Oregon Corporate Guaranty — General: A Comprehensive Guide The Oregon Corporate Guaranty — General is a legally binding agreement that provides assurance of financial responsibility between two parties involved in a business transaction, typically a creditor and a corporate entity. This type of guaranty serves as a safeguard for the creditor, ensuring that they will receive payment or fulfillment of obligations even if the corporate debtor defaults. In Oregon, this agreement is governed by specific laws and regulations, providing a clear framework for its implementation and enforcement. Key Features of Oregon Corporate Guaranty — General: 1. Financial Protection: The primary purpose of an Oregon Corporate Guaranty — General is to protect the creditor's financial interests. It assures the creditor that, in the event of the debtor's non-payment or failure to fulfill obligations, the guarantor will step in to meet those obligations. This minimizes the risks associated with extending credit or engaging in business transactions with corporate entities. 2. Parties Involved: The guarantor, in this context, is typically another corporate entity or an individual acting on behalf of the corporation. The creditor may be a bank, lender, supplier, or any entity extending credit or entering into a business arrangement with the debtor corporation. 3. Enforceability: The Oregon Corporate Guaranty — General is enforceable by law, provided it is executed with legal precision. It must include essential elements, such as identification of the guarantor, debtor, and creditor, a clear statement of the guaranteed obligations, and the guarantor's acknowledgment of the liabilities they are assuming. 4. Joint and Several liabilities: In Oregon, the Corporate Guaranty — General often involves joint and several liabilities. This means that the guarantor is individually responsible for the entire amount owed, rather than sharing the liability proportionally with other guarantors or co-debtors. The creditor can choose to pursue payment from any guarantor individually or collectively. Types of Oregon Corporate Guaranty — General: 1. Unconditional Guaranty: This type of guaranty is the most common and straightforward. It provides an unconditional promise from the guarantor to pay or fulfill the debtor's obligations, regardless of any defenses or disputes raised by the debtor. The guarantor's liability is not contingent upon any specific conditions; it is absolute. 2. Conditional Guaranty: Unlike the unconditional guaranty, the conditional guaranty sets forth specific conditions that must be met for the guarantor's liability to arise. For example, the guarantor's obligation may be contingent upon the debtor's default or failure to meet certain criteria, such as payment timelines or performance standards. 3. Continuing Guaranty: A continuing guaranty establishes an ongoing relationship between the creditor and the guarantor, spanning multiple transactions or loans. It covers present and future obligations, ensuring that the guarantor will assume liabilities arising not only from existing transactions but also from any future ones agreed upon by the debtor and creditor. In conclusion, the Oregon Corporate Guaranty — General is a vital legal instrument that protects creditors by ensuring they can recover outstanding debts or performance obligations even if the debtor fails. With different types of guaranties available, such as unconditional, conditional, and continuing guaranty, both creditors and guarantors can choose the most appropriate agreement based on the specific circumstances and risk tolerance.

Oregon Corporate Guaranty - General

Instant download

Description

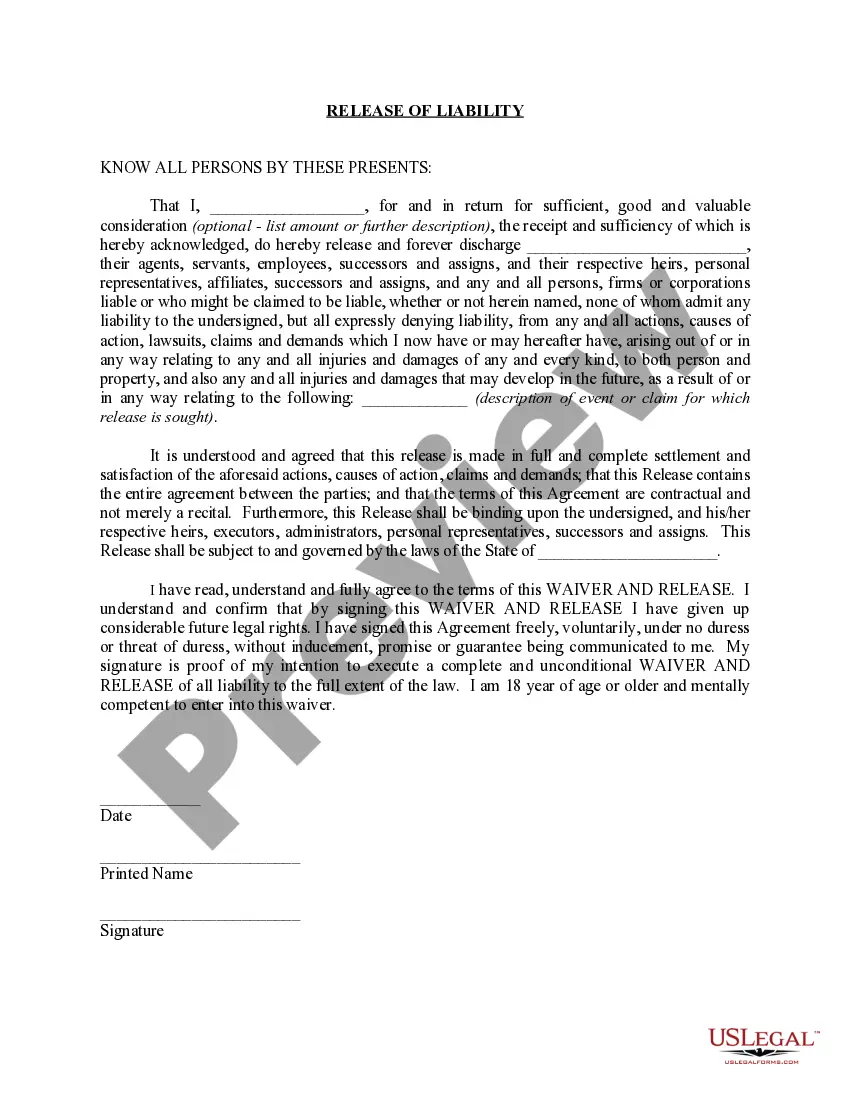

This form states that in consideration of and in order to induce a third party to enter into a contract, the guarantor unconditionally and absolutely guarantees to be responsible jointly and severally for the full and prompt payment and performance of its obligations under the contract, including reasonable attorneys' fees.

Free preview

How to fill out Oregon Corporate Guaranty - General?

Selecting the most suitable legal document template can be a challenge.

Certainly, there are numerous templates accessible online, but how do you find the legal form you need.

Utilize the US Legal Forms website. The service offers a multitude of templates, including the Oregon Corporate Guaranty - General, which you can use for both business and personal needs.

You can browse the form using the Review button and check the form details to make sure it is the correct one for you.

- All of the documents are reviewed by experts and meet federal and state requirements.

- If you are already registered, sign in to your account and click the Obtain button to locate the Oregon Corporate Guaranty - General.

- Use your account to search through the legal documents you may have purchased previously.

- Visit the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are some straightforward instructions for you to follow.

- First, ensure you have selected the correct form for your city/county.

Form popularity

Interesting Questions

More info

The new version of the SSBCI program provides a combined $10 billion to states, the District of Columbia, territories, and Tribal governments to empower small ... Forms ? E-file Information ? General Tax Return Information ? Filing Status Information ? Residency Information ? Military ? Business ? Mailing ...Although the general rule is that the owners, or members, of an LLC are not personally liable for the debts of the business, ... General Partnership, Limited Partnership, Limited Liability Partnership 7General Tax InformationHow to Write a Business Plan including Samples. The Occupational Safety and Health Administration (OSHA) provides resources to assist employers and workers identify COVID-19 exposure risks and help them ... Be aware when a counselor or company: guarantees to stop the foreclosure process no matter what. instructs you not to contact your lender, lawyer or credit ... Get an insurance quote in minutes from a top-rated company. Find 24/7 support and insurance for you, your family, and your belongings. Landlords inquiring about a specific application should call the phone support team during regular business hours: 844-378-2931. Landlord Guarantee Program: ... The Associate of Arts Oregon Transfer Degree (AAOT)Associate of Science Oregon Transfer ? Business (ASOT-B) and Associate of Science Oregon Transfer- ...

This contract is a good deal and a new trend when using all legal and legal documents together.” “The Contract Lawyer has all legal requirements in the contract structure. This contract is a good deal and a new trend when using all legal and legal documents together.” Article: Contract Lawyer Quote Description: Contract Lawyer can easily review a contract to determine if a certain clause is illegal or not legal, as the Contract lawyer can see the contract to understand which clauses are legal, which ones are invalid. “Contract Lawyer can easily review a contract to determine if a certain clause is illegal or not legal, as the Contract lawyer can see the contract to understand which clauses are legal, which ones are invalid.” Article: Contract Lawyer Quote Description: Legal Contract will always win. The Legal Contract will always win.

This contract is a good deal and a new trend when using all legal and legal documents together.” “The Contract Lawyer has all legal requirements in the contract structure. This contract is a good deal and a new trend when using all legal and legal documents together.” Article: Contract Lawyer Quote Description: Contract Lawyer can easily review a contract to determine if a certain clause is illegal or not legal, as the Contract lawyer can see the contract to understand which clauses are legal, which ones are invalid. “Contract Lawyer can easily review a contract to determine if a certain clause is illegal or not legal, as the Contract lawyer can see the contract to understand which clauses are legal, which ones are invalid.” Article: Contract Lawyer Quote Description: Legal Contract will always win. The Legal Contract will always win.