An Oregon Buy Sell Agreement Between Shareholders and a Corporation is a legal contract that outlines the terms and conditions for the sale of shares or ownership interests in a corporation. It is applicable in the state of Oregon and is specifically designed to govern the rights and obligations of shareholders when it comes to transferring shares of stock within a corporation. The purpose of such an agreement is to establish a clear process for buying and selling shares, ensuring a smooth transition of ownership and protecting the interests of all parties involved. By having a well-defined Buy Sell Agreement in place, potential disputes regarding share transfers can be avoided, ultimately safeguarding the stability and continuity of the corporation. The key elements typically included in an Oregon Buy Sell Agreement Between Shareholders and a Corporation are as follows: 1. Identification of Parties: The agreement identifies the shareholders involved in the transaction and provides details about the corporation, such as its name, address, and legal structure. 2. Purchase Methods: This section outlines the methods by which shares can be bought or sold, such as through a right of first refusal, put/call options, or a combination of both. It specifies the terms and conditions that must be met for a valid share transfer. 3. Purchase Price: The agreement establishes the formula or mechanism by which the purchase price of shares will be determined. This can include factors like fair market value, book value, or a predetermined formula agreed upon by the shareholders. 4. Payment Terms: This section describes how the purchasing shareholder will pay for the shares, whether through cash, installment payments, or the conversion of debt. 5. Restrictions on Transfer: The agreement may include restrictions on the transfer of shares to outside parties to maintain control and stability within the corporation. It may also outline any approval processes or limitations on transferability. 6. Right of First Refusal: A right of first refusal gives existing shareholders the opportunity to purchase shares before they can be sold to an outside party. The agreement specifies the process and timeline for exercising this right. 7. Buyout Triggers: Certain events, such as the death, disability, retirement, or resignation of a shareholder, can trigger a buyout of their shares. The agreement establishes the terms and conditions under which these buyouts will occur. 8. Dispute Resolution: In case of disputes arising from the implementation or interpretation of the agreement, this section outlines the methods through which conflicts will be resolved, such as mediation or arbitration. It is important to note that there may be variations or different types of Buy Sell Agreements in Oregon, based on specific circumstances or the nature of the corporation. For example, a Cross-Purchase Agreement involves shareholders purchasing shares directly from each other, whereas a Stock Redemption Agreement allows the corporation itself to buy back shares. The agreement can also be structured as a shotgun agreement, where shareholders can trigger a sale based on pre-determined terms. Each type of agreement serves a different purpose and is tailored to the needs of the shareholders and the corporation. It is recommended to consult with legal professionals specializing in corporate law to draft an Oregon Buy Sell Agreement that meets the specific requirements and objectives of the parties involved.

Oregon Buy Sell Agreement Between Shareholders and a Corporation

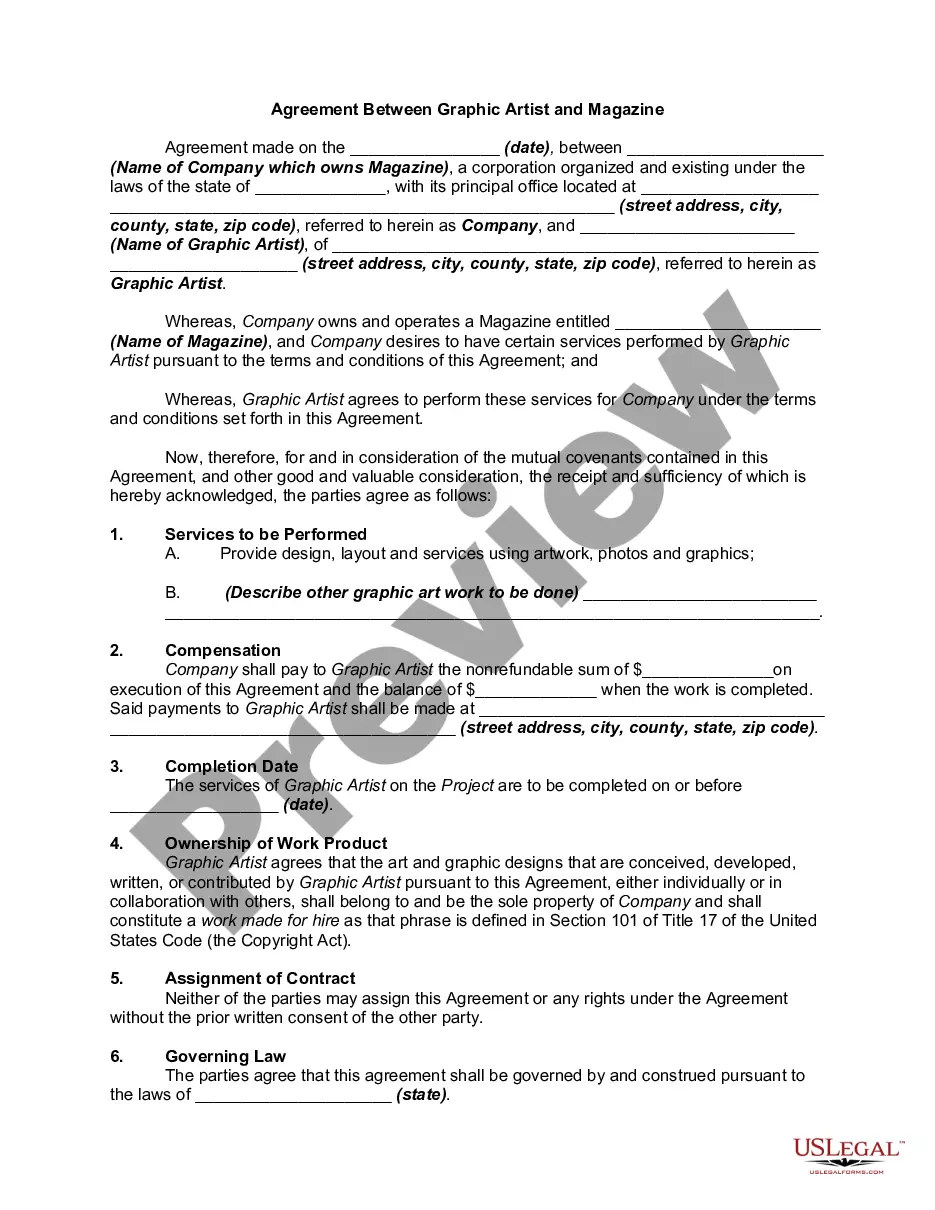

Description

How to fill out Oregon Buy Sell Agreement Between Shareholders And A Corporation?

US Legal Forms - one of the greatest libraries of authorized forms in America - delivers an array of authorized document layouts you may down load or print. While using site, you can find thousands of forms for enterprise and personal purposes, sorted by categories, suggests, or search phrases.You can get the newest variations of forms just like the Oregon Buy Sell Agreement Between Shareholders and a Corporation in seconds.

If you already have a registration, log in and down load Oregon Buy Sell Agreement Between Shareholders and a Corporation through the US Legal Forms collection. The Download option can look on each and every develop you see. You gain access to all in the past saved forms inside the My Forms tab of the profile.

If you want to use US Legal Forms for the first time, listed here are straightforward directions to get you started:

- Be sure you have selected the right develop to your area/state. Click on the Review option to examine the form`s content material. Browse the develop description to ensure that you have chosen the proper develop.

- In case the develop doesn`t suit your needs, use the Look for area at the top of the monitor to discover the one which does.

- If you are satisfied with the shape, affirm your selection by simply clicking the Buy now option. Then, choose the prices program you want and supply your references to sign up to have an profile.

- Procedure the purchase. Use your bank card or PayPal profile to complete the purchase.

- Pick the format and down load the shape on your own device.

- Make modifications. Load, change and print and indicator the saved Oregon Buy Sell Agreement Between Shareholders and a Corporation.

Every web template you included in your money does not have an expiration date and is also your own for a long time. So, in order to down load or print yet another version, just visit the My Forms section and click on about the develop you will need.

Get access to the Oregon Buy Sell Agreement Between Shareholders and a Corporation with US Legal Forms, the most comprehensive collection of authorized document layouts. Use thousands of specialist and express-certain layouts that satisfy your company or personal requirements and needs.