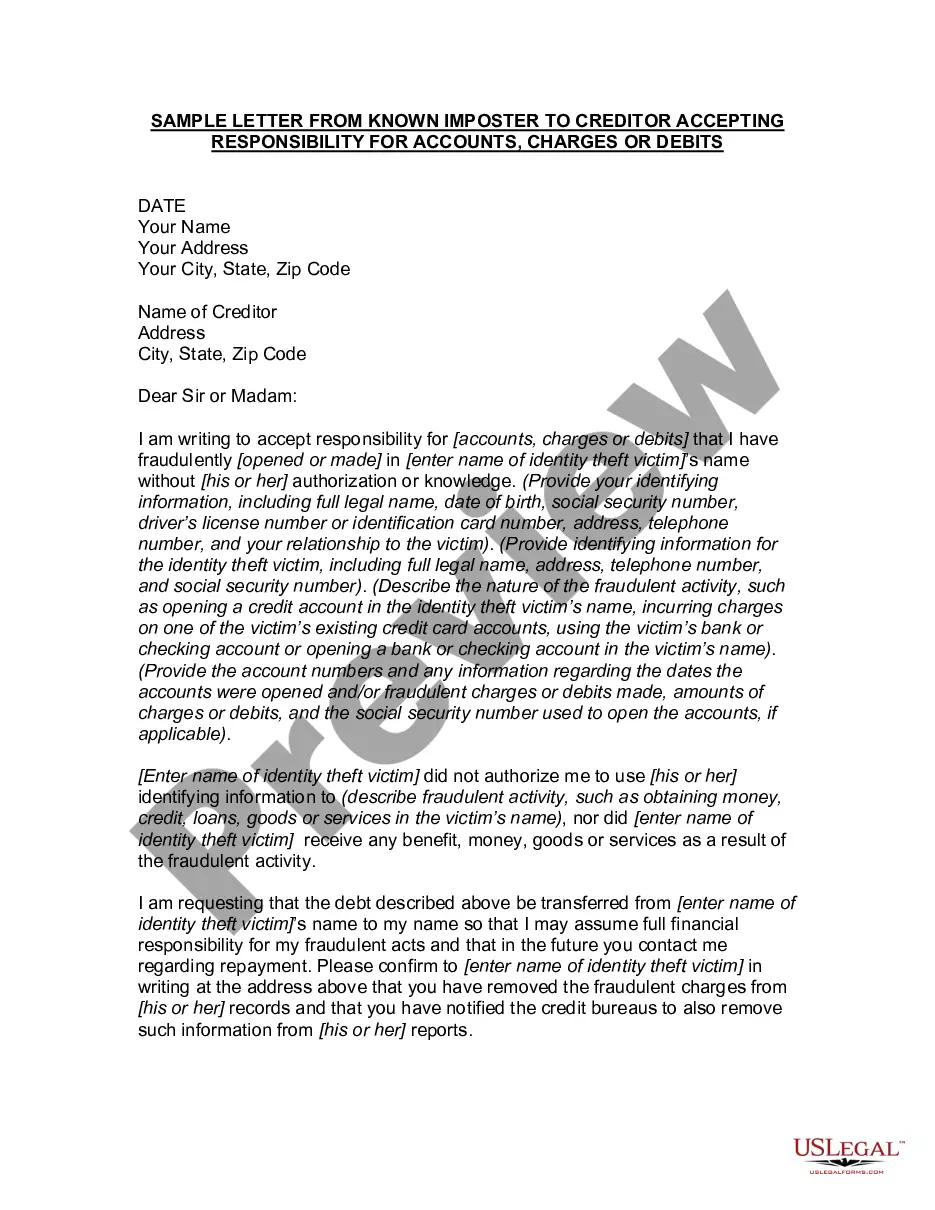

Oregon Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges, or Debits is a legal document that allows an individual who has been a victim of identity theft or fraud to assume responsibility for any fraudulent accounts, charges, or debits made in their name. This letter serves as a written confirmation from the victim, acknowledging the existence of fraudulent activities and accepting the responsibility for resolving them with the creditor. There are two types of Oregon Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges, or Debits: 1. Initial Notification: This type of letter is sent by the victim to the creditor immediately upon discovering the fraudulent activities. The purpose of this letter is to inform the creditor about the identity theft or fraud incident and formally accept responsibility for any fraudulent accounts, charges, or debits associated with them. It includes details such as the victim's name, contact information, account numbers (if known), and a description of the fraudulent activities. The letter should also request that further communication regarding the case be directed to the victim. 2. Follow-up or Resolution Confirmation: This letter is sent by the victim to the creditor after taking necessary steps to address the fraudulent accounts, charges, or debits. It serves to update the creditor on the progress made in resolving the fraud-related issues and reaffirm the victim's acceptance of responsibility for any remaining outstanding matters. The letter should include a summary of the actions taken, such as contacting law enforcement, filing a police report, contacting credit reporting agencies, freezing credit accounts, and any other steps taken to mitigate the damage caused by the identity theft or fraud. Keywords: Oregon, letter, known imposter, creditor, accepting responsibility, accounts, charges, debits, identity theft, fraud, fraudulent activities, victim, notification, initial, follow-up, resolution confirmation, fraudulent accounts, fraudulent charges, fraudulent debits, contact information, account numbers, communication, update, progress, law enforcement, police report, credit reporting agencies, credit freeze, damage mitigation.

Oregon Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits

Description

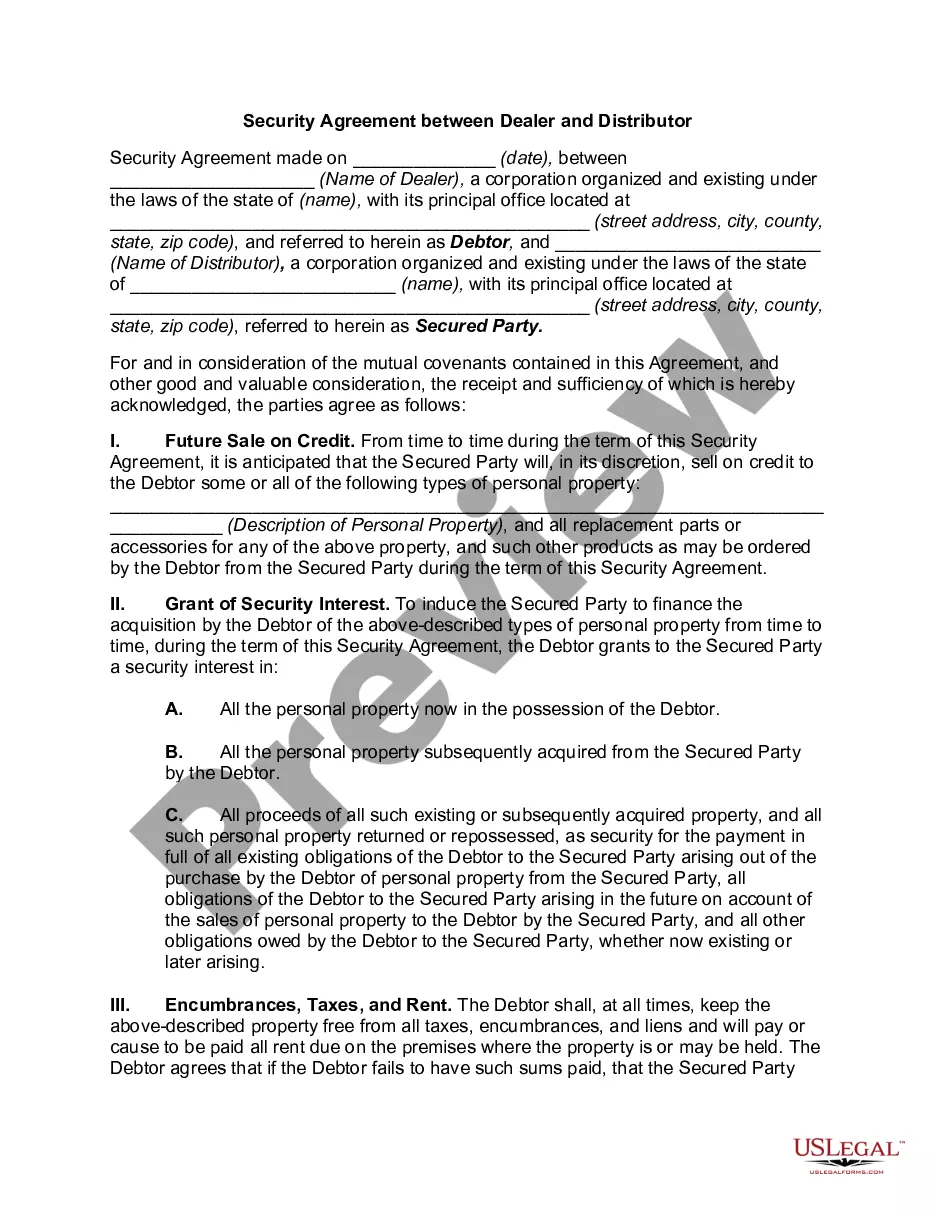

How to fill out Letter From Known Imposter To Creditor Accepting Responsibility For Accounts, Charges Or Debits?

Are you in a place where you need files for possibly organization or person functions virtually every working day? There are plenty of legal papers templates available on the net, but finding ones you can depend on is not effortless. US Legal Forms gives a large number of form templates, such as the Oregon Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits, that happen to be created to fulfill state and federal requirements.

If you are already acquainted with US Legal Forms site and have your account, just log in. Following that, you may obtain the Oregon Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits design.

Unless you offer an account and need to begin to use US Legal Forms, adopt these measures:

- Obtain the form you will need and ensure it is to the appropriate city/area.

- Utilize the Review button to analyze the form.

- Look at the explanation to actually have selected the proper form.

- In case the form is not what you are seeking, take advantage of the Lookup area to get the form that meets your requirements and requirements.

- Whenever you discover the appropriate form, click on Purchase now.

- Opt for the costs prepare you desire, submit the desired info to produce your money, and buy an order making use of your PayPal or Visa or Mastercard.

- Pick a hassle-free document formatting and obtain your version.

Locate all the papers templates you may have purchased in the My Forms food list. You can get a more version of Oregon Letter from Known Imposter to Creditor Accepting Responsibility for Accounts, Charges or Debits whenever, if needed. Just click on the necessary form to obtain or print the papers design.

Use US Legal Forms, by far the most considerable selection of legal types, in order to save some time and avoid mistakes. The services gives expertly produced legal papers templates which you can use for an array of functions. Make your account on US Legal Forms and initiate generating your lifestyle easier.

Form popularity

FAQ

I am requesting that you accept payments of $______________paid on the__________. I assure you that I will add no further debt until my financial situation improves. I will begin making normal payments again as soon as possible. I regret that I have to ask for this consideration and hope that you will understand.

Debt Validation Letter Example I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.

In this letter, you should include: Your name and address. Collection agency's name and address. Acknowledgment of contact from a collection agency, including the date they contacted you. A statement saying you dispute the debt. Request for proof that the debt is valid and belongs to you.

Because my income has dropped considerably I can no longer afford the terms of the original loan. As a loyal customer of your financial institution, I'd like to ask for the following: ? A lower interest rate amount of NO MORE THAN 6% ? Accept lower payments of $ _________ per month.

I respectfully request that you forgive my alleged debt, as my condition precludes any employment, and my current and future income does not support any debt repayment. Please respond to my request in writing to the address below at your earliest convenience. Thank you in advance for your understanding of my situation.

Tips for Writing a Hardship Letter Keep it original. ... Be honest. ... Keep it concise. ... Don't cast blame or shirk responsibility. ... Don't use jargon or fancy words. ... Keep your objectives in mind. ... Provide the creditor an action plan. ... Talk to a Financial Coach.