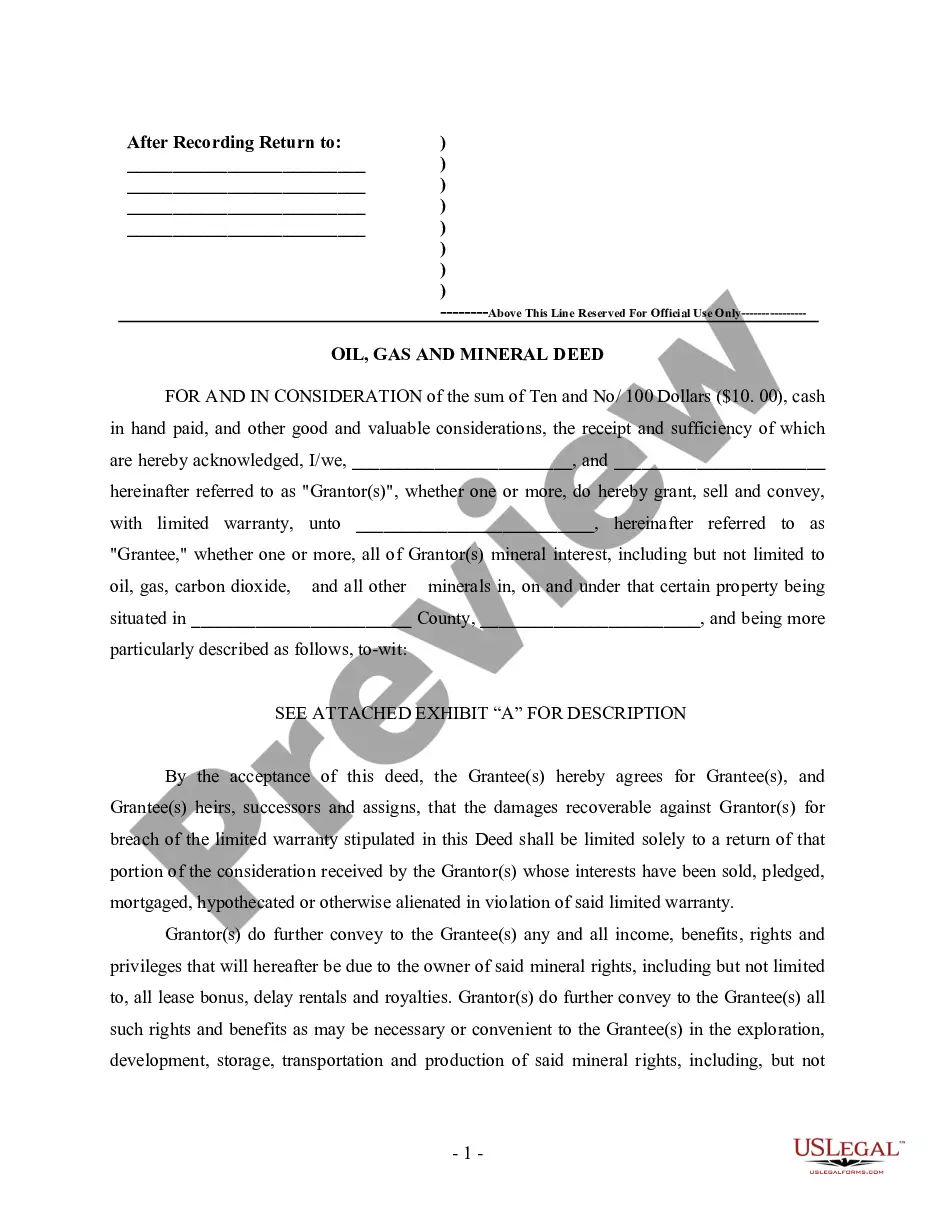

Oregon Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual

Description

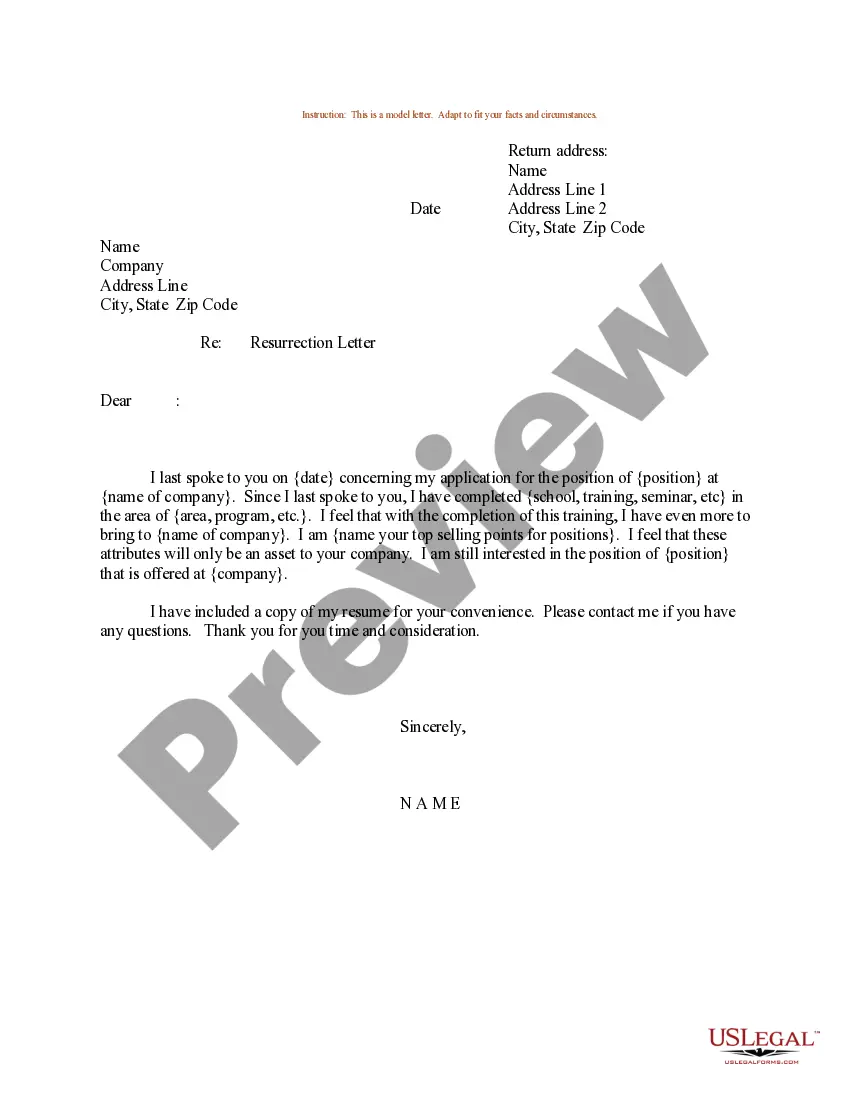

How to fill out Oil, Gas And Mineral Deed - Individual Or Two Individuals To An Individual?

It is possible to devote hours on-line searching for the legal file web template that fits the federal and state specifications you want. US Legal Forms gives a large number of legal forms that are analyzed by specialists. You can actually down load or produce the Oregon Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual from our assistance.

If you already have a US Legal Forms account, it is possible to log in and then click the Acquire key. Afterward, it is possible to complete, revise, produce, or sign the Oregon Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual. Each and every legal file web template you buy is yours forever. To obtain one more version for any obtained develop, visit the My Forms tab and then click the corresponding key.

If you work with the US Legal Forms website for the first time, keep to the straightforward directions beneath:

- Initial, ensure that you have chosen the correct file web template for your region/town of your liking. Browse the develop information to make sure you have picked the correct develop. If accessible, make use of the Preview key to search with the file web template too.

- In order to locate one more variation from the develop, make use of the Look for area to discover the web template that fits your needs and specifications.

- When you have identified the web template you need, just click Buy now to carry on.

- Select the rates strategy you need, type your references, and register for a free account on US Legal Forms.

- Complete the financial transaction. You may use your credit card or PayPal account to pay for the legal develop.

- Select the file format from the file and down load it to the gadget.

- Make adjustments to the file if needed. It is possible to complete, revise and sign and produce Oregon Oil, Gas and Mineral Deed - Individual or Two Individuals to an Individual.

Acquire and produce a large number of file themes using the US Legal Forms Internet site, which provides the largest collection of legal forms. Use professional and status-distinct themes to tackle your business or person demands.

Form popularity

FAQ

The State Land Board and its administrative agency, the Department of State Lands, manage mineral rights on nearly all state-owned land in Oregon.

Is the oil that is being removed from under the neighbors' land limited to what is under that property only? A)Yes, mineral rights can be sold separately from the land itself. Traditionally, ownership rights of real property are described as a barrel of legal rights.

Mineral rights can be divided by specific mineral commodities. For example, one company can own the mineral rights to coal, while another company owns the oil and gas rights. Consequently, it is important to know which minerals are included in a mineral deed. Some deeds specify that ?all minerals? are included.

In the United States, landowners possess both surface and mineral rights unless they choose to sell the mineral rights to someone else. Once mineral rights have been sold, the original owner retains only the rights to the land surface, while the second party may exploit the underground resources in any way they choose.

In the United States, mineral rights can be sold or conveyed separately from property rights. As a result, owning a piece of land does not necessarily mean you also own the rights to the minerals beneath it. If you didn't know this, you're not alone. Many property owners do not understand mineral rights.

Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner.

If you collect royalty income of $100,000, you could pay $30,000+ in taxes and only keep $70,000 and it would takes years to collect. Your basis in mineral rights can affect how much tax you owe when selling mineral rights vs collecting royalties. If you inherited mineral rights, it nearly always makes sense to sell.