Oregon Revocable Living Trust for Single Person

Description

How to fill out Revocable Living Trust For Single Person?

Are you in a condition where you need documents for potential organizational or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can rely on is challenging.

US Legal Forms offers thousands of form templates, such as the Oregon Revocable Living Trust for a Single Individual, that are crafted to meet state and federal regulations.

Select a convenient format and download your version.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Oregon Revocable Living Trust for a Single Individual anytime if needed. Simply click the desired form to download or print the document template. Use US Legal Forms, the most extensive selection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates for a variety of uses. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- After that, you can download the Oregon Revocable Living Trust for a Single Individual template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the form you need and ensure it is for the correct city/area.

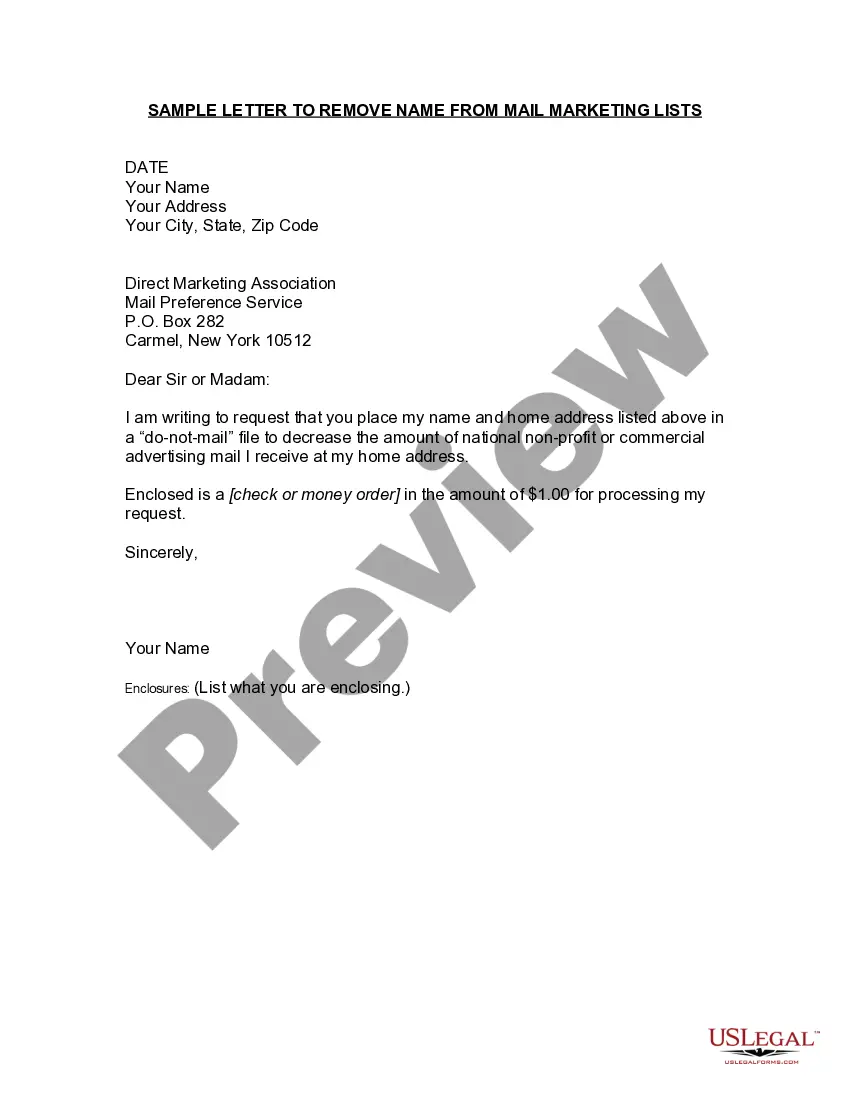

- Utilize the Review button to examine the form.

- Check the description to confirm you have selected the right form.

- If the form is not what you are looking for, make use of the Search field to find the form that suits your needs and requirements.

- When you find the appropriate form, click Get now.

- Choose the pricing plan you want, provide the required information to create your account, and complete the payment using your PayPal or credit card.

Form popularity

FAQ

A single revocable trust is a legal arrangement where an individual, typically a single person, places their assets into a trust that they can modify or revoke at any time. This type of trust, such as an Oregon Revocable Living Trust for a Single Person, allows the grantor to maintain control over their assets while also providing benefits like avoiding probate. It's an effective tool for managing estate planning and offers flexibility to adjust to life changes. Ultimately, this setup facilitates a smoother transition of assets to heirs.

Trust funds can pose certain dangers, particularly if they are not managed or structured correctly. An Oregon Revocable Living Trust for a Single Person requires careful planning to ensure that assets are protected and distributed according to the individual's wishes. Poor management can lead to tax complications or disputes among beneficiaries. It's essential to work with experienced professionals to mitigate these risks and ensure that the trust serves its intended purpose.

One major disadvantage of an Oregon Revocable Living Trust for a Single Person is the initial setup and ongoing maintenance costs. While trusts offer many benefits, they do require legal assistance to create properly, which can lead to higher expenses upfront. Moreover, individuals must continue to manage the trust, which can involve time and effort. However, many find that the advantages outweigh these costs in the long run.

Yes, establishing an Oregon Revocable Living Trust for a Single Person can be a wise choice for your parents. By placing their assets in a trust, they can manage their wealth more effectively and ensure a smoother transfer of assets in the event of illness or death. This mechanism allows them to avoid the complexities and costs associated with probate. Additionally, it provides flexibility, as they can modify the trust as their circumstances change.

Filling out an Oregon Revocable Living Trust for Single Person involves clearly naming the trust and specifying your assets. Begin with personal information, beneficiary details, and instructions for asset distribution. You can streamline this process by utilizing uslegalforms, which offers customizable templates tailored to your needs, ensuring that all necessary legal requirements are met without unnecessary complexity.

You should avoid placing certain types of assets in your Oregon Revocable Living Trust for Single Person, such as retirement accounts or life insurance policies, which often have designated beneficiaries. Additionally, real estate subject to a mortgage can be complicated if placed in a trust without proper financing arrangements. Keeping these assets outside the trust ensures that you maintain flexibility over your estate.

One downside of establishing an Oregon Revocable Living Trust for Single Person is that it may not offer the level of asset protection some individuals desire. Since you retain control over the assets, creditors can still pursue claims against them. Additionally, setting up a trust requires time and effort to ensure proper funding and documentation. It is important to weigh these factors against the benefits of having a trust.

To fill out an Oregon Revocable Living Trust for Single Person, start by gathering essential information about your assets and beneficiaries. You need to designate a trustee, who will manage the trust, and outline how you want your assets distributed upon your passing. Also, include specific provisions for managing your assets during your lifetime. Using an online platform like uslegalforms can simplify this process, providing templates that guide you through each step.

You can indeed set up your own living trust in Oregon. However, making sure it reflects your intentions and adheres to legal standards is crucial. Utilizing resources from US Legal Forms can streamline this process, providing access to templates and legal insights that guide you in creating an effective Oregon Revocable Living Trust for Single Person.

Creating your own trust in Oregon is possible, but it's essential to ensure it meets all legal requirements. An Oregon Revocable Living Trust for Single Person must comply with state laws to be valid. Many individuals find it beneficial to use a platform like US Legal Forms to access templates and guidance, ensuring their trust is correctly established.