Legal Forms website for the first time, stick to the simple recommendations under:

- Initially, make certain you have chosen the proper papers design for your area/metropolis of your liking. Browse the kind description to make sure you have picked out the correct kind. If offered, take advantage of the Preview option to look with the papers design at the same time.

- If you would like get one more variation of the kind, take advantage of the Lookup field to find the design that meets your needs and requirements.

- After you have found the design you want, simply click Get now to proceed.

- Find the rates strategy you want, type in your qualifications, and register for a free account on US Legal Forms.

- Complete the deal. You may use your charge card or PayPal accounts to purchase the authorized kind.

- Find the formatting of the papers and down load it to your system.

- Make adjustments to your papers if required. It is possible to complete, revise and indicator and print Oregon Accounts Receivable Monthly Customer Statement.

Acquire and print 1000s of papers templates while using US Legal Forms Internet site, which offers the biggest selection of authorized kinds. Use expert and status-particular templates to tackle your company or person requirements.

Form popularity

FAQ

For accounting purposes, a payee records a note receivable as an asset on its balance sheet and the related interest income on its income statement. The portion of the note receivable due to be repaid within one year is classified as a current asset and the balance as a long-term asset.

When the company makes a sale, accountants report the asset, in this case, accounts receivable, on the balance sheet. They also list the revenue on the income statement, but not as accounts receivable.

How To Keep Track Of Accounts Payable in 9 Steps Set up a system for recording invoices. Implement approval workflow. Monitor invoice data capturing. Regularly review accounts payable. Match invoices and purchase orders. Pay invoices on time. Track payments. Periodically run reports.

Accounts receivable are listed on the balance sheet as a current asset. Any amount of money owed by customers for purchases made on credit is AR.

Accounts receivable appears under the first section of a cash flow statement, typically referred to as ?cash from operations,? under ?changes in current assets and liabilities.?

AR reports provide visibility into the status of customer payments against current invoices. They're used for managing customer relationships and cash flow, as well as evaluating the efficiency of a business's invoicing and credit control processes.

The total value of all accounts receivable is listed on the balance sheet as current assets and include invoices that clients owe for items or work performed for them on credit.

Ing to US GAAP, the company's accounts receivable balance must be stated at ?net realizable value?. In basic terms, this just means that the accounts receivable balance presented in the company's financial statements must be equal to the amount of cash they expect to collect from customers.