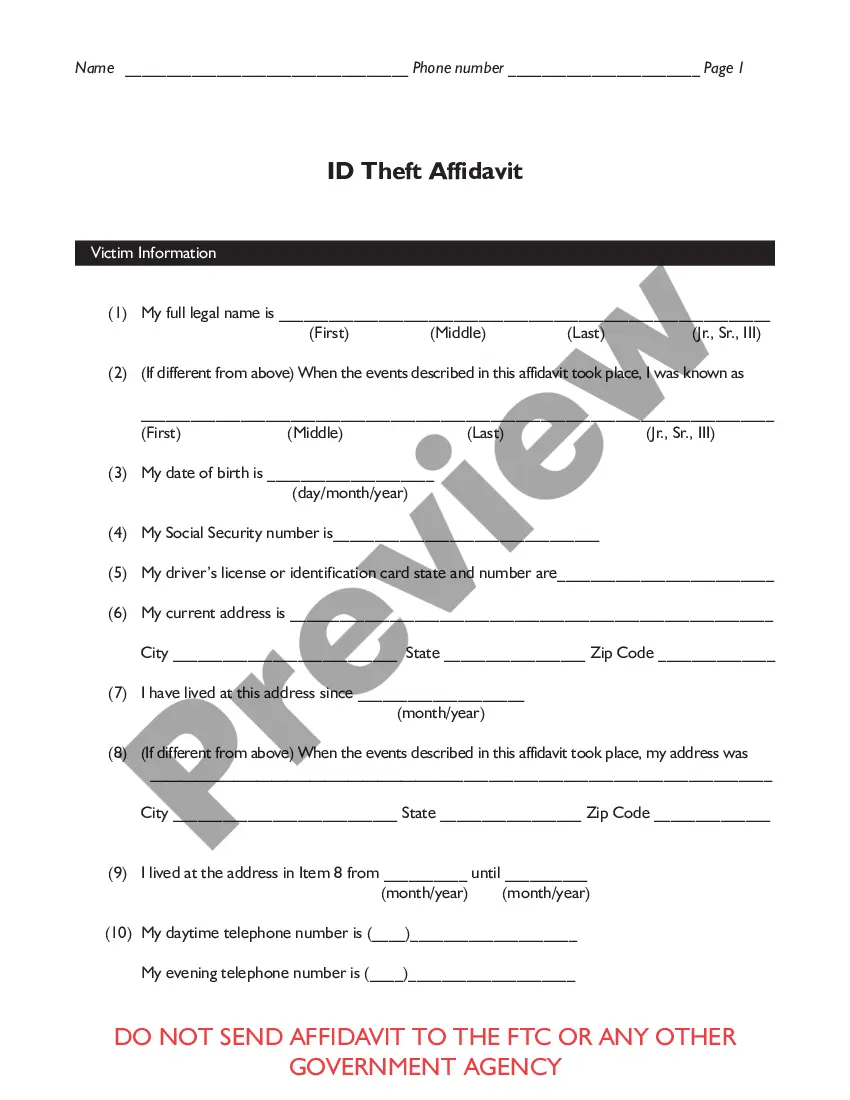

Oregon Federal Trade Commission Affidavit regarding Identity Theft

Description

How to fill out Federal Trade Commission Affidavit Regarding Identity Theft?

Choosing the best legitimate papers template can be quite a have a problem. Naturally, there are a variety of web templates available on the Internet, but how can you discover the legitimate kind you will need? Make use of the US Legal Forms website. The assistance delivers 1000s of web templates, like the Oregon Federal Trade Commission Affidavit regarding Identity Theft, that can be used for organization and personal demands. All of the varieties are checked by specialists and meet up with federal and state demands.

When you are previously signed up, log in in your bank account and then click the Obtain option to find the Oregon Federal Trade Commission Affidavit regarding Identity Theft. Use your bank account to search through the legitimate varieties you might have ordered in the past. Check out the My Forms tab of your own bank account and get an additional duplicate in the papers you will need.

When you are a brand new customer of US Legal Forms, here are simple recommendations that you can follow:

- Initial, ensure you have chosen the proper kind to your town/region. You may examine the shape while using Preview option and browse the shape outline to guarantee this is basically the best for you.

- In case the kind is not going to meet up with your needs, use the Seach industry to get the right kind.

- When you are certain that the shape would work, go through the Acquire now option to find the kind.

- Opt for the costs strategy you want and enter the essential information and facts. Create your bank account and buy your order making use of your PayPal bank account or bank card.

- Opt for the document formatting and acquire the legitimate papers template in your device.

- Complete, revise and print out and signal the obtained Oregon Federal Trade Commission Affidavit regarding Identity Theft.

US Legal Forms is definitely the largest collection of legitimate varieties that you will find a variety of papers web templates. Make use of the company to acquire appropriately-manufactured documents that follow express demands.

Form popularity

FAQ

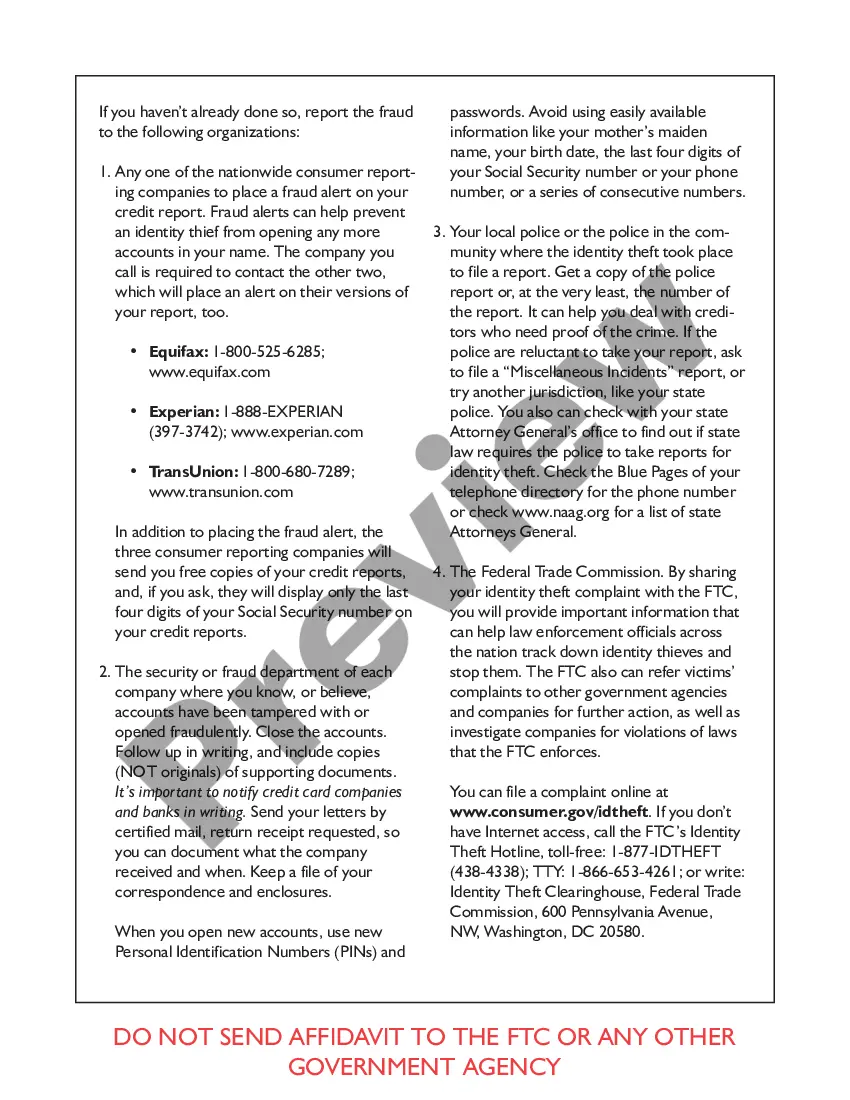

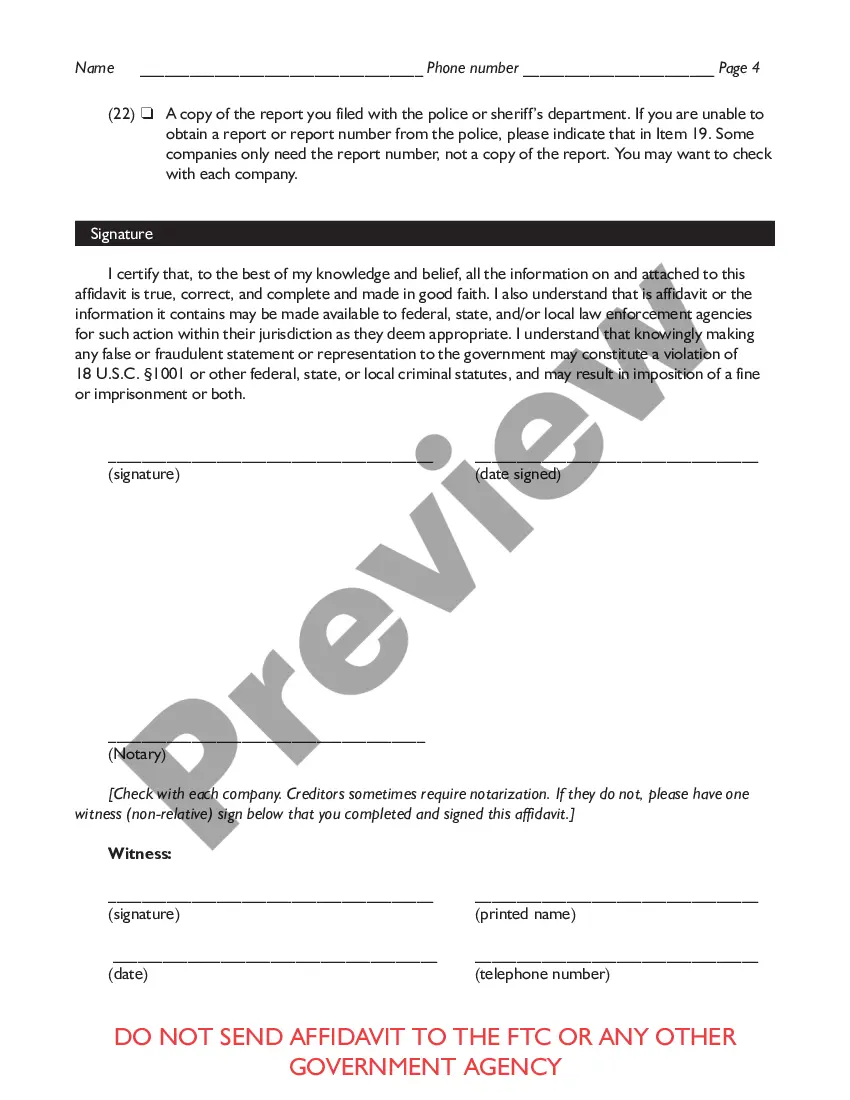

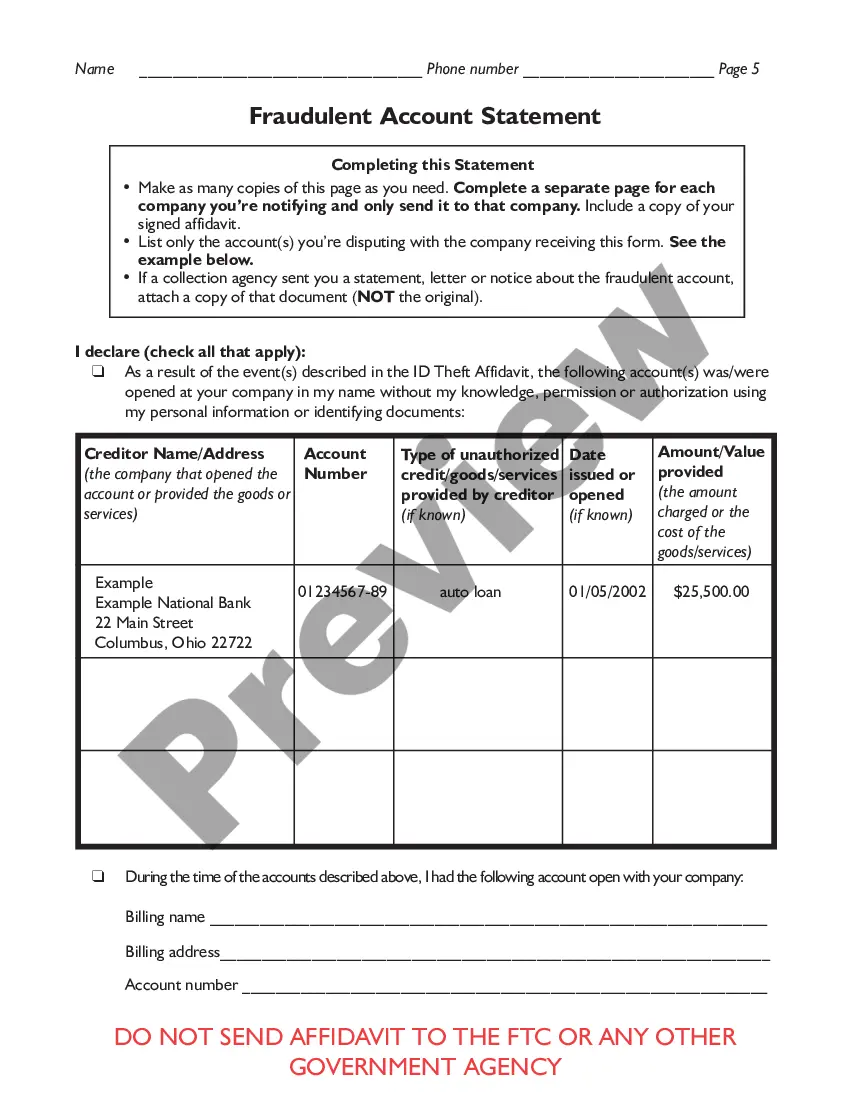

Visit ftc.gov/idtheft to use a secure online version that you can print for your records. Before completing this form: 1. Place a fraud alert on your credit reports, and review the reports for signs of fraud.

Filing Form 14039, Identity Theft Affidavit It can be completed online, printed and attached to a paper tax return for mailing to the IRS. Or taxpayers may complete the form online at the Federal Trade Commission and the FTC will electronically transfer the Form 14039 ? but not the tax return ? to the IRS.

? Go to IdentityTheft.gov or call 1-877-438-4338. Include as many details as possible. Based on the information you enter, IdentityTheft.gov will create your Identity Theft Report and recovery plan.

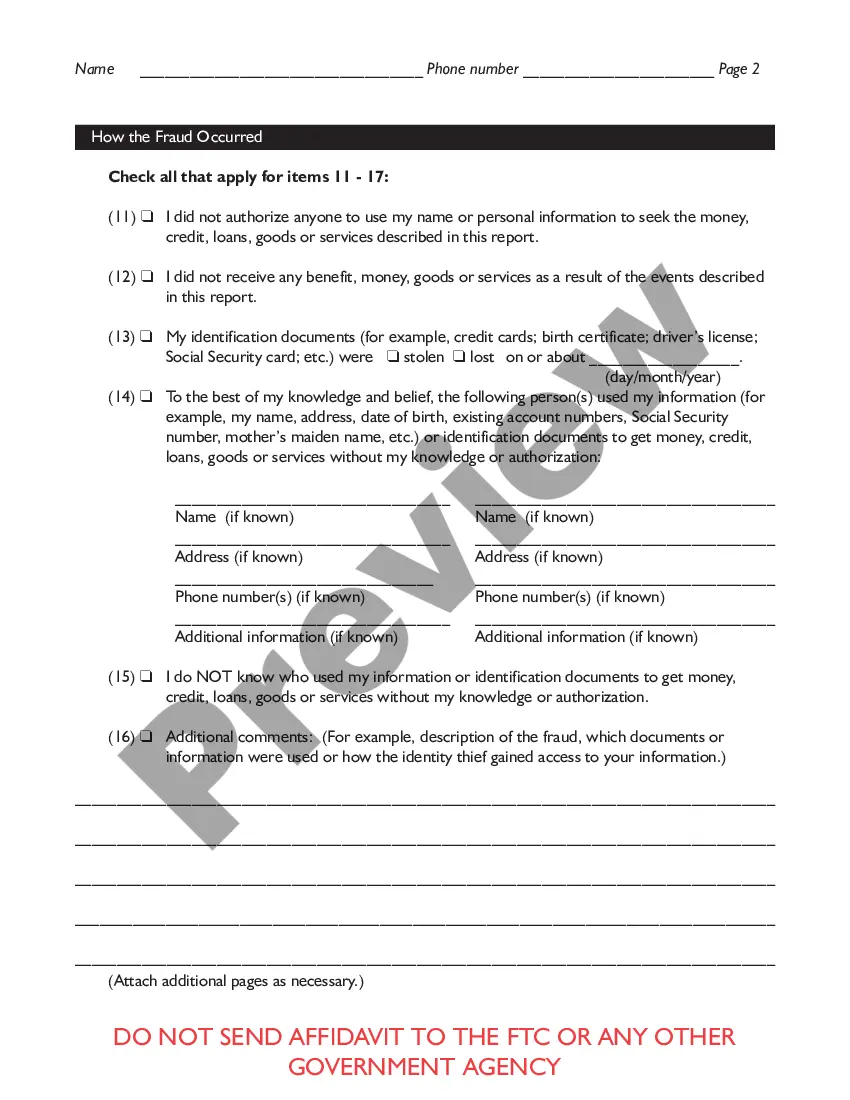

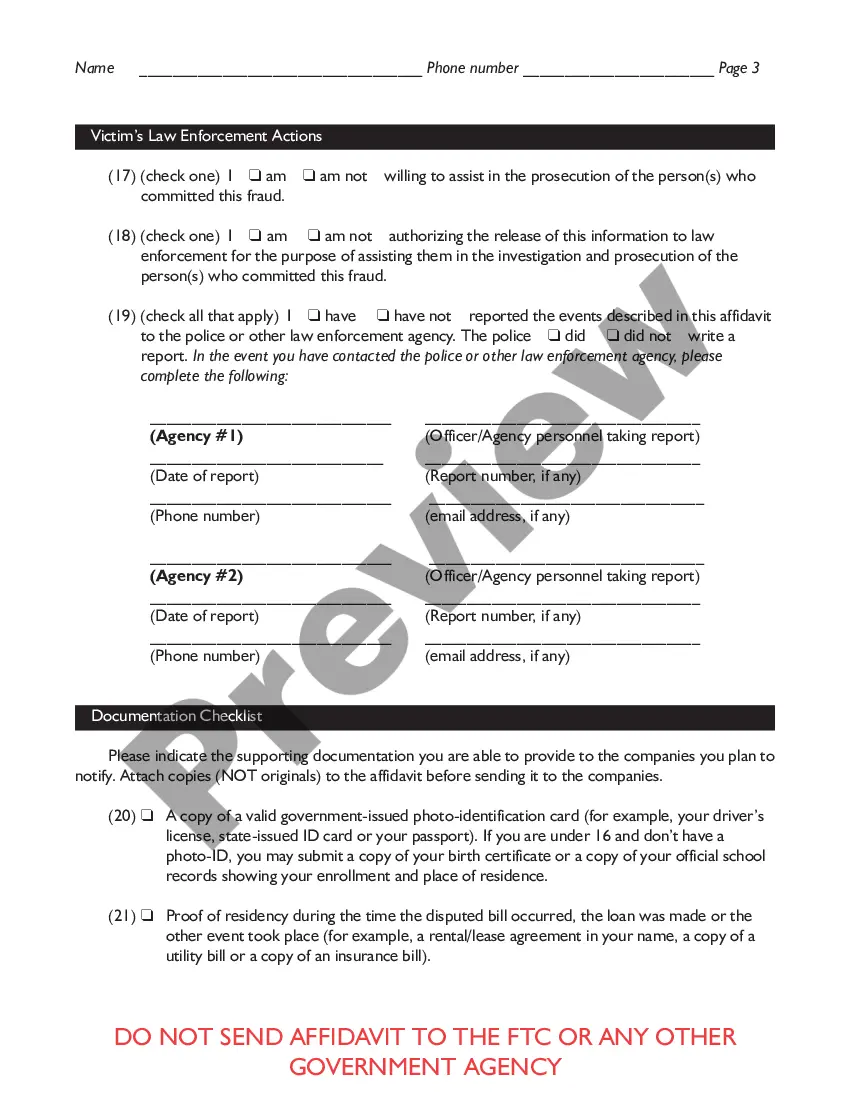

FTC ID Theft Affidavit The FTC provides an ID Theft Affidavit to help victims of identity theft quickly and accurately dispute new unauthorized accounts. It is especially helpful in cases where consumers are unable to file or obtain a police report. Some creditors will accept this affidavit instead of a police report.

You can write to the Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:T:SP, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

In most cases, taxpayers do not need to complete this form. Only victims of tax-related identity theft should submit the Form 14039, and only if they haven't received certain letters from the IRS.

In 1998, Congress enacted the Identity Theft and Assumption Deterrence Act (?the Identity Theft Act? or ?the Act?),1 directing the Federal Trade Commission to establish the federal government's central repository for identity theft complaints and to provide victim assistance and consumer education.