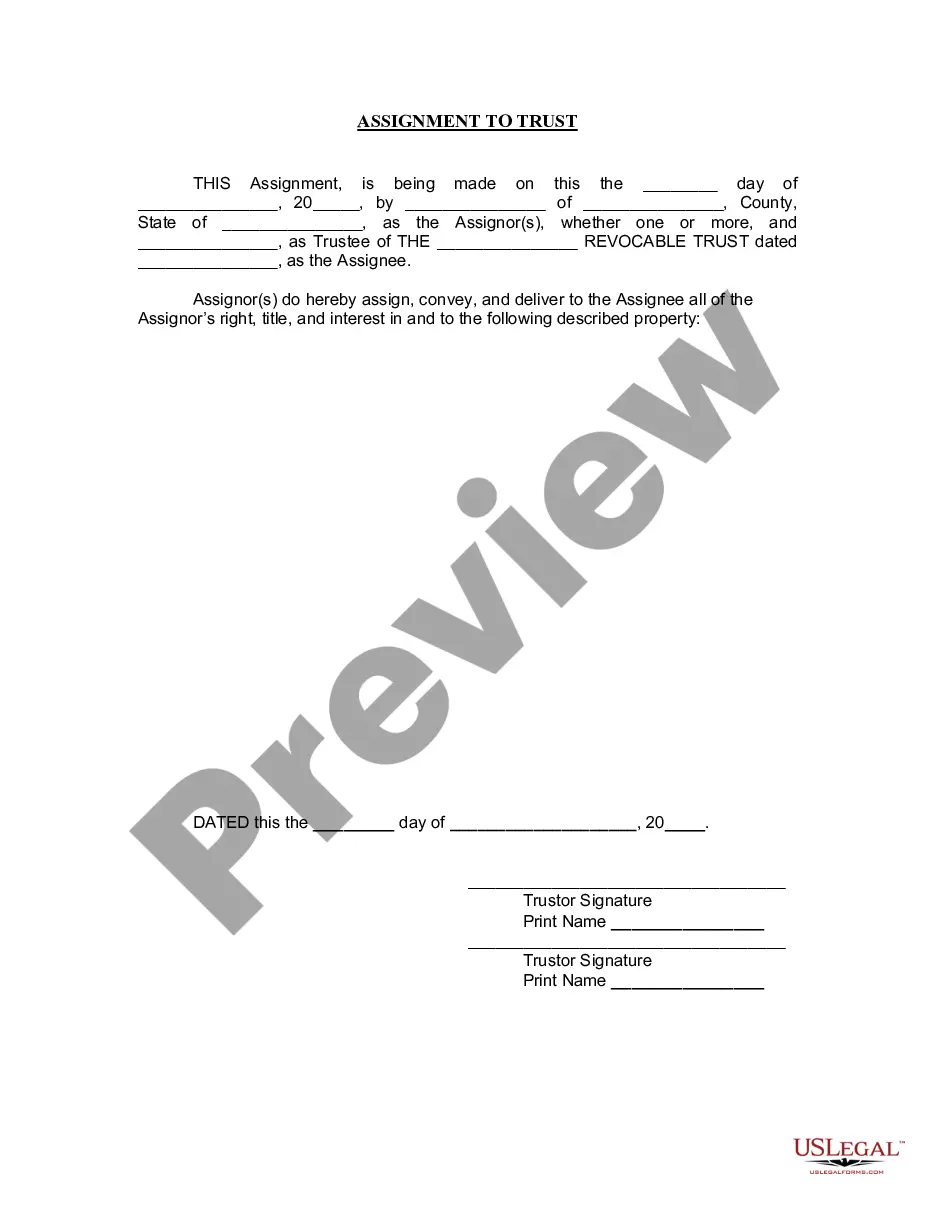

The following form seeks to give such assurance.

Oregon Privacy and Confidentiality of Credit Card Purchases refer to the set of regulations and practices in place to protect the personal information and transaction details of individuals when making credit card purchases in the state of Oregon, United States. These measures are enacted to ensure privacy, prevent fraud, and promote consumer confidence in electronic payment systems. One crucial aspect of Oregon privacy and confidentiality regulations is the protection of personally identifiable information (PIN), such as credit card numbers, names, addresses, and contact information. The use, storage, and disclosure of this sensitive data are subject to strict guidelines, both at the state and federal levels, aimed at preventing unauthorized access or misuse. In Oregon, businesses that accept credit card payments are required to comply with the Payment Card Industry Data Security Standard (PCI DSS). This industry-standard framework provides a comprehensive level of security measures and best practices, ensuring the confidentiality of credit card purchases. Compliance with PCI DSS involves implementing secure networks, regularly monitoring and testing security systems, and having strong data encryption protocols in place. Another key component of Oregon's privacy and confidentiality regulations is the requirement for businesses to obtain explicit consent from customers before sharing their personal information with third parties. This ensures that individuals have control over who can access their credit card details and helps prevent unsolicited marketing and identity theft. Moreover, Oregon has additional privacy laws, such as the Oregon Consumer Identity Theft Protection Act, which sets guidelines for businesses to safeguard personal information to prevent identity theft. Companies must implement measures like firewalls, encryption, and access controls to protect credit card information from unauthorized access. Different types of Oregon privacy and confidentiality protections exist to safeguard credit card purchases. These include secure online payment gateways, SSL encryption, colonization, and adherence to MV chip technology. Secure online payment gateways offer a secure channel for transmitting credit card data during online transactions, reducing the risk of interception by malicious actors. SSL encryption, or Secure Sockets Layer, is a widely used technology that encrypts the communication between web browsers and servers, ensuring that credit card information remains confidential while in transit. Colonization is another technique that replaces credit card numbers with unique identification tokens, adding an extra layer of protection in case of data breaches. Finally, adherence to MV chip technology is increasingly important for credit card purchases in Oregon. These chips generate a unique transaction code for every purchase, making it nearly impossible to clone or counterfeit credit cards, enhancing privacy and reducing fraud. In conclusion, Oregon privacy and confidentiality regulations are designed to safeguard the personal information and credit card details of individuals during purchases. Compliance with PCI DSS standards, obtaining explicit consent, utilizing secure payment gateways, encryption, colonization, and adopting MV chip technology are all crucial elements in maintaining privacy and confidentiality in credit card transactions in Oregon.