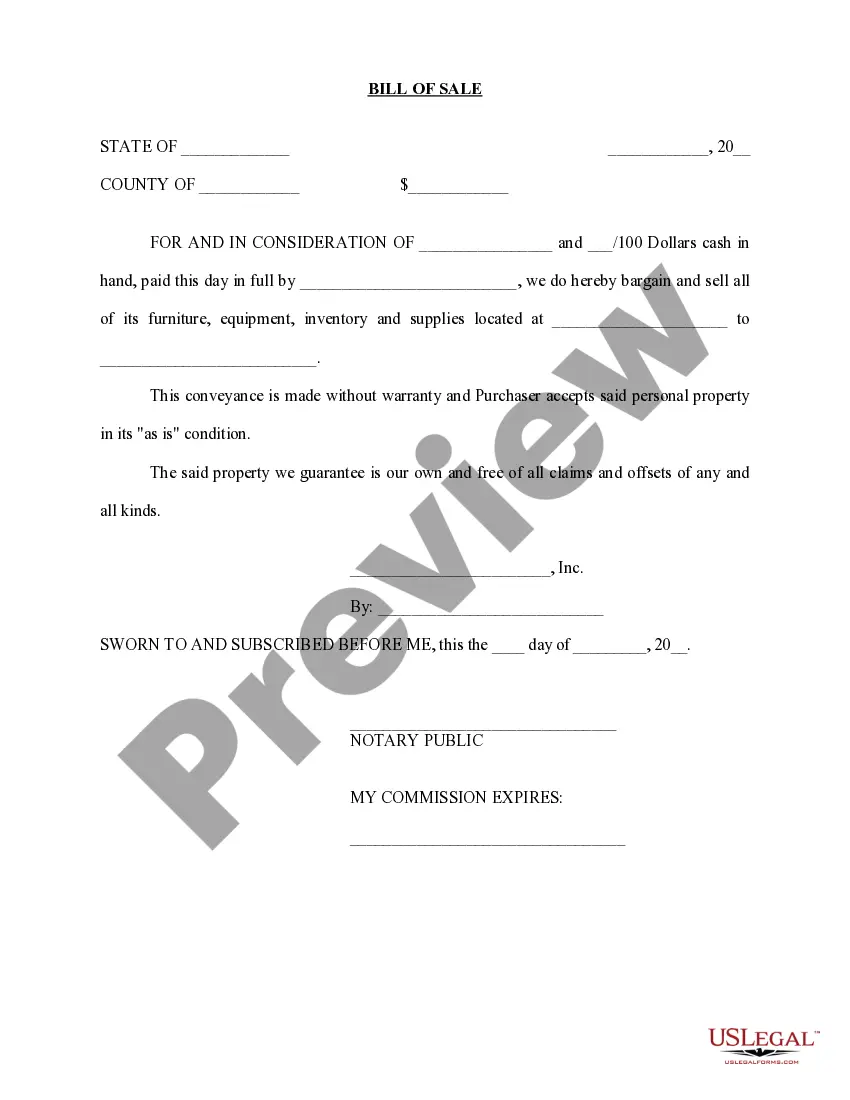

Oregon Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction is a legal document used to facilitate the sale and purchase of personal assets in the state of Oregon. This transaction encompasses the transfer of ownership rights from the seller to the buyer, ensuring a smooth and lawful transition of business ownership. The Oregon Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction can include various types depending on the nature of assets being sold. Some common types are: 1. Equipment and Machinery: This type of transaction involves the sale and purchase of equipment and machinery used for business operations, such as manufacturing equipment, vehicles, office furniture, or computer systems. 2. Inventory: Businesses often need to sell their inventory when closing or transferring ownership. Inventory assets can include perishable goods, raw materials, finished products, or merchandise held for sale. 3. Intellectual Property: In some cases, the sale of a business can include the transfer of intellectual property rights such as patents, trademarks, copyrights, or trade secrets. 4. Real Estate: If a business owns or leases real estate properties, the sale of business assets may include the transfer of these properties. This type of transaction typically requires additional legal documentation beyond the Bill of Sale, such as a Real Estate Purchase Agreement. 5. Accounts Receivable: In certain situations, a business may include the sale of outstanding accounts receivable, which involves transferring the rights to collect payment from customers or clients. It is crucial to mention that all Oregon Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transactions should be drafted by a qualified attorney to ensure compliance with Oregon state laws. These documents typically contain detailed information about the parties involved, the assets being sold, any warranties or guarantees, purchase price, payment terms, and other relevant terms and conditions. In conclusion, the Oregon Sale of Business — Bill of Sale for Personal Asset— - Asset Purchase Transaction is a legally binding document that enables the transfer of ownership rights of personal assets when buying or selling a business in Oregon. Different types of transactions may arise depending on the nature of assets being sold, such as equipment and machinery, inventory, intellectual property, real estate, or accounts receivable. It is always recommended consulting with a legal professional experienced in business transactions to ensure a smooth and lawful transfer of ownership.

Oregon Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction

Description

How to fill out Oregon Sale Of Business - Bill Of Sale For Personal Assets - Asset Purchase Transaction?

Are you inside a placement where you need documents for sometimes company or individual uses virtually every day time? There are plenty of legal papers layouts available on the Internet, but locating versions you can depend on is not simple. US Legal Forms gives a huge number of type layouts, like the Oregon Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction, that are composed to satisfy state and federal needs.

In case you are currently informed about US Legal Forms site and have your account, basically log in. Next, you are able to acquire the Oregon Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction web template.

Should you not provide an profile and wish to start using US Legal Forms, adopt these measures:

- Get the type you need and ensure it is for your appropriate metropolis/county.

- Use the Review switch to check the form.

- Read the description to actually have chosen the correct type.

- If the type is not what you are looking for, make use of the Search field to find the type that fits your needs and needs.

- Once you obtain the appropriate type, click on Get now.

- Choose the rates prepare you would like, fill out the specified details to make your bank account, and pay money for the order using your PayPal or Visa or Mastercard.

- Pick a practical data file structure and acquire your version.

Locate each of the papers layouts you possess purchased in the My Forms menu. You can get a additional version of Oregon Sale of Business - Bill of Sale for Personal Assets - Asset Purchase Transaction any time, if needed. Just click the necessary type to acquire or print the papers web template.

Use US Legal Forms, probably the most considerable variety of legal varieties, in order to save time as well as prevent errors. The assistance gives expertly manufactured legal papers layouts that can be used for a variety of uses. Create your account on US Legal Forms and start generating your daily life a little easier.