The Oregon Direct Deposit Form for IRS is a document provided by the state of Oregon to facilitate the electronic transfer of funds from the Internal Revenue Service (IRS) to taxpayers' bank accounts. This form is specifically designed to streamline the process of receiving tax refunds or other payments directly into the taxpayer's chosen bank account, eliminating the need for physical checks or manual processing. By submitting the Oregon Direct Deposit Form for IRS, taxpayers authorize the state of Oregon to deposit any eligible tax refunds or other payments directly into their bank accounts, ensuring a fast and secure transaction. This form requires taxpayers to provide their personal information, including their full name, social security number, and contact details. Additionally, taxpayers must furnish their banking information, including the bank name, routing number, and account number. The Oregon Direct Deposit Form for IRS is a crucial tool for taxpayers who prefer the convenience and efficiency of electronic fund transfers. It offers a convenient and secure way to receive tax refunds or other payments promptly, eliminating the risk of lost or stolen checks. Moreover, direct deposit allows taxpayers to access their funds immediately upon receipt, rather than waiting for a physical check to arrive in the mail and then having to manually deposit it. It's worth noting that there are no different types of Oregon Direct Deposit Forms specifically for the IRS. The form mentioned above is the standard and only form provided by the state of Oregon for taxpayers to authorize direct deposits from the IRS.

Oregon Direct Deposit Form for IRS

Description

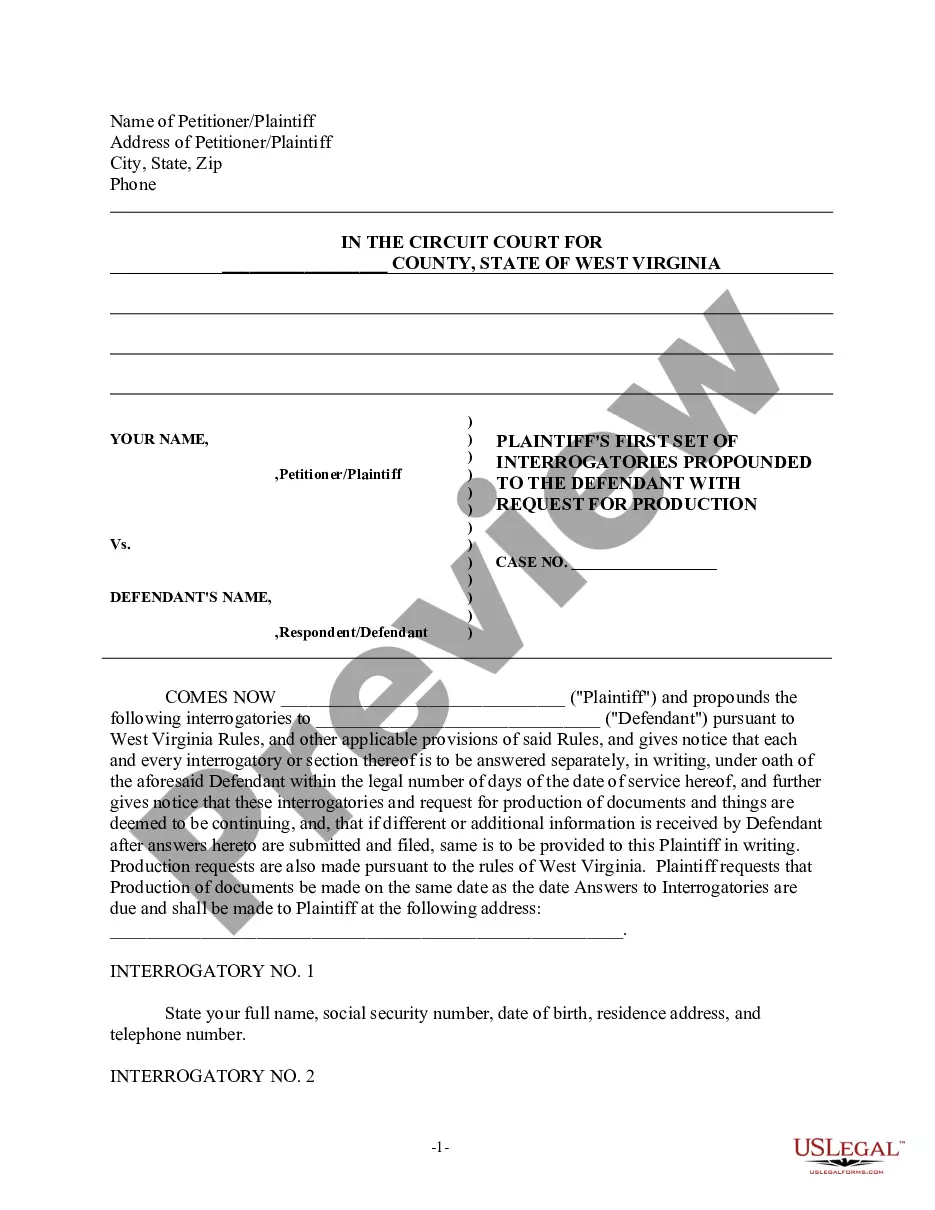

How to fill out Oregon Direct Deposit Form For IRS?

US Legal Forms - one of the most notable collections of legal documents in the United States - provides an extensive selection of legal document templates that you can download or print.

By using the site, you will find thousands of forms for both business and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of forms such as the Oregon Direct Deposit Form for IRS in just a few minutes.

Read the form description to ensure you have chosen the appropriate form.

If the form does not suit your requirements, utilize the Search box at the top of the page to find one that matches.

- If you already hold a subscription, Log In to acquire the Oregon Direct Deposit Form for IRS from the US Legal Forms collection.

- The Download button will be visible on every document you encounter.

- You can view all previously downloaded forms in the My documents section of your profile.

- If you're new to US Legal Forms, here are simple steps to help you begin.

- Make sure you have selected the correct form for your region/location.

- Click the Preview button to review the details of the form.

Form popularity

FAQ

Get the current filing year's forms, instructions, and publications for free from the Internal Revenue Service (IRS).Download them from IRS.gov.Order by phone at 1-800-TAX-FORM (1-800-829-3676)

You can use your tax software to do it electronically. Or, use IRS' Form 8888, Allocation of Refund PDF (including Savings Bond Purchases) if you file a paper return. Just follow the instructions on the form. If you want IRS to deposit your refund into just one account, use the direct deposit line on your tax form.

It's possible to change or update your direct deposit information with the IRS for your tax refund; it's just a matter of if your return has been completely filed already. If you haven't filed your return, or if the IRS rejected your return, you can contact the IRS directly to update your bank account information.

Direct deposit is easy to use. Just select it as your refund method through your tax software and type in the account number and routing number. Or, tell your tax preparer you want direct deposit. You can even use direct deposit if you are one of the few people still filing by paper.

IRS Website Now Has Tools to Add or Change Direct Deposit Information, Track Coronavirus Stimulus Payments. Taxpayers who did not have direct deposit information on record with the IRS can now enter or change that info on the IRS website Get My Payment tool.

To order by phone, call 800-908-9946 and follow the prompts in the recorded message. To request a 1040, 1040A or 1040EZ tax return transcript through the mail, complete IRS Form 4506T-EZ, Short Form Request for Individual Tax Return Transcript.

Download forms from the Oregon Department of Revenue website FormsDownload forms from the IRS website forms online or by calling 1-800-829-3676.Contact your local IRS office.

Forms OR-40, OR-40-P and OR-40-N can be found at or you can contact us to order it. Nonresidents stationed in Oregon.

Next, if they choose, they can change the bank account receiving the payment starting with the August 13 payment. They can do that by updating the routing number and account number and indicating whether it is a savings or checking account.

If you want to change your bank account or routing number for a tax refund, call the IRS at 800-829-1040....If you haven't yet filed your return, or if the IRS rejected your return:Go to the File section of the H&R Block Online product.Choose how you want to file.Choose Direct Deposit.

Interesting Questions

More info

On Social Networks You are to submit the following documents You will be emailed within minutes when your form approval is approved or denied.