Title: Understanding the Oregon Acknowledgment by Charitable or Educational Institution of Receipt of Gift Introduction: The state of Oregon has specific laws and regulations in place to ensure transparency when it comes to charitable or educational institutions acknowledging the receipt of gifts. This article aims to provide a detailed description of the Oregon Acknowledgment by Charitable or Educational Institution of Receipt of Gift, explaining its purpose, requirements, and potential variations. Key Keywords: Oregon, Acknowledgment, Charitable, Educational Institution, Receipt of Gift 1. Purpose of the Oregon Acknowledgment by Charitable or Educational Institution of Receipt of Gift: The Oregon Acknowledgment serves as an official confirmation by charitable or educational institutions that they have received a gift from a donor. This acknowledgment plays a crucial role in maintaining transparency, substantiating tax deductions, and ensuring compliance with state laws. 2. Basic Requirements for Oregon Acknowledgments: a) Identification: The acknowledgment should clearly identify the institution, including its legal name, address, and tax identification number. b) Donor Information: It is essential to include the donor's name, address, and contribution amount or description. c) Description of Gift: The acknowledgment must provide a detailed description of the gift received, such as cash, securities, real estate, or other valuable assets. d) Statement of No Goods or Services: If no goods or services were provided in exchange for the gift, the acknowledgment should explicitly state it. e) Date of Receipt: The acknowledgment must include the date when the institution received the gift. 3. Types of Oregon Acknowledgment by Charitable or Educational Institution of Receipt of Gift: a) Cash Donations: Acknowledgments for cash donations typically include details of the contribution amount, payment method, and the date of receipt. b) In-Kind Contributions: Acknowledgments for non-cash gifts, such as equipment, supplies, or services, should describe the specific contribution and its fair market value at the time of transfer. c) Stock and Securities Donations: If the institution receives stocks or securities, the acknowledgment should provide the donor's name, the specific security transferred, its date of transfer, and its fair market value on the date of receipt. d) Real Estate Donations: In cases of real estate gifts, the acknowledgment must include a description of the property and a statement confirming whether the institution intends to use or sell the property. e) Planned Giving or Bequests: Special considerations apply when donors include charitable bequests in wills or choose to make planned gifts. Acknowledgments for these types of gifts should contain specific language confirming the institution's understanding of the nature of the gift. Conclusion: The Oregon Acknowledgment by Charitable or Educational Institution of Receipt of Gift plays a vital role in ensuring transparency and compliance within the nonprofit sector. By providing clear and accurate acknowledgments, institutions contribute to the trust and confidence of donors, while also meeting legal obligations. Understanding the requirements and different types of acknowledgments enables both donors and institutions to navigate the process effectively.

Oregon Acknowledgment by Charitable or Educational Institution of Receipt of Gift

Description

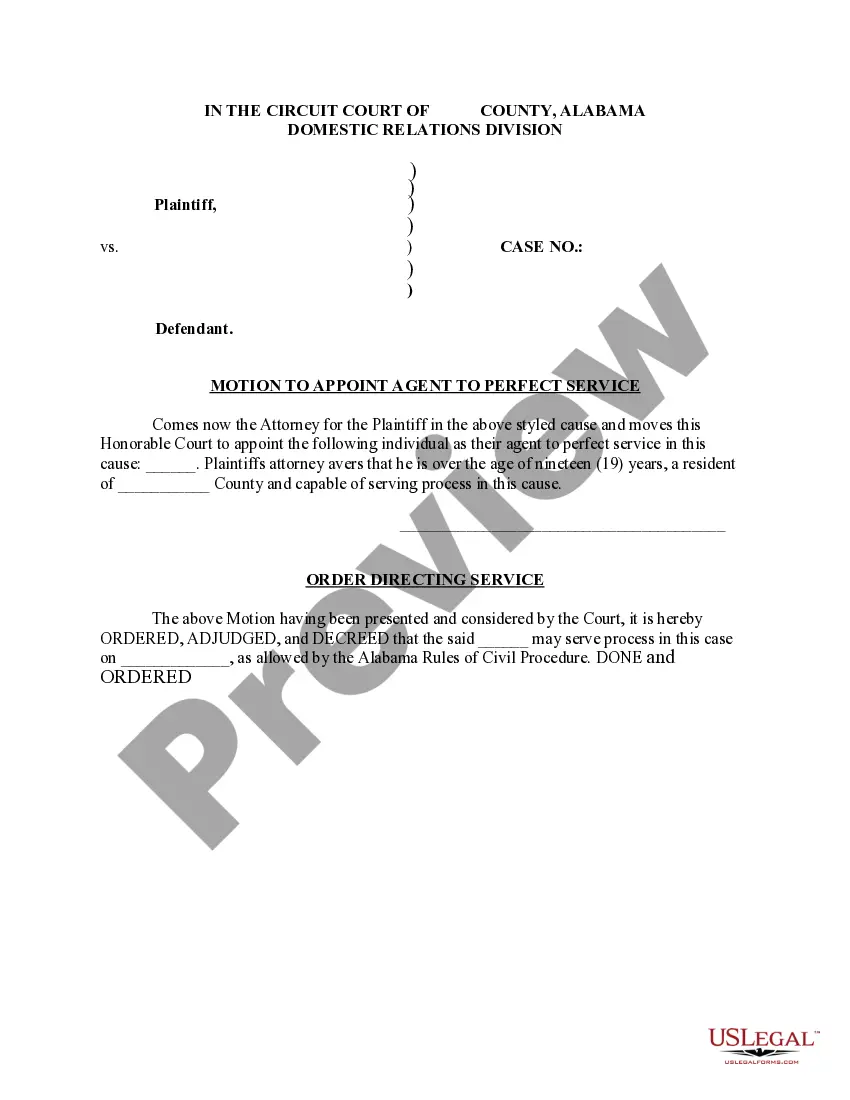

How to fill out Oregon Acknowledgment By Charitable Or Educational Institution Of Receipt Of Gift?

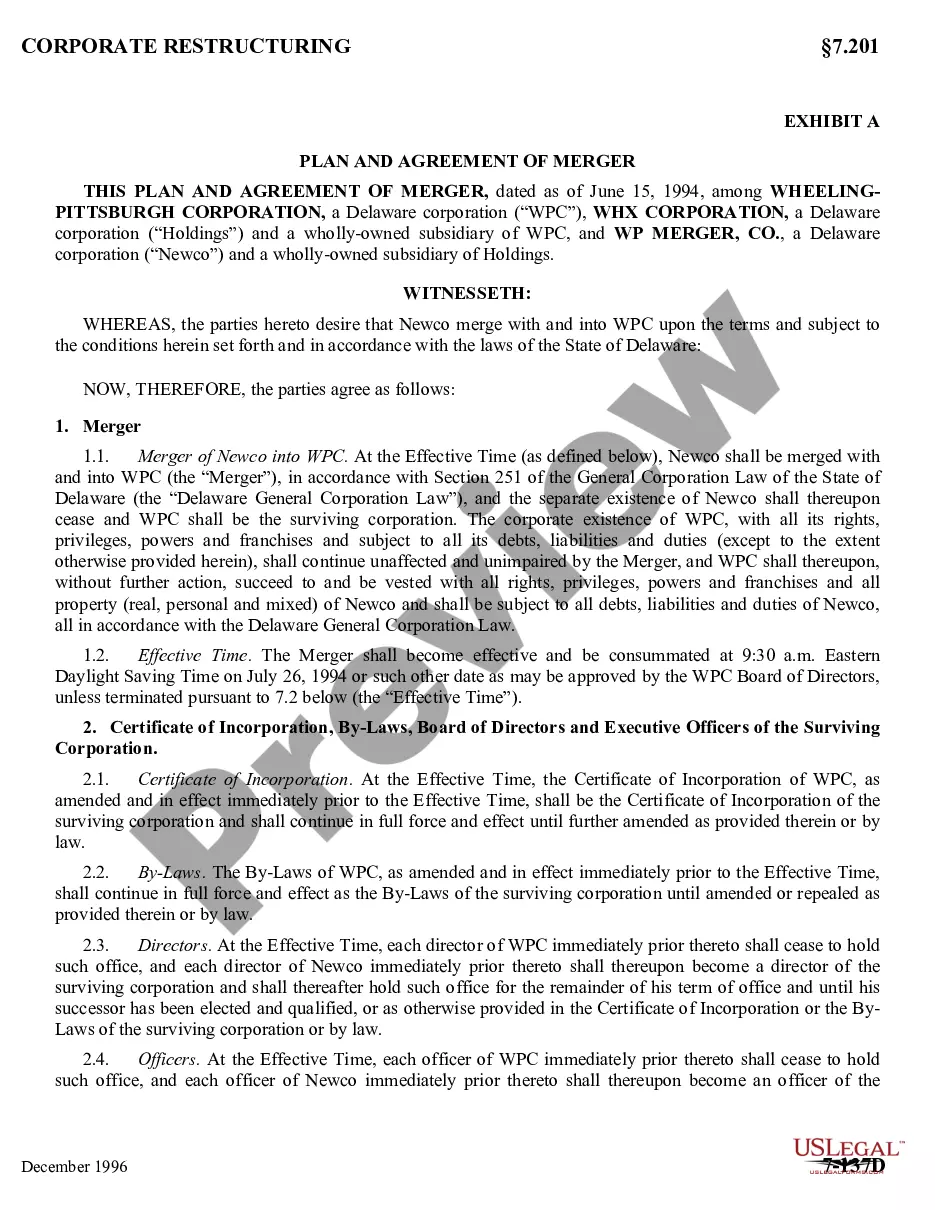

US Legal Forms - one of the most significant libraries of legal forms in the United States - offers an array of legal papers layouts you are able to acquire or produce. Utilizing the website, you can find thousands of forms for organization and specific functions, categorized by groups, claims, or key phrases.You can get the latest variations of forms much like the Oregon Acknowledgment by Charitable or Educational Institution of Receipt of Gift within minutes.

If you already possess a registration, log in and acquire Oregon Acknowledgment by Charitable or Educational Institution of Receipt of Gift in the US Legal Forms local library. The Download key will show up on each type you see. You have accessibility to all earlier delivered electronically forms from the My Forms tab of your respective account.

If you wish to use US Legal Forms the very first time, here are straightforward directions to obtain started:

- Make sure you have selected the right type for your personal metropolis/county. Go through the Review key to review the form`s information. Read the type description to actually have chosen the right type.

- In the event the type doesn`t match your specifications, utilize the Research discipline at the top of the display to obtain the one that does.

- If you are satisfied with the form, verify your selection by simply clicking the Get now key. Then, opt for the costs program you favor and supply your accreditations to sign up on an account.

- Approach the purchase. Make use of charge card or PayPal account to perform the purchase.

- Choose the structure and acquire the form in your device.

- Make changes. Fill up, edit and produce and signal the delivered electronically Oregon Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

Every single template you put into your bank account does not have an expiry day and is the one you have permanently. So, if you want to acquire or produce another backup, just visit the My Forms segment and click on around the type you want.

Obtain access to the Oregon Acknowledgment by Charitable or Educational Institution of Receipt of Gift with US Legal Forms, probably the most substantial local library of legal papers layouts. Use thousands of professional and status-distinct layouts that fulfill your organization or specific requirements and specifications.

Form popularity

FAQ

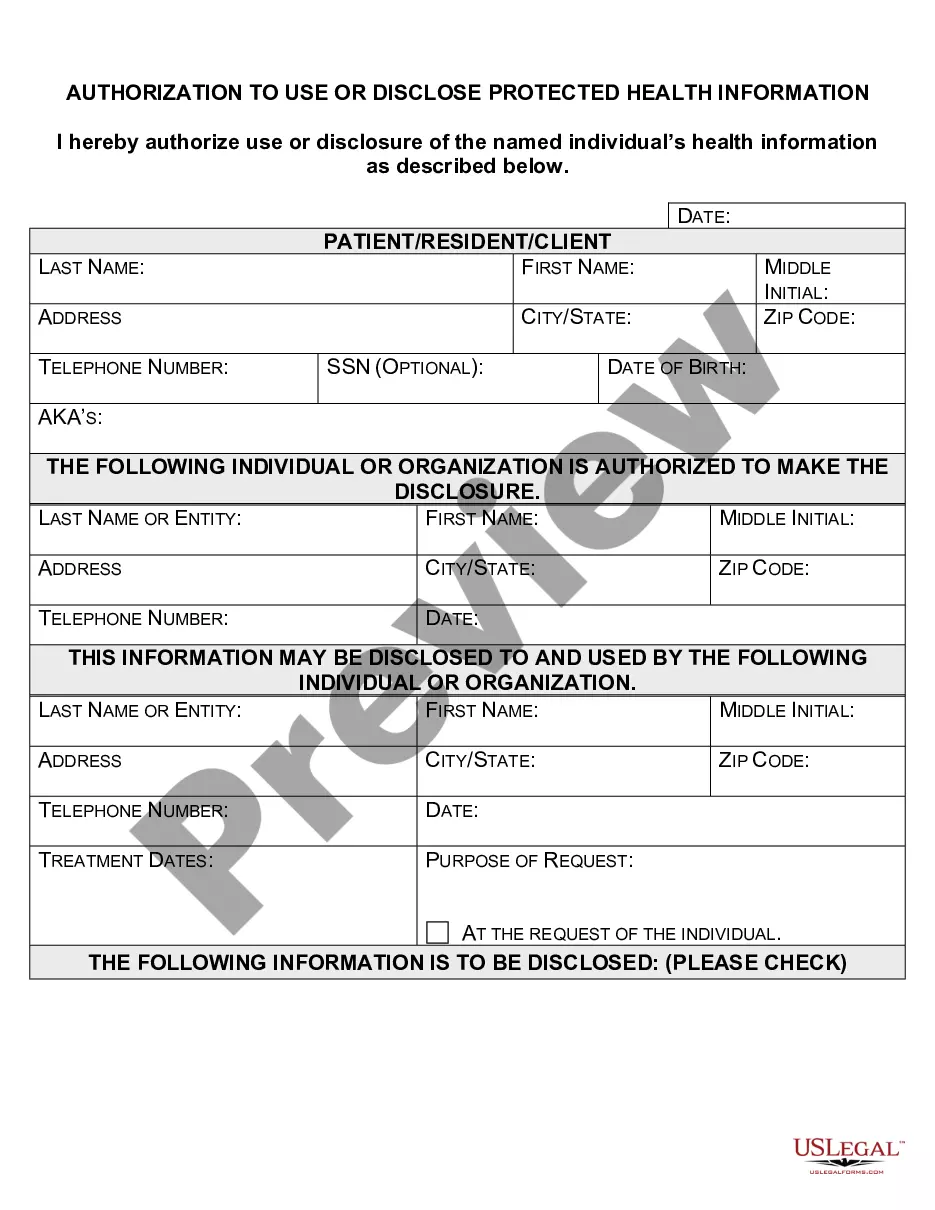

Here are the basic steps to create an acknowledgment receipt: Use a company letterhead. ... Give the receipt a title. ... Write the statement of acknowledgment. ... Create a place for signatures and the date of the transaction. ... Explain any next steps. ... Provide contact information for further questions. ... Be specific and detailed. ... Be formal.

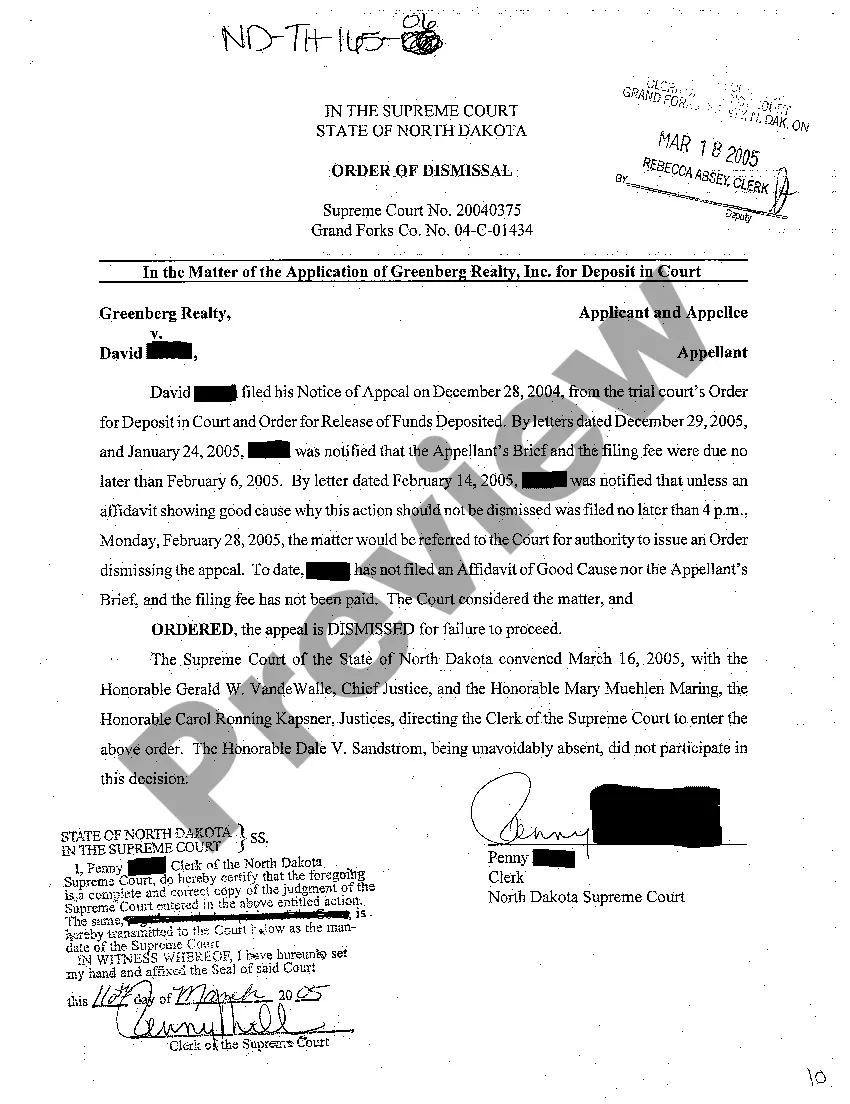

Generally speaking, a receipt is issued for tax reporting purposes of charitable giving and the donor acknowledgement is a thank you letter.

To be contemporaneous the written acknowledgment must generally be obtained by the donor no later than the date the donor files the return for the year the contribution is made. The written acknowledgment must state whether the donee provides any goods or services in consideration for the contribution.

A donation acknowledgment letter is a type of donor letter that you send to donors to document their charitable gifts and donations. Sometimes your donation receipt functions as a donor acknowledgement. However, that's not always the case. All donors deserve to be thanked, no matter the size of their gift.

A donation acknowledgment letter (sometimes called a donation receipt or thank-you letter) is an email or paper that recognizes a charitable contribution. At a bare minimum, it's a confirmation receipt to your donors acknowledging you've received their donation.

Is an acknowledgment receipt a legally-binding document? Acknowledgment receipts are not legally binding. However, they can still serve as evidence for employment-related disputes.

Here are basic donation receipt requirements in the U.S.: Name of the organization that received the donation. A statement that the nonprofit is a public charity recognized as tax-exempt by the IRS under Section 501(c)(3) Name of the donor. The date of the donation. Amount of cash contribution.

Dear [DONOR NAME], Thank you for your generous donation to [ORGANIZATION NAME], a tax-exempt organization under Section 501(c)(3) of the Internal Revenue Code ([EIN #]). On [DATE], you made a contribution of [AMOUNT] in support of our mission. This gift was processed as credit card transaction.