Title: Oregon Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan Description: The Oregon Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan is a legally binding document designed to establish a structured plan for repayments between a victim and an identified imposter in the state of Oregon. This agreement aims to address financial losses resulting from fraudulent activities, such as identity theft or scam-related incidents, by outlining the terms and conditions for restitution. Keywords: Oregon letter agreement, Known imposter, Victim, Repayment plan, Fraudulent activities, Identity theft, Scam-related incidents, Restitution, Terms and conditions. Types of Oregon Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan: 1. Identity Theft Repayment Plan: This type of agreement is specifically tailored for victims of identity theft in Oregon. It outlines the repayment terms and conditions, including interest rates, repayment schedule, and any additional provisions required to restore the victim's financial stability. 2. Scam-Related Incident Repayment Plan: This agreement focuses on victims who have fallen prey to scams conducted by known imposters in Oregon. It provides a structured plan for the victim and imposter to work together, determining a feasible repayment solution that meets the victim's needs while ensuring that the imposter takes responsibility for their actions. 3. Fraudulent Activity Restitution Agreement: This type of agreement applies to various types of fraud or fraudulent activities perpetrated by known imposters in Oregon. It covers a range of situations, such as financial fraud, online scams, or other deceitful practices, aiming to establish a repayment plan that facilitates the victim's financial recovery and holds the imposter accountable. 4. Debt Repayment Negotiation Agreement: Sometimes, known imposters are willing to cooperate with their victims to repay debts owed. In such cases, this agreement helps define the terms, interest rates, and conditions of repayment in Oregon, allowing both parties to reach a mutually agreeable solution while avoiding legal disputes. 5. Financial Resolution Agreement: This agreement caters to victims who wish to resolve financial discrepancies caused by a known imposter in Oregon without involving legal proceedings. It establishes a framework for repayment discussions, mediation, or arbitration, enabling both parties to explore non-adversarial methods to address the financial impact. By utilizing an appropriate Oregon Letter Agreement, victims and known imposters can work collaboratively towards resolving the financial fallout caused by fraudulent activities, fostering a sense of accountability, and providing a path towards financial recovery.

Oregon Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan

Description

How to fill out Oregon Letter Agreement Between Known Imposter And Victim To Work Out Repayment Plan?

If you want to complete, acquire, or printing legitimate record themes, use US Legal Forms, the largest assortment of legitimate forms, that can be found online. Take advantage of the site`s simple and easy hassle-free research to discover the files you want. Different themes for enterprise and person functions are categorized by groups and says, or keywords and phrases. Use US Legal Forms to discover the Oregon Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan with a couple of clicks.

When you are previously a US Legal Forms consumer, log in to the accounts and then click the Down load switch to get the Oregon Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan. You may also access forms you formerly delivered electronically within the My Forms tab of the accounts.

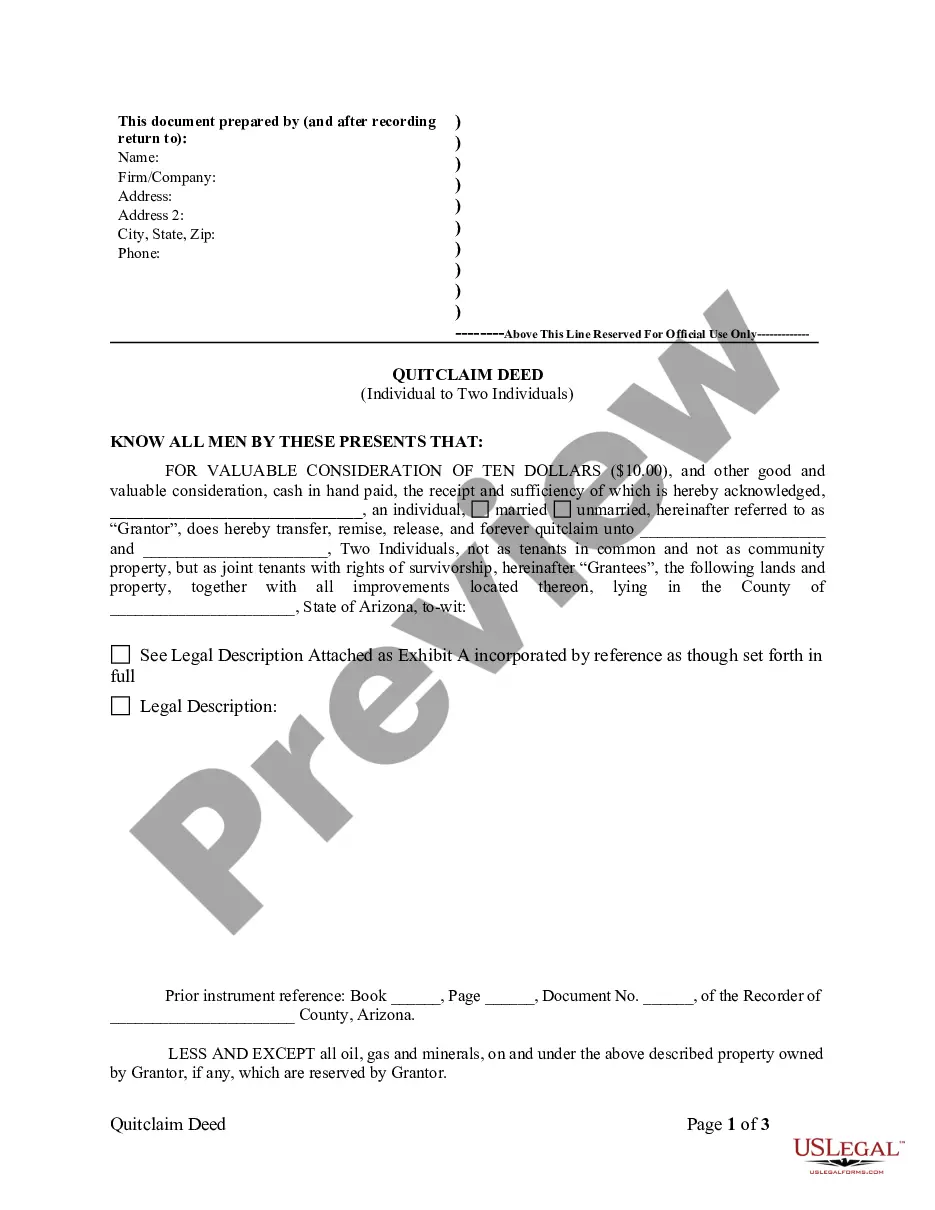

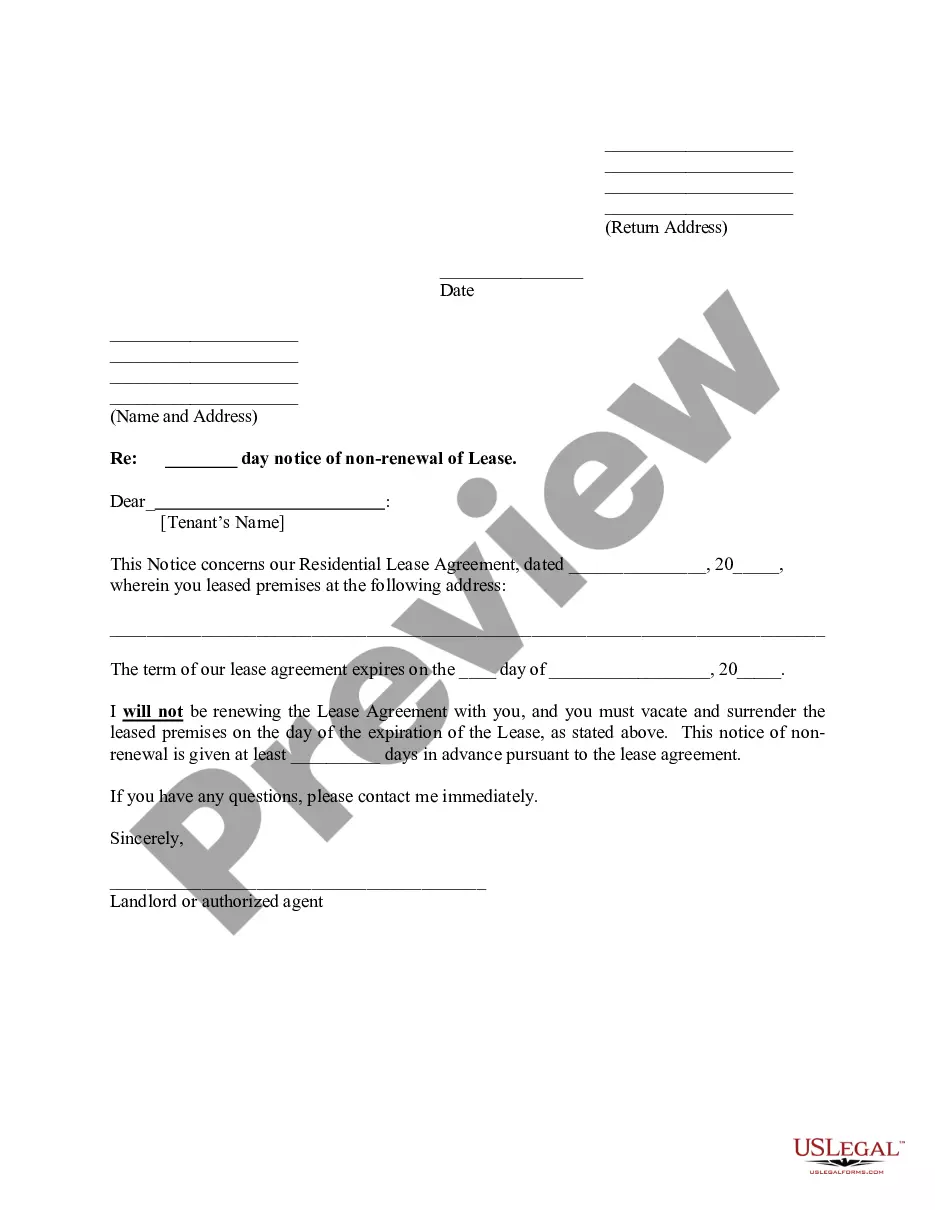

If you are using US Legal Forms initially, refer to the instructions below:

- Step 1. Be sure you have chosen the shape to the appropriate metropolis/region.

- Step 2. Take advantage of the Preview choice to check out the form`s content material. Never neglect to read through the description.

- Step 3. When you are not happy using the kind, make use of the Lookup discipline towards the top of the monitor to find other versions in the legitimate kind template.

- Step 4. After you have identified the shape you want, go through the Acquire now switch. Choose the costs strategy you favor and include your qualifications to sign up for the accounts.

- Step 5. Method the deal. You should use your charge card or PayPal accounts to complete the deal.

- Step 6. Select the formatting in the legitimate kind and acquire it on your device.

- Step 7. Comprehensive, revise and printing or signal the Oregon Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan.

Every single legitimate record template you purchase is the one you have permanently. You may have acces to each and every kind you delivered electronically in your acccount. Select the My Forms area and pick a kind to printing or acquire once again.

Contend and acquire, and printing the Oregon Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan with US Legal Forms. There are many skilled and express-specific forms you can use for the enterprise or person requirements.