Title: Oregon Letter to Creditors Notifying Them of Identity Theft of Minor — Comprehensive Guide Introduction: Discover how to protect minors from identity theft in Oregon by sending a compelling letter to creditors to inform them about the incident. In this article, we will provide a thorough description of what an Oregon Letter to Creditors Notifying Them of Identity Theft of Minor entails, as well as discuss any variations or types that exist. Keywords: Oregon, Letter to Creditors, Identity Theft of Minor, Notifying, Comprehensive Guide 1. Understanding Identity Theft of Minors in Oregon: Learn about the increasing prevalence of identity theft targeting minors in Oregon, causing significant financial repercussions and potential long-term consequences. 2. Purpose of an Oregon Letter to Creditors: Explore the crucial role of a well-crafted letter in promptly notifying creditors of the identity theft experienced by a minor, ensuring swift action and damage control. 3. Essential Components of an Oregon Letter to Creditors: Discover the key elements that should be included in a comprehensive and effective letter, including proper identification, detailed explanation of the incident, and specific actions requested from the creditors. 4. Sample Oregon Letter to Creditors Notifying Them of Identity Theft of Minor: Get inspired by a carefully crafted sample letter, tailored to meet Oregon's requirements, which can serve as a template adaptable to individual situations. 5. Legal Obligations and Rights of Creditors in Oregon: Understand the legal obligations that creditors have to address identity theft allegations concerning minor victims, including the need to investigate promptly and freeze accounts upon initiating the notification process. 6. Different Types of Oregon Letters to Creditors: Explore any possible variations or types of letters that may be used in Oregon, such as letters for notification to credit bureaus, banks, credit card companies, loan providers, and other financial institutions. 7. Additional Measures to Take: Discover supplementary actions beyond sending a letter, such as reporting the theft to Oregon law enforcement, contacting credit bureaus to freeze the minor's credit file, and employing a credit monitoring service. 8. Preventive Measures for Minors: Highlight the significance of proactive steps, such as educating minors about online privacy and proper handling of personal information, to prevent future identity theft incidents. Conclusion: By following the guidelines and using the provided resources and sample letter, Oregon residents can effectively notify creditors of identity theft targeting minors. By doing so, individuals can minimize potential financial damages and work towards resolving the issue promptly. Keywords: Oregon, Letter to Creditors, Identity Theft of Minor, Notifying, Comprehensive Guide, Sample Letter, Legal Obligations, Types, Preventive Measures

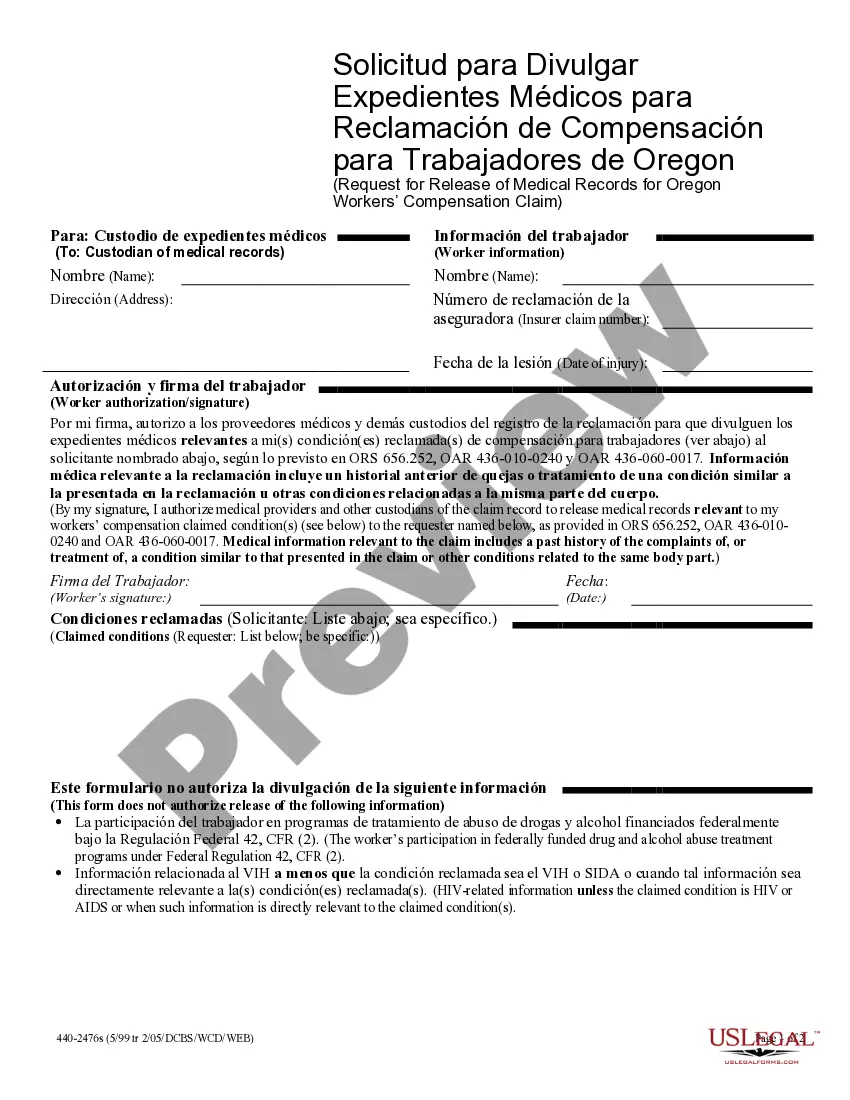

Title: Oregon Letter to Creditors Notifying Them of Identity Theft of Minor — Comprehensive Guide Introduction: Discover how to protect minors from identity theft in Oregon by sending a compelling letter to creditors to inform them about the incident. In this article, we will provide a thorough description of what an Oregon Letter to Creditors Notifying Them of Identity Theft of Minor entails, as well as discuss any variations or types that exist. Keywords: Oregon, Letter to Creditors, Identity Theft of Minor, Notifying, Comprehensive Guide 1. Understanding Identity Theft of Minors in Oregon: Learn about the increasing prevalence of identity theft targeting minors in Oregon, causing significant financial repercussions and potential long-term consequences. 2. Purpose of an Oregon Letter to Creditors: Explore the crucial role of a well-crafted letter in promptly notifying creditors of the identity theft experienced by a minor, ensuring swift action and damage control. 3. Essential Components of an Oregon Letter to Creditors: Discover the key elements that should be included in a comprehensive and effective letter, including proper identification, detailed explanation of the incident, and specific actions requested from the creditors. 4. Sample Oregon Letter to Creditors Notifying Them of Identity Theft of Minor: Get inspired by a carefully crafted sample letter, tailored to meet Oregon's requirements, which can serve as a template adaptable to individual situations. 5. Legal Obligations and Rights of Creditors in Oregon: Understand the legal obligations that creditors have to address identity theft allegations concerning minor victims, including the need to investigate promptly and freeze accounts upon initiating the notification process. 6. Different Types of Oregon Letters to Creditors: Explore any possible variations or types of letters that may be used in Oregon, such as letters for notification to credit bureaus, banks, credit card companies, loan providers, and other financial institutions. 7. Additional Measures to Take: Discover supplementary actions beyond sending a letter, such as reporting the theft to Oregon law enforcement, contacting credit bureaus to freeze the minor's credit file, and employing a credit monitoring service. 8. Preventive Measures for Minors: Highlight the significance of proactive steps, such as educating minors about online privacy and proper handling of personal information, to prevent future identity theft incidents. Conclusion: By following the guidelines and using the provided resources and sample letter, Oregon residents can effectively notify creditors of identity theft targeting minors. By doing so, individuals can minimize potential financial damages and work towards resolving the issue promptly. Keywords: Oregon, Letter to Creditors, Identity Theft of Minor, Notifying, Comprehensive Guide, Sample Letter, Legal Obligations, Types, Preventive Measures