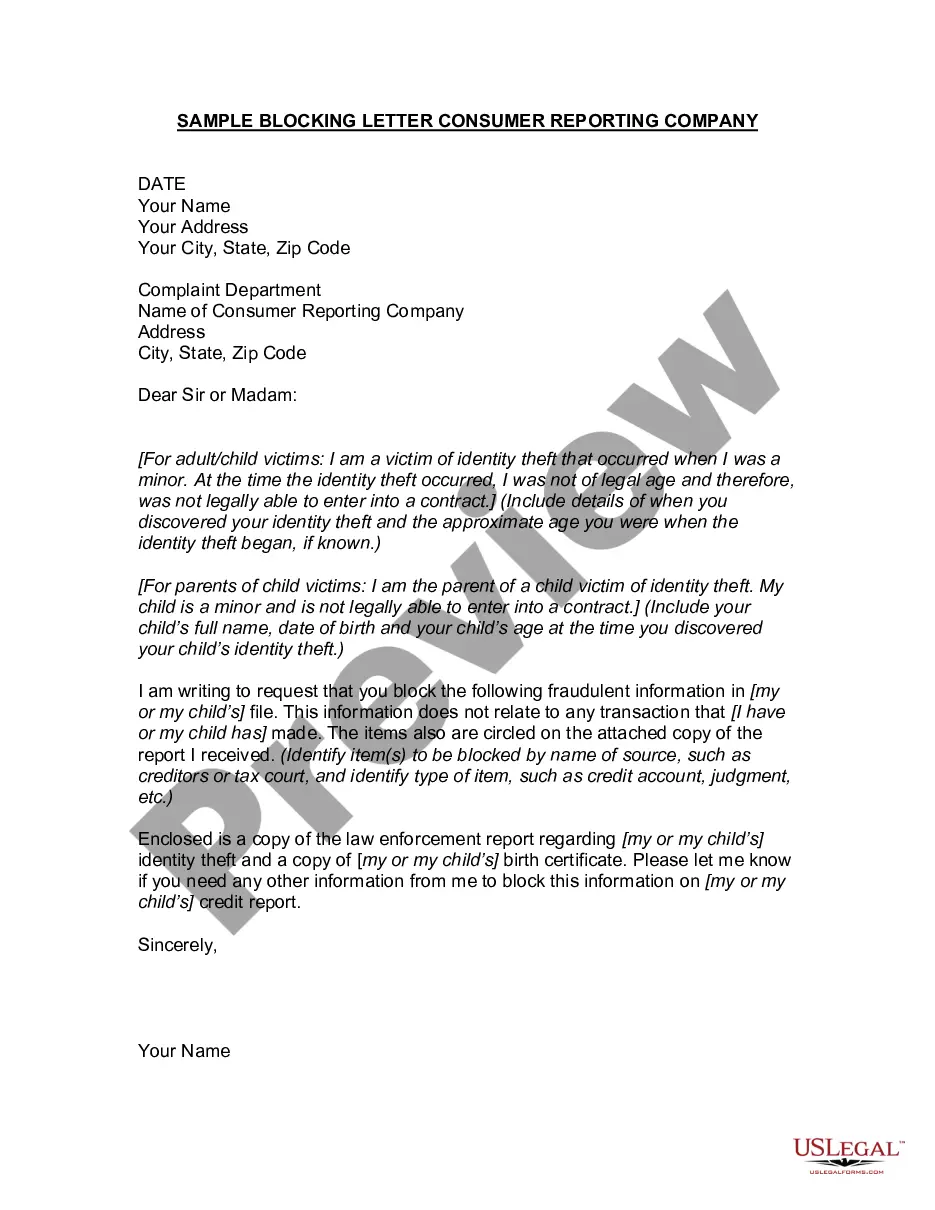

Oregon Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor Identity theft has become a prevalent issue in today's digital age, affecting individuals of all ages, including minors. To combat this growing problem, Oregon law provides specific guidelines for writing a letter to a credit reporting company or bureau regarding the identity theft of a minor. There are two main types of letters that can be written in Oregon in such cases: 1. Initial Letter to Credit Reporting Company: This letter is the first step to report the identity theft of a minor to a credit reporting company or bureau. It outlines the details of the identity theft, including the minor's personal information that has been misused. The letter aims to initiate an investigation and resolve any fraudulent accounts or activities associated with the minor's name. Keywords: Oregon, letter, credit reporting company, bureau, identity theft, minor, initial, report, personal information, misuse, investigation, fraudulent accounts, resolution. 2. Follow-up Letter to Credit Reporting Company: In some instances, additional information or confirmation may be required from the credit reporting company or bureau to resolve the identity theft of a minor fully. A follow-up letter can be sent to provide any necessary documentation or follow-up on the initial letter's progress. This letter emphasizes the need for prompt action to prevent further harm to the minor's credit history and ongoing financial stability. Keywords: Oregon, letter, credit reporting company, bureau, identity theft, minor, follow-up, additional information, confirmation, resolution, documentation, progress, prompt action, credit history, financial stability. When writing an Oregon Letter to a Credit Reporting Company or Bureau Regarding Identity Theft of a Minor, it is crucial to follow specific guidelines: 1. Provide complete personal details of the minor: Clearly state the minor's full name, date of birth, and Social Security number (if applicable). This information helps the credit reporting company or bureau identify and investigate any fraudulent activities associated with the minor's identity. 2. Describe the identity theft incident: Explain how and when the identity theft was first discovered. Include details about any unauthorized accounts, transactions, or fraudulent activities that have occurred using the minor's personal information. Providing a chronological account helps the credit reporting company or bureau understand the severity and scope of the identity theft. 3. Attach supporting documentation: Include copies of any relevant documents, such as police reports, identity theft affidavits, or previous correspondence related to the incident. These documents validate the authenticity of the identity theft claim and support the request for action from the credit reporting company or bureau. 4. Request immediate action: Clearly state that the letter is a formal request for the credit reporting company or bureau to investigate the identity theft, remove any fraudulent accounts or entries from the minor's credit report, and prevent further misuse of the minor's personal information. 5. Provide contact information: Share the contact details of the individual writing the letter, including their name, address, phone number, and email address. This ensures that the credit reporting company or bureau can reach out for additional information if needed. By following the guidelines outlined above and addressing the specific concerns related to the identity theft of a minor, an Oregon Letter to a Credit Reporting Company or Bureau can effectively initiate an investigation and secure the minor's financial future.

Oregon Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor

Description

How to fill out Oregon Letter To Credit Reporting Company Or Bureau Regarding Identity Theft Of Minor?

It is possible to commit several hours on the Internet attempting to find the lawful record format that meets the state and federal needs you need. US Legal Forms gives a huge number of lawful varieties that happen to be evaluated by specialists. You can actually download or print out the Oregon Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor from my services.

If you already possess a US Legal Forms bank account, you can log in and click the Obtain key. Following that, you can complete, modify, print out, or indicator the Oregon Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor. Each lawful record format you buy is your own forever. To acquire another copy of any bought form, proceed to the My Forms tab and click the related key.

Should you use the US Legal Forms site for the first time, keep to the simple guidelines below:

- Initially, make sure that you have chosen the right record format to the area/area of your liking. Read the form outline to make sure you have selected the correct form. If readily available, utilize the Preview key to appear throughout the record format as well.

- If you want to discover another version in the form, utilize the Lookup field to obtain the format that meets your requirements and needs.

- Upon having identified the format you need, click Get now to carry on.

- Pick the rates plan you need, enter your credentials, and sign up for a free account on US Legal Forms.

- Complete the financial transaction. You may use your charge card or PayPal bank account to purchase the lawful form.

- Pick the file format in the record and download it to your gadget.

- Make changes to your record if possible. It is possible to complete, modify and indicator and print out Oregon Letter to Credit Reporting Company or Bureau Regarding Identity Theft of Minor.

Obtain and print out a huge number of record web templates making use of the US Legal Forms Internet site, that provides the biggest assortment of lawful varieties. Use specialist and condition-specific web templates to take on your business or specific requires.