The Oregon Deferred Compensation Agreement — Long Form refers to a contractual arrangement made between an employee and the state of Oregon for the purpose of deferring a portion of the employee's income. This voluntary agreement allows employees to save and invest a portion of their salary for retirement while enjoying potential tax advantages. The Oregon Deferred Compensation Agreement — Long Form typically contains detailed information regarding the deferral amount, payment frequency, vesting schedule, investment options, and distribution rules. By deferring a portion of their income, employees have the opportunity to accumulate additional savings, potentially increasing their retirement income. The agreement offers several investment options to employees, allowing them to choose the best investment strategy based on their risk tolerance and financial goals. These investment options may include various mutual funds, index funds, target-date funds, and fixed-income options, among others. Additionally, the Oregon Deferred Compensation Agreement — Long Form may outline the vesting schedule, which determines when employees become fully entitled to their deferred compensation. This schedule often incentivizes employees to stay with their employer for a certain period of time to earn the full benefits of their deferred compensation plan. The agreement may also provide details about the distribution rules, including when and how employees can access their deferred compensation. Typically, employees may withdraw funds upon retirement, separation from service, or specific qualifying events, subject to certain tax implications. It's important to note that there may be different types or variations of the Oregon Deferred Compensation Agreement — Long Form, tailored to specific employee groups or positions. For example, there may be specialized agreements for public safety employees, educators, or other specific professions. These specialized agreements may have additional provisions or benefits specific to those employee groups. Overall, the Oregon Deferred Compensation Agreement — Long Form offers a valuable opportunity for employees to supplement their retirement savings while providing flexibility and control over investment options. It serves as a crucial retirement planning tool for employees of the state of Oregon, helping them secure a financially stable future.

Oregon Deferred Compensation Agreement - Long Form

Description

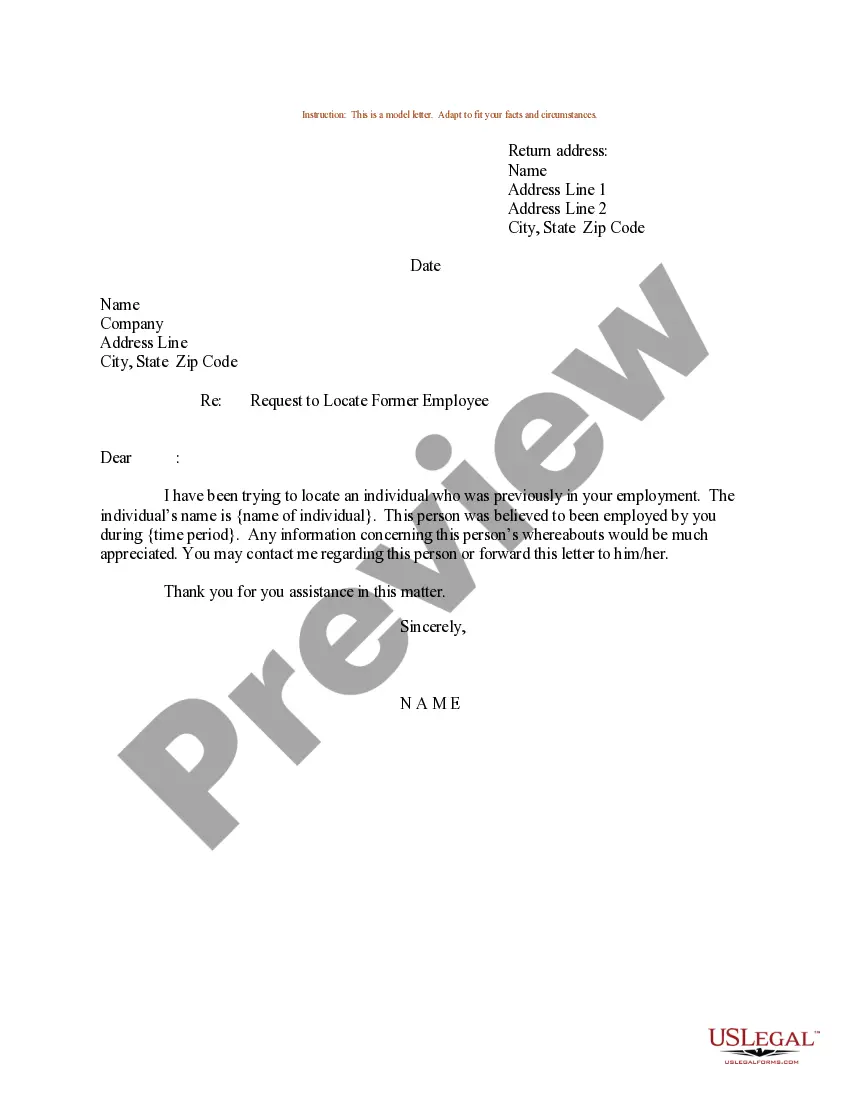

How to fill out Deferred Compensation Agreement - Long Form?

If you require extensive, acquire, or print out legal document templates, use US Legal Forms, the most extensive collection of legal forms available online. Leverage the site's user-friendly and practical search to obtain the documents you need.

A range of templates for business and personal purposes are categorized by type and state, or keywords and phrases. Use US Legal Forms to obtain the Oregon Deferred Compensation Agreement - Long Form with just a few clicks of your mouse.

If you are already a US Legal Forms user, sign in to your account and click the Download option to locate the Oregon Deferred Compensation Agreement - Long Form. You can also access templates you previously downloaded from the My documents section of your account.

Every legal document template you purchase is yours indefinitely. You have access to every form you've downloaded within your account. Navigate to the My documents section and select a form to print or download again.

Stay competitive and download, and print the Oregon Deferred Compensation Agreement - Long Form with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Step 1. Ensure you have selected the form for your appropriate city/state.

- Step 2. Utilize the Preview option to review the form’s content. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you desire, click on the Buy now option. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Process the payment. You may use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print out or sign the Oregon Deferred Compensation Agreement - Long Form.

Form popularity

More info

The minimum investment is 5. Select a Category to view each strategy. The following investment strategy will provide the maximum return potential with the lowest risk. The minimum investment is 5. Select a Category to view each strategy. See detailed returns for each strategy. Agency fees are also paid by certain IRA custodians or by the plan to other Plan providers.