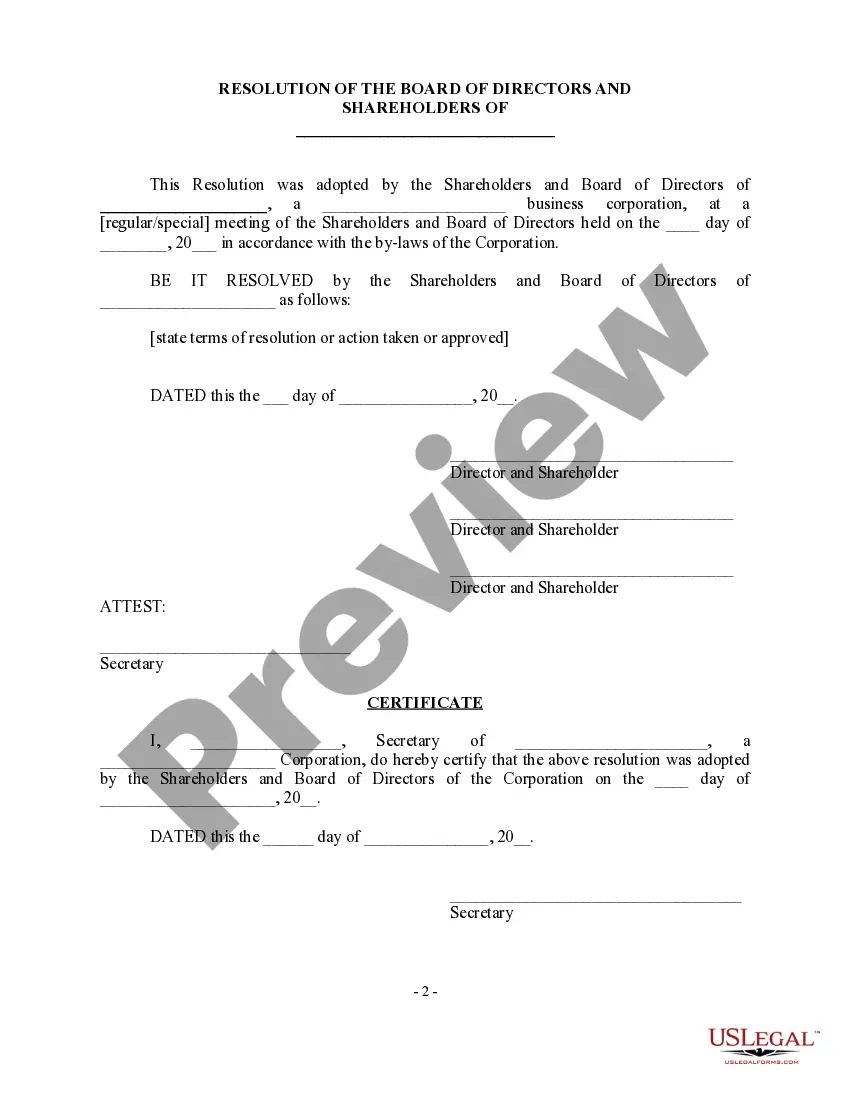

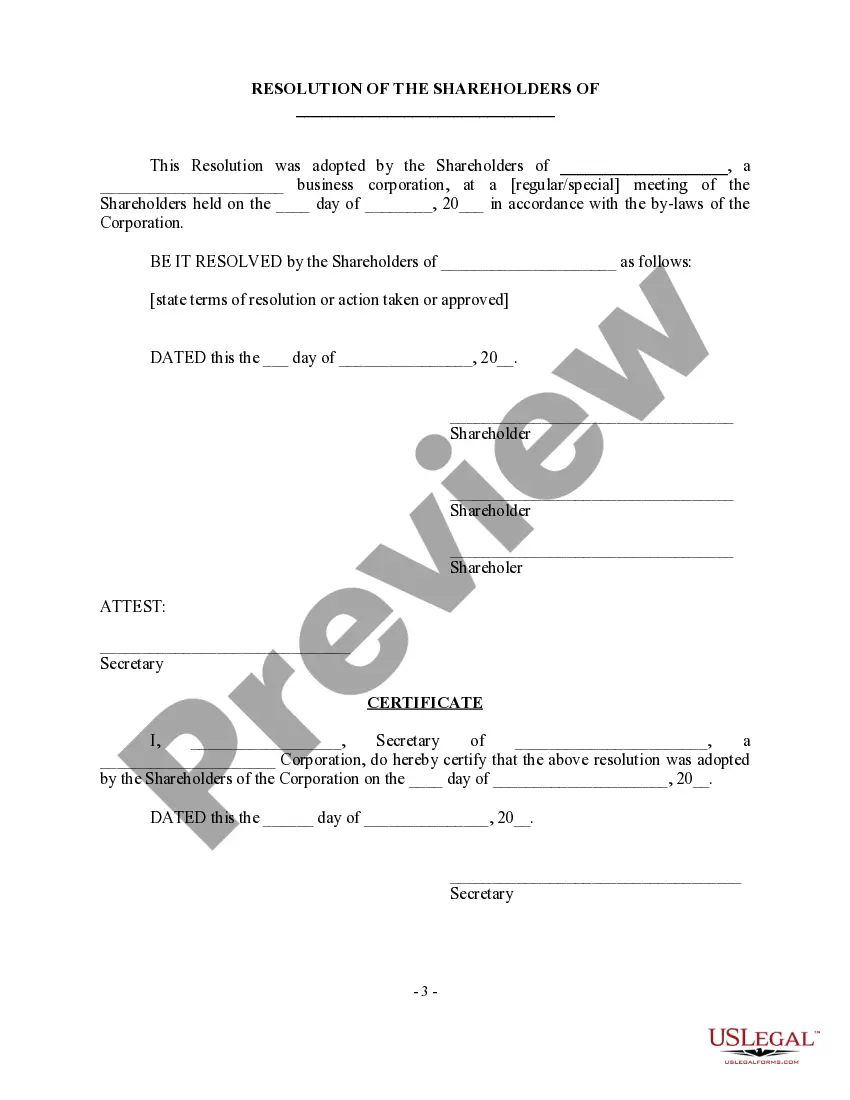

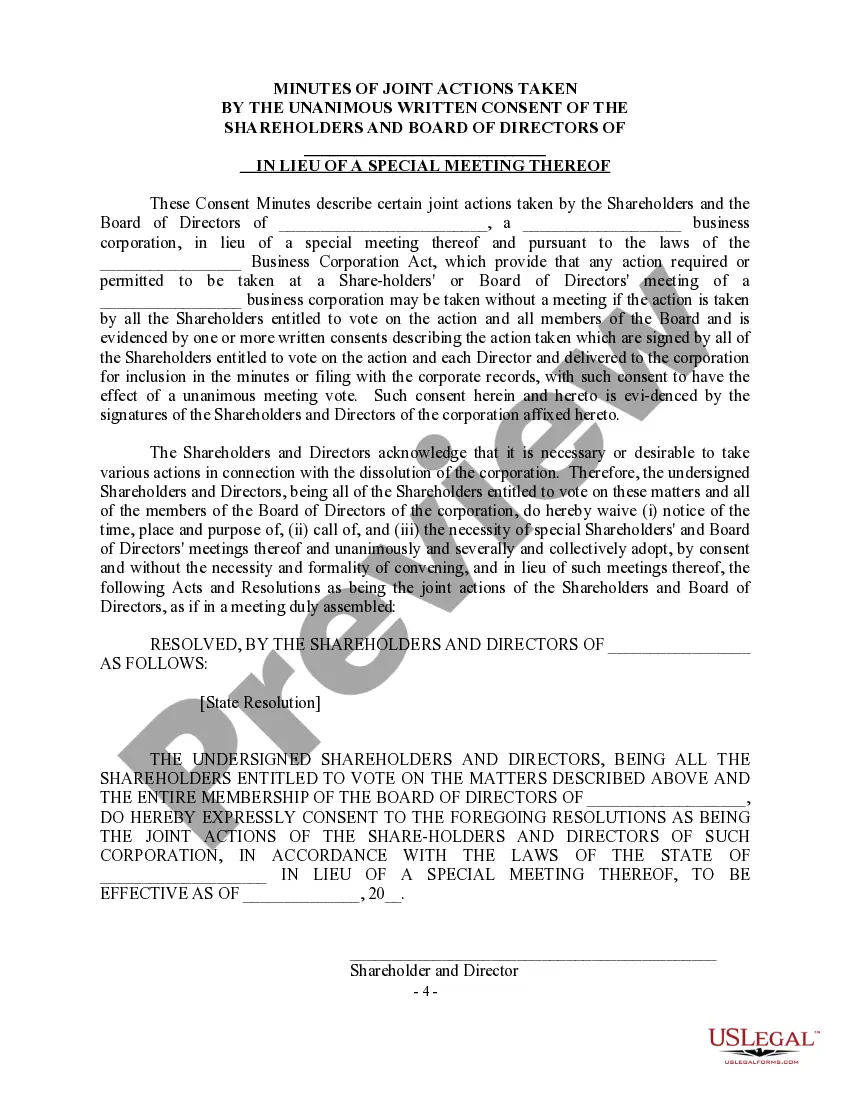

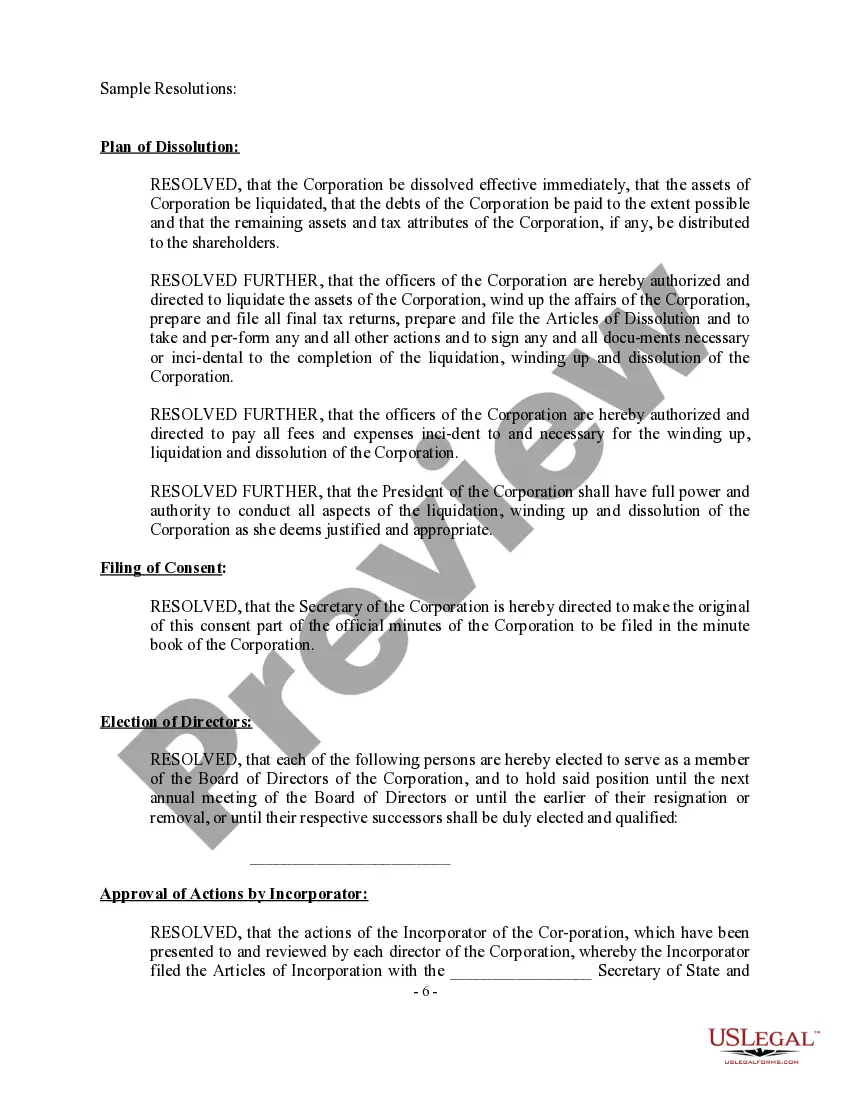

Oregon Resolutions - General

Description

How to fill out Resolutions - General?

Selecting the finest legal document template can pose a challenge.

Certainly, there are numerous templates accessible online, but how do you find the specific legal form you require.

Utilize the US Legal Forms platform.

Initially, ensure you have selected the correct form for your city/state. You can review the form using the Preview button and read the form description to confirm it is right for you.

- The service provides thousands of templates, including the Oregon Resolutions - General, suitable for both business and personal purposes.

- All forms are reviewed by professionals and comply with federal and state standards.

- If you are already a registered user, Log In to your account and click the Acquire button to locate the Oregon Resolutions - General.

- Use your account to search through the legal documents you have previously obtained.

- Go to the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward steps for you to follow.

Form popularity

FAQ

The best grounds for appeal often include significant legal errors that affected the trial's outcome, substantial evidence discrepancies, and procedural violations. Legal errors signify flaws in how the law was applied, while evidence discrepancies arise when the facts do not support the court’s conclusions. Procedural violations involve breaches in the expected legal process that could influence the trial's integrity. Understanding these effective grounds is vital for addressing issues within Oregon Resolutions - General.

You can make an appeal based on various grounds, including legal errors, misinterpretation of facts, and lack of jurisdiction. Legal errors could include mistakes in applying the law or failing to follow correct procedures. Misinterpretation of facts occurs when the court does not accurately consider the evidence presented. Additionally, if the court lacked jurisdiction over the case, this also serves as a valid ground for an appeal. Familiarity with these grounds can enhance your understanding of Oregon Resolutions - General.

Filing a lawsuit in Oregon requires you to prepare a complaint that outlines your case and submit it to the appropriate court. You'll need to include key details such as the facts of the case, grounds for jurisdiction, and the relief you are seeking. After filing, serve the defendant with the complaint according to Oregon law. Resources like US Legal Forms provide templates that can assist you in this process, ensuring you meet all legal requirements.

Three common reasons to appeal include legal error, insufficient evidence, and procedural problems. An appeal can be based on the belief that the trial court made a legal mistake that affected the outcome. Alternatively, if the evidence presented did not support the ruling, it may warrant an appeal. Lastly, if there were significant procedural issues that impacted the fairness of the trial, these could also provide grounds for an appeal. Understanding these reasons is crucial in the context of Oregon Resolutions - General.

Filing a complaint with the Oregon Attorney General involves completing a complaint form available on their website. You should include all relevant details such as your contact information, the nature of your complaint, and any supporting documentation. Once you submit your complaint, the Attorney General's office reviews the information and determines if further action is warranted. For guidance through this process, consider looking into resources provided by US Legal Forms.

To file a motion or answer in Oregon, you need to prepare the necessary documents and submit them to the appropriate court. Include relevant information such as case number, parties involved, and the specific relief you seek. It's essential to follow Oregon court rules regarding formatting and filing fees. Consider using US Legal Forms to access templates that can streamline this process and ensure compliance.

There are several reasons you may not have received the Oregon kicker, including not meeting the income requirements or failing to file your taxes correctly. If your tax return did not reflect the necessary conditions for eligibility, you would not qualify for the kicker. To better understand your situation, review your tax filings and consider seeking assistance from resources like US Legal Forms to ensure all your documents are adequately submitted. This can prevent future issues with receiving benefits.

The existence of a 2025 Oregon kicker will largely depend on the state's budget performance and any tax surplus accrued. If the Oregon economy continues to perform strongly, a kicker may likely be issued in 2025. To keep informed on future tax credits, it's wise to follow announcements from the Oregon Department of Revenue or utilize US Legal Forms for updates. This proactive approach will ensure you are well prepared for any benefits available.

As of now, the exact amount of the 2024 Oregon kicker has yet to be determined, as it depends on the state’s tax revenues and the final closes of the budget year. Historically, the kicker can be a significant amount, reflecting the state's economic performance. To stay updated on these developments, you can check with the Oregon Department of Revenue or use resources available through US Legal Forms for accurate tax guidance. Understanding potential amounts will help you plan for your finances effectively.

To get the Oregon kicker, you must file your state tax return accurately and on time. The Oregon kicker is triggered if the state's revenues exceed the expected funds, which will reflect on your tax return. It is crucial to consult the latest tax guidelines or use a service like US Legal Forms to ensure you are taking the right steps to claim your kicker. Proper tax filing practices will maximize your chances of receiving the benefit.