Oregon Direct Deposit Form for Unemployment

Description

How to fill out Direct Deposit Form For Unemployment?

US Legal Forms - one of the largest collections of authentic documents in the United States - provides a variety of legal document templates that you can download or print.

By using the website, you will find thousands of templates for commercial and personal purposes, organized by categories, states, or keywords. You can access the latest editions of templates like the Oregon Direct Deposit Form for Unemployment within moments.

If you already have a monthly membership, Log In and retrieve the Oregon Direct Deposit Form for Unemployment from the US Legal Forms library. The Download button will be visible on each template you view. You can access all previously saved templates in the My documents section of your account.

Proceed with the purchase. Use a Visa or Mastercard or a PayPal account to complete the transaction.

Choose the format and download the document to your device. Edit it as needed. Fill out, modify, print, and sign the saved Oregon Direct Deposit Form for Unemployment.

Each template you added to your account has no expiration date and is yours permanently. So, if you wish to download or print another copy, simply navigate to the My documents section and click on the template you need.

Access the Oregon Direct Deposit Form for Unemployment with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct template for your city/state.

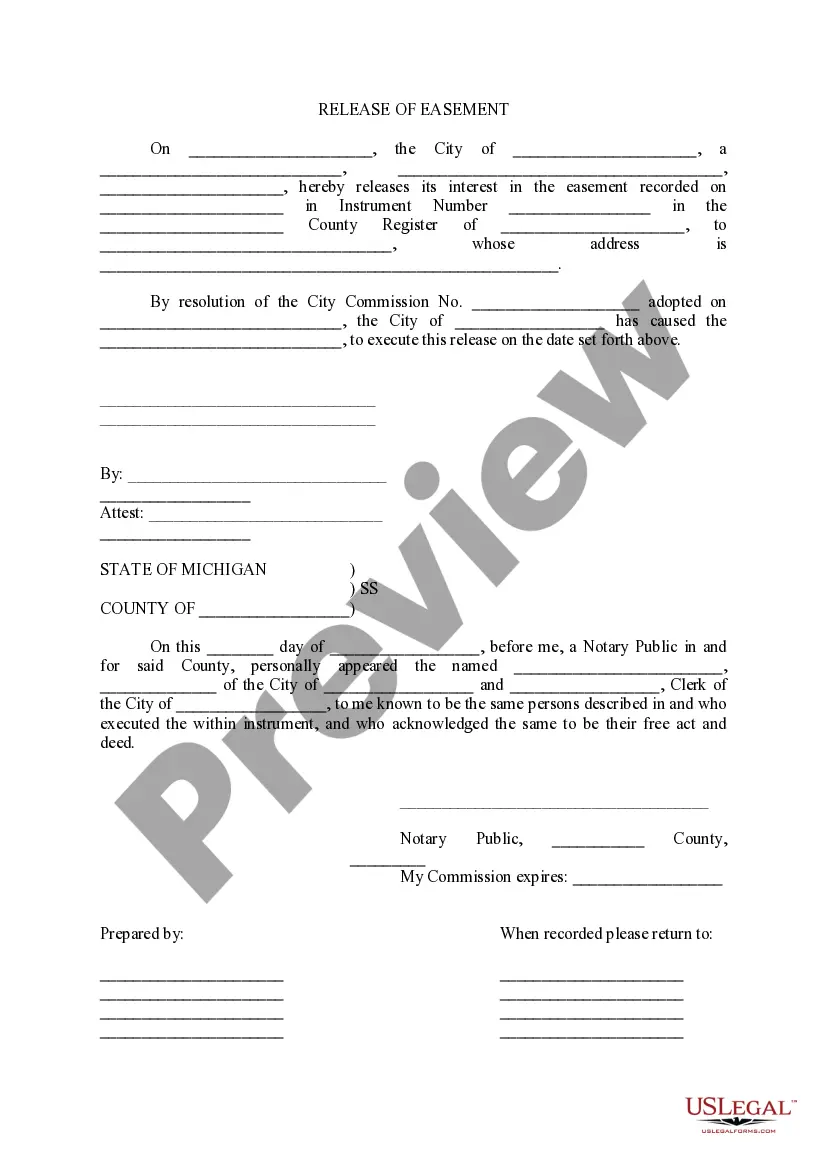

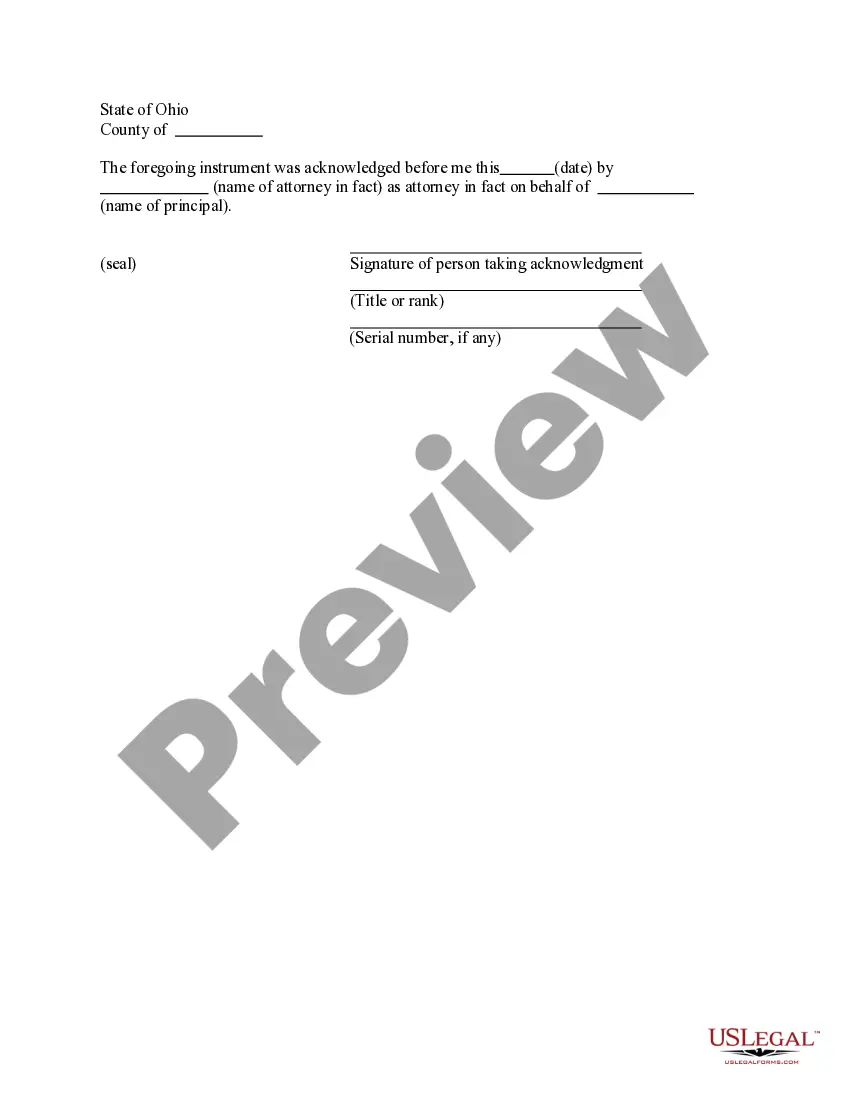

- Click the Preview button to review the template’s details.

- Check the document details to confirm that you’ve chosen the right template.

- If the template does not meet your requirements, use the Search field at the top of the page to find one that does.

- If you are satisfied with the document, confirm your choice by clicking the Get now button.

- Then, select the pricing plan you prefer and enter your credentials to sign up for an account.

Form popularity

FAQ

You can update your payments from debit card to direct deposit when you certify weekly through your NY.GOV account. Note: You will be unable to apply for or change to direct deposit through our IVR phone system.

For security reasons, you cannot enroll in or change direct deposit information over the telephone. You must log in with your NY.gov ID and click on Unemployment Benefits to cancel or change your direct deposit information.

Payments are deposited 2 business days after your weekly claim is processed. If you use Electronic Deposit and your bank account changes, be sure to give us the new account information by submitting another Electronic Deposit application.

The process required to change direct deposit can be cumbersome. They would need to contact your HR department and fill out a form with the credentials of their new institution, authorizing the new bank to receive the direct deposit. This process can take two-to-four weeks, or one-to-two pay cycles.

Form 132 is filed with Form OQ on a quarterly basis. Oregon Combined Quarterly Report- Form OQUse this form to determine how much tax is due each quarter for state unemployment insurance, withholding, Tri-Met & Lane Transit excise taxes, and the Workers' Benefit Fund.

Most can be done fairly quickly. After you receive and activate your card, contact Bank of America either online or by phone, 1-866-692-9374 (voice), or TTY 1-866-656-5913, to set up your direct deposit transfer.

Payments are deposited 2 business days after your weekly claim is processed. If you use Electronic Deposit and your bank account changes, be sure to give us the new account information by submitting another Electronic Deposit application.

To do so, sign in to your account and selecting the Update Direct Deposit option from the dashboard. If you requested direct deposit when you filed your new claim online, you do not need to sign up again unless you need to change your bank account information.

Direct depositUse the Online Claim System and select electronic deposit," or.Print the Authorization for Electronic Deposit Form and send it to us. Note: Due to our current workload, mailing or faxing these forms to us will delay your direct deposit.