Oregon Sample Letter for Settlement Itemization

Description

How to fill out Sample Letter For Settlement Itemization?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal form templates you can acquire or create. By using the website, you can access thousands of forms for business and personal use, categorized by types, claims, or keywords.

You can obtain the latest versions of forms such as the Oregon Sample Letter for Settlement Itemization in just a few minutes. If you already possess a monthly subscription, Log In and retrieve the Oregon Sample Letter for Settlement Itemization from the US Legal Forms library. The Obtain button will appear on every form you view.

You can access all previously acquired forms in the My documents section of your account. If you are using US Legal Forms for the first time, here are straightforward steps to assist you in getting started: Ensure you have selected the correct form for your area/county. Click on the Preview button to review the form's content. Check the form description to confirm that you have chosen the right form.

Every template you add to your account has no expiration date and is yours indefinitely. Therefore, to obtain or create another copy, simply navigate to the My documents section and click on the form you need.

Access the Oregon Sample Letter for Settlement Itemization with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal needs and requirements.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, select your preferred payment plan and provide your credentials to register for the account.

- Process the transaction. Use your Visa or Mastercard or PayPal account to complete the transaction.

- Choose the format and download the form to your device.

- Make modifications. Complete, edit, print, and sign the downloaded Oregon Sample Letter for Settlement Itemization.

Form popularity

FAQ

Summary: Ultimately, it's better to pay off a debt in full than settle. This will look better on your credit report and help you avoid a lawsuit. If you can't afford to pay off your debt fully, debt settlement is still a good option.

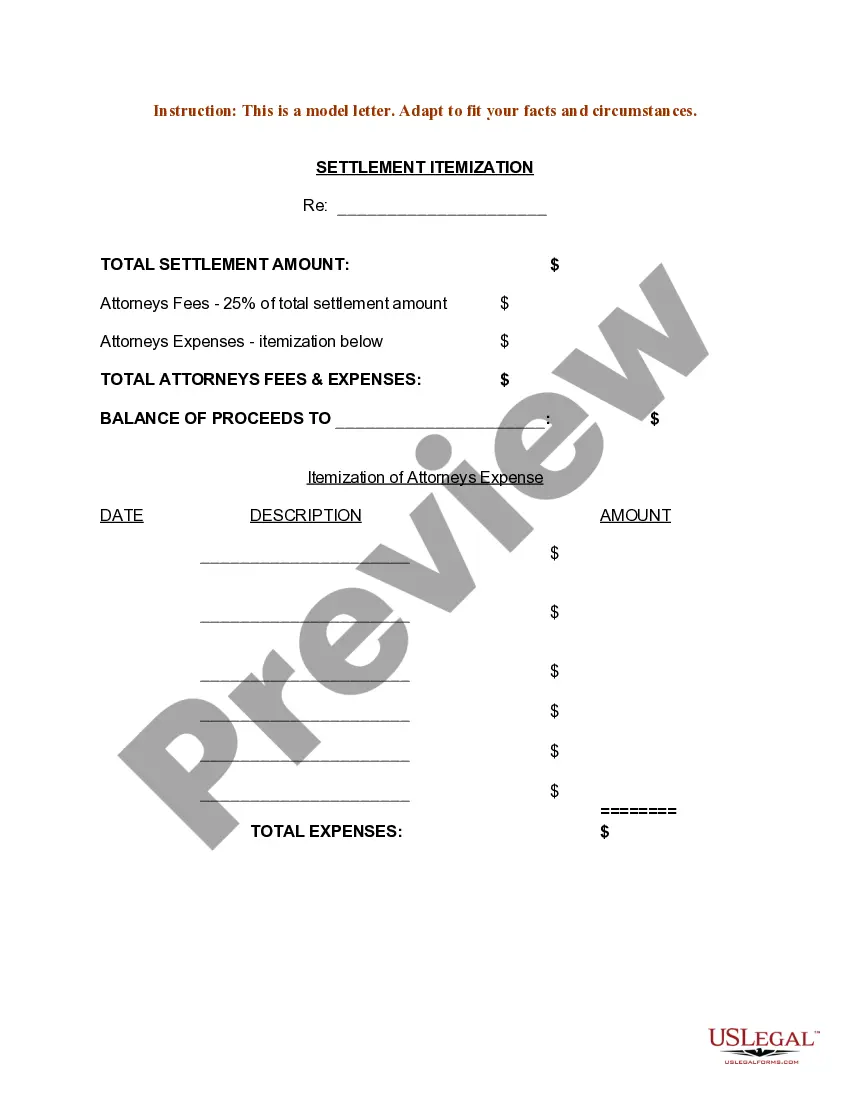

A debt settlement letter is a written proposal for you to offer a specific amount of money in exchange for the forgiveness of your debt. These letters address why you're unable to pay the debt, how much you're willing to pay now, and what you would like from the creditors in return.

Statutory offer of settlement is a monetary offer extended to a plaintiff by a defendant to settle all disputes before trial. Usually the plaintiff has a short period of time depending on the state and case to accept the offer.

A settlement letter is a written offer from a creditor to settle a debt, and serves as legal documentation of this arrangement. A settlement letter is a legally binding agreement on both you and the creditor, and technically replaces your original contract with them.

A Settlement Offer Letter is a communication between two parties in a dispute. The dispute does not have to be in a court of law, although most of the time, it is. One party sends the other party this Settlement Offer Letter, with the proposed terms for a complete settlement between the parties.

This is a formal letter that should include: A summary of the original incident with any factual disputes highlighted. Evidence to support the version of events provided in the Settlement Demand Letter. An outline of any relevant legal standards that apply to the matter. A settlement offer and terms/timeline for acceptance.

A letter of advice to be sent to an employee client, containing commentary on Standard document, Settlement agreement: employment (long form). The letter should be adapted to reflect any specific instructions given by the client.

In its simplest form, the settlement agreement states that for a specific amount of money paid, the lawsuit is dismissed. In a more complex form, this type of document can stipulate: Payment limits and plans. Confidentiality clauses.

I/We understand that the Bank has introduced ?OTS SCHEME? for recovery of outstanding dues, waiving some part of the interest and other charges in the account. I/We request you to consider my case for One Time Settlement and advise me the rebate I shall get if I arrange to pay the balance outstanding in full.

I am writing about the money which you are claiming on the above account. I can confirm that I am unable to pay the money which I owe in full. Include a paragraph explaining your circumstances and details of your financial situation that you want the creditor to take into account.