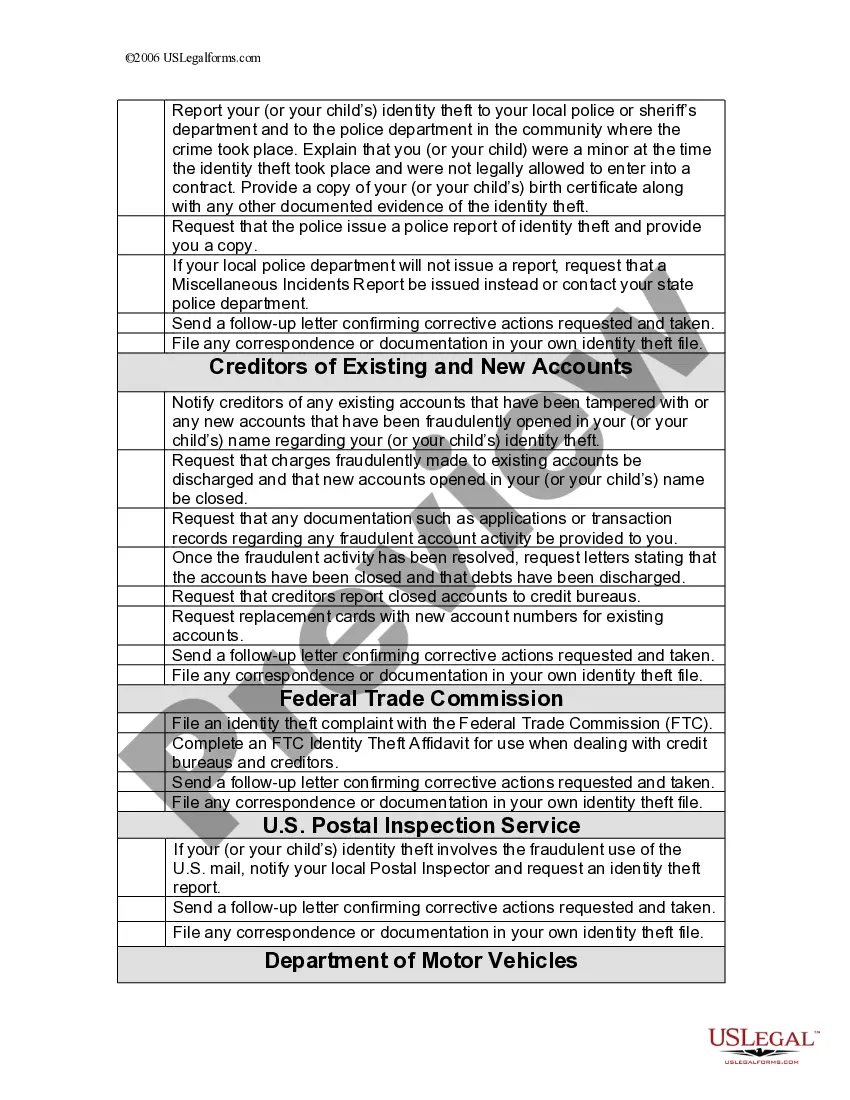

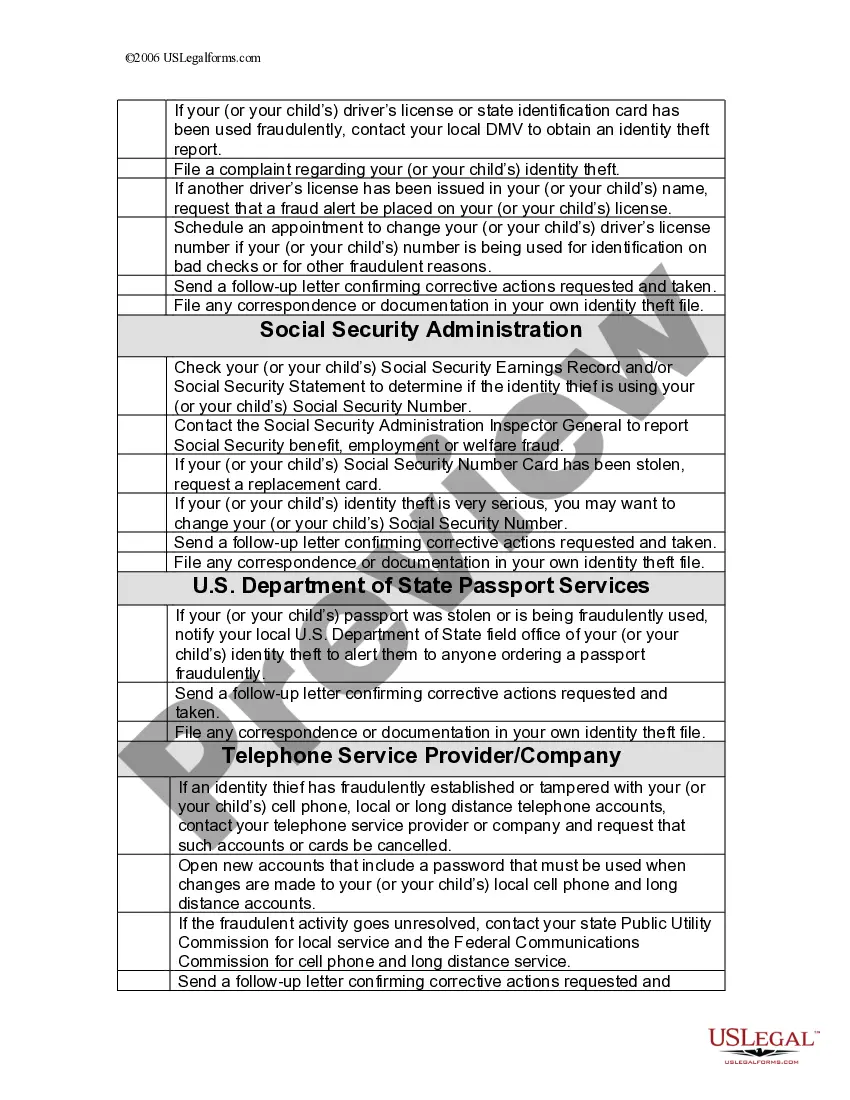

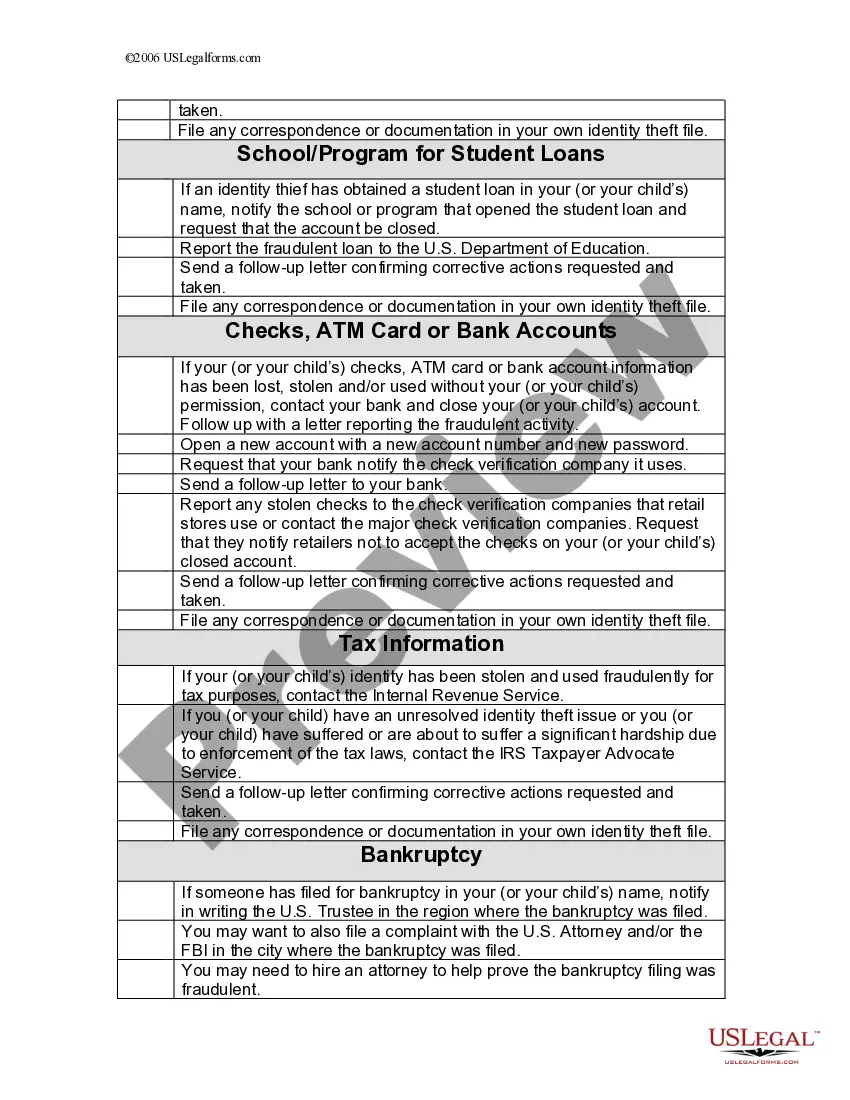

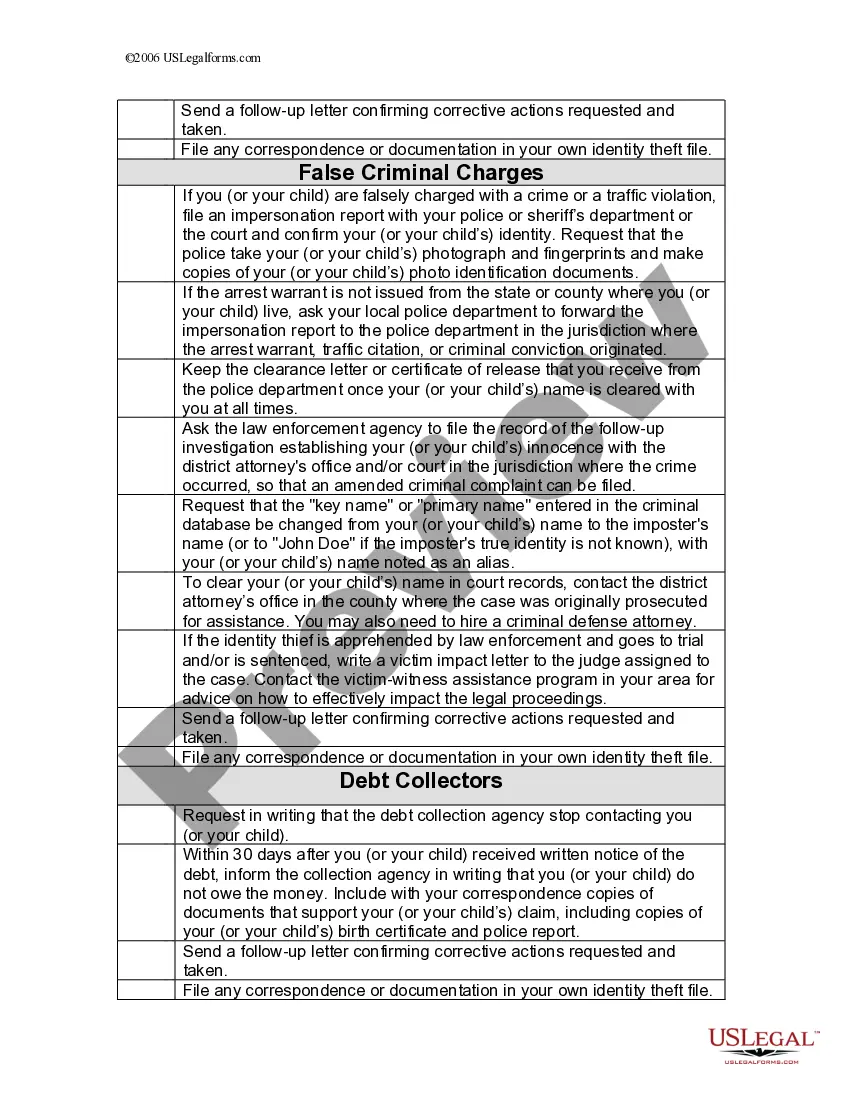

The Oregon Identity Theft Checklist for Minors is a comprehensive guide that aims to protect children from becoming victims of identity theft. Identity theft, a serious and growing concern in today's interconnected world, can have devastating effects on a child's financial and personal well-being. This checklist equips parents, guardians, and caregivers with the necessary tools to detect, prevent, and resolve instances of identity theft targeting minors in Oregon. The checklist begins by explaining the importance of being proactive in safeguarding children's personal information. It emphasizes the significance of monitoring credit reports regularly, as minors may unknowingly fall prey to identity thieves who exploit their clean credit history. In addition, the checklist recommends minimizing the exposure of a minor's Social Security number, as this is a prime target for identity thieves. Moreover, the Oregon Identity Theft Checklist for Minors advises parents and guardians to educate their children about the potential risks associated with sharing personal information online. Teaching them how to identify phishing attempts, being cautious while using social media platforms, and emphasizing the importance of strong passwords are crucial components of raising digitally savvy children. The checklist also highlights the steps that should be taken if identity theft is suspected. It guides parents through the process of filing a report with local law enforcement, notifying credit bureaus, and placing a credit freeze on the minor's accounts. Additionally, it provides information on contacting financial institutions to alert them about the potential fraud and resolving any fraudulent transactions or accounts. It emphasizes swift action to mitigate the damage caused by identity theft. Different types of Oregon Identity Theft Checklists for Minors may vary based on the target audience. For instance, there could be checklists specifically tailored for educators and school administrators, helping them recognize signs of identity theft among students and providing guidance on how to address these issues. Another type may be geared towards foster parents, offering specialized advice for protecting the personal information of children under their care. Customized checklists may also cater to different age groups, addressing age-appropriate concerns and strategies. Overall, the Oregon Identity Theft Checklist for Minors is a valuable resource for individuals invested in safeguarding the well-being and future financial security of children. By following its comprehensive steps and recommendations, parents, guardians, and educators can take proactive measures to minimize the risk of identity theft and protect the identities of the young ones under their watchful eyes.

The Oregon Identity Theft Checklist for Minors is a comprehensive guide that aims to protect children from becoming victims of identity theft. Identity theft, a serious and growing concern in today's interconnected world, can have devastating effects on a child's financial and personal well-being. This checklist equips parents, guardians, and caregivers with the necessary tools to detect, prevent, and resolve instances of identity theft targeting minors in Oregon. The checklist begins by explaining the importance of being proactive in safeguarding children's personal information. It emphasizes the significance of monitoring credit reports regularly, as minors may unknowingly fall prey to identity thieves who exploit their clean credit history. In addition, the checklist recommends minimizing the exposure of a minor's Social Security number, as this is a prime target for identity thieves. Moreover, the Oregon Identity Theft Checklist for Minors advises parents and guardians to educate their children about the potential risks associated with sharing personal information online. Teaching them how to identify phishing attempts, being cautious while using social media platforms, and emphasizing the importance of strong passwords are crucial components of raising digitally savvy children. The checklist also highlights the steps that should be taken if identity theft is suspected. It guides parents through the process of filing a report with local law enforcement, notifying credit bureaus, and placing a credit freeze on the minor's accounts. Additionally, it provides information on contacting financial institutions to alert them about the potential fraud and resolving any fraudulent transactions or accounts. It emphasizes swift action to mitigate the damage caused by identity theft. Different types of Oregon Identity Theft Checklists for Minors may vary based on the target audience. For instance, there could be checklists specifically tailored for educators and school administrators, helping them recognize signs of identity theft among students and providing guidance on how to address these issues. Another type may be geared towards foster parents, offering specialized advice for protecting the personal information of children under their care. Customized checklists may also cater to different age groups, addressing age-appropriate concerns and strategies. Overall, the Oregon Identity Theft Checklist for Minors is a valuable resource for individuals invested in safeguarding the well-being and future financial security of children. By following its comprehensive steps and recommendations, parents, guardians, and educators can take proactive measures to minimize the risk of identity theft and protect the identities of the young ones under their watchful eyes.